Investors,

Bitcoin just completed the highest monthly close since October 2021, but I’m particularly focused on how the 36-month Williams%R Oscillator closed above the overbought level for only the 4th time in history.

In the past, I’ve shared similar signals for the 12-month, 18-month, and 24-month timeframe in order to represent price behavior and trend using the 1 to 2-year view; however, I was alarmed by the significance of this 3-year signal.

Historically, the first thrust above the upper-bound is followed by bullish returns:

February 2013 = +3,900% in 9 months

December 2016 = +1,900% in 12 months

November 2020 = +260% in 12 months

This signal has sparked the beginning of the exponential phase of each cycle.

I say it all the time & I'll continue to repeat it: overbought signals are incredibly bullish and should be viewed as momentum signals, rather than using them to fade the current trend.

In combination with a variety of indicators that I’ve shared over the past 12-18 months, the weight of the evidence continues to suggest that bullish outcomes outweigh bearish outcomes and that our bias should be skewed to the upside.

While that certainly doesn’t mean to abandon forms of risk management, go “all-in”, or use leverage in order to maximize potential upside, I want to reiterate my expectation that Bitcoin will trade at $175,000+ in this current cycle.

If you want to read more of my thoughts about this Williams%R signal and the implications for the current market environment, read the full post here on X.

I also had an opportunity to be interviewed by my friends over at the Investing Broz on Friday evening, where we covered a range of topics from macro & monetary policy, Bitcoin ETFs, price targets, Bitcoin miners, AI altcoins, market psychology, and more.

Given the wide range of topics, this interview serves as an update on my current market views, as the show was streamed live on Friday at 3pm ET. Please watch the discussion, subscribe to their channel, and let them know that I sent you!

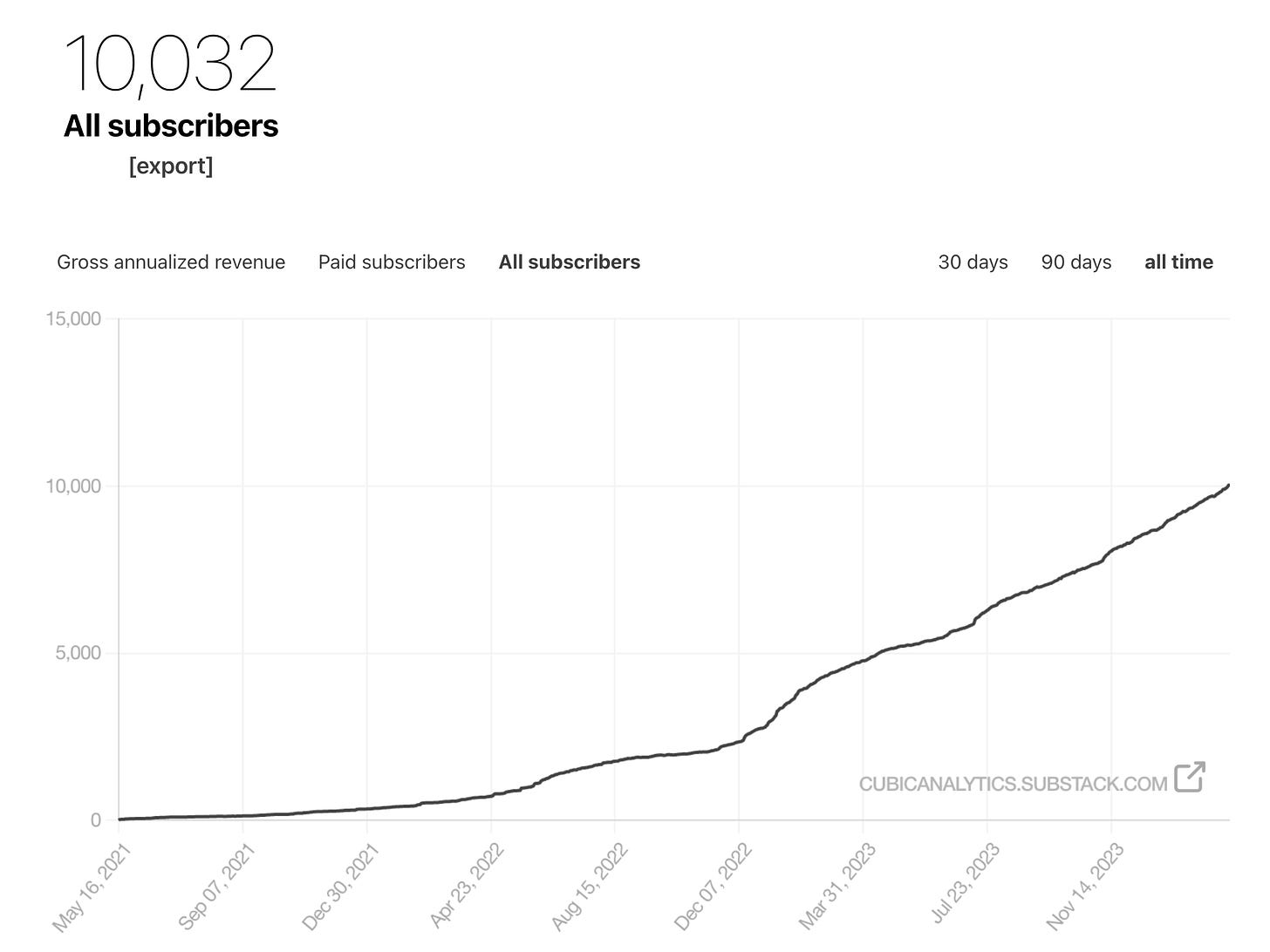

I also want to take a brief moment to celebrate the fact that 10,000+ investors are now subscribed to the Cubic Analytics newsletter. This is a surreal milestone and I’m extremely grateful for all of your support, kind messages, and encouragement since I launched this endeavor as an independent analyst in May 2021.

I’m currently offering a 10% discount on the monthly or annual plan to upgrade to a premium membership, which will grant you access to the full suite of my research, in-depth weekly analysis on the stock market & crypto, updates to my long-term portfolio holdings, and also the weekly analyst calls that I host for Q&A.

Aside from your kind words & sharing my research with people in your inner-circle, a premium membership is the best way to support my work as an independent analyst.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Been with you long time. Keep it up

Big Dog Franzen doing big things in bitcoin.