Investors,

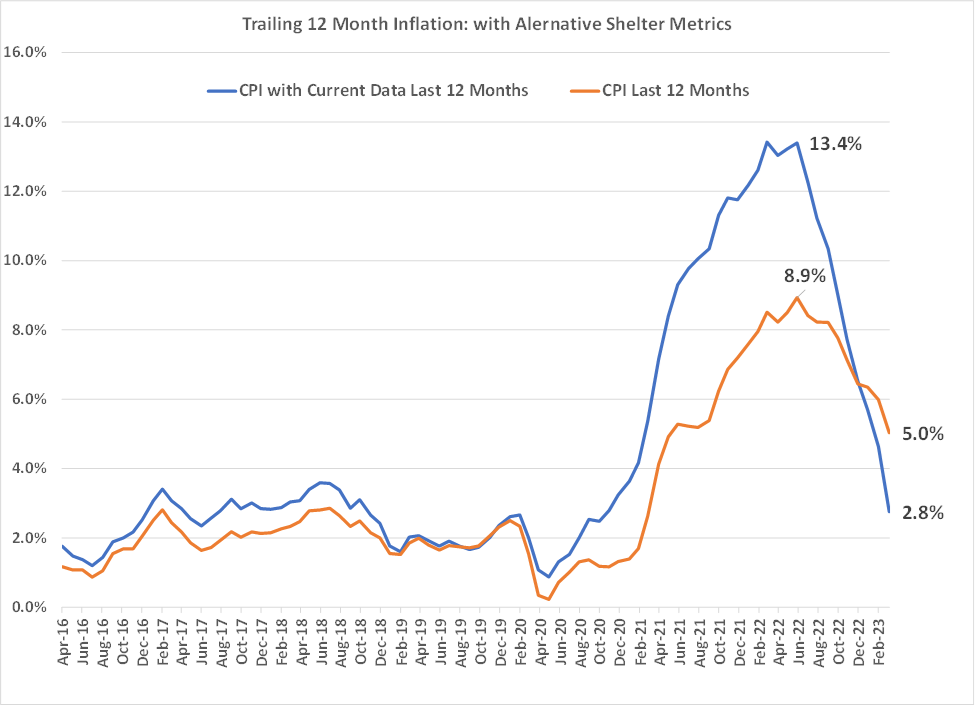

After publishing yesterday’s deep-dive on disinflation, which focused predominantly on the lagging impacts of Shelter/OER on the CPI data, I saw an interesting chart from Jeremy Schwartz, the Global Chief Investment Officer at WisdomTree. The team at WisdomTree has been able to create an alternative CPI model that swaps Owners’ Equivalent Rent with real-time housing/rental market data. The result is exactly what I would’ve expected.

First of all, the alternative CPI model using real-time housing market data magnified the inflationary pressures during 2022 because laggy OER underrepresented actual home/rent price increases. Second of all, the model suggests that the current inflation rate is actually +2.8% YoY vs. the actual result of +5.0%. It’s clear that CPI was being underestimated in 2022 and that CPI inflation is being overestimated in 2023.

Using this alternative model for the Shelter component of CPI, which comprises roughly 33% of the overall CPI weighting, the current inflation rate is at arm’s length from the Federal Reserve’s long-term target of +2.0% YoY. This reaffirms my belief that the Fed is relying on data that is not only backward-looking, but also inaccurate.

This premium report will be entirely focused on major developments in the stock market and crypto, but I thought this additional context was necessary to finalize yesterday’s deep-dive on inflation. Below, I’ll be analyzing:

Under-the-hood metrics for the S&P 500 + developments for market leadership

Crude oil & energy stocks

The top earnings reports I’m going to be watching this week & why

My favorite Ethereum chart right now and the altcoins I’m trading

As a reminder, you can upgrade to a premium membership using this 20% discount link below to read the remainder of this report and benefit from the additional perks of a premium membership! Monday, April 17th is the final day to activate the discount.