Investors,

Cubic Analytics has grown by +70% since the start of June 2022! If you’ve become a recent subscriber during the past few months, I’m so glad to have you here and I hope that my analysis has been useful in navigating the market. I’m truly excited about the growth we’ve experienced and I’m glad to know that people are continuing to discover Cubic Analytics! Let’s keep the momentum going by sharing this newsletter with any colleagues, family, and friends who might be interested:

To those of you who have been long-time supporters & readers of this research, I’m beyond thankful for your continued interest!

Macroeconomics:

After two consecutive months where inflation accelerated at a significant pace, the July 2022 CPI data finally shows that inflation might be decelerating. The YoY rate of change in the headline CPI decreased from +9.1% in June to +8.5% in July, indicating an important deceleration in consumer prices. On a month-over-month basis, consumer prices were unchanged in the month of July vs. a pace of +1.3% in June.

From a headline basis, this was a critical sign that inflation could indeed be in the process of peaking, though it’s difficult to celebrate the idea of +8.5% inflation in a vacuum.

Recall the publication that I sent on June 25th, “Economic Data Driving Financial Markets or Financial Markets Leading Economic Data?”, where I shared my belief that markets were at an important inflection point. There were two key messages that I communicated in that report:

“Quite simply, I think the market is telling us that inflation is peaking.”

“‘Smart money’ believes inflation is going to decline… We may see a gradual & sustained decline in the YoY percent increase in the CPI and PCE.”

Based on this July CPI data, we have quantifiable evidence that the bond market has been correct in its assessment thus far. In other words, the rapid decline in yields from mid-June through July 2022 was a decisive signal that inflation is in the process of peaking. I will continue to monitor and analyze bond market dynamics as a representation of how “smart money” views inflation & economic growth outlooks.

The disinflationary factors caused by less supply chain pressures & lower commodity/energy prices won the battle in July. If we analyze the data more thoroughly, however, I think there’s less reason to celebrate. First & foremost, core CPI (Headline CPI ex-Food & Energy) remained stable at a YoY pace of +5.9% for the second consecutive month. Meanwhile, the cost of food increased from a pace of +10.4% in June to +10.9% in July:

The shelter component, which comprises roughly 33% of the CPI, increased at the fastest YoY pace since February 1991 at +5.7%:

Many economists are still scratching their head why the shelter component is so low considering that the median sales price of a home has risen by +15% YoY in Q2 2022 (the 5th consecutive quarter greater than +15% YoY). Rent.com recently published data for July 2022, indicating that the average cost of a 1-bedroom increased by +25.3% YoY while a 2-bedroom increased by +26.5% YoY! Regardless, the shelter component continues to accelerate in a linear fashion, which is likely a disappointment in the eyes of the Federal Reserve.

Additionally, each of the alternative measures of CPI that I monitor accelerated in July:

YoY change in median CPI: From +5.95% in June to +6.27% in July.

YoY change in trimmed mean CPI: +6.9% to +7.0%.

YoY change in sticky-price CPI: +5.6% to +5.8%.

Therefore, while we can be encouraged about the deceleration in headline inflation, it’s vital to contextualize it against the acceleration in these various other measures. What this tells me is that most, if not all, of the decline in consumer prices was driven by lower energy & oil prices. While this is an encouraging first step, we’re not out of the woods yet. From my perspective, it’s possible that we’ve seen a peak in headline inflation while these alternative measures (core, median, trimmed mean, and sticky-price) continue to increase. At the end of the day, a win is a win.

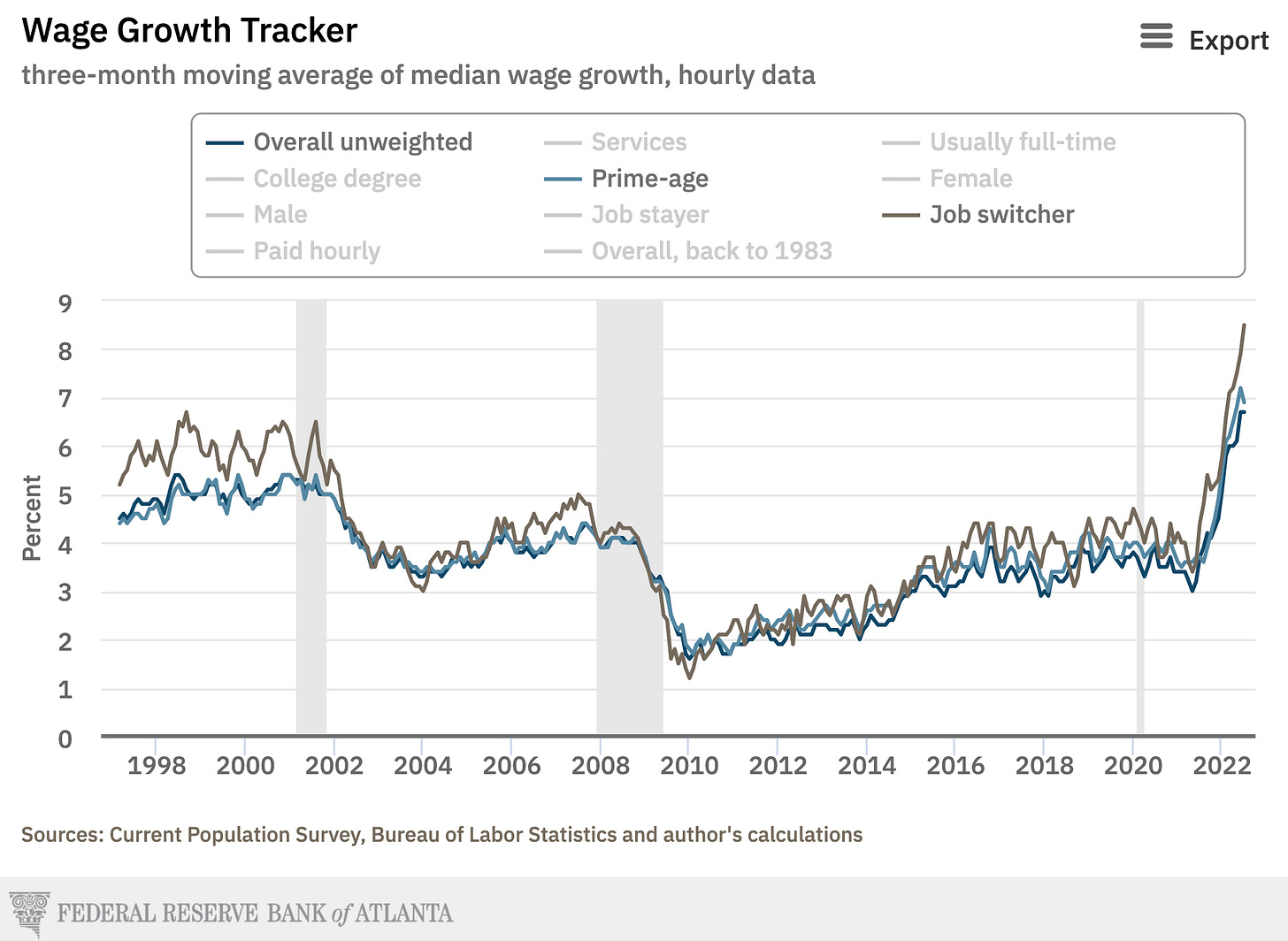

While the disinflationary pressures from commodity/energy prices are encouraging, I expect to see inflation remain historically elevated so long as we see a dynamic labor market with rising wage growth and a high quits rate. In the chart below, the Atlanta Fed published their July update of the Wage Growth Tracker, showing strong wage gains across the board. Notably:

Overall unweighted: +6.7% YoY

Prime-age: +6.9% YoY

Job switchers: +8.5% YoY

With nominal wages growing at historically elevated levels, I view these wage gains as a “floor” for the CPI in some capacity. It’s important to note that the labor market is a lagging indicator, so these wage gains could reverse very quickly should the economic environment deteriorate substantially. Either way, historic wage growth is likely to produce historically elevated inflation.

Stock Market:

The upside momentum in the stock market has been unfathomable over the past several weeks, likely fueled by the fact that investors are still too cautious to get involved. As the market continues to grind higher, FOMO increases and sidelined investors start to allocate capital into high momentum assets. Emotional investing isn’t a winning strategy; however, investors are currently forced to make up their mind about which direction the market will go from here and how heavily they want to get involved. One thing’s for certain, financial markets are forward-looking pricing mechanisms and they have been telling us for the past 6 weeks that inflation is peaking. Should we continue to see evidence of peak inflation, wage growth, and “not terrible” economic activity, I think markets will continue to celebrate higher.

Let’s contextualize what markets have accomplished recently…

First & foremost, none of the U.S. indexes are still in bear market territory (down at least -20% from their 52-week highs). Here are the updated YTD returns for each index in 2022:

Dow Jones Industrial Average $DJX: -7.1%

S&P 500 $SPX: -10.2%

Nasdaq-100 $NDX: -16.9%

Russell 2000 $RUT: -10.2%

The magnitude and speed of this recovery has been a shocking display of an increased appetite for risk, as markets front-ran peak inflation and peak hawkishness from the Federal Reserve. With the July CPI inflation data coming in below estimates and seemingly suggesting that “the peak is in”, markets are celebrating in full force. In combination with better than expected corporate earnings, risk appetite has skyrocketed. Or perhaps, was risk appetite simply too low in May & June and the market is simply mean reverting?

Consider the rebounds we’ve witnessed by the largest companies in the S&P 500 from their YTD lows:

Apple Inc. AAPL 0.00%↑: +33.3%

Microsoft MSFT 0.00%↑: +20.8%

Alphabet GOOGL 0.00%↑: +19.4%

Amazon AMZN 0.00%↑: +42%

This has been a broad-based rally, with the riskiest sectors of the markets leading the charge. This is beautifully illustrated by analyzing the relative performance of two ETF’s: S&P 500 High Beta (SPHB) vs. S&P 500 Low Volatility (SPLV)

This ratio, comparing a risk asset vs. a less risky asset, is officially creating higher highs & higher lows for the first time since peaking in Q4 2021. Breaking above this pivotal support & resistance area is a major accomplishment, possibly indicating that momentum continues to grow to the upside. Will it continue? I don’t know. What I do know is that the market will eventually take a breather and will give sidelined investors another opportunity to take a swing.

As a final thought on the stock market, I wanted to share another key relationship that I’m monitoring, the Nasdaq-100 QQQ 0.00%↑ / Treasury Inflation-Protected Securities TIP 0.00%↑ (QQQ/TIP):

In my opinion, this is likely one of the most important ratios in the market and it’s officially breaking above key structure. Price is breaking above the descending channel, indicating that momentum favors QQQ vs. TIP, or more broadly speaking, that momentum favors risk assets vs. less risky assets. This structural confirmation indicates that there is favorable upside ahead and a clear level to manage risk against.

Quite simply, I think QQQ 0.00%↑ has tailwinds to rise further relative to bonds in this environment.

Bitcoin:

As of Friday evening, Bitcoin is trading at $24.5k and continues to grind higher from the YTD lows. With that said, it’s not expressing the same degree of positive momentum that stocks or Ethereum are witnessing. Along these lines, here’s Bitcoin vs. the Nasdaq-100 over the past six years:

For the past four weeks, Bitcoin has made no progress relative to the Nasdaq and continues to trade along a critical support level. It’s difficult for me to imagine a scenario where the Nasdaq rises and Bitcoin falls, but Bitcoin is clearly lacking conviction around these levels. This degree of indecisiveness is of minor concern, but I’d like to see an engulfing candle to give us a better indication of market direction.

Regardless of what happens next in terms of Bitcoin’s price, the fundamental adoption of the monetary network continues to grow. Total addresses used has now surpassed 1Bn addresses, continuing to climb higher regardless of whether or not the price is in a bull or bear market.

This illustrates the exponential adoption driven by network effects and Metcalfe’s Law, which I don’t expect to stop for a very long time.

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.