The Mice Will Play

Investors,

I’m excited to announce a brand new series that I’ll be publishing throughout 2023, exclusive for paid members, where I’ll be analyzing the investment thesis of a specific company every month! Conducting individual security analysis is what made me fall in love with finance & investing 9 years ago, and premium members told me how much they valued my “Portfolio Strategy” series in the latter-half of 2022. Analyzing the qualitative and quantitative investment thesis of a stock is an intense process, similar to solving a puzzle, but with real wealth implications.

These are my favorite puzzles to solve and I want to create a feedback loop with the premium members who want to access this research to understand how I approach investment analysis and what I think of specific companies.

Therefore, I’m announcing a monthly series where I’ll be conducting a deep-dive on a subscriber-voted company. These will be published on the first Wednesday of every month going forward, so the first edition will be available on Wednesday, February 1st!

Below is the first poll I’m running for this series! Whichever company receives the most votes will be analyzed & extensively reviewed in the first edition on 2/1/23.

Polls will be accessible for 1 week, and the company with the second most votes will be included in the next month’s poll! In the future, only paid members will be able to vote on polls, but I’m going to make this first one available for everyone to vote on. With this new series set to begin on February 1st, premium members now receive the following reports/benefits, in addition to the free weekly research that everyone receives:

Weekly analysis sent every Sunday, focused specifically on the stock market & crypto. These deep-dives are intended to highlight advanced market metrics, trends, and various dynamics that I think are vital to understand. These are technical in nature, but have significant takeaways to help you as an investor. I analyze market fundamentals, underlying trends, price structure/TA, fund flows, exclusive studies with backtested data, insightful charts, and a variety of institutional-quality data. The purpose of these reports is to tell you exactly what I’m seeing in the stock & crypto markets, and how new developments fit within my investment thesis & market strategy.

Full access to the “Portfolio Strategy” series, where I shared the 15 individual stocks & ETF’s that I’m buying in portfolios that I manage and consult for. This series analyzed the qualitative and quantitative investment thesis behind each long-term position and highlighted the 20+ runner-ups that didn’t make the cut in the portfolio, with an elevator pitch & brief financial review of the company. This series explains how I’m putting my overall investment thesis into action and shares how I’m investing within my own portfolio.

33% discount for 1-on-1 hourly meetings! Use these meetings as an opportunity to ask me direct questions about the economy, the stock market, individual stocks, career advice, literally anything. At the present moment, these meetings are available at a two-tier rate for premium and free members:

$50/hr for premium members

$75/hr for free members

The newly announced series, where I’ll be analyzing a specific company that premium members vote for every month! In each of these reports, I’ll analyze the bullish case and the bearish case to determine and investment rating, after analyzing the core fundamentals of the business, the operating performance, and shareholder return.

In summary, premium members receive an additional 5 reports per month from Cubic Analytics and can access all premium reports published in the past. With a $25 discount to 1-on-1 meetings, the $19.99 monthly subscription essentially pays for itself.

If you have questions about becoming a premium member or about this new series, please leave a comment below and I’ll respond ASAP.

With that out of the way, let’s dive into the latest edition of Cubic Analytics!

Macroeconomics:

On October 14th, I published “Edition #217 - No, Inflation Hasn’t Peaked”. At the time, we had just received the September CPI data, which reflected headline inflation of +8.2% YoY. Within that report, I cited how the alternative measures of inflation (notably core CPI, median CPI, and trimmed-mean CPI) were still accelerating higher. With the October and November data continuing to show a deceleration in headline inflation, we now have evidence that these alternative measures of inflation are also starting to decelerate! With the December headline CPI at +6.5% YoY and a monthly decline of -0.1%, investors are growing increasingly confident that inflation concerns are becoming smaller in a rear-view mirrors.

At this point, I’d have to agree.

While I generally thought inflation dynamics would be stickier over the past several months, we can’t ignore the steep deceleration we’ve witnessed since the data for June 2022. Based on the December data, alternative measures of inflation are echoing the sentiment that inflation has peaked and is likely to keep decelerating:

Core CPI +5.71% vs. +5.96% in the prior month

Median CPI +6.93% vs. +6.98% in the prior month

Trimmed-mean CPI +6.54% vs. +6.66% in the prior month

While these decelerations aren’t as substantial as the decline in YoY headline CPI, they are a decline nonetheless. That’s worth celebrating.

While Shelter prices continue to accelerate on a YoY and MoM basis, reaching the highest YoY increase since mid-1982, we’re starting to see certain segments of the CPI rotate into outright deflation. Per the December 2022 data, Gasoline and Used Car prices are down on a YoY basis at -1.5% and -8.8%, respectively. However, there are five out of fourteen sub-components that are experiencing deflation relative to prices in November 2022. As we continue to accumulate evidence that inflation is in the process of rolling over and returning towards the Fed’s long-term target, this is what we want to see.

Is the battle with inflation over? No. Are we trending in the right direction now? Yes.

As we think about inflation dynamics going forward, I think we should expect to see a continued moderation in the months to come. The Shelter component of the CPI, which comprises roughly 33% of the total index weighting, is likely to keep accelerating through the first quarter and into the second quarter of 2023. Why? Because the Bureau of Labor Statistics using something called Owner’s Equivalent Rent to calculate housing/rental costs, not real-world data. This fictitious datapoint is merely a facade, and lags the actual housing/rental market by 8-12 months. With the housing market peaking in June 2022, it’s very likely that the Shelter component will only start to decelerate in February through June 2023!

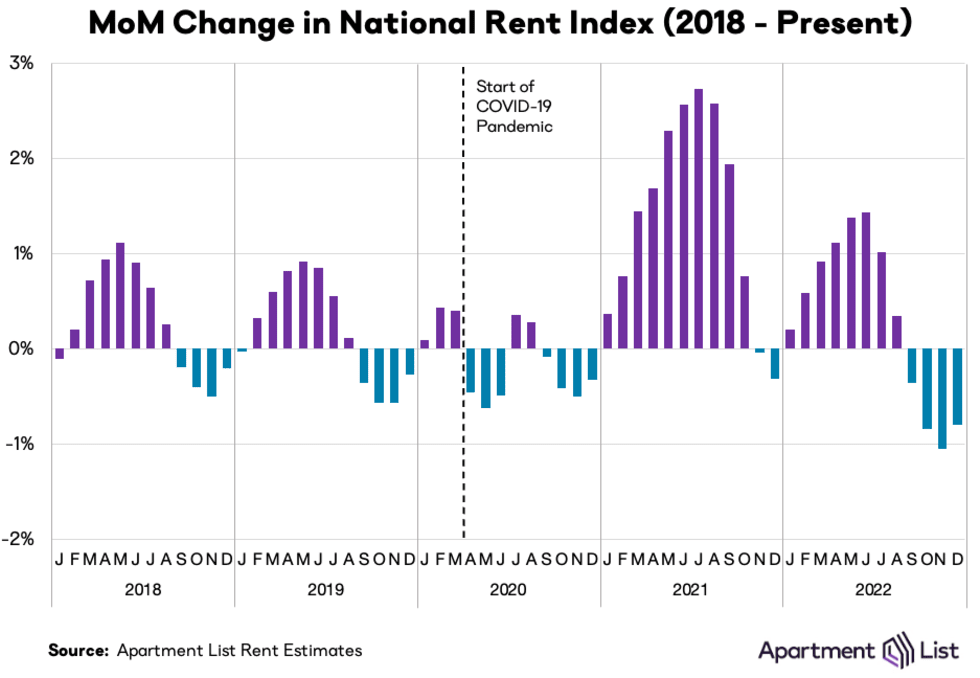

With nationwide rents continuing to decline on a month-over-month basis since August 2022, I think that the Shelter component of the CPI will start to put significant downward pressure on official inflation dynamics before we enter the second half of the year.

According to Apartment List’s latest estimate for December 2022, median rents declined by -0.8% MoM but are still up +4% YoY. Further, their estimates indicate that rents had monthly declines in 90 of the 100 largest cities in the United States. Once these dynamics are reflected in the formal CPI data, likely to occur in Q2 2023, it’s very possible that disinflationary dynamics (a deceleration in the pace of inflation) will be in full force.

From my perspective, I see four dynamics taking place with respect to the CPI data:

Alternative measures are peaking & decelerating.

Energy prices are experiencing outright deflation, which will put downward pressure on inflation expectations, and further pressure on actual inflation.

Base effects are likely to peak in the first half of 2023, meaning that YoY comparisons are going to become more favorable towards disinflation.

The Shelter component is likely to peak in Q2 2023, which will start to become disinflationary thereafter. This is due to the lag effects of OER vs. the actual housing/rental market.

On the aggregate, my assumption is that these dynamics will reduce inflationary pressures, particularly when we enter Q2, further confirming that June 2022 was the peak in YoY headline CPI inflation.

Stock Market:

With continued evidence that inflation is decelerating, investors are feeling rejuvenated after sentiment reached levels of extreme negativity in late-December 2022. From my perspective, this extremely negative positioning has quickly flipped from fear to greed at the start of the new year. I certainly didn’t forecast that we’d have a massive spark higher, yet here we are.

In last week’s premium newsletter, I noted the following with respect to the S&P 500’s under-the-hood metrics:

“Shorter timeframe analysis indicates a constructive improvement across the board, [notably] the resounding improvement in new 20-day highs vs. new 20-day lows”.

The momentum produced by such an improvement certainly had the ability to spark continued demand for the S&P 500, which is exactly what occurred this past week. Major U.S. indexes performed extremely well!

Dow Jones $DJX: +2.0%

S&P 500 $SPX: +2.67%

Nasdaq-100 $NDX: +4.54%

Russell 2000 $RUT: +5.26%

This is exactly the dynamic that bulls want to see during a potential bottoming process, where the riskier segments of the market (tech & small cap) are outperforming the conservative segments (Dow Jones & value). With the Nasdaq and the Russell producing massive returns this past week, this is an important signal we’re seeing in terms of risk appetite. In my opinion, bulls couldn’t have asked for a better week in terms of macro conditions and overall market dynamics.

I’m reminded of the classic saying: “When the cats are away, the mice will play.”

In a week absent of major Federal Reserve speeches and the continued deceleration of inflation, investors had their opportunity to party. And party they did.

Focusing on the Nasdaq, the tech index is finally showing signs of life after almost producing new bear market lows at the end of December. The index achieved six consecutive days of gains, the longest such streak since November 2021. Mega-cap technology stocks also woke up from their slumber, with the NYSE FANG+ Index gaining +5.9%. Unequivocally, this was one of the strongest segments of the market last week and I have re-entered a position in FNGU 0.00%↑ as a way to gain exposure to more potential upside. At the present moment, my position has produced a net gain of +8%, with my initial purchase on 1/10/23 being up +14.5%. During the week, I sold exposure to YINN 0.00%↑, the 3x leveraged China Bull ETF, and TSLL 0.00%↑, the 1.5x leveraged Tesla Bull ETF.

I likely sold my YINN exposure too soon, but I secured a +3$ to +4% gain on both positions and was happy to take the win in such a short period of time.

In tomorrow’s premium report, I’ll share more in-depth dynamics about market conditions and explain more about how I’m looking to position myself within the market and how I will attempt to manage risk.

Bitcoin:

With riskier segments of the stock market outperforming less risky segments, we finally saw Bitcoin participate in the action. At the time of writing, around 5:30pm ET Friday evening, Bitcoin is trading at $19,950 and has gained +17.5% relative to the prior Friday.

These are the three Bitcoin charts you should have on your radar:

1. Bitcoin vs. key price structure & moving averages:

Throughout the week on Twitter, I continued to highlight key structure for Bitcoin & focused specifically on the red support/resistance range and the 200-day moving average cloud. During Friday’s trading session, Bitcoin successfully blasted through this resistance zone & has entered within the 200 day moving average cloud. This is a key retest in my opinion, particularly considering how price has responded to the 200 day MA cloud in the past. I don’t know if BTC will be able to achieve a breakout above this dynamic support/resistance, but we should be encouraged by the momentum produced by this recent price action. While this range is currently threatening as resistance, it could become support if we break above it. We should continue to stay nimble around this range.

2. Bitcoin and the anchored volume-weighted average price (AVWAP) from 2015:

The AVWAP is an extremely powerful tool, essentially acting as a volume-weighted moving average pivoted to a specific point in time. Using exchange data from Coinbase, we can add the AVWAP from the 2015 bear market lows (green). During prior bear market crashes in 2018 and 2020, Bitcoin declined into this level & briefly fell below it, essentially confirming that it’s a semi-powerful support range. During the latest bear market decline caused by the FTX debacle, Bitcoin retested this range and has rebounded thus far. I’m not cherry-picking this after the fact, as this is something that I shared on Twitter in mid-October, sharing that “I expect Bitcoin to retest the AVWAP from the 2015 lows”. Like clockwork, this has manifested to perfection.

With the immediate rebound after retesting this level, I think it’s important to highlight the opposite side of the spectrum, focusing specifically on the AVWAP from the 2021 peak. This level acted as resistance during the late-March/early-April retest, so we can confirm that it’s a valid indicator to keep watching for. It’s currently priced at $30.25k, so I’ll be interested to see if the current rally will be able to extend that high.

3. Bitcoin and the short-term holder realized price:

I actually highlighted this on-chain indicator in Edition #215, published on October 8th, 2022, telling investors to be aware of the STH realized price as “potential resistance”. Historically, we can see that this on-chain price data has been fairly accurate as both support during a bull market and resistance during a bear market. As such, it’s super important to note that Bitcoin’s recent uptrend has pushed price above the STH realized price! Let’s zoom in:

This is the first time since March/April 2022 that Bitcoin’s price has broken above the STH realized price, indicating a strong signal! Clearly, the signal in April failed to provide bullish tailwinds going forward, so the takeaways from this indicator are simple:

If price can remain above STH realized price, there is a solid likelihood that the STH realized price acts as support if/when we retest it again. This takeaway is based on the historical data showed in the first chart above. We’ve seen multiple occasions where this level perfectly acted as support during an uptrend.

If price falls below the STH realized price once again, similar to the events from April 2022, that would indicate more downside potential. The breakdown in April led to a cascading decline lower, causing Bitcoin to fall from $48k to $17k in just a few months. Should price fall below this level again, it would be a “risk off” signal.

I don’t know if BTC’s price will use the STH realized price as support this time, but I do know how this particular indicator can be used to manage risk and understand different scenarios for price action. As an investor, that’s all I can ask for.

Using this indicator, I will likely reduce my Bitcoin exposure if/when we fall below the STH realized price for two consecutive days. Until then, I will continue to hold my existing position and resume DCA purchases now that price has recovered above the STH realized price.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subjected to change without notice. The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. Everyone is responsible to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that the information contained herein does not constitute and should be construed as a solicitation of advisory services. Cubic Analytics believes that the information & sources from which information is being taken are accurate, but cannot guarantee the accuracy of such information.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation & reference.

As always, consult a registered financial advisor and/or certified financial planner before making any investment decisions.