Markets Cheer For Soft Landing

Investors,

Disinflation is in full force, exactly as I’ve been saying that it would all year. I won’t re-hash the October 2023 CPI data, but you can read my thoughts on it here:

The day after the CPI was released, the Producer Price Index (PPI) for October 2023 was published, which also reaffirmed my thesis. I’ll keep my comments on this brief:

On a month-over-month basis, Wall Street was expecting to see headline PPI rise by +0.1%. The actual result was -0.5%, showing outright deflation relative to September’s producer prices.

On a year-over-year basis, headline PPI decelerated from +2.2% to +1.3% while core PPI decelerated from +3.0% to +2.9%.

This is exactly what disinflation looks like.

In response to the disinflationary data this week, stocks celebrated. This is exactly why I’ve been so focused on getting inflationary dynamics & the trend of disinflation correct — stocks & asset prices thrive during disinflation.

What else do stocks like? Ongoing proof of the famed “soft landing”.

Disinflation + vibrant labor market + resilient GDP growth is the recipe for success.

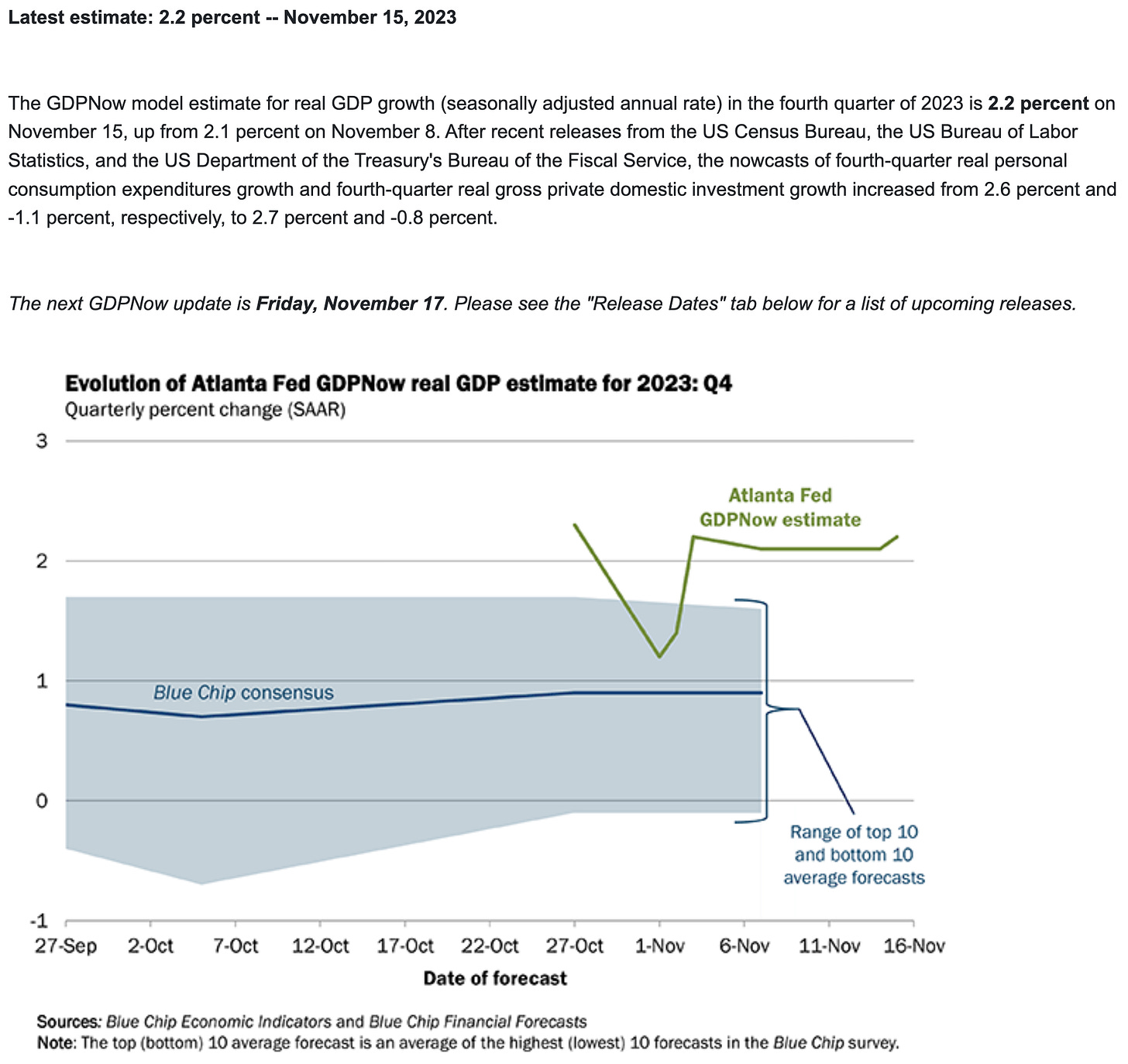

The Atlanta Federal Reserve’s model-based GDP forecast was published during the week, predicting for +2.2% real GDP growth in Q4 2023.

While this is softer than the Q3 result (+4.9%), it’s still solid growth. As I said a few weeks ago “softness (not weakness) is bullish”. So far, this continues to be true.

Since the late-October lows, the U.S. indexes have been on fire:

Dow Jones $DJX: +8.1%

S&P 500 $SPX: +10.0%

Nasdaq-100 $NDX: +12.6%

Russell 2000 $RUT: +10.0%

YTD returns are now positive, across the board:

Dow Jones $DJX: +5.5%

S&P 500 $SPX: +17.6%

Nasdaq-100 $NDX: +44.8%

Russell 2000 $RUT: +2.0%

Bonds have rallied back. Bitcoin achieved the highest daily close of the year. Even utility stocks have participated in the upside! All of these bullish dynamics are being confirmed by the decline in the U.S. Dollar relative to other currencies:

My expectations over the past few weeks is that the DXY is going to break below the 200-day moving average cloud. As you can see in the chart above, DXY closed perfectly within this dynamic range, on track for a breakdown within the coming weeks, if not days. This will unequivocally create a strong ripple effect for equities, Treasuries, Bitcoin, and crypto.

I wanted to provide these brief comments to clarify my assessment of current trends; however, I also wanted to share my recent interview with Brandon from Green Candle Investments. Brandon invited me onto his show at the end of October and our interview just dropped, which you can watch below. In it, I provide an in-depth assessment of ongoing macro conditions, monetary policy, and how I’m viewing Bitcoin and the equity markets. Enjoy!

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged & direct/inverse, to the NYSE FANG+ Index.

For investors who are looking to generate income on their assets while also having simultaneous exposure to FANG+ stocks, their new $FEPI product is extremely interesting and worth researching on your own.

I partnered with MicroSectors in 2023 because I’ve been using their products for over a year and it was an organic and seamless fit.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, & timeframes expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.