Investors,

We are in a bull market and there is no debate about it.

Whether or not we remain in a bull market is certainly up for debate (though my belief is that the broader uptrend & catalysts for the uptrend will stay intact); however, there is a cohort of investors with large audiences who refuse to acknowledge the strength of the market.

Instead, these “analysts” have constantly cast doubts & aspersions on the market.

They’ve cited datapoint after datapoint, indicator after indicator, and chart after chart in order to convince their readers that the uptrend either:

Doesn’t exist

Won’t exist

Yet here we are… with the Russell 2000 reaching new 30-month highs and up +24.25% on a trailing 2-year basis (CAGR = +11.5% per year), while both the Dow Jones and the S&P 500 both make new all-time highs.

Their fear-based narratives, studies, and charts have been wrong for 18+ months.

Their latest prediction is that the market can’t keep going up this fast, which inherently requires the acceptance that asset prices have been rising during a period where they’ve been consistently bearish… no? So why listen to them now if they are implementing the same techniques that have caused them to be wrong during such a strong uptrend?

On top of that, this market hasn’t been going up “too fast”.

On the contrary, it’s been quite average, which is something that I’ve been saying for awhile now (read “Average Returns Are Great Returns”, published on March 23, 2024).

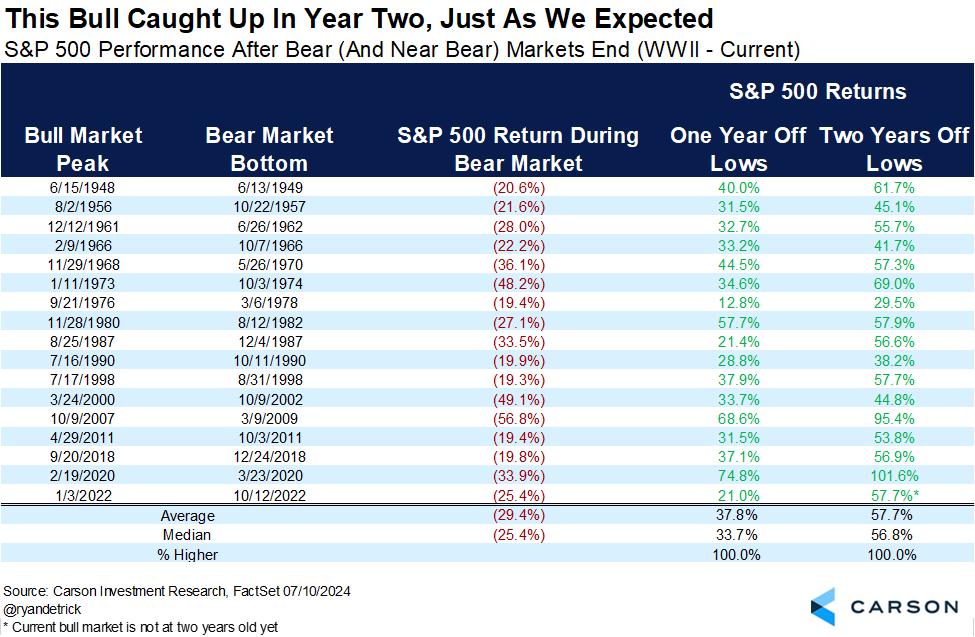

According to updated data from Carson Research’s Ryan Detrick, S&P 500 returns have actually been underwhelming on a relative basis vs. prior bull markets!

The S&P 500 was up +21% off the October 2022 lows one year later, lower than the average 1-year return from the lows of +37.8%. On a 2-year basis, which we’ll officially reach in October 2024, the index is currently tracking to slightly outperform the average return of +57.7%.

We don’t know what will happen over the next three months, so there’s a chance that the S&P 500 even underperforms the average in the event that the market slips in the coming months (which is always a valid possibility).

So is the market objectively going up too fast, or is it subjectively going up too fast for the people who have been underexposed and bearish for the past 24+ months?

I’d suggest the latter, given that the objective facts indicate that recent returns are congruent with average bull market returns.

On Friday, we even saw the equal-weight version of the Nasdaq-100 ($QQQE) make new all-time highs and achieve a decisive breakout above the 2021 peak:

I’ve been watching this structure extensively and highlighting this potential breakout in advance due to the extremely bullish implications of making new all-time highs.

As I pointed out in yesterday’s free edition of Cubic Analytics, there’s nothing more bullish than making new all-time highs and forward returns at new all-time highs exceed the returns from all other periods.

Which therefore begs the question: “If the market cap-weighted indices in the U.S. have already been making new all-time highs (35+ new highs YTD for the S&P 500, so far), how will the indices perform if the average stock experiences strong tailwinds going forward?”

My hunch is that the market will do quite well.

Just look at how the Nasdaq-100 (NDX) performed after making new ATH’s in Dec.’23:

The index has gained +21% in the ~7 months since the initial breakout move, even though there was a bit of choppiness that occurred immediately after the breakout.

The focus of this premium report will center around intermarket relationships.

In doing so, it will help to contextualize ongoing market dynamics and to understand how risk appetite is evolving across the market. This is an extremely important exercise in order to develop an all-encompassing view of market conditions and to diagnose the trend of market dynamics. While those market conditions & trends could change, we often see that trends can persist for much longer than initially expected.

Therefore, we will attempt to diagnose the trends to see where they might persist.

Let’s begin.