Investors,

Financial markets continue to be dominated by macroeconomic dynamics, specifically monetary policy and the core variables that influence decisions by the Federal Reserve (inflation & labor market data). This week was largely influenced by two factors related to these dynamics:

New labor market data

Speeches & interviews by various Federal Reserve officials

In a market environment plagued by the fastest monetary tightening in modern history, investors are ironically viewing good news as bad news. Why? A stronger labor market and/or stronger economic data means that the Federal Reserve will need to pump the brakes even harder in order to reduce aggregate demand and fight inflation. Conversely, bad news is good news when weak economic data means that the Fed’s rate hikes are working and aggregate demand is falling. It signals that we’re closer to the end of the rate hike cycle.

At the end of the day, investors are solely focused on the trajectory and path of monetary policy, something that I’ll expand on in the Stock Market section below. The higher rates are projected to go, and the longer they are projected to remain there, the lower assets will fall. In turn, if economic data is more resilient and comes in stronger than expectations, markets will price in more aggressive monetary policy, particularly if inflation remains historically elevated.

Unfortunately, markets are continuing to come to the realization that interest rates are likely to remain higher for longer. Let’s discuss:

Macroeconomics:

Regarding new macro data, headlines were dominated by labor market conditions. At the beginning of the week, the August 2022 JOLTS data was released, in which median estimates were predicting for 11.08M openings at the end of August. The result was 10.05M, far below estimates and the September result of 11.17M job openings. Other than the decline in April 2020, this was the largest nominal decrease in job openings ever.

Markets celebrated this news on Tuesday morning, potentially signaling that the Fed was en route to achieving their target of creating a softer labor market. Throughout the rest of the week, the market would learn that this assumption was a mistake.

As mentioned in the intro, bad news for the economy is being interpreted as good news for financial assets, based on the implications for monetary policy. Interestingly, there’s a key correlation between the monthly JOLTS data and the stock market, wherein the stock market tends to lead JOLTS:

The consistent downward pressure on U.S. stocks is likely foreshadowing further weakness in the labor market, in which job openings are expected to decline.

One of the key aspects of the JOLTS data that I’ve been focused on this year is the quits rate and the layoffs rate, which provide further context on labor market dynamics. The quits rate continues to remain historically elevated at 2.7% for the second consecutive month, down moderately from the ATH of 3.0% in November & December 2021. This is further proof that employees are pursuing better opportunities, at higher pay, that are more aligned with their career goals at other firms. With inflation at multi-decade highs, employees are incentivized to become job-switchers because in order to capture larger wage/salary growth when they change companies.

Meanwhile, the layoffs rate remains near historical lows, currently measured at 1.0%. Clearly, employers are very hesitant to let go of their existing workforce, further highlighting labor shortage dynamics. This is a stark contrast vs. the headlines, which seemingly want us to believe that layoffs and hiring freezes are running rampant across corporate America.

This has been the trend for a year, and I expect that this theme will continue to persist for months to come. In turn, this is likely to keep wage growth relatively elevated and continue to keep underlying inflation pressures elevated as well.

Regarding wages, average nominal wage growth declined to +5.0% YoY, the slowest increase since December 2021:

Wage growth appears to be decelerating, however, it’s significantly higher than the post-Great Recession environment from 2010-2019.

On Friday, the non-farm payroll data was released for September 2022, in which median estimates were projecting for +275,000 jobs vs. August 2022 results of +315k. The result was +263k; however, the key focus from this report was the decrease in the unemployment rate from 3.7% to 3.5%. Additionally, the labor force participation rate (LFPR) also decreased from 62.4% to 62.3%. It’s important to highlight the positive correlation between these two variables, as I believe that September’s decline in the unemployment rate is largely being driven by a decline in the LFPR.

The Federal Reserve has continuously expressed that the labor market is too tight and that they will attempt to weaken demand by softening the labor market. Quite simply, the decline in the unemployment rate is the exact opposite of what the Fed would like to see. Various former Fed officials have stated that the Fed will likely need to get the unemployment rate above 4% in order to bring inflation back towards their long-term target of 2% for the CPI. With a tight & resilient labor market, aggregate income is expected to remain elevated, therefore giving consumers a stronger propensity to absorb higher consumer prices. This is antithetical to what the Fed is trying to achieve, which is likely to make the Fed increasingly resolved to combat inflation regardless of the short-term economic consequences. While a lower unemployment rate is theoretically good for the economy, financial markets weren’t happy about this news.

Notably, here were some quotes from Fed officials this week:

“The fact is, lower commodity prices and receding supply-chain issues will not be enough by themselves to bring inflation back to our 2% target.” - John Williams, New York Fed President

“I fully expect there to be losses and failures in the global economy.” - Neel Kashkari, Minneapolis Fed President

“I am not considering slowing or stopping rate increases due to financial stability concerns.” - Chris Waller, member of the Fed’s Board of Governors

“There will be no rate cuts next year.” - Loretta Mester, Cleveland Fed President

The Fed should stay “purposeful and resolute” and not be quick to cut rates if economy weakens. - Raphael Bostic, Atlanta Fed President

The Federal Reserve was out in full force to reaffirm their commitment against inflation, despite any potential economic & financial deterioration. Markets didn’t react positively to this rhetoric.

Stock Market:

As mentioned above, stocks started the weekly session very strong but finished with significant downward momentum. In fact, the two-day rally on Monday and Tuesday was the largest stock market gain since March 2020. The S&P 500 gained roughly +5.75% in this two-day span, but proceeded to fall -4% from the market close on Tuesday through Friday.

At this point, I think market participants have realized the significance of yields in terms of evaluating asset prices. As I’ve been sharing since I first started on Twitter in June 2020, there’s an inverse correlation between interest rates and asset prices, all else being equal. Those who have been echoing this narrative have likely been on the right side of the market all year. Although I initially expressed a below-average performance for the S&P 500 in my “Investment Outlook for 2022”, I quickly recognized the writing on the wall when Fed rhetoric became aggressive in early January:

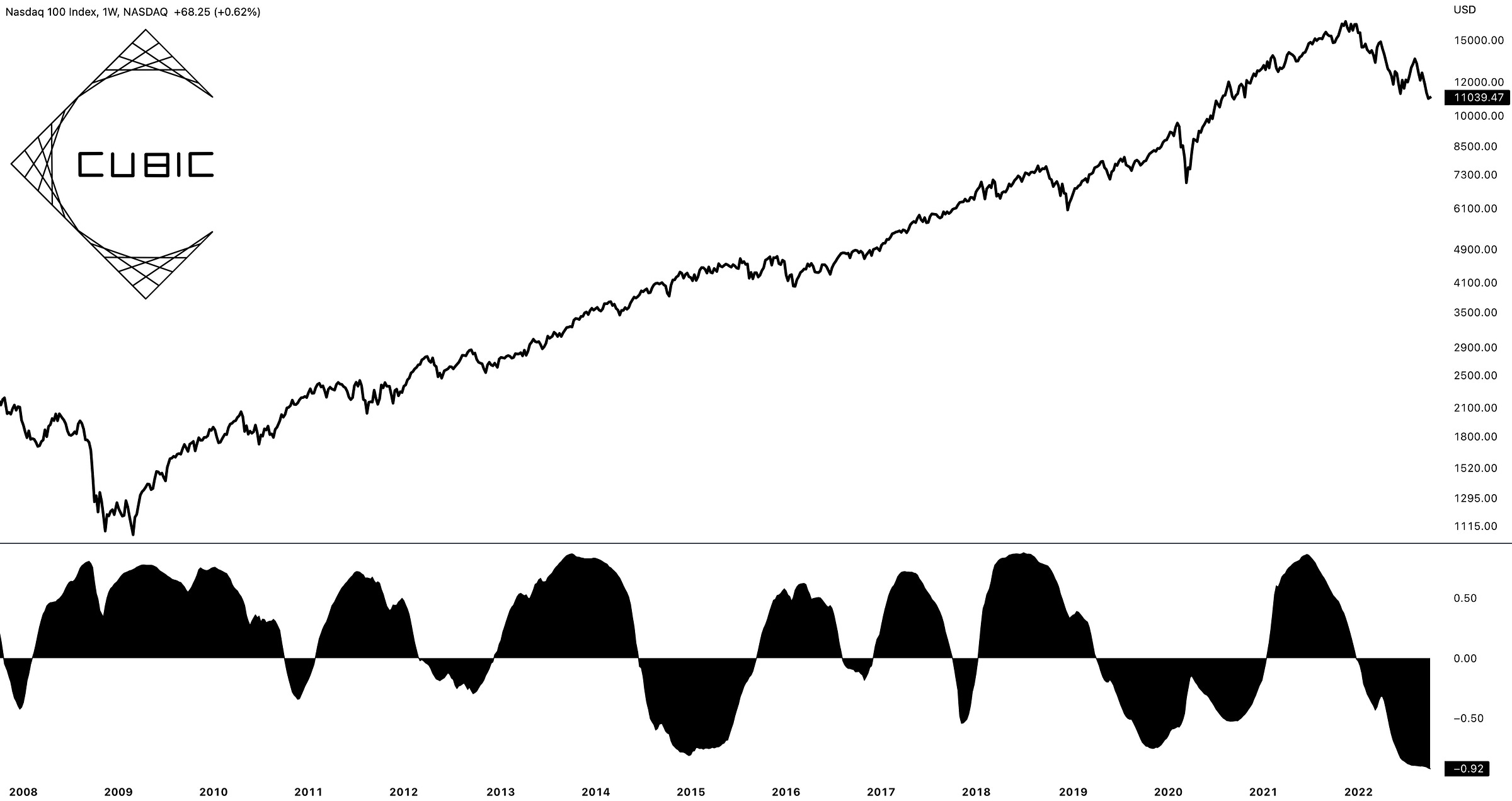

With the week coming to a close, I wanted to quantify the magnitude of the correlation between yields and stocks by analyzing the correlation coefficient between the Nasdaq-100 and 10-year Treasury yields. In the chart below, we’re analyzing the Nasdaq-100 since 2008 with the 52-week (1-year) correlation coefficient:

Based on this analysis, the 1-year correlation between tech stocks & yields is -92%. This means that there’s a near-perfect inverse correlation between stocks & interest rates in the current market environment! Interestingly, this is the largest negative correlation since Q4 1995! Quite literally, changes in yields are almost entirely responsible for the repricing of equities over the past 12 months:

As yields ↑, equities ↓

As yields ↓, equities ↑

This means that equity prices on the aggregate aren’t falling because of company fundamentals or a significant decrease in future cash flows (earnings per share, net income growth, revenue growth, etc.). In fact, corporate profits have remained resilient and hit new all-time highs in Q2 2022 of $3.043Tn in the quarter:

Corporate balance sheets appear strong, with ample liquidity and capital availability. From my perspective, the primary driver of the current bear market is unequivocally the historic acceleration of interest rates. Premium members know that I’ve been viewing this market environment as an opportunity to build long-term positions in core portfolio holdings, taking a patient approach to buying high-quality stocks.

In fact, I’ve been sharing the exact stocks I’ve been buying in portfolios that I manage and consult, providing in-depth analysis of each individual stock and explaining the portfolio allocation strategy. If you’re interested in accessing these exclusive reports, called “Portfolio Strategy”, consider exploring premium membership options below:

While I still foresee tailwinds for yields to rise going forward, we will eventually reach a point where yields have peaked. I genuinely don’t know how far away that point is, but it’s likely 6-12 months away in my base-case. This monetary tightening cycle will likely cause fundamental pain to the economy, the financial system, or both. It’s also possible that global economic/financial weakness could cause ripple effects in the United States. The future is uncertain, undoubtedly.

Bitcoin:

I saw an interesting post this week from my friend, TheRationalRoot on Twitter, which emphasized the short-term holder cost basis metric:

As the Bitcoin & broader crypto market continues to operate within an 11-month downtrend, I noticed that price is trading below the short-term holder cost basis and wondered, “has this metric acted as resistance during prior bear markets?”.

It’s important to know what the STH cost basis actually measures, which essentially measures the average purchase price of Bitcoin bought within the last 155 days. Fundamentally, it makes sense why this is an important metric because short-term investors are going to have a lot of price memory at the level that they purchased Bitcoin. In a downtrending market, these investors may sell their Bitcoin when price retests their costs basis in order to recoup their initial investment. As such, we can logically expect that the STH cost basis level might act as consistent resistance during a bear market trend.

Throughout Bitcoin’s history, we can see that the STH cost basis indeed acts as resistance during bear market trends. At a current price of $19.5k and a STH cost basis of $22.3k, it’s quite possible that this level will act as resistance if/when we retest it in the near future. To be clear, the STH cost basis hasn’t been perfect resistance historically; however, it’s been a great gauge for potential resistance. Either way, I think Bitcoin investors should be aware of this level.

As price continues to consolidate near the 2017 peak and the YTD lows, I think the Bitcoin market is preparing to make a significant move in either direction over the coming weeks. Genuinely, I do expect to see more downside pressure ahead, but I acknowledge that massive rallies can occur in the short-run. My friend, Matthew Hyland, has been posting great analysis about Bitcoin’s Bollinger bands, which are currently at their tightest level since late-2020:

This squeezing dynamic of the Bollinger bands, created by John Bollinger, typically foreshadow a significant, high-volatility move in either direction. I think we should all be prepared for fireworks and do our best to enjoy the ride. For BTC holders, I’m hoping that it’s for the best.

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.