Investors,

I’m writing this emergency newsletter to reiterate that immaculate disinflation is still underway, as confirmed by the latest CPI data for October 2023 released this morning.

All year, I’ve encouraged investors to have conviction in the disinflationary thesis, which has been soundly backed by broader macro data, Fed policy, and a careful dissection of individual components within the Consumer Price Index.

Once again, the latest round of data validates my thesis & that’s worth celebrating!

I’m going to dive into a few charts within this report, but I first want to extend an offer to you with this 20% discount to join the premium version of Cubic Analytics:

The weekly premium reports and investor calls for Q&A ensure that you can stay focused on the key macro trends & market dynamics in order to accurately understand the market better. If you’ve been a free subscriber, I hope that you’ve gotten a taste of how I approach the macroeconomic landscape, the market environment, and being an investor. If my approach resonates with you, I’d be happy to have you upgrade to the premium team.

Let’s get into a few charts:

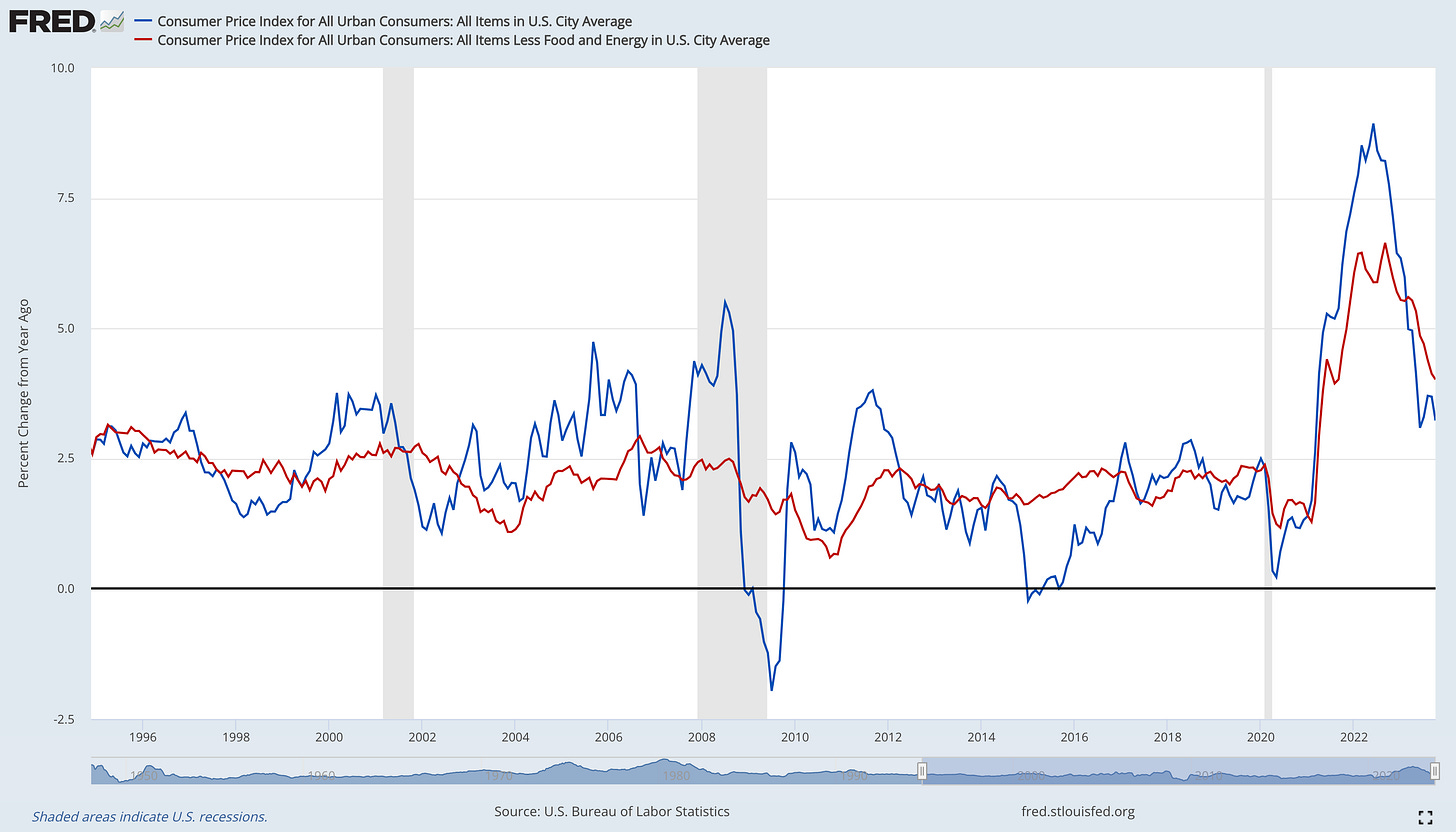

1. Both headline & core CPI decelerated on a YoY basis, coming in below estimates:

Headline (blue): +3.2% YoY & +0.0% MoM

Core (red): +4.0% YoY & +0.2% MoM

2. Shelter, the largest component of the CPI (33% of headline & 41% of core) also decelerated on a YoY basis, falling from +7.1% in September to +6.7% in October:

3. Headline CPI excluding Shelter decelerated, falling from +2.1% YoY in September to +1.5% YoY in October:

4. Headline CPI excluding Energy decelerated, falling from +4.1% YoY in September to +3.9% in October:

5. Food inflation fell from +3.7% YoY in September to +3.3% in October:

Across the board, the various components of inflation are showing one of two things:

Steady disinflation

Outright deflation

On the aggregate, this has been producing broad-based disinflation and this continues to be my outlook going forward, which has major implications for Federal Reserve policy, asset prices, and overall economic trends. These are all major topics that I focus on at Cubic Analytics, which is why I encourage you to upgrade your membership today or to take advantage of this pricing while you have a chance.

Best,

Caleb Franzen