Investors,

This Wednesday, February 1st, will be the first edition of my newest series, where I’ll be conducting a deep dive on a subscriber-voted stock! These monthly reports will be exclusive for premium/paid members and the first edition will be focused on Chevron ($CVX)! The company reported earnings earlier this past week, so there will be a bunch of juicy new details to discuss as it pertains to the oil giant! To receive that analysis on Wednesday, please consider upgrading your subscription using the link below, which will provide a 20% discount!

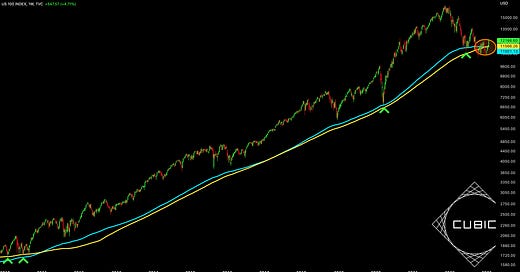

The market is rocking and rolling to start 2023, continuing to accelerate higher each week of the new year. Tech & growth stocks have predominantly led the market higher, exhibiting an increased appetite for risk assets. As highlighted in yesterday’s free version of Cubic Analytics, each of the major U.S. indexes are trading above their respective 200 day moving-average clouds for the first time since early January 2022. Broadly speaking, bull markets can be characterized by a sustained period of the indexes trading above their 200-day moving average.

Now that each index has gotten above it, it’s vital to stay above it.

Earnings have been informative, but somewhat underwhelming in terms of providing a decisive answer about the operating performance of stocks on the aggregate. The CBOE Market Volatility Index $VIX is reflecting complacency, closing the week at 18.51. The Fear and Greed Index is reflecting high levels of greed in the market, but not yet achieving a status of “extreme greed”.

On January 14th, I published “The Mice Will Play”, pointing out that the absence of Federal Reserve speeches/policy decisions and the continued deceleration of inflation was providing an opportunity for the markets to party. These two factors have continued over the past two weeks, with the Fed operating in a “blackout period” (no public communication) and more data confirming the deceleration of inflation. Markets have fully utilized this opportunity to turn up the music and take a couple extra shots of tequila, but the neighbors are irritated and considering to call the cops.

The Federal Reserve will be making their FOMC policy decision this week, almost certainly settled to raise interest rates by +0.25% on February 1st. Markets have near-perfect consensus on this topic, with the CME futures indicating a 98.4% likelihood that the FOMC hikes by +0.25% on Wednesday.

The police are coming and the market knows it, but there’s a chance that the police are undercover strippers who are coming to turn the party up a notch.

It’s clear that the market is prepared for another +0.25% hike and is knowingly accepting of this upcoming rate increase. Clearly, investors don’t care. Should they?

I don’t know.

What I do know is that financial markets are forward-looking pricing mechanisms, digesting all known (and potentially unknown) data, risks, and potential returns in order to determine the fair value of any given asset at any minute of the day. Markets are looking beyond the Fed at this point, but it’s unclear whether or not this is a mistake.

Today’s newsletter will focus primarily on key market data for the S&P 500, Nasdaq-100 dynamics, a recap of the earnings preview I provided last week, and an extremely important indicator for the broader crypto market as we prepare for the upcoming week and beyond. To support my work and benefit from the premium research that I publish on a weekly basis, consider upgrading your subscription using the link below or the 20% discount at the top: