Bears Fight For Control

Investors,

Unlike the bears, who refused to acknowledge bullish tailwinds that were evident starting in Q2 2023, I’m a bull who is willing to recognize that short-term momentum is swinging in favor of the bears. They won the fight this past week, unquestionably.

Many of my criteria for becoming outright bearish have not flashed yet, though we have clear warning signs within the data that I monitor to confirm that momentum is shifting. I’ve been pounding the table on bullish equity dynamics for months. That bullishness was warranted and paid off. I currently believe that a degree of caution is warranted, due to the following developments:

1. The S&P 500 and the Nasdaq-100 have fallen below their respective 21-day EMA’s:

The S&P 500 has closed below its 21-day EMA for two consecutive sessions, for the first time since May 4, 2023:

In and of itself, this isn’t bearish; however, bulls would certainly prefer to be above the 21-day EMA. You’ll notice that the index has been resilient in 2023 and has shown an ability to get back above the 21-day EMA rather quickly. Given that this is a dynamic range, I think it will be important to monitor this relationship on a daily basis.

The Nasdaq-100 is expressing the same characteristic; however, it’s now closed below its 21-day EMA for three consecutive sessions:

The good news for both of these indexes is that both are still trading above structural support zones. The S&P 500 hasn’t fallen below the former YTD highs (teal) and the Nasdaq-100 hasn’t fallen below its own former YTD highs, which aligns back to key structure since the beginning of 2022 (red).

I want to be very clear about this: If/when the indexes fall below these potential support zones, then I will become outright defensive. This could happen as early as next week, but I want to reiterate that these are still valid potential support zones and the indexes could rebound on these levels. Personally, I think risk/reward is favorable here for a swing, so long as positions are cut if/when the support zones are broken.

2. A deterioration in net new 20-day highs (new 20-day highs minus new 20-day lows):

For months, we’ve seen extremely strong internal data for the S&P 500 on a short, medium, and long-term timeframe. For example, here are some statistics over the past few months:

May 22, 2023: Net new 20-day highs = +49 (75 new highs, 26 new lows)

June 2, 2023: Net new 20-day highs = +73 (91 new highs, 18 new lows)

June 13, 2023: Net new 20-day highs = +191 (195 new highs, 4 new lows)

June 28, 2023: Net new 20-day highs = +60 (83 new highs, 23 new lows)

July 10, 2023: Net new 20-day highs = +62 (80 new highs, 18 new lows)

July 25, 2023: Net new 20-day highs = +103 (120 new highs, 17 new lows)

Day after day, week after week, market internals have looked great.

However, that tide is turning started to turn this week.

August 2, 2023: Net new 20-day highs = -2 (46 new highs, 48 new lows)

August 4, 2023: Net new 20-day highs = -33 (50 new highs, 83 new lows)

These are the first days in months where we are seeing a decisive shift in favor of net new-20 day lows, and I think it’s vital to be objectively aware of this development!

I’ll cover the 3rd point in the Stock Market section below, but if these potential reversal signals are making you feel bearish, I’d strongly suggest researching the various investment products from MicroSectors, notably their inverse products. Perhaps you think that these potential reversal signals are simply “potential”, and the market is providing an attractive opportunity to buy within an uptrend, I’d strongly suggest researching the products from MicroSectors.

Either way, their team has created a variety of ETN’s that provide investors with a way to exercise their thesis on the market in unique niches. It’s no wonder why their funds have a combined $6Bn+ in AUM.

Macroeconomics:

I was extremely bored with macro this week given the extent of labor market data that was released throughout the week. All of the reports seemed to echo the same conclusions that I’ve been sharing for over a year: the labor market is resilient and dynamic.

Despite calls from many economists that the labor market will crack soon, we continue to see evidence that the labor market is resilient & dynamic.

Heck, even I published a report on June 3, 2023 titled “My Recession Signal Just Flashed”, citing a unique labor market signal. In the two months since that report, labor market data has remained resilient & dynamic. Amazingly, there are still a significant amount of doom & gloom perspectives being shared about the labor market from the same cohort who has been predicting a massive & rapid deterioration in labor market conditions for the past 12-18 months.

Eventually, those individuals will be correct, but when?

3 months from now?

9 months from now?

24 months from now?

Eventually…

In the past three months, we’ve seen the unemployment rate fall from 3.7% to 3.6% to 3.5% while the labor force participation rate (particularly for prime-age workers) continues to stabilize or increase. Regarding the LFPR, the aggregate measurement has been 62.6% since March 2023, while the prime-age LFPR has climbed to 83.4% in the latest reading (down from 83.5% in May 2023).

While the number of jobs created in July came in below estimates & prior month results (187k vs. estimates of 200k and prior of 209k), wage growth remains strong. Average hourly earnings grew at a pace of +4.4% YoY, consistent with the results in each month of 2023 so far.

However, the total amount of hours worked has been in a steady downtrend & continued to decline in the July data:

Why is this important? First of all, it could indicate that more of the composition of workers is shifting to part-time labor, therefore resulting in less hours. Second of all, there’s a fairly clear correlation between this labor market data and inflation.

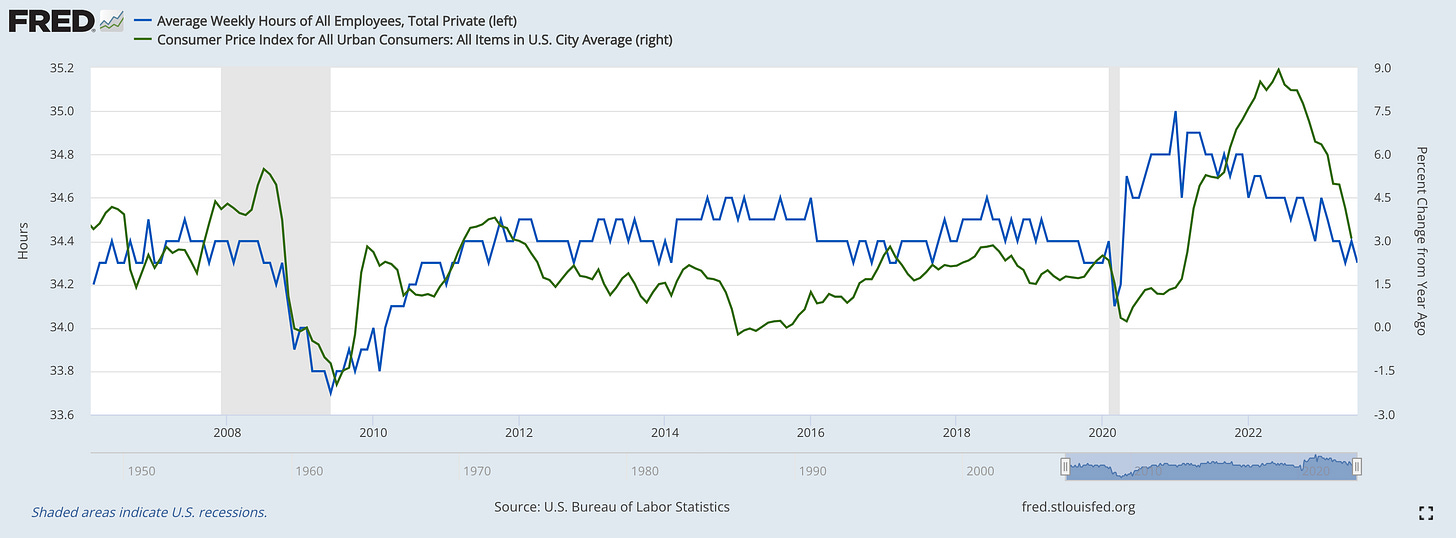

The chart below compares the average weekly hours of all employees vs. the YoY inflation rate for the Consumer Price Index (CPI):

It seems that the labor market data is a leading variable for inflation, rising sooner than the CPI did in 2020 and peaking sooner than the CPI did in 2021. Given the ongoing deceleration in the average number of weekly hours worked, just one variable in my multi-faceted approach to analyzing inflation dynamics, I continue to believe that disinflation will persist through the remainder of the year.

Thankfully, the quits rate is echoing the same sentiment:

Remember, inflation (rate of change) has peaked, but prices haven’t. To reiterate, the Consumer Price Index is still rising, just at a slower pace than it was in 2021 and 2022.

Stock Market:

The third point I wanted to raise about a potential shift towards bearish momentum is the fact that defensive stocks are doing well on a relative basis vs. the market.

We can measure this in a variety of ways, but I’ll focus on three below:

1. Dow Jones vs. the S&P 500 (DJX/SPY):

Analyzing this relationship since the start of 2022, we can see that Dow Jones stocks outperformed the S&P 500 last year, but this trend has completely reversed in 2023.

Interestingly, this ratio of DJX/SPY is rebounding on the 2022 lows and I suspect that a return into the red zone is a logical next step. If/when we get there, I think there’s a strong possibility that it gets rejected, meaning that the S&P 500 will start to outperform the Dow Jones once again.

2. Nasdaq-100 vs. the Ark Innovation ETF (QQQ/ARKK):

In this particular case, both the Nasdaq and ARKK are high risk assets; however, ARKK is significantly higher risk and the Q’s are more defensive on a relative basis.

We can see that this relationship has started to regain some upside momentum, perhaps indicating that QQQ is going to outperform ARKK in the weeks/months ahead. To be clear, that could simply mean that QQQ falls less than ARKK.

3. Consumer Staples vs. the S&P 500 (XLP/SPY):

There is early evidence that consumer staples stocks are trying to produce higher lows relative to the S&P 500 recently, quite similar to the behavior that occurred in February through April 2023. Perhaps this development doesn’t persist for much longer, but it’s worthwhile to keep watching.

These signs are early, highlighting the deterioration in short-term upside momentum which could potentially persist long enough to display weakening medium-term momentum. In tomorrow’s premium report, I’ll be analyzing some of the different dynamics that I’m monitoring on a medium-term basis.

Use the link above to upgrade your subscription and receive that full report.

Bitcoin:

While traditional markets failed to hold on to upside momentum, Bitcoin has continued to trend sideways with a slight downward bias, as has been the case for the past 6 weeks. Volatility has been absent and investors on Twitter/X continue to express their boredom with the digital asset right now.

It feels as if everyone is just waiting for something to happen, or even taking a hiatus by stepping away from the market for a little while.

As a way to measure this lack of volatility, we can refer to the Bollinger Band indicator, specifically measuring the wide of the upper & lower-bound known as the Bollinger Band Width (BBW). Taking a long-term measurement of this indicator using weekly candles, we see the following:

With Bitcoin trading just shy of $29k, the BBW indicator is trading at the lowest level in its history. This means that Bitcoin volatility is extremely low by measuring the “tightness” of the Bollinger Band. Typically, these low volatility periods don’t last for very long, which could indicate that a catalyst could cause higher volatility in the near future. As investors, we should be prepared for this potentiality while recognizing that we don’t know which way that volatility will materialize.

As always, I think it’s vital to stay nimble and question our biases constantly; however, I continue to reiterate an overall bullish outlook on both Bitcoin and equities in the months ahead, based on the signals that I’m currently seeing in the markets. If those signals cease to persist, or if bearish signals arise, then I’ll gladly change my outlook.

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged and direct/inverse, to the NYSE FANG+ Index. They have a suite of products ranging from big banks, to oil and gas, and even gold/gold miners.

I started a partnership with MicroSectors because I’ve been using their products for over a year and this was an organic and seamless fit with my views.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.