Investors,

In 2022, the impact of monetary policy on market conditions was clearly displayed, highlighting the market’s deep reliance on low interest rates and ample liquidity. The phrase “don't fight the Federal Reserve” holds true in both directions, and market participants saw how the withdrawal of monetary stimulus and outright monetary tightening caused some of the worst market conditions in U.S. history. After injecting financial markets with $120Bn per month in liquidity via asset purchases for nearly two years, the Federal Reserve increased the federal funds rate by 4.25% from March 2022 to the end of the year. This was the fastest acceleration of interest rates in terms of magnitude and pace since 1980 and 1981, as illustrated by the following chart of the YoY nominal change in the federal funds rate:

In response to historic monetary tightening, mortgage rates doubled on a year-over-year (YoY) basis for the first time ever. Mortgage applications & refinance activity declined to historically low levels. Pending home sales saw their steepest annual decline on record. 20+ year Treasuries underperformed stocks throughout the year, declining by -32.8%. The 60/40 portfolio of stocks & bonds generated a return of -18.3%, the third-worst year on record. Consumer sentiment plummeted, falling below the levels seen during the pandemic in 2020. There was a record decline in homebuilder sentiment, and business activity plummeted. The U.S. household net worth to GDP ratio fell at a faster pace than it did in 2008/2009. Inversions occurred across the entire yield curve. The cumulative market cap of Apple, Amazon, Google, Microsoft, Facebook/Meta, and Tesla fell by approximately $4.7 trillion in 2022. The trailing price-to-earnings ratios for U.S. equities fell at the fastest pace on record. Crypto market cap declined by $1.4Tn in 2022 and by $2.25Tn from the peak in November 2021.

2022 will be remembered as one of the worst years in financial market history, particularly because no one saw this coming. In December of 2021, the market was expecting the Federal Reserve to raise rates two or three times in 2022, starting in the second half of the year, for an aggregate rate hike of +0.75%. In reality, we received 4.25 percentage points in aggregate rate hikes, starting in March 2022. Monetary policy tightened much sooner and by a larger degree than 99% of market participants had anticipated. This past year serves as a reminder that consensus expectations rarely come to fruition.

Going into 2022, I took the Fed at face-value and believed that we should see a gradual progression from tapering monetary stimulus to outright monetary tightening. Knowing that even a small degree of monetary tightening would likely create headwinds for asset prices, I shared a less-than-optimistic view for the stock market and predicted “below-average” market returns. Persistent inflation and the corresponding monetary policy response were the key risks that I foresaw in 2022, sharing the following caveat in my prediction:

“If the Fed is forced to tighten monetary policy more hastily, caused by relentless inflationary pressures, I believe asset prices could face worse-than-expected returns.”

While I recognized these risks and the potential headwinds caused by monetary tightening, my outlook wasn’t bearish enough! Looking towards 2023, I recognize that the monetary tightening of 2022 could produce serious economic ramifications in 2023. The Federal Reserve’s playbook follows a simple, two-step process:

1. Raise interest rates & tighten monetary policy in order to slow growth & inflation.

2. Lower interest rates & loosen monetary policy in order to incur growth & inflation.

The Federal Reserve typically overstays their welcome in both aspects of this two-step process, providing excessive stimulus and forcefully overtightening for too long.

Unfortunately, two wrongs don’t make a right...

In October 2021, I expressed concerns that the Fed was tightening monetary policy into a weakening expansion. We proceeded to experience two consecutive quarters of negative real GDP growth in the first half of 2022 and financial markets were in a state of chaos amidst a slew of high inflation, geopolitical conflicts, and the beginning of monetary tightening. In September 2022, I expressed concerns that the Fed was dangerously close to overtightening and was at risk of making a new policy mistake. Since then, the Federal Open Market Committee has voted to raise the federal funds rate by another 2.0 percentage points.

In short, the fundamental concerns that I raised about the economy and the Fed are still in place, but we haven’t sufficiently faced the consequences.

This means one of two things. Either, my concerns are misplaced or the consequences have yet to materialize. While I acknowledge the risk of being wrong, I can’t ignore the indicators, signals and data points highlighted below. I believe that caution is warranted in 2023, given the substantial economic risks amidst a backdrop of elevated inflation, monetary tightening, and a plethora of economic indicators flashing signs of concern. Given these concerns, I’m predicting below-average returns for the S&P 500 in 2023 and reiterate an underweight rating for U.S. equities this year.

This is a difficult perspective for me to share, as I’m generally an optimist. However, I cannot ignore the implications from the various macroeconomic dynamics and market factors that I will highlight below. My framework for understanding market dynamics has thankfully put investors on the right side of the market trend since I started publishing these annual market forecasts.

Going into 2021, I was extremely bullish on U.S. equities and I expressed an “overweight position for equities in 2021, especially with the consideration that U.S. interest rates will most likely remain at/near the zero-bound over the intermediate future.” The S&P 500 produced massive returns amidst a backdrop of extremely friendly monetary stimulus, generating an annual performance of +26.9%. Volatility was muted & markets chugged higher as the economy reopened, consumer sentiment blossomed, and central bank-induced liquidity was abundant.

As my optimism for 2021 turned to caution for 2022, I’m becoming even more defensive based on the current data in front of us today. The purpose of this report is to highlight & analyze the specific charts that I’m focusing on and how they impact my overall investment thesis for 2023. Simply put, I fear that the downside risks are too great to ignore. While there’s a chance that the Federal Reserve is able to engineer a soft landing, a scenario that could cause stronger-than-expected returns, ignoring the potential risks caused by overtightening is not advisable in the current climate.

Without further ado, the market dynamics and analysis below are driving my outlook for 2023!

If you enjoy this analysis and the insights contained below, please consider sharing this post, leaving a comment, and liking the post!

Monetary Policy Dynamics:

Thomas Hoenig, the former President of the Kansas City Federal Reserve, provided the following perspectives about the market’s dependency on monetary stimulus & quantitative easing (QE) in 2016:

“You had seven years of basically zero-interest rates. Now, what happens in an economic system over seven years? The entire market system develops a new equilibrium – around a zero rate. An entire economic system. Around a zero rate. Not only in the U.S., but globally. Now think of the adjustment process to a new equilibrium at a higher rate. Do you think it’s costless? Do you think that no one will suffer? Do you think that there won’t be winners and losers? No way.

You have taken your economy and your economic system and you’ve moved it to an artificially low zero rate. You’ve had people making investments on that basis, people not making investments on that basis, people speculating in new activities, people speculating on derivatives around that, and now you’re going to adjust it back?

Good luck, it isn’t going to be costless.”

I came across this quote while reading Christopher Leonard’s “The Lords of Easy Money”, published in January 2022, which helped to reinforce the significant relationship between monetary policy and financial market dynamics in my own analysis. Monetary policy is the foundation upon which my other analysis is based. I previously shared the following framework, which I’m reiterating once again in 2023:

Become overweight U.S. equities and dollar-denominated assets in periods of monetary stimulus. These periods are identified by falling/suppressed interest rates, an expanding Fed balance sheet, and rising M2 & reserves.

Shift towards caution as the Federal Reserve reduces their rate of asset purchases and begins to transition into a period of monetary tightening. These periods are identified by calculating the derivative, or rate of change, in monetary policy.

Become underweight U.S. equities and dollar-denominated assets in periods of monetary tightening. These periods are identified by rising interest rates, a contracting Fed balance sheet, and declining M2 & reserves.

Going into 2023, the United States is firmly in the third category, and I believe it will likely remain in that position for the significant majority of the year.

While I believe that the worst of the rate hike cycle is likely behind us, I think that balance sheet dynamics will play an increasingly important role in 2023. In reality, balance sheet runoff has hardly begun in 2022. The Fed’s balance sheet peaked in April 2022 at $8.965Tn, shortly after the first rate hike in March vs. $8.551Tn as of December 25th, a decline of -4.5%. This seems like a minimal detail, but it’s extremely important for understanding market dynamics.

Here are two charts to prove why you should be aware of the Fed’s balance sheet:

1. Total assets held by the Federal Reserve vs. the S&P 500:

As the Fed conducts open market operations, buying Treasuries and mortgage-backed securities, they inject the financial system with liquidity. All else being equal, liquidity conditions are positively correlated with asset prices (more liquidity benefits asset prices, while less liquidity curtails asset prices).

2. Total reserves vs. the relative performance of high beta vs. low volatility stocks:

As the Fed conducts open market operations, buying Treasuries & mortgage-backed securities, they provide the sellers (banks) with a reserve asset. Therefore, reserves are positively correlated to monetary stimulus and liquidity, which has a positive correlation with asset prices. If A = B and B = C, then A = C. More specifically, there’s a correlation between reserves and the relative performance of high risk (high beta) vs. low risk (low volatility) assets:

As reserves rise, higher risk assets appear to outperform (SPHB/SPLV ↑).

As reserves fall, lower risk assets appear to outperform (SPHB/SPLV ↓).

Both of these charts highlight the same concept: liquidity conditions are an important driver of asset returns & risk appetite.

I believe that the Fed’s balance sheet is likely to decline in 2023, as they continue to emphasize tighter financial conditions and lower liquidity to strain economic activity and curb inflation. In turn, I think this will have an effect of increasing pressure in financial markets, which was the core pillar of my mid-November piece, “The Earthquake Effect”. In that report, I leveraged Warren Buffett’s famous quote that “you don’t find out who's been swimming naked until the tide goes out”, in order to illustrate current market dynamics as the Fed tightens monetary policy.

The analogy of the earthquake effect was intended to highlight the extreme monetary policy response to historic inflation and the consequences that have arisen as a result. In this analogy:

Earthquake = inflation

Tectonic plate displacement = Federal Reserve rate hikes & balance sheet reduction

Receding water = tighter financial conditions & declining liquidity

Naked swimmers = leveraged investors, scams/frauds, malinvestments

Tsunami = recession, financial crisis, market failures, bankruptcies

The Federal Reserve likely has more rate hikes left in the chamber, at which point rates are likely to remain elevated until inflation has sustainably returned near the Fed’s 2% target. In his latest memo, legendary investor Howard Marks recently expressed that the Fed will likely need to generate a positive real federal funds rate in 2023, adjusting the FFR against inflation. Marks suggest that the real FFR is roughly -2.2%, implying that there is still work to be done. A positive real FFR can be achieved by an increasing FFR, declining inflation, or a combination of both.

Even if the magnitude and pace of rate hikes decelerates, which appears likely, higher real rates will tighten financial conditions and reduce liquidity. The longer they remain elevated, the more liquidity will decline. The combined effect of real rates that are higher for longer and the simultaneous reduction of the Fed’s balance sheet will apply pressure on the financial system and the economy. On net, this means that liquidity will continue to recede, potentially exposing more naked swimmers and creating an avalanche of fundamental economic pressure.

In reality, balance sheet runoff has hardly begun in 2022. Since the peak in April 2022 ($8.965Tn), the balance sheet has declined by -4.5%; however, the total change for the calendar year ($8,757Tn) is a meager -2.2%. Knowing that the likely path for the Fed’s balance sheet will be a reduction in its size, the logical projection is that asset prices (notably equities) will be hindered by the headwinds caused by less liquidity & tighter financial conditions.

Suppose for a minute that my assessment of monetary policy is incorrect, such that the Fed doesn’t raise interest rates in 2023 and that their balance sheet increases. It’s vital to understand the economic circumstances that would cause the Federal Reserve to make such a policy decision, deviating from their 2022 resolve to combat inflation. Historically, the three primary drivers that have caused the Federal Reserve to inject monetary stimulus into the system are:

Recessions;

Financial crises, or the looming threat of one; and/or

Lack of inflation.

When the Fed cut interest rates in December 2000, they did so to curb the economic impact and recession caused by the bursting of the dot-com bubble. When the Fed cut interest rates in 2007, they did so to curb the recession caused by the housing bubble and the Financial Crisis. When the Fed paused rate hikes in December 2018, they cited a lack of inflation as their justification for pausing monetary tightening. In mid-2019, the Fed cut interest rates because of rising concerns in the repo market and potential failures that were occurring in the short-term lending market. When the Fed cut interest rates in February 2020, they attempted to stimulate the U.S. economy in response to an exogenous pandemic that created a severe economic recession.

Considering that inflation remains historically elevated near multi-decade highs, the “lack of inflation” justification isn’t realistic at this time. Therefore, a recession or a financial crisis would likely be necessary for the Federal Reserve to revert back to providing monetary stimulus. Both scenarios are unequivocally bearish for the stock market in the short-term, and I believe that they are plausible risks in 2023. My baseline assumption is that the Fed will likely conduct 2-3 more rate hikes, for an aggregate amount of +0.5% to +1.25%, and that their balance sheet will decline in 2023. In this scenario, the potential path for rates & the balance sheet are likely to produce bearish market dynamics in 2023. Conversely, if the Fed is forced to cut rates in 2023 in order to respond to a recession/financial crisis, bearish market dynamics and extreme volatility are also likely to occur. Either way, it’s difficult for me to envision a positive path forward.

Macroeconomic Dynamics:

In addition to monetary policy considerations, fundamental macroeconomic indicators are signaling the need for caution in 2023. In particular, many signals are flashing that correspond with or precede a recession.

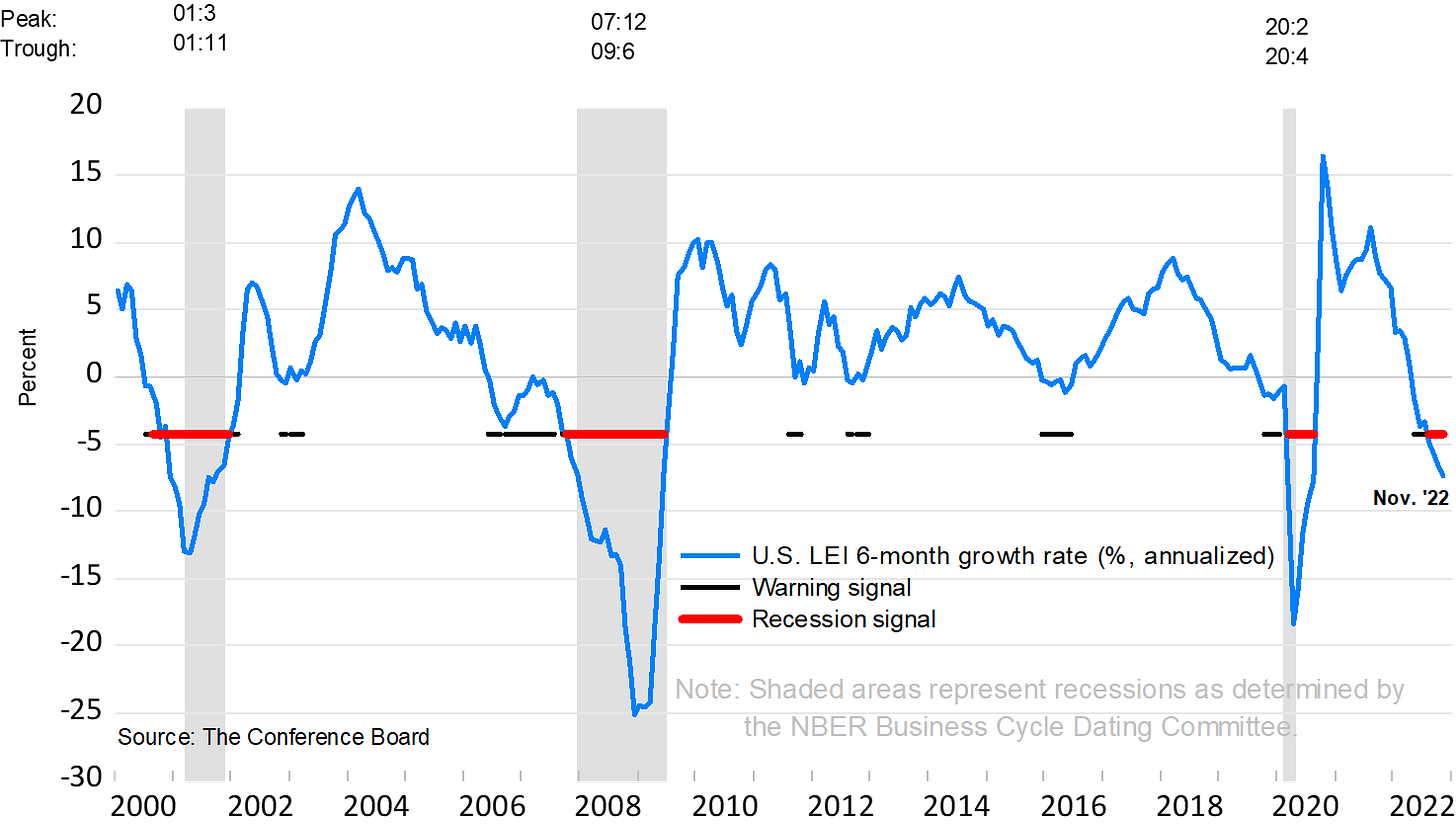

The Conference Board, a nonprofit economic research group, publishes the Leading Economic Indicators on a monthly basis. The latest publication, representing data for November 2022, continued to highlight significant weakness & deterioration in the U.S. economy. The LEI has historically been a meaningful tool to forecast GDP growth, shown by the chart below. It unfortunately indicates that real GDP growth on a YoY basis is going to continue to decelerate and turn negative.

Each time the LEI has fallen below -2.5% on a YoY basis, a recession has occurred shortly thereafter. Being that it’s currently down roughly -4.5%, the YoY rate of change for the LEI is indicating that a recession is likely. The LEI’s 6-month rate of change is also flashing a recession signal, which has a high degree of effectiveness for the past 20+ years. While warning signals have given false-flag signals in the past, the recession signal appears quite conclusive.

Moving on, the Chicago PMI measures the performance of the manufacturing and non-manufacturing sector in the Chicago region. Results above 50 indicates that Chicago business activity is expanding, while results below 50 indicate that it’s contracting. For the month of November, the result was 37.2 vs. analysts estimates of 47. Going back to the 1960’s, the U.S. economy has been in a recession or was on the verge of falling into one when the Chicago PMI fell below 40.

Meanwhile, the Philadelphia Federal Reserve published new analysis about state-level economic data, showing the number of states with negative growth. The current level of this reading coincides with recessionary periods.

Additionally, yield curve inversions have been a predominant topic in the second-half of 2022 because of their historical significance as a precursor for recessions. Most notably, I focus on the relationship between the 10-year Treasury yield (10Y) and the 3-month Treasury yield (3M) because it was popularized by the grandfather of yield inversion analysis, Campbell Harvey. Typically the inversion of the 10Y/3M occurs 6-18 months prior to the onset of a recession and have occurred prior to the past eight recessions with 100% accuracy.

The 10Y/3M relationship inverted for two consecutive weeks in late-October, once again putting investors on alert for a recession looming in the distance. The chart below highlights subsequent stock market dynamics (top) after this curve inverts for at least two consecutive weeks (bottom):

Historically, this inversion has severe implications for the stock market, given by the following data that highlights the maximum drawdowns post-inversion:

On one occasion, the market peaked four months after the 10Y/3M inversion occurred, then proceeded to suffer the extensive declines shown in the table above. On another other occasion, the peak occurred fifteen months after the inversion occurred. It’s worth noting that each of these drawdowns were associated with a recession/financial crisis. With the current inversion flashing in late-October 2022, I think there’s a considerable likelihood that the drawdown occurs in 2023.

Another relationship that I’m monitoring closely is the inversion between the 2-year Treasury yield and the effective federal funds rate. This curve inverted briefly after the Fed’s +0.5% rate hike in mid-December; however, it’s no longer inverted as of the end of the year. Historically, this inversion has been less accurate than the 10Y/3M inversion, but it’s still flashing an important signal. 30% of the time, a recession starts within the first 12 months of this inversion, going back to the late-1970’s. Additionally, recessions have occurred 60% of the time within the first 18 months after this inversion happens. With this inversion happening in December 2022, history suggests that there’s a 30% chance for a recession to occur by the end of December 2023 and a 60% chance by the end of June 2024.

While I recognize that these inversions aren’t bullet-proof recession indicators and that they’ve produced false signals in the past, I think we must listen to the alarm bells considering the context of the monetary policy environment amidst a weakening economy. As the Fed continues to pursue a historic tightening cycle of epic proportions, I believe that risks of a market failure and/or recession are relatively high as we go into 2023.

The final macroeconomic factor that I’m focused on is the labor market, arguably the glimmering bright spot for the U.S. economy in 2022. The most basic measurement for the backward-looking health of the labor market is the unemployment rate, which started the year at 4.0% in January 2022. It fell to 3.6% between March - June 2022, then made YTD lows of 3.5% in July. It’s stayed relatively muted since then, but ticked higher to 3.7% for the second consecutive month as of November 2022.

This context is extremely important because the Federal Reserve has communicated that they are trying to soften the labor market.

The Fed’s Keynesian models imply that inflation and growth are positively correlated because growth is caused by rising aggregate demand. Therefore, a moderate degree of inflation is welcomed by the Fed because it implies that aggregate demand is rising. To stimulate aggregate demand, and therefore inflation, the Fed attempts to stimulate economic activity by targeting full/maximum employment. Considering that aggregate demand is impacted by aggregate income earned by labor market participants, there’s a clear bridge suggesting a positive correlation between aggregate income and inflation. Therefore, the Federal Reserve is attempting to reduce inflationary pressures by softening the labor market and reducing aggregate income!

The Federal Reserve is being challenged by ongoing labor market dynamics which were resilient to broader economic pressures throughout 2022. The unemployment rate has consistently remained near historically low levels for the entirety of 2022, illustrative of a dynamic labor market with an abundance of opportunities (JOLTS data indicates that there are 10.334M job openings as of 10/31/22) and rising incomes (average hourly earnings was up +5.1% YoY in November 2022, the 14th consecutive month at/above +4.9%).

Essentially, the U.S. labor market can be characterized by the following:

Historically low unemployment

Historic demand for skilled workers

Historically strong wage/salary growth

On the aggregate, these three dynamics are inflationary and are therefore antithetical to the Fed’s goal of taming inflation. In response, the Fed has been transparent about their intention to soften the labor market in order to reduce inflationary pressures. I am going to take them at their word.

With a baseline expectation that the unemployment rate is likely to climb higher, I’m cautious of the economic implications. The U.S. economy has historically entered a period of noticeable economic weakness when the unemployment rate rises above its 12-month moving average, which is currently measured at 3.9%. With the unemployment rate currently sitting at 3.7%, I am fearful that a rise above 3.9% in 2023 will quantifiably indicate economic deterioration. Unfortunately, the Fed’s own forecast from their Summary of Economic Projections indicates that the unemployment rate is likely to reach 4.6% in 2023 and 2024, significantly above the 3.9% threshold of the 12-month moving average. My base-case outlook is that the unemployment rate will at least reach 4.3% at some point in 2023 & is likely to accelerate higher than its current 3.7% level.

Regarding accelerations, there’s an important relationship that I’m monitoring as a key indicator for market dynamics. The chart below tracks the YoY rate of change in the unemployment rate (blue) vs. the YoY rate of change in the Nasdaq Composite Index (green).

This visualization shows a clear, inverse correlation between the rate of change in the unemployment rate and the Nasdaq, highlighting the dynamics that occur when the unemployment rate accelerates higher. Particularly, an upward acceleration in the YoY rate of change in the unemployment rate correlates to a significant decline in the YoY rate of change for the Nasdaq. There are two criteria that investors should be aware of as it pertains to this dynamic:

When the YoY change in the unemployment rate crosses above the YoY change in the Nasdaq, the economy trends into a recession and Nasdaq performance worsens.

When the YoY change in the unemployment rate crosses above 0%, the economy trends into a recession and Nasdaq performance worsens.

I first highlighted this dynamic in July 2022, which has continued to worsen & materialize such that the YoY change in the unemployment rate rises and the YoY change in the Nasdaq falls. I believe that this theme will continue to manifest in 2023, alluding to further weakness for the Nasdaq Composite.

At the present moment, the YoY rate of change in the unemployment rate is -11.9% (but rising quickly) and the YoY rate of change for the Nasdaq is -33.4%. Given the context of the monetary policy environment and the economic indicators reviewed above, I feel quite confident that the labor market will deteriorate in 2023 and continue to experience an acceleration in the YoY rate of change in unemployment. History indicates that the stock market doesn’t perform well in that environment. While stocks have already experienced pain in 2022, the implications of the aggregate data above indicate that market conditions are likely to remain difficult in 2023 as economic headwinds persist. Perhaps “difficult” is an understatement...

Concluding Remarks:

The Federal Reserve provided historic levels of monetary stimulus from Q1 2020 through Q1 2022. With inflationary pressures surging in 2021, Fed officials portrayed confidence and undeniably postured that inflation would be transitory and easily managed. As inflationary pressures continued to surge at the beginning of 2022, the Fed continued to operate QE and provided monetary stimulus for too long. Realizing that they were behind the curve, Fed members voted to front-load rate hikes and embark on a tightening of historic precedence. Despite the magnitude & pace of their rate hikes, the Fed reached a “neutral” policy stance in December 2022, when the federal funds rate became roughly equivalent to the 2-year Treasury yield.

The Fed sprinted half of a marathon in order to achieve this neutral policy stance, but now embarks on the second half of the marathon. Various Fed officials have acknowledged their intention to keep monetary policy “sufficiently restrictive for some time”, likely indicating that rates will rise a bit further and that Quantitative Tightening (QT) will be persistent in 2023. However, the Fed isn’t the only central bank to be coordinating such a policy response. The European Central Bank, the Bank of England, the Bank of Japan, the Bank of Canada, and the Royal Bank of Australia are also tightening monetary policy & withdrawing liquidity from their respective markets.

With global yields having tailwinds to rise and global central bank balance sheets likely to decline, I envision a difficult year ahead for asset prices. Against all odds, stocks, bonds, real estate, and crypto could have strong years, but I don’t have faith in this possibility. The coordinated efforts by foreign central banks will also have a net impact on U.S. assets, in addition to policies pursued by the Federal Reserve, likely to create mountainous challenges for dollar-denominated assets in 2023.

Plenty of cracks have occurred across the U.S. economic & financial system after 9 months of domestic monetary tightening; however, it’s likely that these cracks will exacerbate new issues across the system. Monetary policy dynamics create a ripple effect, which requires time to undulate through the economy & financial system. In other words, we don’t know how economic data will be impacted by the known lag effects of monetary policy, or when said impacts will occur. What we do know is that draining liquidity out of the system will likely expose more “naked swimmers”, wiping out leveraged investments, scams/frauds, and malinvestments. This likely means that more dominos will fall in 2023, following the 2022 dominos that were primarily contained within the cryptocurrency industry. Should these contagion events spread into the traditional financial system, market failures are likely to create a cascading effect on the real economy.

Regardless of the economic consequences, receding global liquidity will have a negative impact on asset prices, as suggested by the historical correlation between central bank policy & market returns. All else being equal, continued tightening in 2023 will produce headwinds for stock market returns and will likely require investors to remain defensive & long-term focused.

Based on the data and charts above, I acknowledge an increasing risk of a second policy mistake caused by the Federal Reserve. Faced with this risk, it’s likely that the economy transitions from decelerating growth towards an outright contraction as a result of this potential policy mistake. According to the current state of affairs, I feel justified in voicing this assessment; however, I will gladly welcome debate on this topic and genuinely hope that I’m incorrect. Should evidence arise that is contrary to the data & beliefs expressed above, I will gladly update my assessment of economic conditions & expectations for stock market returns. Similarly, a substantive shift in monetary policy could force me to become optimistic on stock market dynamics, depending on the context of such a policy shift.

Until then, I am formally providing an underweight rating for U.S. stocks & risk assets in 2023. I think it’s prudent to walk a thin line between having a defensive portfolio stance (large cash position) while remaining long-term optimistic on U.S. equities & dollar-denominated assets.

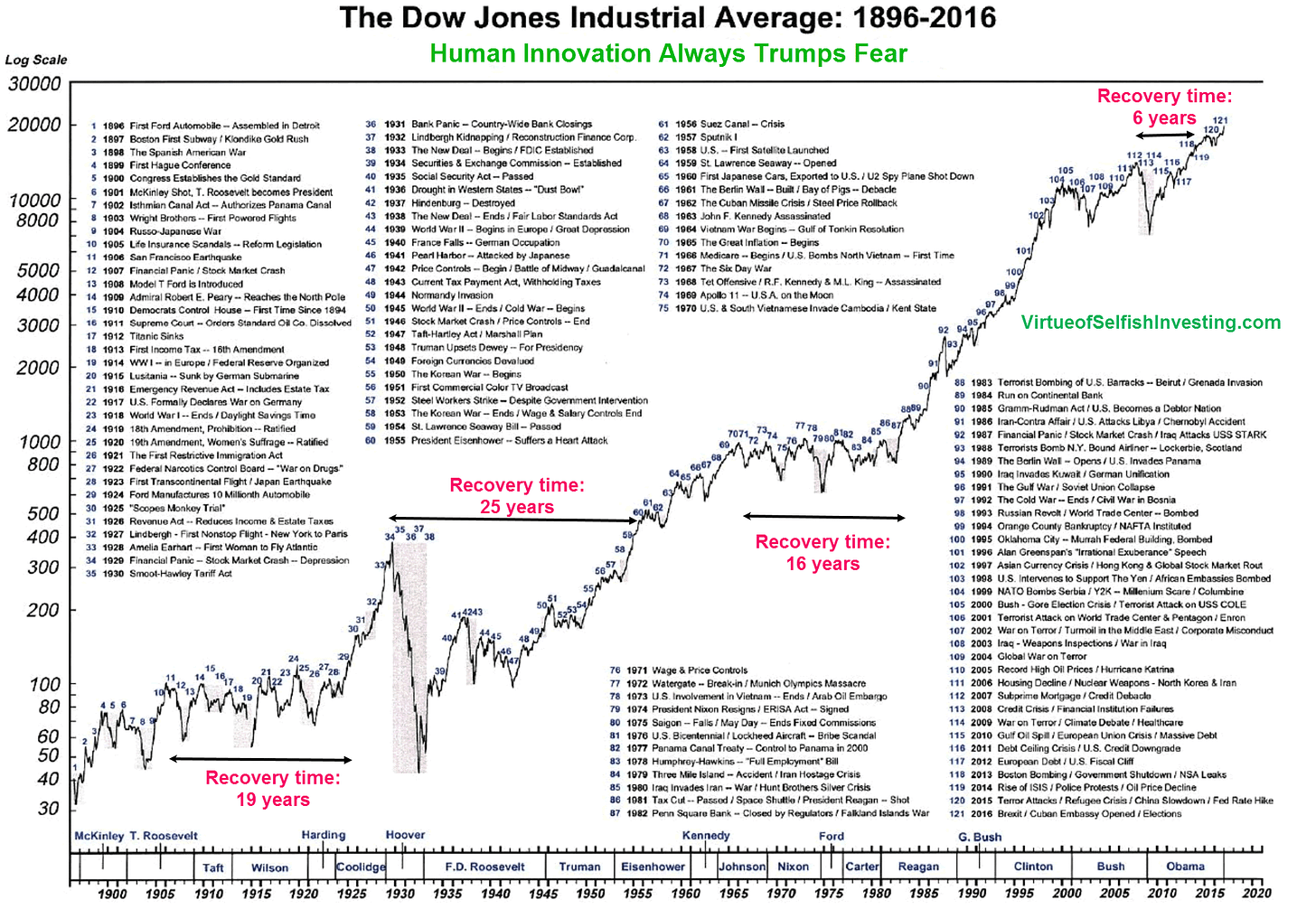

Should the stock market fall an additional -20% to -30% due to an economic downturn, I will broadly use that decline as an opportunity to purchase high-conviction assets that I intend to own for the long-run. The fact of the matter is that there’s always something to worry about regarding macroeconomics, geopolitics, and societal dynamics. The stock market has proven to be able to overcome these concerns, over time, and gradually trend higher:

Stock market volatility is a feature, not a bug. Investors should recognize that stock market results are skewed to the upside, indicating that short-term risks can produce long-term returns:

In 2023, I intend to steadily increase my exposure to high-conviction assets that I intend to own for the long-run. The entire analysis of my “Portfolio Strategy” series is available for premium Cubic Analytics members, where I share the qualitative and quantitative investment thesis behind each position and why I’m convinced that they belong in my portfolio. The final edition of this series provided additional context about 20 other investments that I think are deserving of an allocation in long-term portfolios.

Premium members will continue to stay abreast of my market views on a weekly basis, via the Premium Market Analysis reports published every Sunday, where I provide exclusive research about market dynamics and trends impacting my investment thesis.

Caleb Franzen,

Founder & Senior Market Strategist of Cubic Analytics

January 1, 2023

DISCLAIMER:

This memorandum expresses the views of the author as of the date indicated above, and are subjected to change without notice. The investment thesis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. Everyone is responsible to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that the information contained herein does not constitute and should be construed as a solicitation of advisory services. Cubic Analytics believes that the information & sources from which information is being taken are accurate, but cannot guarantee the accuracy of such information.

This memorandum may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation & reference.

As always, consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Thank you!

It sounds like you aren’t expecting the lows to hold