Investors,

After months of pounding the table on disinflation, it’s unequivocal that inflationary pressures are abating and trending lower. While there could there be a hiccup due to a supply shock or unforeseen event, my outlook of broader economic trends and an understanding of how the CPI data is calculated makes me believe that inflation will continue to decelerate (aka disinflation) in the months ahead.

It’s critical to understand the following: Inflation has peaked. Prices haven’t.

We received an abundance of important economic data this past week, which reaffirms the views expressed above. We’ll dive into the details within this report, but the takeaways are simple:

Inflation is rapidly decelerating.

The labor market is showing early signs of deterioration.

Consumer spending is softening.

Before diving into the full report, I wanted to share my excitement that we have crossed 5,000 total subscribers for Cubic Analytics! When I started this newsletter in May 2021, I knew that I wanted to build something special and focus on growth with a marathon mindset, rather than a sprint. Somehow, it feels like we’re managing to sprint a marathon. It’s amazing to me that Cubic Analytics had 685 subscribers this time last year and that we’ve managed to 7x over the past twelve months.

If you’d like to join hundreds of premium members and access the full extent of my research, please consider upgrading your subscription using this 20% discount code:

Here’s to the next twelve months!

Macroeconomics:

Year-over-year (YoY) inflationary pressures are plummeting, with headline CPI falling from +6.0% in February 2023 to +5.0% in March 2023. This was the largest decline that we’ve seen from one month to next since inflation peaked at +9.1% in June 2022. Within nine months, we’ve seen headline CPI fall by 410 basis points (-4.1%), despite the fact that the largest component of CPI, Shelter, has continued to accelerate during that same time period.

Let that settle in: Disinflation is in full force, despite the fact that the largest component of the CPI making multi-decade highs. The chart below helps to highlight this development, tracking the YoY rate of inflation for:

Headline CPI in blue

Core CPI (ex-food & energy) in green

Shelter CPI in red

There’s typically a clear correlation between these variables (notably between core CPI & Shelter CPI); however, there’s a clear deviation between Shelter vs. headline & core CPI at the present moment.

While Shelter has continued to accelerate to the highest level since June 1982, headline & core inflation have moderated lower, which indicates that most inflationary pressures are declining and normalizing. Importantly, Shelter is a figment of the Bureau of Labor Statistics’ imagination, and lags the actual housing/rental market by 8-12 months. Fundamentally, the Shelter data is detached from the current state of the housing/rental market, which means that it isn’t properly diagnosing the current state of inflation.

Therefore, we must ask ourselves “what is the actual housing market telling us and what does it imply about the likely path of inflation going forward?”

1a. Case-Shiller National Home Price Index (nominal value): According to the most recent Case-Shiller data, as of January 2023, the Case-Shiller NHPI has been declining since the peak in June 2022. More specifically, it’s fallen -5% during this time period. While -5% can be easily dismissed at face value, it’s a substantial decline for the housing market over a 6-month period.

With the index peaking in June 2022, the Shelter component of CPI is likely going to peak between now and the June 2023 data, which will be released in July 2023.

1b. Case-Shiller National Home Price Index (YoY rate of change): In addition to an outright decline in the nominal value of the Case-Shiller index, home prices have also decelerated on a YoY basis!

This is important because the data indicates that the YoY change in Shelter/OER lags the YoY change for the Case-Shiller Index! Once the Case-Shiller National Home Price Index peaks/stabilizes on a YoY basis, it takes time for Shelter to also stabilize:

According to the YoY Case-Shiller data, home prices have stabilized dramatically:

In March 2022, home prices had gained +20.8% YoY.

In January 2023, home prices have gained +3.8% YoY.

In rate of change terms, it’s clear that the large acceleration in the housing market is in the rear-view mirror. With YoY Case-Shiller peaking in March 2022, I fully expect to see Shelter/OER decelerate immediately. Please note, this doesn’t mean that home prices will fall negative on a YoY basis (though this is possible). My prediction is simply that Shelter will fall from +8.2% YoY towards +4% by Q4 2023.

2. Apartment List National Rent Index (YoY rate of change): Real-time data from Apartment List indicates that rental prices are still rising YoY, but at a lower pace than in 2021 or 2022.

On a YoY basis, rents have risen by +2.6% in March 2023 vs. a peak of +8% in Q4 2021. This rental data reaffirms the takeaways from the Case-Shiller Index, suggesting that Shelter/OER should begin to decelerate imminently.

3. Zillow Home Values Index is declining, especially in major cities: According to data from Zillow, shown in the table below from Lance Lambert of Forbes, home prices in major cities are declining. These declines have been fairly minimal, but we’re seeing evidence that prices are falling from their peaks and that major cities are turning negative on a MoM or YTD basis.

With YoY data starting to turn negative, these outright declines and decelerations will ripple into the Shelter data soon. With broader inflationary pressures cooling off, this upcoming deceleration in Shelter will help overall CPI inflation data fall at an even faster pace.

And to be very clear, broader inflationary pressures are cooling off!

Food prices (roughly 14% of the overall CPI weighting) are still at historically high levels, but they peaked in August 2022 at +11.3% YoY and are currently up +8.5%:

Used car prices are in outright deflation on a YoY basis, down -11.2%:

Energy prices are finally experiencing outright deflation on a YoY basis, down -6.4%:

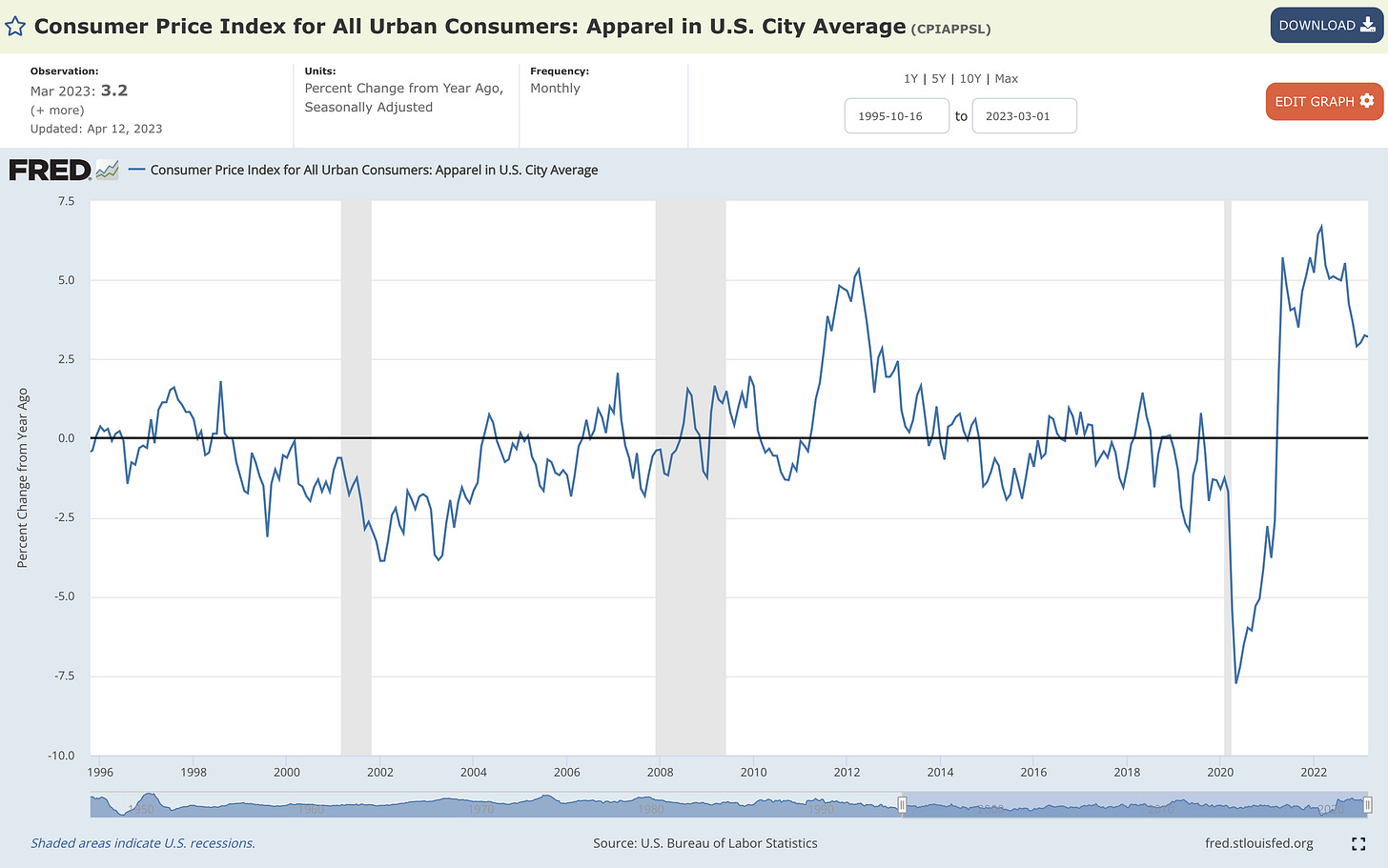

Apparel seems to have peaked, though it’s stagnating around +3.5% YoY:

Medical care peaked in September 2022 at +6.0% YoY, currently at +1.5% YoY:

Across the board, the largest components of the inflation basket are in outright disinflation or deflation. The only major component to be accelerating on a YoY basis is Shelter, which is by far the largest component of the CPI calculation.

Looking at alternative measures of inflation, like trimmed-mean CPI (blue) and median CPI (orange), we can see that inflation is losing momentum and turning lower.

While median CPI hasn’t seen a decisive peak and decline, I fully expect to see this occur in the upcoming reports once Shelter starts to impact the data. On the aggregate, CPI data & various components within it are confirming a common theme:

Disinflation is here.

The disinflationary theme isn’t just happening for the CPI either — we’re also witnessing it in Personal Consumption Expenditures (PCE), which we reviewed a few weeks ago, and for the Producer Price Index (PPI).

Regarding producer prices, the March PPI data also came out this week, falling from +4.96% YoY in Feb.’23 to +2.8% YoY in March.

With PPI reaching +11.6% YoY in March 2022, it’s clear that peak PPI is in the rearview mirror! On a month-over-month basis PPI fell -0.5% vs. expectations of ±0.0%. With wholesale prices on the decline, this is great news for businesses and consumers! For businesses, this means that margins are potentially going to expand and therefore boost their net income margins. For consumers, this means that producer input costs are decelerating and should trickle into a slower increase (or outright decrease) in consumer prices.

In recent weeks & months, we’ve witnessed rising initial unemployment claims, lower job openings, and softer nominal wage growth, all of which will suppress demand and constrict price pressures. Since bottoming in September 2022 at 182k, initial jobless claims have been steadily rising to the recent level of 239,000.

Nominal wage growth is also decelerating after a period of strong wage increases for the U.S. workforce, falling from +5.9% YoY in March 2022 to +4.2% in March 2023:

Advance retail sales data also contracted in the month of March, falling -1% relative to February 2023, significantly lower than estimates which projected a monthly change of -0.4%. Retail sales have now contracted in four of the past five monthly reports! Interestingly, the YoY change in retail sales doesn’t get much attention so I decided to pull the data myself.

We can see a clear peak in April 2021 on a YoY basis, which makes sense considering that it was a comparison vs. retail spending in April 2020 during the peak of COVID lockdowns. Nonetheless, we can see a clear downtrend and normalization since then, with retail sales in March 2023 being higher by +1.5% YoY. The downtrend here is significant, illustrating a smooth & steady decline in consumption activity.

While we shouldn’t cheer for a slow deterioration in the labor market and retail sales, the implications for inflation are, in and of themselves, encouraging. All in all, my outlook on economic growth, consumer activity, and housing market dynamics reaffirm my prediction for further disinflation in the months ahead, particularly with commodity prices and crude oil down significantly YoY.

From a simple mathematical standpoint, I firmly believe that headline & core CPI will trend lower on a YoY basis, aided by an upcoming rollover in Shelter. There’s been a clear downshift in 3M and 6M annualized versions of headline & core CPI, which bodes well for upcoming inflation trends.

These annualized metrics are trending below the 1-year rate of change in headline & core, which indicates that momentum is in favor of disinflation going forward. To be specific, I expect to see inflationary pressures subside very rapidly in the next 3-4 monthly reports, likely through the June and/or July 2023 data. Considering that YoY headline CPI just fell from +6.0% to +5.0% in a single month, I wouldn’t be surprised if YoY headline CPI reaches the +3% range by July 2023.

The Fed is focused on lagging data in order to make policy decisions that take time to ripple through the economy and the financial system. The brute force tightening of 2022 has yet to have its full impact on the economy today, and the Fed is still forecasted to raise rates again in May 2023. I fully expect for their prior policy decisions to anchor & reduce economic activity very shortly, which will further constrict inflationary pressures. From my perspective, the outlook is clear:

We have been in disinflation since the November 2022 data. We’re firmly within disinflation right now. Disinflation is likely to become more forceful in the coming months, primarily due to Shelter & YoY base comps for energy/commodity prices. There’s a chance that the Fed’s policy actions could lead to deflation in the event that further cracks occur in the financial system & broader economy.

I’ve been vocal & concerned about overtightening monetary policy since Q3 2022:

I remain convinced that this risk is becoming a more substantial threat.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subjected to change without notice. The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. Everyone is responsible to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that the information contained herein does not constitute and should be construed as a solicitation of advisory services. Cubic Analytics believes that the information & sources from which information is being taken are accurate, but cannot guarantee the accuracy of such information.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation & reference.

As always, consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Well done on the 5,000 Caleb.

Do you think these disinflationary pressures are good or bad for the stock market? On the one hand it can lead to the Fed to end the tightening cycle (thought that doesn't mean they cut rates right away). On the other hand, it seems like the disinflationary pressures are brought about by a weakening economy.