Investors,

The S&P 500 just had its highest weekly close of all-time.

The index continues to generate strong returns*, evidenced by the following:

1M return = +5.1%

YTD return = +10.3%

6M return = +20.9%

1Y return = +30.8%

2Y return = +17.3%

3Y return = +33.75%

5Y return = +83.4%

*not including dividends

In particular, I was keen to see the results for the trailing 2-year period given that we just passed the 2-year anniversary of the Federal Reserve’s first rate hike. Despite the severity of the market decline in 2022, the 2Y results of +17.3% produce a compounded annual growth rate (CAGR) of +8.3%, consistent with the average return for the S&P 500 post-WW2.

Even the trailing 3-year results, which fully encapsulates the bull market of 2021, the bear market of 2022 and the massive recovery in 2023, has a CAGR +10.17%!

In other words, despite the whipsaw price action that we’ve endured in recent memory, transitioning from bull to bear and back to bull markets, the S&P 500 is doing what it has always done over the long-run: compound at high single-digits.

In a strange way, the market has just been average despite being in uncharted territory.

Has it been easy to navigate the market environment in recent years? No.

On the contrary, it’s been one of the hardest environments to navigate, even according to legendary investors like Stanley Druckenmiller.

However, stock market investors who zoomed out, stayed focused, and stomached the short-term volatility are quite literally richer than they’ve ever been.

That’s just a fact, given that the Dow Jones, S&P 500, Nasdaq-100 and their equal-weight alternatives hit new all-time highs this week.

If you’re a stock market investor who’s portfolio isn’t hitting new all-time highs, it might be time to consider shifting your portfolio to own less individual stocks and own more of the S&P 500 itself (the greatest hedge fund of all-time).

There’s a reason why almost every single hedge fund underperforms the S&P 500 on both a five and ten-year basis. As the saying goes, “if you can’t beat ‘em, join ‘em.”

In this edition of Cubic Analytics, I’ll cover the key charts from the week across three different pillars:

Macro

The stock market

Bitcoin

These Saturday editions are completely free, but if you want to access the full capabilities of my long-form analysis and support my research, consider upgrading to a premium membership using the link below:

Macroeconomics:

I’ll cut right to the chase and begin by saying that the FOMC Policy Decision meeting and Jerome Powell’s subsequent press conference was a snooze fest. Nonetheless, I watched the entirety of the presser (twice) and my biggest takeaway was the fact that Powell acknowledged that committee members discussed the potential for reducing the pace of balance sheet runoff.

While it appears that the Federal Reserve is still operating under the expectation that they’ll cut rates three times in 2024 (reiterating the message from their Dec.’23 meeting), this was the first time that we’ve heard about reducing the pace of balance sheet runoff.

Remember, the Federal Reserve isn’t doing Quantitative Tightening (QT), which is defined as actively selling assets from their balance sheet to other financial institutions. What they’re doing is simply letting the assets on their balance sheet mature and “roll off”, which in turn reduces the size of their balance sheet because they are not re-investing the principal into new assets.

Specifically, Powell said the following:

“Turning to our balance sheet, our securities holdings have declined by nearly $1.5Tn since the committee began reducing our portfolio. At this meeting, we discussed issues related to slowing the pace of decline in our securities holdings. While we did not make any decisions today, the general sense of the committee is that it will be appropriate to slow the pace of runoff fairly soon, consistent with the plans we previously issued.

The decision to slow the pace of runoff does not mean that our balance sheet will ultimately shrink by less than it would otherwise, but rather that it would allow us to approach that ultimate level more gradually. In particular, slowing the pace of runoff will help ensure a smooth transition, reducing the possibility that money markets experience stress, and thereby facilitating the ongoing decline in our securities holdings, consistent with reaching the appropriate level of ample reserves.”

As of March 20th, the Fed’s balance sheet is currently $7.5Tn and has been steadily declining since mid-2022 (aside from the brief uptick in March/April 2023 following the bank failures of SVB & other regionals):

On a year-over-year basis, the balance sheet has declined by 14%.

We shouldn’t expect the pace to be that large for much longer, but I’d expect for runoff tapering to begin after the first rate cut (for which my timing is still no sooner than Q3’24, likely at the September meeting).

On net, this potential reduction in the pace of balance sheet runoff will be accretive for asset prices and the ongoing bull market in financial assets.

Stock Market:

Some of the most important data that I track for the stock market is related to the amount of stocks making new highs vs. the amount of stocks making new low across various timeframes.

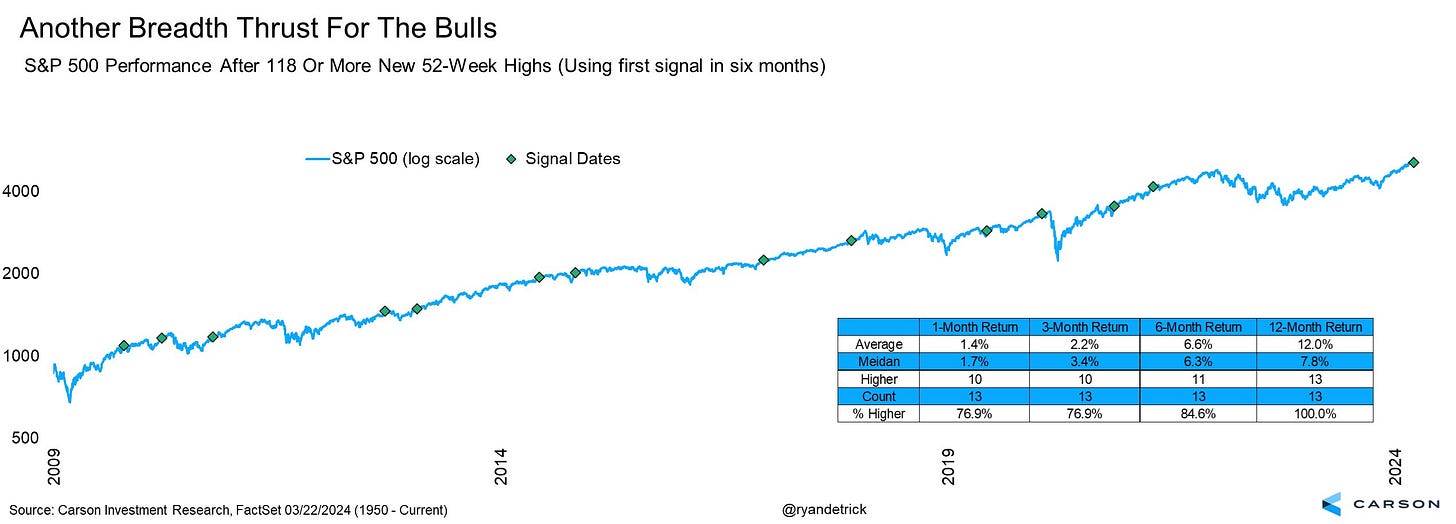

In particular, I focus on three timeframes to evaluate short, medium, and long-term dynamics… which is why I was so happy to see this fantastic study from Ryan Detrick, who noted that 118 stocks in the S&P 500 (roughly 24% of the index) made new 52-week highs during Thursday’s trading session.

Given the significance of this overwhelmingly bullish dynamic (especially considering that 0 stocks in the index made new 52-week lows), it’s probably important to know how the S&P 500 typically performs after this type of thrust occurs.

Based on the data above, with 13 other signals occurring over the past 15 years, the S&P 500 is higher 100% of the time one year later with an average return of +12%.

As we look at something like the equal-weight version of the S&P 500 ($RSP) and its relationship with three key exponential moving averages, we can see that bullish dynamics continue to occur for the typical stock in the index:

🔵 21-day EMA

🔴 55-day EMA

🟢 200-day EMA

Not only is the equal-weight S&P 500 hitting new all-time highs, but it’s also flipping the former ATH’s from November 2021 - January 2022 into support, while trending beautifully above all three EMA’s. Given that all three EMA’s have a rising slope and are trading in a bullish formation (21 > 55 > 200), it’s clear that we are (and have been in) a bull market.

Those who doubted the validity of this uptrend in 2023 continue to bury their head in the sand, ignore the positive developments in both the economy and the market itself, and will continue to underperform.

I’m glad that I’m not one of those individuals that I was humble & flexible enough to change my mind about the market this time last year.

Kudos to all of you who were able to do the same.

Bitcoin:

The only on-chain datapoint that I consistently track for Bitcoin is the short-term holder realized price (STHRP), as it’s arguably the most powerful indicator that we have for Bitcoin.

My rule of thumb is simple:

If Bitcoin is trading above the STHRP, Bitcoin is in an uptrend.

If Bitcoin is trading below the STHRP, Bitcoin is in a downtrend.

The indicator is also powerful because it has a proven track record of consistently acting as either support or resistance during the trend, and can represent a regime change if/when the price of Bitcoin breaks above/below the STHRP.

My friend On-Chain College shared the following chart on X on Saturday morning:

I posted a similar chart earlier in the week when the STHRP was trading around $53k, saying that it’s the lowest price that I’m willing to entertain in the event that we experience a deeper pullback. I continue to reiterate that same message today, acknowledging that this dynamic indicator will continue to grind higher in the days, weeks, and potentially months ahead.

As such, I believe that the “floor” for Bitcoin within this bull market will continue to rise and that any future retests of the STHRP (like in March 2023, June 2023, Q4’23, and January 2024) are strong buying opportunities.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Great post!

Not many talking about the potential slowing in the balance sheet run down.

I also like the RSP chart. Nice action out of the average stock last week.

You also saw net new highs jump with last week’s action across stock exchanges.

Great report, as always. Thank you! What's your take on the $1.2 trillion spending bill that just passed and it's impact on assets like the S&P 500 and Bitcoin? Would love to hear your thoughts maybe in this coming Sunday report.