Investors,

First & foremost, I wanted to remind everyone that I am available for 1-on-1 meetings! If there are any topics in this newsletter, or specific market topics that you want to discuss directly with me, I’d love to share my perspectives with you and answer any questions that I can. So far, I’ve met with 8 subscribers to chat about monetary policy, inflation dynamics, my recession forecasts (or lack thereof), technical analysis, crypto investing, etc., etc.

Book a meeting with Caleb Franzen

With 9+ years of investment experience, 5+ years of professional experience in wealth management & banking, and a decade of endless fascination with markets & macro, I’d love to chat with you!

Intro:

If you haven’t noticed yet, monetary policy is a crucial determinant of financial market conditions and stock market performance. If you have yet to accept this reality, perhaps the chart below will help to highlight the correlation between central bank-driven liquidity and the S&P 500:

This week was flush with meaningful data & actions regarding monetary policy, specifically:

November CPI data

FOMC rate hike

European Central Bank rate hike

In today’s edition, we will analyze the key components of these macroeconomic events in order to understand how markets evolved in the manner that they did. The short summary: markets weren’t happy.

Macroeconomics:

The long-awaited November CPI was released at 8:30am ET on Tuesday morning, in which median estimates were expecting to see an inflation rate of +7.3% on a YoY basis. Investors were geared up for this report, particularly after seeing a decelerating rate of inflation since the peak in June 2022 at +9.1%. Since then, inflation has moderated at a steady pace:

July 2022: +8.5%

August 2022: +8.3%

September 2022: +8.2%

October 2022: +7.7%

While inflation is undeniably running above the Federal Reserve’s 2% target, we now have clear evidence that inflation is moderating, at the very least. Certainly, the Fed would like to see inflation decelerate faster, but beggars can’t be choosers, as they say. The November CPI data was important to once again confirm the YoY deceleration that we’ve witnessed lately. Thankfully, we received that confirmation, and more.

The result for the headline CPI was +7.1% in November, vs. estimates of +7.3%. Core inflation also moderated, falling from +6.3% in October to +6.0% in November. Considering that this also came in below estimates, this was a resounding improvement in terms of inflation dynamics in the United States. In mid-October, I published a research piece titled, “No, Inflation Hasn’t Peaked”. In this report, I cited two important factors for why I was unwilling to celebrate peak inflation:

Month-over-month inflation dynamics were accelerating despite the improvements in the year-over-year data.

Alternative and underlying metrics of inflation weren’t decelerating.

Now, we have decisive evidence that both of these dynamics are cooling down.

Regarding MoM inflation, it fell from +0.4% in September to +0.3% in October. The November result was +0.1%, barely inflationary. This is encouraging evidence!

Regarding alternative metrics for inflation, we can see that core inflation, median inflation, and trimmed-mean have also started to decelerate:

While median CPI inflation has merely stabilized, core CPI is decisively declining alongside trimmed-mean CPI. This means that overall measures of consumer prices are increasing at a decreasing pace, based on the official government data.

With the CPI data coming in significantly below estimates and prior month data, futures markets celebrated on Tuesday from 8:30am to 9:20am. After that, they tanked.

Downside pressure occurred on Wednesday, following the Federal Reserve’s announcement to raise the federal funds rate by +0.5%. With the target range now being 4.25% to 4.5%, the Fed has sufficiently achieved a neutral policy stance based on market signals from the 2-year Treasury yield. Markets were ready & prepared for this outcome; however, the market-moving action came from the Fed’s forward guidance about where interest rates are likely to go in 2023.

Prior to Wednesday, the market was anticipating a peak/terminal rate of 4.6% in September and nearly 5% in early December. Based on the Fed’s announcement, they are now signaling their expectation for a terminal rate of 5.1%. This confirms the “higher for longer” sentiment that markets continue to dismiss & ignore, hence why the market reacted so significantly on Wednesday afternoon.

Truthfully, there wasn’t much of a surprise for me regarding the FOMC policy decision. Leading into the report, there was an 86% chance that the Fed would raise by +0.5% and that’s exactly what happened. I’ve continued to warn investors all year that they shouldn’t underestimate the Fed, regardless of any minor improvements for inflation, and that they should continue to stay defensive in a rising rate environment.

Unfortunately, the Fed isn’t the only central bank to be tightening at a rather aggressive pace. On Thursday morning, the ECB announced their decision to raise rates by +0.5%. This is their fourth rate hike of 2022, since they first adjusted them higher in July 2022. While I don’t closely follow the ECB, or have an acute knowledge of European banking, the net effect is crystal clear:

Global liquidity conditions are tightening via a coordinated effort by central banks to combat inflation.

If you take anything away from this newsletter, let it be this statement above. Whether we’re talking about the Fed, the ECB, the Bank of England, the Bank of Canada, the Bank of Mexico, or the Reserve Bank of Australia, they are all raising rates at historically significant paces. On the aggregate, this means that the cost of global capital is rising and that asset prices will struggle to appreciate in value. After the ECB’s decision to raise rates on Thursday, following gently behind the Fed, financial markets once again realized the uphill battle they are climbing. Risk appetite declined and asset prices followed.

That’s the recipe. This is the exact framework for risk that I outlined in both my 2021 and 2022 market outlooks, telling investors that they should “de-risk during periods of blatant monetary tightening, reducing exposure to tech and emphasizing strong cash flows, profitability, dividends, and share buybacks.”

This isn’t anything new, and investors shouldn’t expect anything new until there is material evidence that monetary policy is shifting from tightening to easing.

Stock Market:

I touched on stocks above, but investors were probably aware of the downward pressure we experienced this past week. On net, the indexes had terrible performance and have quickly fallen from their peaks on Tuesday morning. Since the highs on Tuesday, here’s how each index performed for the rest of the week:

Dow Jones $DJX: -5.2%

S&P 500 $SPX: -6.1%

Nasdaq-100 $NDX: -7.6%

Russell 2000 $RUT: -6.25%

Brutal.

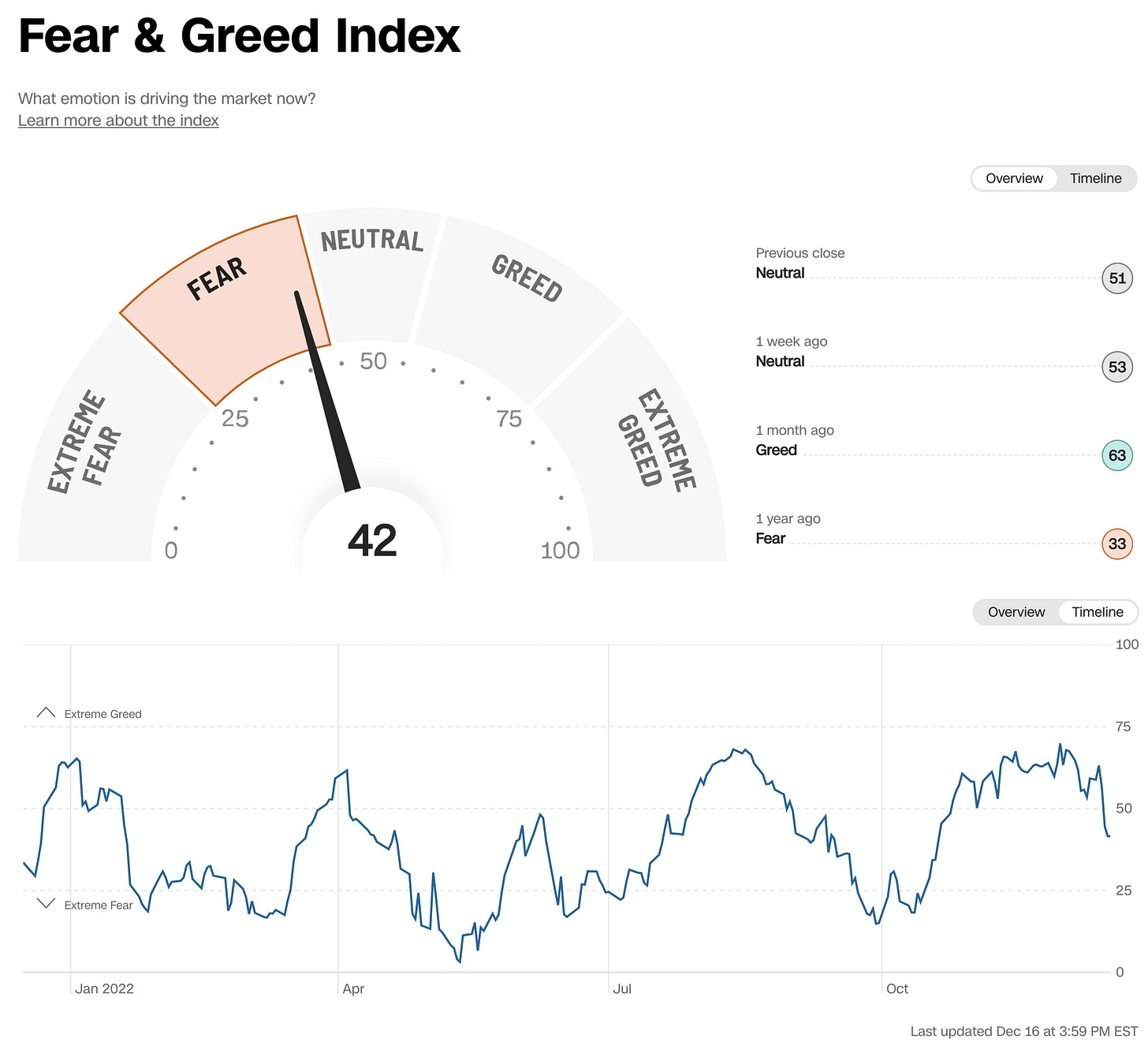

The market has quickly rotated from the highest levels of greed in the past 12 months to a position of fear, according to the final reading of the Fear & Greed Index:

Risk happens fast! Investors are so risk averse that the relative value of low volatility stocks vs. the S&P 500 just hit a 30-month high! Here’s the relationship of SPLV/SPY since September 2021:

This is not the sign of a bull market, where investors have significant demand for risk assets and push further out on the risk curve. In a bull market, there is minimal demand for safety & low volatility; however, it’s all that investors want in 2022. The fact that SPLV/SPY is breaking to new highs indicates that this sentiment has hit an extreme in 2022 and could exacerbate further market weakness in the coming weeks or months.

Remember, trends follow three steps:

Extension (trend development)

Consolidation (trend cool down)

Breakout (trend continuation)

The extension phase was in November 2021 - May 2022. The consolidation phase was from June - November 2022. It now appears that we are entering the breakout phase.

This is another confirmation that the market has entered risk-off territory. Even if I’m wrong in this assessment, I won’t be disappointed if I miss any market upside. This market is too crazy and choppy to have concrete confidence about any market move; however, I continue to acknowledge the macro-driven headwinds that we are facing.

Bitcoin:

Considering that the broader appetite for risk assets is declining, Bitcoin is also partaking in market downside. There are increasing concerns surrounding Binance, which other market analysts have detailed much more acutely than I can. At the end of the day, investors are scared, spooked, and potentially creating a self-fulfilling prophecy. At the end of the day, Binance could be another fraud/scam in the market but I haven’t seen sufficient evidence to confidently say that it absolutely is. Either way, I see no need for investors to keep their digital assets or cash on the platform.

Better safe than sorry, right?

Unfortunately, the dynamics surrounding the broader crypto market are entirely driven by these two components:

Low appetite for risk

Contagion events & failures, with Binance being the latest concern

Since Bitcoin fell below the June lows, I warned that the prior YTD low range would eventually act as resistance if/when we ever retested it. Earlier this week, I told investors to avoid FOMO’ing into the market as we approached this range, highlighting my belief that it would act as resistance…

Sure enough, it did:

With former support acting as current resistance, my expectation, from a technical perspective, is that BTC will produce new YTD lows. At the very least, I expect to see price fall to $15,800 vs. the current price of $16,722 as of 11:58pm ET, 12/16/22.

I don’t sense any degree of urgency to enter the market with sizable amounts of capital to DCA or trade BTC (or any other cryptocurrency for that matter), and will continue to exercise patience in this market. When it’s time to turn bullish, I will be.

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.

Great analysis especially SPLV/SPY ratio and chart, looks like it’s breaking out indeed!

read this today, 10 days after you authored it and spot on. thank you.