Investors,

This past week was full of economic data & interesting market reactions, which I’m excited to dive into! Quickly, there’s something I need to ask from you…

Cubic Analytics has been growing at a massive pace in 2023, closing in on 5,000 total subscribers! With a growing and engaged audience, I’m starting to get approached by traditional finance companies who are looking to market their products/services within the free weekly newsletters. Historically, I’ve always rejected these inquiries, which have predominantly come from crypto/NFT projects and exchanges. I’ll never promote pump & dumps or projects that are simply looking to shill their scheme to new investors. However, I’ve been approached by a company who has reached out to me after I had mentioned that I liked their products and they are now interested in formally partnering with Cubic Analytics to increase the awareness of their products.

Before I make a decision, I feel obligated to ask you if this is something that would hurt your perception of Cubic Analytics and the brand that we’ve all been building since May 2021.

Since Day #1, I’ve avoided the “influencer model” of monetization. I’m not an influencer… I’m a market analyst & economist who is using social media as a distribution platform to share my work. The only money that I earn from this newsletter is based on me delivering additional value to premium members via paid subscriptions. At the end of the day, your trust and our relationship is what matters most to me, regardless of how much people are offering to engage with the Cubic Analytics audience.

This decision has been weighing on me because it’s potentially an important inflection point for me and the Cubic Analytics newsletter/brand. Reputations take years to build and minutes to destroy, and the last thing I’m trying to do is destroy the trust that we’ve built over the past ~3 years. Please vote in the poll above and/or provide some thoughts in the comment section about this situation, as I’d love to hear from you.

If you want to support my work directly, please consider upgrading to a premium membership using the link below:

With that out of the way, this is the latest edition of Cubic Analytics:

Macroeconomics:

This week was dominated by labor market data, which provided some mixed signals. On one hand, the following data suggests that the labor market is softening:

Job openings fell from 10.563M in January 2023 to 9.931M in February, the lowest level since May 2021.

Weekly initial unemployment claims have been trending higher, coming in above estimates in the recent reading at 228,000.

Average hourly earnings growth continues to decelerate, falling from +4.6% YoY in February to +4.2% in the March data. While this figure is still historically strong, the ongoing deceleration is notable. Recall, average hourly earnings growth peaked at +5.9% YoY in March 2022 and has been slowing since then.

On the other hand, the following data suggests that the labor market is strong:

The unemployment rate declined back to 3.5% in March, from 3.6% in February.

The U.S. economy added 236,000 jobs in March (vs. estimates of 230,000).

The labor force participation rate continued to climb higher, reaching the highest levels in the post-COVID era at 62.6%. Prime-age LFPR, measuring the participation of people aged 25-54, is now equivalent to where it was in January 2020 at 83.1%, which was a multi-year high at the time.

The ongoing tug-of-war between softening & improving conditions is exactly why I continue to refer to the labor market as “resilient” and “dynamic”. Despite bleak economic data in 2022, the labor market has generally been the consistent bright spot for the U.S. economy. There are two aspects that I want to focus on in this newsletter:

1. The quits rate: I’ve been talking about the quits rate for over a year now, particularly with respect to the influence that it has on wage growth and inflation. Fundamentally, job-switchers have stronger wage growth than job-stayers; therefore, a high quits rate would theoretically imply strong wage growth and stronger inflationary pressures, all else being equal. The latest data from the February JOLTS report showed the quits rate edge higher from 2.5% to 2.6%; however, the overall direction of the quits rate is very clear — it’s decelerating. Why is this important? Because it implies & confirms that inflation is also decelerating!

Don’t believe me? The chart below compares the quits rate vs. YoY personal consumption expenditures (PCE) inflation:

We can see a very clear & tight correlation between these variables since 2001! While the quits rate ticked higher in the latest monthly data, I don’t believe that month-over-month evolutions of the quits rate will effectively determine the results for PCE inflation. Rather, I think that the overall direction here is the important factor. As such, I continue to believe that disinflationary pressures are underway and will continue to become more overwhelming in the months ahead.

2. The YoY percent change in the unemployment rate: This is a datapoint that I’ve been sharing since mid-2022 that I’m trying to spearhead & bring more awareness to. Rather than looking at the unemployment rate itself, I think that the year-over-year evolution can provide fantastic context about the labor market. When I’ve shared this datapoint before, I’ve been focused on the re-steepening of the YoY % change in the unemployment rate, which has occurred before each recession within the data series:

There are certainly false signals that occur, meaning that it’s not a 100% perfect indicator; however, each recession (grey zone) has been preceded by this YoY re-acceleration in the unemployment rate. The data nonfarm payroll data in March showed that the YoY change was -2.8% (vs. -5.3% in February 2023), which continues to display a softening evolution in the labor force. Just to be clear on how this figure is calculated, the unemployment rate in March 2022 was 3.6% vs. 3.5% in March 2023. This represents a -2.8% decline on a YoY basis vs. -5.3% in the February comparison.

As we think about the data going forward, the unemployment rate in April 2022 was 3.6%. Therefore, if the April 2023 result comes in below 3.6%, the chart above will still be in negative territory on a YoY basis. However, a result of 3.6% or higher means that the chart above will officially become flat at 0% or positive. These crossovers from negative to flat/positive aren’t a good sign for the U.S. economy, based on the recessionary signals shown above.

The labor market has been resilient, but there are signs that it will begin softening soon. As financial conditions tighten and bank deposits decline, I fully expect to see loan growth decelerate and outright contract. In turn, this will put more pressure on the overall economy as credit becomes increasingly scarce. The Federal Reserve’s intervention with the BTFP facility has worked, but recent data shows that the Fed’s balance sheet has now contracted for two consecutive weeks. This indicates that the latest round of Fed-induced liquidity is waning and could put renewed pressure on the financial system, particularly with the market expecting a 71.2% chance that the Fed hike by +0.25% at the FOMC meeting in May.

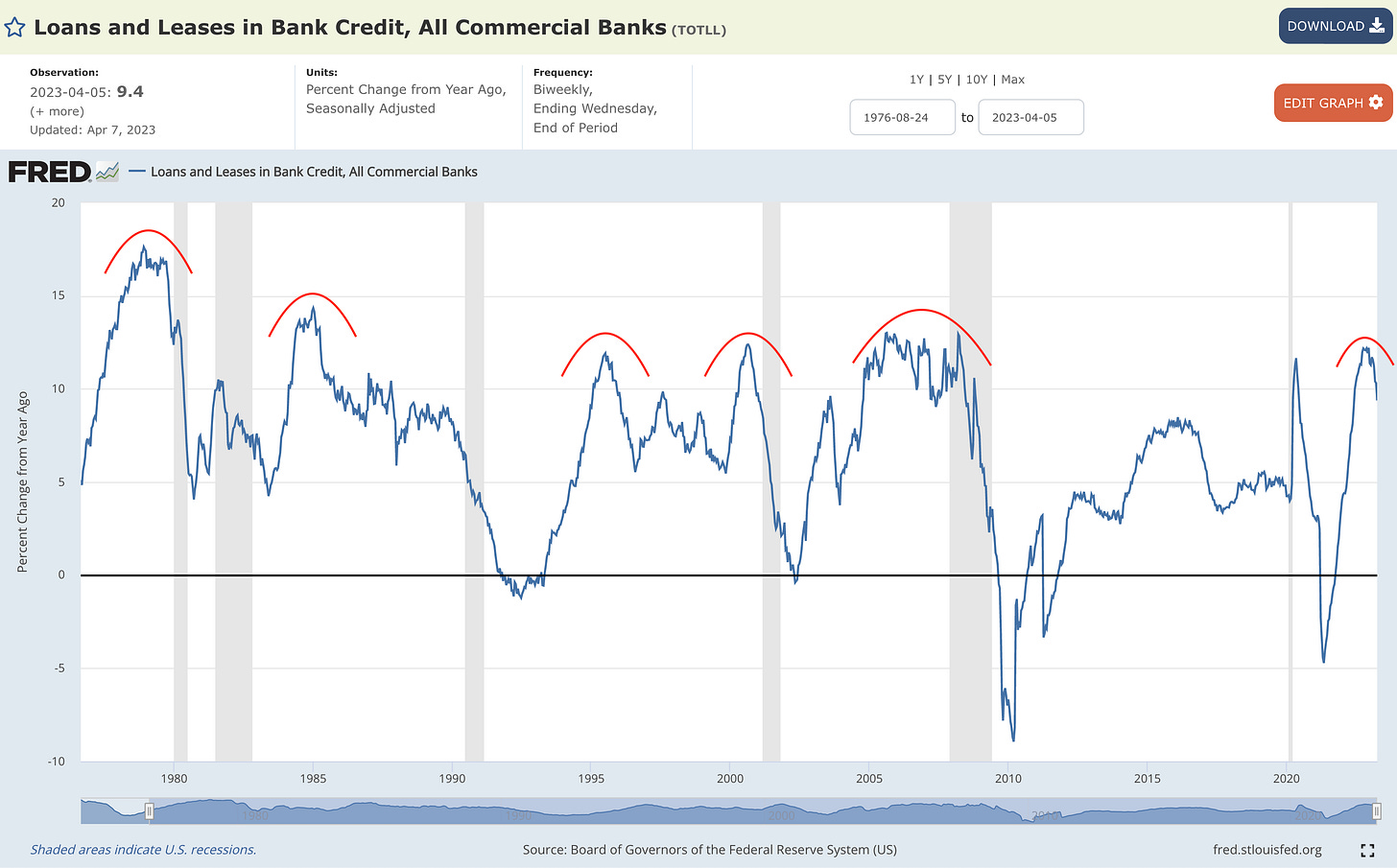

Monitoring credit dynamics is going to be extremely important in the months ahead; however, we’re already seeing loan growth decelerate rapidly after a period of strong growth:

I fully expect to see YoY loan growth trend lower going forward, considering that banks are likely going to be hesitant to extend their balance sheet this late into the credit cycle when there is pressure on deposits. Combining the labor market and lending activity analysis above, I fully expect to see economic deterioration in the months ahead. This means that we should likely expect to see the labor market transition from “resilient” and “dynamic” to outright “softening”. I think that this deterioration could happen quite suddenly, given the macroeconomic uncertainty and even the recent announcements from companies like McDonald’s announcing layoffs.

Stock Market:

The stock market was a mixed bag this past week, seeing somewhat of a mean reversion relative to recent market dynamics. The Dow Jones, which has been weak relative to the S&P 500 and the Nasdaq-100, was the only index to finish the week with a positive gain:

Dow Jones $DJX: +0.64%

S&P 500 $SPX: -0.11%

Nasdaq-100 $NDX: -0.9%

Russell 2000 $RUT: -2.67%

Bank stocks are continuing to face pressure, with the Regional Bank ETF ($KRE) falling more than -2.8% this week. With the Russell 2000 having the most exposure to banks & financials relative to the other indexes, it’s clear to see why the small-cap index is struggling the most. For the year, the Russell 2000 is down -0.4% YTD after being up more than +14% through early February.

In fact, small-cap stocks are bleeding relative to large-cap technology stocks. Looking at the Nasdaq-100 relative to the Russell 2000 (NDX/RUT), we can see the following:

Said differently, tech stocks have only been this high relative to small-caps on two occasions:

The Dot Com Bubble

The 2nd half of 2020

That’s it. That’s the list.

On this point, I want to be clear that I’m not saying tech is in a bubble relative to small-caps. Why? Look at the pace of the growth in the late-1990’s vs. today. These are two very different types of market environments — one fueled by speculation and another fueled by demand for the some of the best companies in the world. The fundamental composition of the Nasdaq-100 is completely different today than it was in the late-90’s; however, I don’t want to dismiss the fact that I think tech stocks are expensive here. In fact, I dedicated an entire report last weekend to analyzing tech valuations, which I believe are unnecessarily expensive right now. You can read that report in its entirety here:

I wouldn’t be surprised if this relationship continues to climb higher (though I’m not sure much higher), simply because I expect to see the Russell 2000 and other small-cap stocks perform poorly in this environment, particularly if economic data worsens in the coming months.

Bitcoin:

Despite choppiness in the stock market this past week, Bitcoin has remained resilient around $28,000. Every decline into the $27k range was immediately snatched up by investors who seem to have an insatiable bid for more Bitcoin. However, each increase towards $29k was immediately rejected.

I continue to closely monitor the price action around the anchored volume-weighted average price from the November 2021 highs, using Coinbase exchange data. While we haven’t seen a decisive breakout or rejection from this dynamic level, it’s worthwhile to point out the different type of behavior in the current retest vs. the March 2022 retest.

In March 2022, Bitcoin briefly broke above the AVWAP but immediately fell lower. While BTC hasn’t been able to sustain above the AVWAP in the current market environment, it hasn’t been been decisively rejected either. In fact, this coiling behavior is a stark contrast vs. an immediate failed breakout. Perhaps bulls should find this comforting, given the fact that BTC has gained +80% from the 2022 lows and is perhaps just digesting the gains at a logical supply/demand zone! For context, the March 2022 rally had gained +45% from the lows in January 2022.

Bitcoin dominance remains at YTD highs, continuing to highlight how this crypto rally has been fueled & led by Bitcoin’s performance. However, we can see that BTC.D has responded very consistently around this level since mid-2021:

Once Bitcoin dominance has gotten around 47% - 49%, we’ve typically seen it fall back towards the 39% - 40% range. Mathematically, this means that altcoins are outperforming Bitcoin when BTC.D is declining. In other words, the crypto market share belonging to altcoins is increasing and capital is flowing out of Bitcoin and into other cryptocurrencies, including Ethereum.

Considering that Bitcoin’s massive rally from $19k to $28k has occurred since the onset of the banking crisis, potentially emblematic of Bitcoin’s sound-money system, there’s reason to believe that more pressures within the traditional financial system will fuel more strength for Bitcoin vs. altcoins. In this scenario, a breakout above 50% seems plausible, if not likely. However, we can’t ignore the fact that BTC.D has fallen each time it’s retested this zone over the past ~2 years.

Which way does it go? Your guess is as good as mine. All I know is that it’s important to remain extremely flexible and dynamic around this range, based on how it has reacted to this level in the past.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subjected to change without notice. The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. Everyone is responsible to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that the information contained herein does not constitute and should be construed as a solicitation of advisory services. Cubic Analytics believes that the information & sources from which information is being taken are accurate, but cannot guarantee the accuracy of such information.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation & reference.

As always, consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Caleb, I’m absolutely good with a paid ad. You deserve compensation above premium memberships in my book.

A paid ad doesn't really bother me on the free newsletter. I would just ask you are very selective and extremely transparent about the relationship. Seems like this is already your path