Investors,

The first premium member group session will be happening on Tuesday, April 4th at 6pm ET! I’ll be sending out invitations on Sunday, so please keep an eye out for that email in your inbox. These weekly meetings are a new benefit that I recently announced for premium members, so I’m extremely excited to kick it off this week!

If you’d like to participate in the call & ask questions, consider upgrading to a premium membership below and access more exclusive research and benefits beyond the free weekly edition of Cubic Analytics. All of your support means a lot to me and I will continue to find new & innovative ways to create value. To support my work beyond being an avid reader of Cubic Analytics, you can upgrade to a premium membership below:

If you sign up for a premium membership between Sunday and Tuesday, I’ll send you a direct email with the invitation to the call so that you don’t miss it!

In addition to the group session on Tuesday, I will be publishing new analysis for premium members about Advanced Micro Devices AMD 0.00%↑ on Wednesday, April 5th. Semiconductors have captivated investor interest this year with the mainstream interest in artificial intelligence, ChatGPT, and OpenAI. The semiconductor industry was one of the best performing groups in Q1 2023, with the VanEck Semiconductor ETF SMH 0.00%↑ gaining +30% in the quarter. 30%!

Nvidia, one of the core portfolio positions that I outlined in my “Portfolio Strategy Series” has gained +90% so far YTD. There’s a reason why semiconductors are one of my favorite long-term ideas! The industry is on fire right now, so I think it’s the perfect time to be covering AMD, which I had previously highlighted in November 2022 as one of my favorite “runner ups” within the semiconductor industry.

Macroeconomics:

Throughout my coverage of inflation dynamics on Substack, I was very hesitant to decisively say that inflation has peaked; however, I’ve really staked that claim since December 2022 when I published “Everything Falls, Including Inflation”. Prior to that report, I was encouraged by the inflation data and even acknowledged in August 2022 that investors should be encouraged by the inflation data at the time and that “it’s possible that we’ve seen a peak in headline inflation”. Since then, headline CPI has fallen from +8.5% YoY to +6.0% in the latest data for February 2023.

Even in June of 2022, I shared my belief that markets were at an important inflection point. There were two key messages that I communicated in my report “Economic Data Driving Financial Markets or Financial Markets Leading Economic Data?”:

“Quite simply, I think the market is telling us that inflation is peaking.”

“Smart money believes inflation is going to decline… We may see a gradual & sustained decline in the YoY percent increase in the CPI and PCE.”

Bingo! Headline CPI peaked in June at +9.1% YoY and has been falling since.

Since December 2022, I’ve been confident enough in my outlook of inflation to state that disinflation will be the overwhelming trend in 2023. My view is that inflationary pressures will decelerate even faster in March - June 2023 due to the way that the Shelter component of the CPI is calculated (it’s roughly 33% of the overall CPI weighting and lags the actual housing/rental market by 8-12 months).

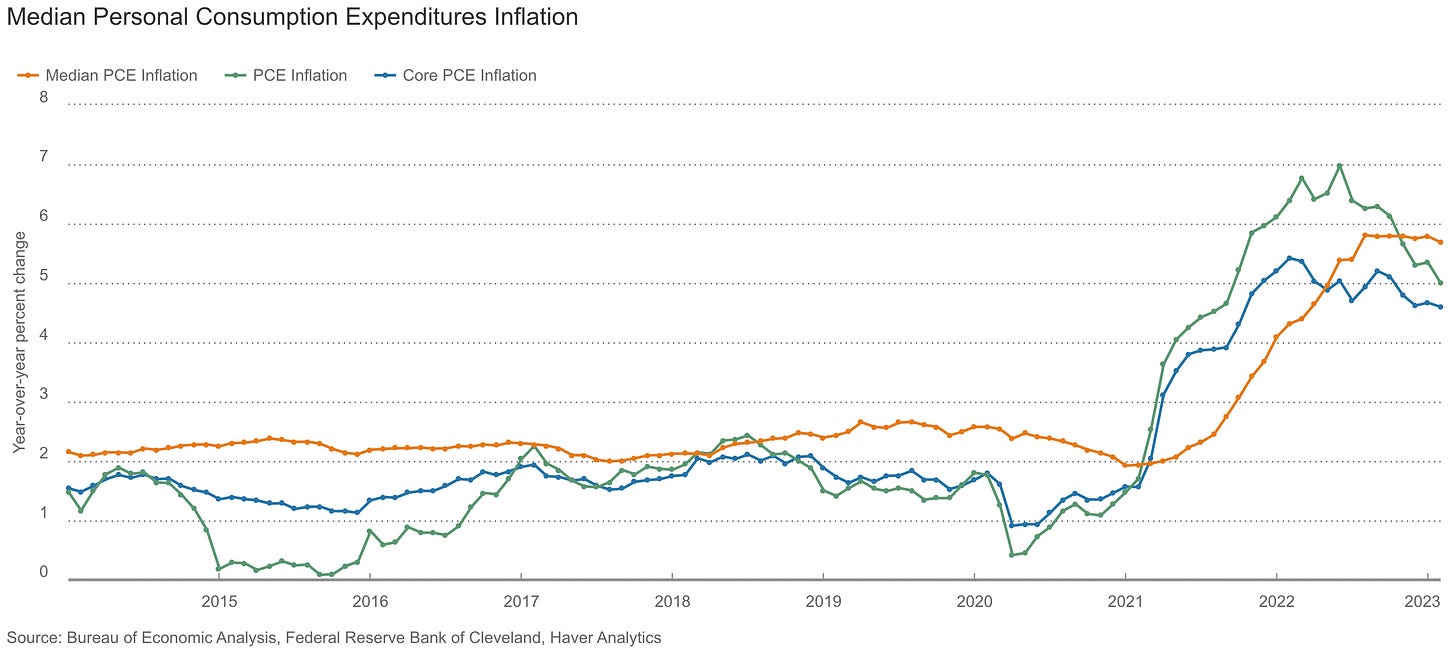

I continue to reiterate this outlook, which was strengthened this past week with the updated Personal Consumption Expenditures (PCE) data that we received on Friday morning for the month of February. While the Fed doesn’t target a specific level for PCE (their 2% inflation target is for CPI), it is their preferred method of measuring inflation. As such, it’s vital for investors to keep a close eye on these metrics.

The February results showed a YoY increase of +5.0% vs. expectations of +5.1% and prior results of +5.4%. At a basic level, this confirms that inflation continues to decelerate, perhaps even faster than the market had expected. Core PCE was +4.6% YoY vs. prior month results of +4.7%. This figure has been stickier than the headline data because it places a more significant weighting on services inflation, which are still running hot due to shelter dynamics. Nonetheless, it’s worthwhile to note that the effective federal funds rate of 4.83% is now above the YoY core PCE inflation data! With the Federal Reserve officially being in a restrictive policy stance since December 2022, this is a major win for the Fed’s fight against inflation and I think there’s reason to believe that the policy rate will continue to remain restrictive.

Considering that Powell has stated multiple times that monetary policy will need to “remain sufficiently restrictive for some time”, we’re officially 4 months into this new phase and the data is encouraging. The fight isn’t over, but the Fed is winning.

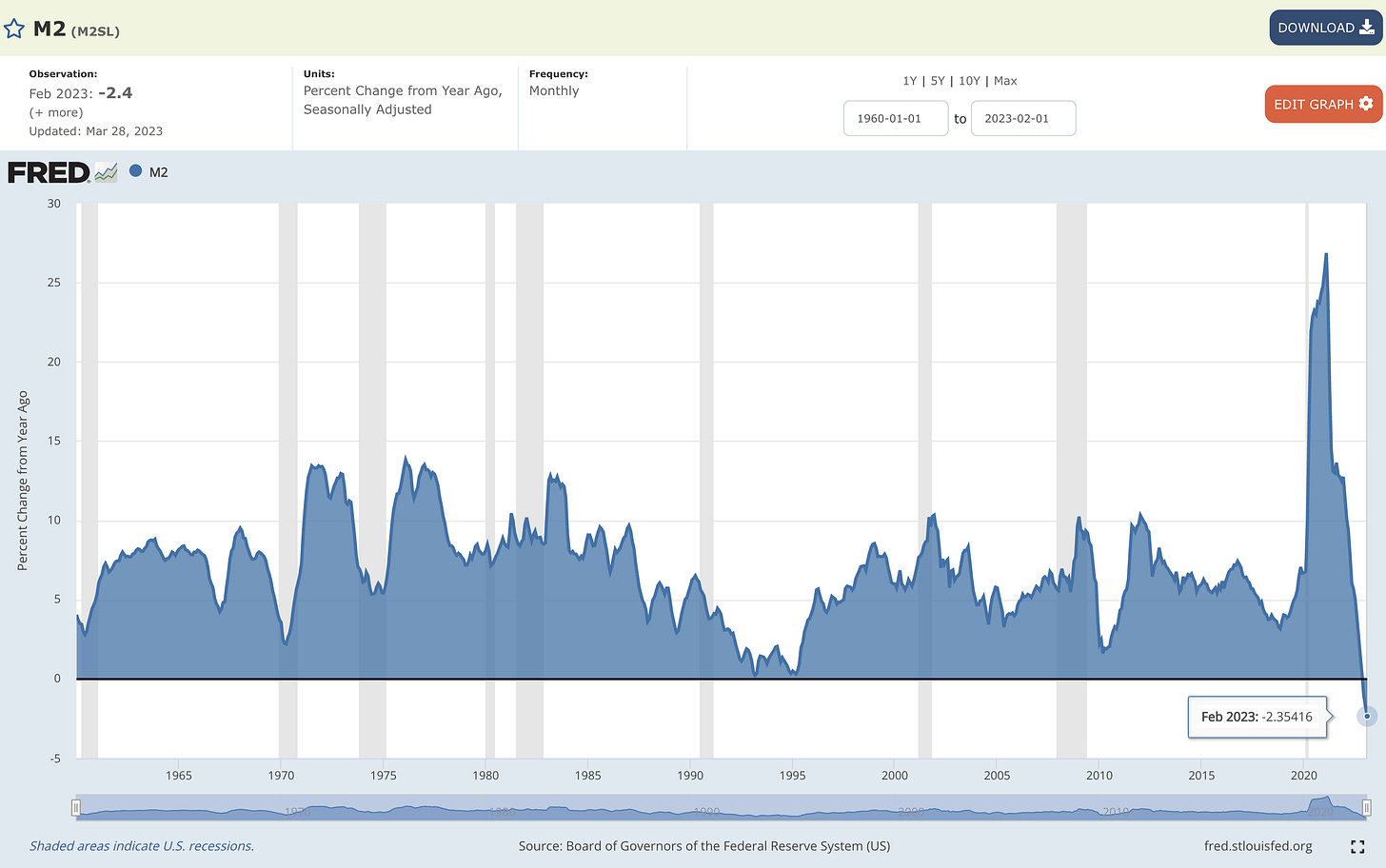

M2 money supply continues to contract (down -2.4% YoY), as well as reserves and deposits, which reaffirms that the Fed is walking a thin line of tightening conditions while providing support directly to the banking system via the BTFP.

The rapid shift from monetary expansion to contraction has been unprecedented in order to navigate an unprecedented period of economic & public health circumstances. The consequence(s) of this historic monetary policy response are unknown, and many pundits are even saying that they might be negligible. So far, the Fed has done a stellar job of minimizing cracks within the financial system, marginally reducing economic activity, maintaining a dynamic & resilient labor market, and simultaneously bringing down inflationary pressures.

As I pointed out in Q4 2022, the Fed might actually be threading the needle and pulling this off. Kudos to them if they do, but it’s still too early to pop the bottles of champagne.

Going back briefly to PCE data, I remain focused on the median measure of the data in order to get a better sense of how broader inflationary pressures are evolving. Based on the chart below, we’re seeing a decisive peak & “rolling over” in both headline and core PCE data, with median PCE essentially trending sideways.

The latest median PCE data showed a decline from +5.8% YoY to +5.7%. While it’s nothing to write home about, a win is a win. Expect to see this figures decelerate much faster in the coming months, including other inflation measures like CPI & PPI!

Stock Market:

Bulls couldn’t have asked for a better start to 2023, with the market blindsiding so many investors in the first quarter of the year. I’ve also been blindsided and I’m not ashamed to admit it. I had reasons to shift bullish in late-January through February, particularly with the indexes retesting their respective 200-day moving averages. So far, the three major indexes are all higher today than when they tested those 200 MA’s!

However, I have been shocked at the market’s strength in light of recent events in the banking industry and a variety of other macro factors. Hey, maybe the peak influence of macro on short-term market dynamics from 2022 is officially behind us…

I wrote the following on Twitter earlier in the week as a way to describe the conundrum right now:

“We’ve undergone the following in the past month:

2nd & 3rd largest bank failures in US history

Credit Suisse essentially bailed out

Federal Reserve +0.25% rate hike

ECB +0.5% rate hike

2 major crypto banks shutdown

Coinbase issued a Wells notice

CZ & Binance sued by CFTC

Concerns about systemic CMBS issues

Massive increase in SWAP pricing for banks

Rapid tightening of financial conditions

Historic inflows into money market funds

An escalation of de-dollarization

(fill in the blanks if I missed anything)

And yet, the CBOE Market Volatility Index $VIX is trading at 20.81 and is down -4.2% YTD. Investors quite literally DGAF.

What’s the straw going to be that breaks the camel’s back? Will it even break?

So far, nothing has produced material downward pressure for the overall market.”

At this point, what will it take for the market to resume lower? I haven’t a clue. As I alluded to in the post, it could be a small development that acts as the proverbial straw to break the camel’s back. The crypto industry has shrugged off all crypto-related risks. The stock market has shrugged off all equity-related risks. The broader asset markets have shrugged off all macroeconomic risks.

When the market continues to grind higher despite an abundance of risks and cause for concern, we have to ask ourselves one simple question: “Is our understanding of risk wrong/misguided, or is the market’s understanding wrong/misguided?”

Is the market being irrational? Maybe, but considering that “the market” is the aggregate opinion of all investors, an irrational market means that the aggregate view of all investors is wrong and only the extreme pessimists are right. The reality is that we’re probably somewhere in between. My view is simple:

The market is extended and perhaps somewhat irrational.

Extended/irrational market environments can stay extended/irrational.

As such, this uptrend could persist longer than we currently anticipate.

Leadership in mega-cap tech & semiconductors is rational.

Markets don’t move in a linear fashion and follow a choppy path higher/lower.

The market will cool down, but to what extent, when, and for how long?

While many will pretend to have the answer to this final question, I’m not embarrassed to say that I don’t know. The humility to admit that I don’t know what’s around the corner is why I think it’s so important to find 10-20 stocks & ETF’s to hold and continuously purchase in long-term portfolios. This is why I published my “Portfolio Strategy Series” in Q3 2022 — it was a beautiful moment to DCA and take advantage of lower prices! I’ve continued to buy long-term holdings throughout 2023 and even purchased more stocks this week. I’ve been a net buyer of stocks in 2023!

As I’ve been sharing since mid-2022, it’s possible to be bearish/defensive while simultaneously increasing your exposure to risk assets.

After a monumental first quarter of 2023, there’s historical precedence for stocks to do well for the remainder of the calendar year, according to data from Carson Research’s Ryan Detrick:

With the S&P 500 gaining +7.03% in Q1 2023, the forward-looking implications are extremely strong. With an average calendar year return of +23.1%, this means that the index would need to gain +15% over the subsequent three quarters in order to achieve the average calendar year return. With this data going back to the 1950’s, investors shouldn’t be quick to dismiss this analysis even if it is a simple approach to forecast where the market might go next.

Is there reason to be bullish? Yes. Is there reason to be bearish? Yes.

Despite where you fall on this scale, I think investors should continue to be a net buyer of assets in 2023. To know what I’m buying and why, refer to this Portfolio Strategy series below:

Bitcoin:

After last weekend’s full dedication to Bitcoin in my premium market analysis, the digital asset performed extremely well this week in light of ongoing macro events. $BTC is hovering around $28.5k, generating a weekly return of +2.9%. For the first time in quite awhile, Ethereum actually outperformed BTC this week, gaining +3.9%.

ETH/BTC is still negative YTD by -11%, highlighting how the 2023 rally has been predominantly a Bitcoin-led rally. Looking at the multi-year trend for ETH/BTC, we’ve been moving within a clear consolidation zone since mid-2021:

The relationship is in no-man’s-land right now, so it’s anyone’s guess if we retest the upper-bound or the lower-bound first. My personal opinion is that the lower-bound is most likely.

Focusing specifically on Bitcoin, a major signal that I’ve been patiently waiting for has finally flashed: the 24-month Williams%R oscillator has left the “oversold” level for the first time since July 2022!

I’ve been patiently waiting for this signal since I first discovered it in June 2022, which now adds more statistical confirmation that the bear market lows are behind us and that a new bull market is probable. Not certain… probable. However, we can unequivocally recognize that good things tend to happen after this signal flashes.

At the present moment, we’ve achieved all the major statistical signals I’ve been waiting for to gain confidence in the trajectory of Bitcoin across a variety of timeframes:

12-month Williams%R ≠ “oversold”

24-month Williams%R ≠ “oversold”

Bitcoin trading above the 200-day moving average

Bitcoin trading above the 200-week moving average

Bitcoin trading above the AVWAP from the 2021 cycle highs

Bitcoin trading above the short-term holder realized price

Bitcoin trading above the long-term holder realized price

Short-term holder realized price > long-term holder realized price

I’ve highlighted all of these developments & accomplishments in real-time, but this is the first time since the prior bull market where each of them are flashing simultaneously. Based on the aggregate implication of each of these signals flashing, I finally feel confident to say that the worst of the bear market is in the rearview mirror, that the $15.5k lows from November 2022 are likely THE cycle lows, and that a new bull market going into the 2024 halving is probable.

Statistics don’t operate in a vacuum absent of macro & monetary policy; however, I think it would be irresponsible to ignore the cumulative signal being provided by each of these indicators that are happening right now.

If you want to know exactly how I plan to allocate capital given this market signal, please refer to the thread below where I outline how I’m going to invest going forward:

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subjected to change without notice. The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. Everyone is responsible to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that the information contained herein does not constitute and should be construed as a solicitation of advisory services. Cubic Analytics believes that the information & sources from which information is being taken are accurate, but cannot guarantee the accuracy of such information.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation & reference.

As always, consult a registered financial advisor and/or certified financial planner before making any investment decisions.

DCA into a down trend /bear /unknow market? Is like catching fallen knives! JUST DONT! When there is blood in the streets -even then don't buy yet! Wait for a reason/catalyst to go clean up the streets. Then you get back in ...

Trust me - I lived, traded through the 90"s, dot.com and GFC, 2020 Covid dip ! We are so early into this recession, there is not even blood in the streets, as yet.

Just be patient, sit in cash!

“Bull markets ignore bad news, and any good news is reason for a further rally” 🎯

--- Michael Platt