Is It Really "So Over"?

Investors,

Is Bitcoin repeating the same exact topping pattern as 2021?

I don’t believe so and here’s why:

If we focus on weekly candles and the weekly closes, in particular, we can see that the price action is completely different!

At least, for now…

In a world where U.S. macroeconomic data remains robust (Q2’25 real GDP growth was just revised up from +3.1% annualized growth to +3.3%), we continue to see clear evidence of bull market characteristics in the stock market and yet another opportunity for Bitcoin to produce a higher low.

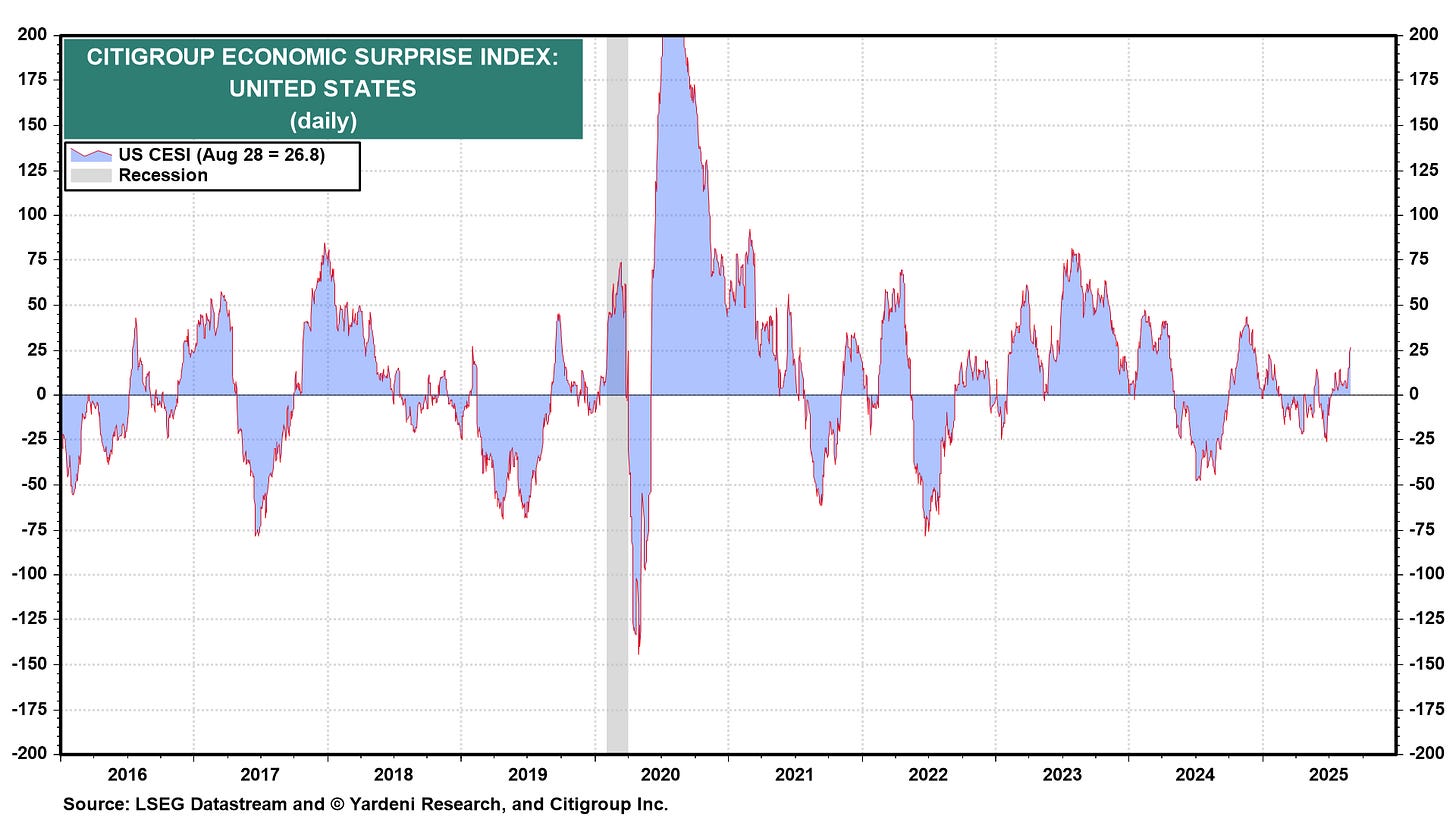

The Citigroup Economic Surprise Index, which tracks the results of economic data relative to expectations, is making new YTD highs, indicating that macro data is surprising to the upside in a positive way.

Even the recent acceleration of inflation data is not necessarily bearish, as I wrote about extensively in 2024 and have continued to reiterate over the past few months as I’ve highlighted the re-inflation trend.

More than a year ago, I wrote “Re-Inflation Is… Bullish?”

This was a free report that I published in April 2024, but I’d still encourage you to go back and read it today, particularly the section where I showed the correlation between modest & rising inflation vs. stock market trends.

We had a chance to reevaluate inflation dynamics this week with the July report on Personal Consumption Expenditures, allowing us to see how the Federal Reserve’s preferred inflation metric is evolving.

Unfortunately, it reaffirmed the re-inflation trend for CPI inflation.

As we look at headline PCE, core PCE, and median PCE inflation on a YoY basis, each of them are higher today than they were in April 2025, ending a clear-cut disinflationary trend.

The acceleration has been modest, so far, likely due to the patience with which companies are exhibiting before raising prices on consumers as overall tariff policy still remains uncertain.

But even if you refuse to call this trend an acceleration, it certainly isn’t decelerating.

Of course, this re-inflation isn’t solely caused by tariffs.

We can’t even diagnose how much of the acceleration is actually caused by tariffs!

But as we look at the key variables that cause and/or contribute to inflation, we see:

• M2 money supply growth accelerating on a YoY basis, now at +4.8% YoY:

• Credit creation growth is accelerating on a YoY basis, shown via loans & leases in bank credit now growing at +4.4% YoY:

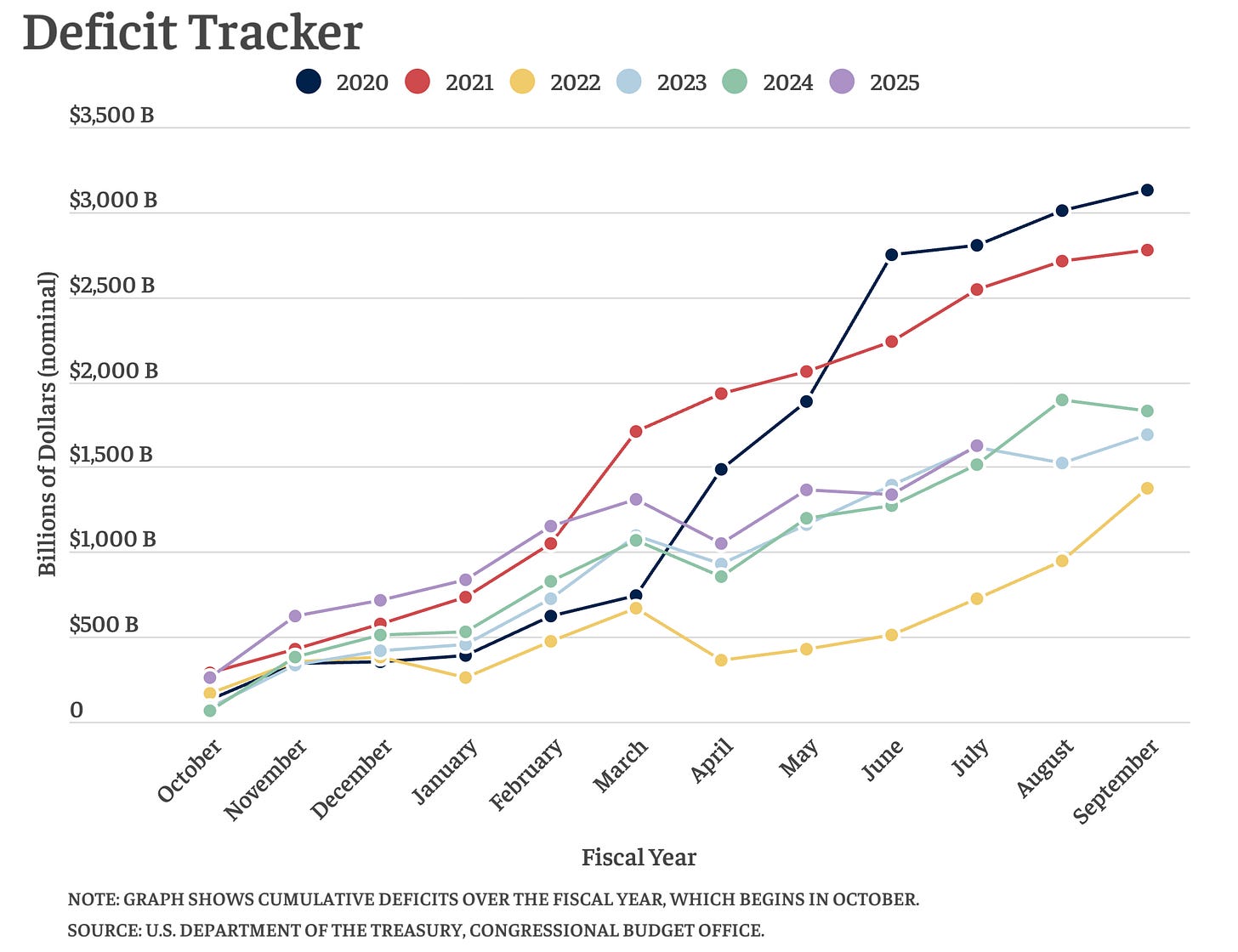

• Fiscal spending is on the rise, particularly with the passing of the “Big Beautiful Bill”, and the deficit is tracking higher than the levels in both 2023 and 2024.

• Wage growth is still robust and has also started to reaccelerate on a YoY basis. The growth rate of average hourly earnings is +3.9% YoY, outpacing inflation, while the Atlanta Fed’s wage growth tracker is showing +4.1% growth YoY.

• 5Y inflation expectations, which have an actual impact on future inflation trends due to the psychological nature of inflation, are also accelerating in recent months:

These objective facts highlight how multiple inflation catalysts are trending against the Federal Reserve’s inflation goal of +2% YoY.

Thankfully, the acceleration hasn’t been significant (yet).

Thankfully, financial assets can produce solid returns in *inflationary regimes*.

However, those are modest inflationary regimes!

If inflationary trends continue to accelerate, both in terms of magnitude and duration, then there could be a tipping point that causes a fundamental risk to this bull market.

We aren’t there yet.

The broader macroeconomic data reiterates the same thesis that I’ve been sharing since late 2022… that the U.S. economy is resilient & dynamic.

Q3’25 forecasts for real GDP growth are now measured at +3.5% (annualized).

The Atlanta Fed cited strong developments for consumption & investment, specifically that “third-quarter real personal consumption expenditures growth and second-quarter real gross private domestic investment growth increased from 2.2 percent and 4.4 percent, respectively, to 2.3 percent and 6.1 percent”.

This forecast will evolve, perhaps substantially, in the weeks ahead; however, we shouldn’t dismiss the significance of what it’s telling us right now.

The economy today looks starkly different than the conditions in late-2021.

Asset prices themselves also look completely different.

If we see similarities occur or if new risk dynamics appear, then we can shift.

I firmly believe, based on objective facts, that we are in a bull market.

Bull markets are simply a sustained production of higher highs and higher lows.

By very nature, this means that bull markets MUST have consolidations, corrections, and risk-off periods in order to actually produce that higher low.

As investors seeking to make money in the market, we have no better opportunity to achieve that goal than by aligning with uptrends as much as possible.

So that’s exactly what I’m going to keep doing, until the data tells me to shift.

Best,

Caleb Franzen,

Founder of Cubic Analytics

This was a free edition of Cubic Analytics, a publication that I write independently and send out to ~14,000 investors every Saturday. Feel free to share this post!

To support my work as an independent analyst and access even more exclusive & in-depth research on the markets, consider upgrading to a premium membership with either a monthly or annual plan using the link below:

There are currently ~1,100 investors who are on a premium plan, accessing the exclusive alpha and benefits that I share with them regarding the stock market, Bitcoin, and my own personal portfolio.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.