Investors,

The Dow Jones $DJX is +0.8% away from ATH’s.

The S&P 500 $SPX is still trading above 5,000.

The Nasdaq-100 $NDX is up +5.1% in 2024.

Bitcoin is still trading above $51,000.

Ethereum gained +12.8% this week.

The Ark Next Generation Internet ETF ARKW 0.00%↑ just hit new 52-week highs.

The Industrial sector, both XLI 0.00%↑ and RSPN 0.00%↑, are making new ATH’s.

Recent IPO stocks ($IPO) are trading at their highest levels since April 2022.

Financials, XLF 0.00%↑, are trading at the highest levels since March 2022.

Consumer discretionary stocks, RSPD 0.00%↑, just hit new 2-year highs.

Berkshire Hathaway Inc. ($BRK.B) is trading at new all-time highs.

Homebuilder stocks, ITB 0.00%↑, just hit new all-time highs.

The German & Japanese stock markets are also at ATH’s.

Meanwhile, the market has completely priced out any meaningful probability of rate cuts in either March or May 2024, a timeline for rate cuts that I never viewed as likely.

And in fact, the Federal Reserve just did a “ghost” rate hike that I’ll tell you about in the Macroeconomics section below!

There is unequivocal evidence of disinflation in both CPI and PPI data, with more evidence of macroeconomic data that is both resilient, but softening in some aspects.

For the attentive readers of Cubic Analytics, you know that all of these factors fit within my overall thesis for both macro & markets in 2024, which I reiterated in my December 2023 report, “My Outlook Is Simple”. If you’re a relatively new subscriber, or if you’d simply like a reminder of my views, I’d highly recommend reading the report.

Shockingly, the debate around disinflation is still ongoing; however, I did a fun debate with the team at

and both sides made their case for the future outlook on inflation dynamics.Without further ado, this is the latest edition of Cubic Analytics!

Macroeconomics:

Disinflation is intact. In January 2024, we saw all of the following dynamics:

• Food inflation decelerated.

• Goods inflation decelerated.

• Shelter inflation decelerated.

• Apparel inflation decelerated.

• New vehicle inflation decelerated.

• Nondurable goods inflation decelerated.

• Headline CPI inflation decelerated.

• Core CPI inflation decelerated.

• Median CPI inflation decelerated.

• Trimmed-mean CPI inflation decelerated.

• Headline CPI less Shelter inflation decelerated.

• Headline CPI less Energy inflation decelerated.

• Energy services inflation decelerated.

• Energy deflation accelerated.

• Used vehicle deflation accelerated.

• Durable goods deflation accelerated.

On a YoY basis, all of these datapoints were lower in Jan.’24 than their Dec.’23 results.

While the rate of disinflation could be underwhelming for some folks who criticize the pace of inflation normalization, we simply cannot argue about the facts above.

Prices are still increasing; however, the rate at which they are rising is slowing.

The Fed isn't trying to make prices go down. They are trying to produce disinflation.

Powell said they need more proof of progress. The January data provided more proof.

Regarding CPI data, there are three vital charts to have on your radar:

1. Headline CPI less Shelter was +1.5% YoY, down from +1.9% in December 2023.

It doesn’t take a Ph.D in economics to recognize that non-Shelter components of CPI (roughly 65% of the index composition) are experiencing an aggregate inflation rate well-within the historically normal range. One could even argue that this inflation rate is lower than the typical range over the past 30+ years.

Because Shelter is both the largest and the laggiest component within the CPI (35% of headline and 41% of core), this helps to provide a more accurate picture of real-time inflation dynamics. You’ll also notice that the current result of +1.5% is very close to the Truflation data, which fluctuated between +2.4% and +2.5% throughout January 2024 (inclusive of their private-market Shelter component).

2. Median CPI & Trimmed-mean CPI were both lower than their December results on a YoY basis, though the deceleration was modest relative to the recent trend.

This chart does a fantastic job of highlighting how each of the four broad-based measures of CPI inflation experienced disinflation on a YoY basis in January. Again, while the pace of disinflation in January could be dissatisfactory to some folks, the fact of the matter is that disinflation DID happen in January.

3. Headline CPI less Energy was +3.68% YoY, down from +3.74% in December.

This is an important datapoint for two reasons:

Because energy is (and has been) experiencing deflation, removing it from the equation helps to give a pulse on how all other components are behaving.

Those who have doubted disinflation have often referenced how most (if not all) of the disinflationary trend has been caused by lower oil prices; however, this chart immediately debunks that narrative. After peaking at +7.3% in September 2022, it’s unequivocally clear that non-energy components of the CPI have experienced rapid disinflation. While this datapoint is still too high at +3.68%, the disinflationary trend is still intact and has been uninterrupted since it began.

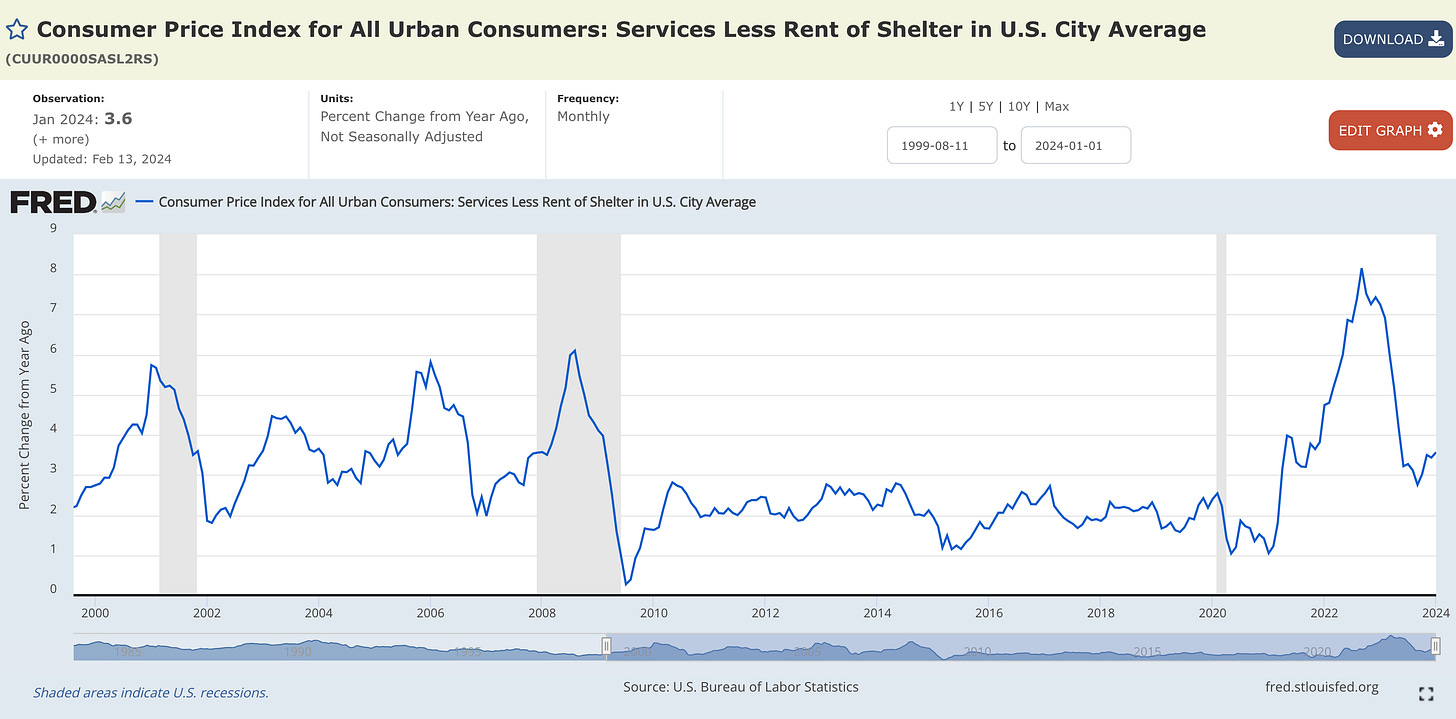

My biggest concern about CPI inflation is the recent acceleration in Services ex-Shelter CPI, which is something that I’ve highlighted in the past.

This datapoint is now trading at its highest levels since May 2023 and it remains above the normal range from the period between 2010 and 2020. Given that the service sector is the largest part of the U.S. economy, the re-acceleration of inflation in “every day” services is not something to sweep under the rug.

As I look holistically at the January 2024 CPI data, it’s clear that disinflation is intact. The trend of disinflation over the past 18+ months has been doubted month after month, quarter after quarter, and yet here we are with more evidence of ongoing disinflation.

Is the data perfect? No.

However, I’d suggest that each report over the past 18 months had certain aspects that could be nitpicked in order to express concern that inflation is re-accelerating, which hasn’t materialized in 18+ months.

Is the Consumer Price Index still rising? Yes, and I never said that it wasn’t!

However, the pace with which it’s rising is unequivocally declining and the ongoing deceleration is the very definition of disinflation.

As a final note on CPI the data, I wanted to highlight how the Federal Reserve’s monetary policy stance got even tighter, resulting in a hidden rate hike that no one is talking about. The chart below shows the Effective Federal Funds Rate (EFFR) minus the headline CPI inflation rate on a YoY basis, providing us with one estimate of the real federal funds rate:

The real fed funds rate has been positive since May 2023, which means that the Fed has officially been “restrictive” for 8 months, and the measurement increased from 2.0% in December 2023 to 2.2% in January 2024. This is the highest real fed funds rate since August 2007 when it was 3.06%.

With disinflation expected to continue while the Federal Reserve likely remains paused over the coming meetings, this means that the real EFFR is going to increase even more in the months ahead. Effectively, this is a “ghost” rate hike.

The Fed is completely aware of this dynamic, which is why they’ve been twiddling their thumbs since Q3 2023 — to let their prior monetary tightening ripple through the system and theoretically choke inflation even further through a higher real EFFR.

In plain English, they haven’t needed to explicitly raise rates because their policy stance is implicitly becoming more restrictive as disinflation continues. Because of my data-driven outlook that disinflation will persist, the implication is that the real EFFR will become increasingly positive in the months/quarters ahead, which will essentially force the Fed to bring policy into a more neutral stance by cutting the nominal EFFR once the Fed is satisfied with disinflationary progress towards their 2% target. My expectation, as I’ve been sharing since July 2023, is that these cuts won’t begin until Q3 2024, at the soonest.

Stock Market:

Tomorrow’s premium report will provide an abundance of in-depth analysis on the stock market, so I’m going to save all of the alpha for tomorrow’s report.

To access that report when it’s available, please be sure to upgrade to a premium membership with either a monthly or annual plan.

Bitcoin:

Regarding Bitcoin, there are three primary trends to be aware of:

1. Net inflows into Bitcoin ETFs are extremely strong, with non-Grayscale ETF issuers gobbling up 259,088 Bitcoin in 26 trading days. In total (inclusive of $GBTC’s holdings), U.S.-listed spot Bitcoin ETFs have amassed 715,416 BTC.

2. Bitcoin is trading in a bullish fashion with respect to its 1-year, 2-year, and 3-year exponential moving averages, which themselves are starting to expand & rise higher.

🟠 Weekly price of Bitcoin

🔵 52-week EMA (1 year)

🔴 104-week EMA (2 years)

🟢 156-week EMA (3 years)

Historically, good things have happened during this bullish structure. The recent expansion in the EMA’s after coiling for several months is very reminiscent of the same expansion that occurred in Q1 2016, en route to a massive bull market in Bitcoin.

That isn’t to say that the same price reaction will absolutely repeat in 2024, but it helps us to think of possible outcomes based on statistical behavior of buyers and sellers in the past.

3. HODL Waves continue to indicate that investors who have held their Bitcoin for at least 12 months are not selling, a sign that conviction in BTC is rising.

Both independently and on the aggregate, these three charts & dynamics point to optimistic outcomes for Bitcoin and the investors who hold the digital asset.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, & timeframes expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Enjoyed every bit of the article

Solid post!