Investors,

I need to be extremely clear about my base-case expectations going forward, reiterating the various trends & dynamics I’ve been highlighting throughout the year:

Disinflation will continue to persist, as has been my forecast since December 2022, with a rising probability of deflation at some point in 2024.

The economy, which has been impressively resilient, will likely remain resilient.

The labor market, which has also been resilient, will likely remain resilient.

Nonetheless, both the labor market & the broader economy are likely to soften in the quarters ahead; however, softness is not weakness. Eventually, persistent softness will create outright weakness, but this requires an ongoing deterioration which isn’t promised based on the dynamic nature of the economy.

The Fed is done with rate hikes, as I forecasted in June 2023, although balance sheet reduction is likely to continue over the next 12 months.

So long as the economy stays resilient, disinflation will put pressure on the Fed to be forward-thinking and to cut interest rates in order to maintain a consistent real federal funds rate (FFR) within the next 8-12 months. Real FFR is currently around +2%; however, the combination of persistent disinflation + a Fed pause will cause the real FFR to rise even further & become even more positive. In turn, based on the Fed’s own models, this will put unnecessary strain on the economy once the Fed’s dual-mandate is achieved by mid-2024 (which I expect). This will prompt them to cut rates by 100-250 basis points in order to bring real FFR back to approximately +2%, where it is today.

Because the market is forward-looking and because asset prices thrive in a disinflationary environment, equities, Treasuries, and crypto are likely to experience strong tailwinds in the quarters ahead if these assumptions above, which are bold, come to fruition.

It’s simple: Disinflation + resilient (but softening) economic data + less restrictive monetary policy = strong asset returns

I hope that this breakdown provides clarity on my expectations, combining macro & overall market dynamics to create a holistic outlook.

Without further ado, this is the latest edition of Cubic Analytics. If you enjoy these free reports and benefit from the ideas and analysis within them, please consider sharing Cubic Analytics with your colleagues, friends, and/or family.

Macroeconomics:

You’ve heard me say it a hundred times: disinflation is intact.

Prices are rising at decelerating pace, the same way a driver decelerates from 80mph to 65mph when they see a police officer on the highway. We must continuously remind ourselves that the Federal Reserve isn’t trying to bring prices back to their 2021 levels or their pre-COVID levels, but rather attempting to target a rate of inflation of +2% per annum. They are trying to slow down from 80mph to 65mph. One could even argue that they’re trying to slow down from 120mph to 65mph, an even more abrupt and difficult challenge.

Continuing to monitor the strength of the disinflationary trend is vital, which is why the Personal Consumption Expenditures for October 2023 was so important, released on Thursday this past week. In other words, the October PCE ensures that the car (economy) is decelerating to 65mph (disinflation) to achieve the legal speed limit.

PCE is the Federal Reserve’s preferred gauge for measuring inflation dynamics, and since it’s important to the Fed, it’s important to us in order to better understand how inflation data could impact monetary policy decisions in the near future.

So how’d the PCE data shakeout? Remarkably well.

Headline PCE decelerated from +3.4% to +3.0% YoY, perfectly in line with estimates, after rising a total of +0.0% in the month of October. This was the lowest YoY reading since March 2021 and the lowest MoM reading since July 2022, clearly confirming that PCE is experiencing disinflation.

Core PCE decelerated from +3.65% to +3.46% YoY, a modest but solid deceleration. You’ll notice that while headline PCE briefly re-accelerated (due to the temporary rise of energy prices), core PCE continued to decelerate in recent months. This ongoing deceleration in core PCE was one of many reasons why I continued to believe that disinflation was still the overwhelming trend.

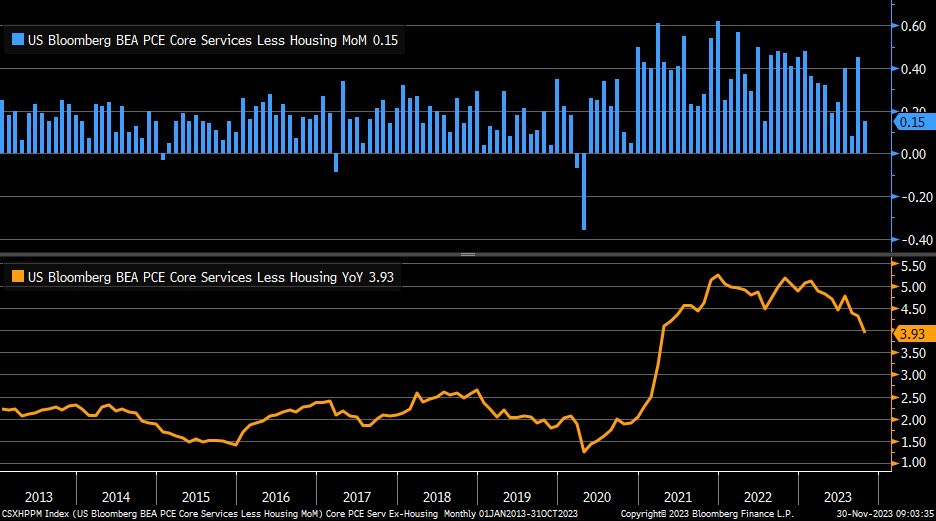

Core PCE services ex-shelter, a super niche slice of the PCE data also decelerated on both MoM & YoY metrics. Specifically, the YoY datapoint (which I care about more) fell to +3.93%.

I simply bring this up because Powell himself has cited the importance & significance of this datapoint throughout the year, explicitly stating that the Fed is watching this variable closely as a gauge for the trend of disinflation.

There’s no way around it, this was a fantastic report to confirm the nature of disinflation & verify that the trend is intact. It shows that more time is required to bring inflation to the Fed’s stated target, but that significant progress is being made.

As a final note on macroeconomic dynamics from this past week, I wanted to highlight how the Atlanta Fed’s forecast for Q4 real GDP growth was modified, falling from their prior estimate of +1.8% to their latest estimate of +1.2%.

I want to highlight this because it fits within my broader expectation that economic growth will be resilient, but soften. After the revised Q3 2023 data for real GDP growth, rising from the initial +4.9% to +5.2% in the revised figure, a forecasted deceleration to +1.2% growth is notable. But it’s growth nonetheless, and I don’t want “perfect” to be the enemy of “good”.

As far as I’m concerned, this week’s data reaffirmed my existing understanding & expectations for the economy.

And the stock market seems to like that…

Stock Market:

The month of November was historic for U.S. equities, with the S&P 500 posting its 2nd best month of November since 1980! The index generated a net return of +9.55% during the month and secured the highest daily close of 2023 on Friday.

Bearish investors continue to beat the same old drum about why they are bearish, highlighting their ignorance, cognitive dissonance, or their blatant misrepresentation of facts in order to justify their world-view.

I’m sorry if that upsets you or if you are disappointed in my harsh tone, but I genuinely despise their constant fear-mongering in the face of improving & strong market conditions. All year, they’ve cast aspersions on the validity of the uptrend, arguing that it’s poised to end, that it’s unhealthy, and that markets will fall.

12+ months of price action has proved them wrong, but they continue to bark louder.

Seemingly afraid to admit that they were wrong and that their prior fears were unjustified, their “solution” is to simply scream louder about new problems or dynamics that are going to surprise everyone.

I kid you not, some folks with 50k -250k followers on Twitter/X are still saying that we’re going to $3k on the price of Bitcoin, which is the same thing they were saying when BTC was trading at $16k in Q4 2022.

Their ongoing complaint about the stock market is breadth and that the Magnificent 7 are solely responsible for the gains in the market this year; however, I’ve disproved this time and time again.

This is an index composition and sector story, not a Magnificent 7 story.

If it was only the Magnificent 7 that were going up, why is the iShares Expanded Tech ETF ($IGV) up +55.3% YTD even though only 1 of the Magnificent 7 are in the fund?

The bearish sensationalists don’t want to acknowledge this truth.

If it was only the Magnificent 7 that were going up, why are 540 stocks in the Russell 2000 up more than +20% YTD? That’s 27% of the small cap index that’s outperforming the S&P 500 itself, which is up +19.7% YTD.

If it was only the Magnificent 7 that were going up, why are small cap stocks generating positive YTD returns in 2023?

Specifically, I filtered the Russell 2000 by the following criteria:

Market cap > small cap ($300M+ valuation) = 1,550 stocks of 2,000 in the index

YTD return > 0% = 804 stocks of the 1,550 from the first criteria

Therefore, ~52% of non-micro cap stocks in the Russell 2000 have generated positive YTD returns. These figures would be even better if we removed the financials & banking stocks too, which have been a significant drag on Russell 2000 performance in 2023 given the bank failures that occurred in Q1 and the looming shadow that has remained over the sector for the rest of the year.

Specifically, of the 1,550 stocks with a market cap larger than $300M, there are 260 stocks that are classified as financials. Of this 260 cohort, 168 of them (or ~65% of them) have a negative YTD return, which confirms my suspicion.

My man Larry Thompson (aka @hostilecharts on X) posted the following on Friday:

Clearly, it isn’t just the Magnificent 7. It never was. It still isn’t today.

Bitcoin:

As I’ve been writing this report, the price of Bitcoin has thrust above $39,000 and continues to make new YTD highs in an impressively strong year. The apex digital asset is now up +137% in 2023, making a series of higher highs and higher lows.

The Bitcoin mining stocks that I’ve been buying for the past 5+ weeks have been on fantastic run over the last two weeks, and the trade has generated a net return of +20% since I started to build the positions 5 weeks ago. In my opinion, this trade is still getting warmed up and I view the Bitcoin mining arbitrage as a 6-12 month thesis.

I’ve been pounding the table since early January of 2023 that Bitcoin was exhibiting bullish behavior and achieving bullish statistical milestones that shouldn’t be ignored. Every week on Twitter/X and on the various editions of Cubic Analytics, I’ve proudly expressed my conviction in the digital asset and laid out a variety of strategies to implement depending on risk tolerance, timeframes, and existing exposure.

I hope these have been useful.

While it’s amazing to see the price of Bitcoin appreciate vs. fiat currencies globally, not just vs. the U.S. dollar, it’s also amazing to see the fundamental value proposition of Bitcoin as a digital currency also increase.

Just today, I arrived in the town of Riomaggiore, one of the Cinque Terre villages in northern Italy, and saw this small market accepting Bitcoin as payment:

These are small but important wins, representing a change in the tides. These shops don’t accept USD, but they are certainly willing to accept BTC. I think that’s a win.

Best,

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, & timeframes expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Great read man...agree 100 percent...keep up the great work

Great write up Caleb!