Will This Divergence Continue?

Investors,

This past week was ripe with economic data & market action, so I want to jump straight into it. I had two phenomenal 1-on-1 sessions with subscribers on Friday, discussing macro trends, inflation dynamics, Bitcoin DCA strategies, and some of the key charts that I think investors should be aware of. Shout out to Reale and Vince — it was a pleasure meeting you both!

If you’d like to meet with me directly over video call, consider booking a session on my calendar through the following link!

Book a meeting with Caleb Franzen

Macroeconomics:

This week was dominated by labor market data, which has become an extremely important topic considering the continued resilience of the labor market and how it continues to prop up the U.S. economy. In attempt to reduce inflation by suppressing aggregate demand, the Federal Reserve has been clear about their intent to “soften” the labor market; however, they’ve had little to no success despite 8 months of historic monetary tightening.

The latest data from the past week confirms this to be true.

First & foremost, the Job Openings & Labor Turnover Survey (JOLTS) for October decreased to 10.3M openings vs. 10.7M at the end of September. While this 400,000 decline is a step in the right direction to soften the labor market, it’s extremely elevated relative to the historical data & trends. The data has consistently reflected more than 10M job openings at the end of every month since July 2021! For context, the pre-COVID level in January 2020 was 7.1M and the COVID low in April 2020 was 4.7M. While we’ve declined from the March 2022 peak of 11.855M, it’s clear that there is a shortage of labor and an excess of opportunity.

In turn, this has created a preferable environment for workers who have the ability to pursue new opportunities. As a result of abundant opportunity, people have been able to find better positions, with better pay, that are more aligned with their skills, interests, and career goals. This is actually fantastic, but the consequence is that it has produced a high quits rate, measured at 2.7% in October, and a massive divergence in wage growth of job-switchers vs. job-stayers (3-month moving average of median hourly wage growth is +7.6% vs. +5.4%). To highlight the extreme nature of both job openings and the quits rate, this chart from Ben Casselman shows the standard deviation of both relative to their pre-Pandemic averages:

Job openings are more than 4 standard deviations above their pre-Pandemic average, while the quits rate is more than 2 standard deviations. These are statistical anomalies that I expect to normalize; however, the normalization process has clearly been longer than anyone has anticipated.

The nonfarm payroll data for November was released on Friday, in which median estimates were expecting for +200k jobs created during the month. The result was a staggering +263k, continuing to highlight the high demand for labor.

Overall, businesses are hiring in order to meet consumer demand for their products/services. The fact that businesses continue to hire at consistently strong rates, beating analyst estimates, highlights that consumer demand is still very strong and that the U.S. economy is perhaps stronger than anticipated. The unemployment rate remains near historically low levels, unchanged relative to the prior result of 3.7%. The labor force participation rate inched lower, from 62.2% to 62.1%, still well-below the pre-Pandemic level of 63.4%. This continues to be a weak spot for the overall labor market, along w/ the employment to population ratio which currently stands at 59.9%.

Going forward, how should we think about the direction of the labor market and how it relates to monetary policy & financial market dynamics? I see three potential scenarios:

The labor market remains tight, dynamic, and “strong”:

Despite raising the federal funds rate by +3.75% in eight months, the Fed hasn’t been able to slow down the labor market. Will more hikes “break the camel’s back” and normalize the shortage of labor/abundance of opportunity? Eventually, yes. The Federal Reserve wants to reduce inflation by reducing aggregate demand. While lower asset prices create an inverse wealth effect, thereby reducing aggregate demand, they are also trying to reduce aggregate income, which will therefore reduce aggregate spending, demand, and consumption. A stronger labor market means stronger income, which in turn will keep consumption relatively elevated. This is antithetical to their goals. Therefore, resilient labor market dynamics could force the Fed to push their foot on brakes even harder, depending on how other factors impacting inflation evolve going forward. As it pertains to financial markets, one of the worst-case scenarios is for the labor market to remain tight while inflation remains sticky, as this will force the Fed to maintain a “higher for longer” monetary policy.

The labor market gradually softens:

In the event that the Fed successfully & moderately weakens the labor market, in order to suppress aggregate consumption, this would significantly increase the likelihood of a “soft landing”. If the unemployment rate steadily rose from 3.7% to 4.5% over the coming 6-8 months, inflation would likely moderate and overall economic activity would become anemic (chopping between slightly negative & slightly positive growth). There would be economic pain associated with this path, but not to a significant degree. I’m not trying to minimize said pain, but this would likely be the bitter medicine that the U.S. economy would have to swallow in order to beat the sickness (inflation). Asset markets would theoretically perform well in this environment, looking beyond the immediate discomfort and towards the potential prosperity around the corner. Rates would likely remain elevated, but eventually resume their multi-decade downtrend, which would provide strong tailwinds for long-term asset returns.

The labor market deteriorates rapidly:

The second worst-case scenario is one where the labor market nosedives, with unemployment quickly accelerating beyond 4.5% and extending even higher. This would happen if/when demand falls off of a cliff, and businesses respond by reducing their work force to decrease supply at a new market equilibrium. Per the Fed’s model, this could theoretically put the market at a lower equilibrium price, reducing inflation back to their 2% target, or perhaps even creating a deflationary environment. This scenario skips the “soft landing” and immediately puts the economy into a severe recession. In no way, shape, or form is that beneficial to asset prices in the short-term; however, investors could become risk tolerant in the event that the Fed quickly reverts to providing monetary stimulus. In this scenario, I’d expect to see a March - May 2020 recovery for asset prices, forming a v-shape bounce, depending on the magnitude of monetary stimulus. While this scenario would create short-term pain for the market, I think it could generate substantive returns in the medium to long-term. At the very least, it sets the stage for a continued long-term bull market.

Stock Market:

Amidst a continued decline in yields and the U.S. dollar, investors are once again pricing in peak inflation, peak Federal Reserve hawkishness, and a moderate deceleration in U.S. economic activity. With the appearance that we’re trending towards a soft landing, investors are celebrating by buying stocks & bonds once more.

This is extremely important:

Stocks aren’t rising because the dollar is falling! They are moving in their respective directions, moving inversely from one another, for the same underlying reasons highlighted at the start of this section!

With medium & long-term yields declining materially from their mid-October peaks, bond investors are pricing in lower economic growth, lower inflation, and therefore a less aggressive path of monetary policy. Eerily similar to the dynamics we witness in June - August, investors are reengaging with the market and chasing high-momentum assets. The difference vs. June - August is that the least risky stocks, like constituents of the Dow Jones, are appreciating the fastest & by the largest magnitudes.

As of Friday’s close, the Dow Jones has gained +20.1% since the intraday lows on October 13th. Meanwhile the S&P 500 has gained +16.6% and the Nasdaq-100 has gained +15.0% over the same time period. Considering that the S&P and the Nasdaq are higher risk indexes due to their tech exposure, we’d generally expect to see them outperform the Dow Jones during an uptrend. Historical returns confirm this idea.

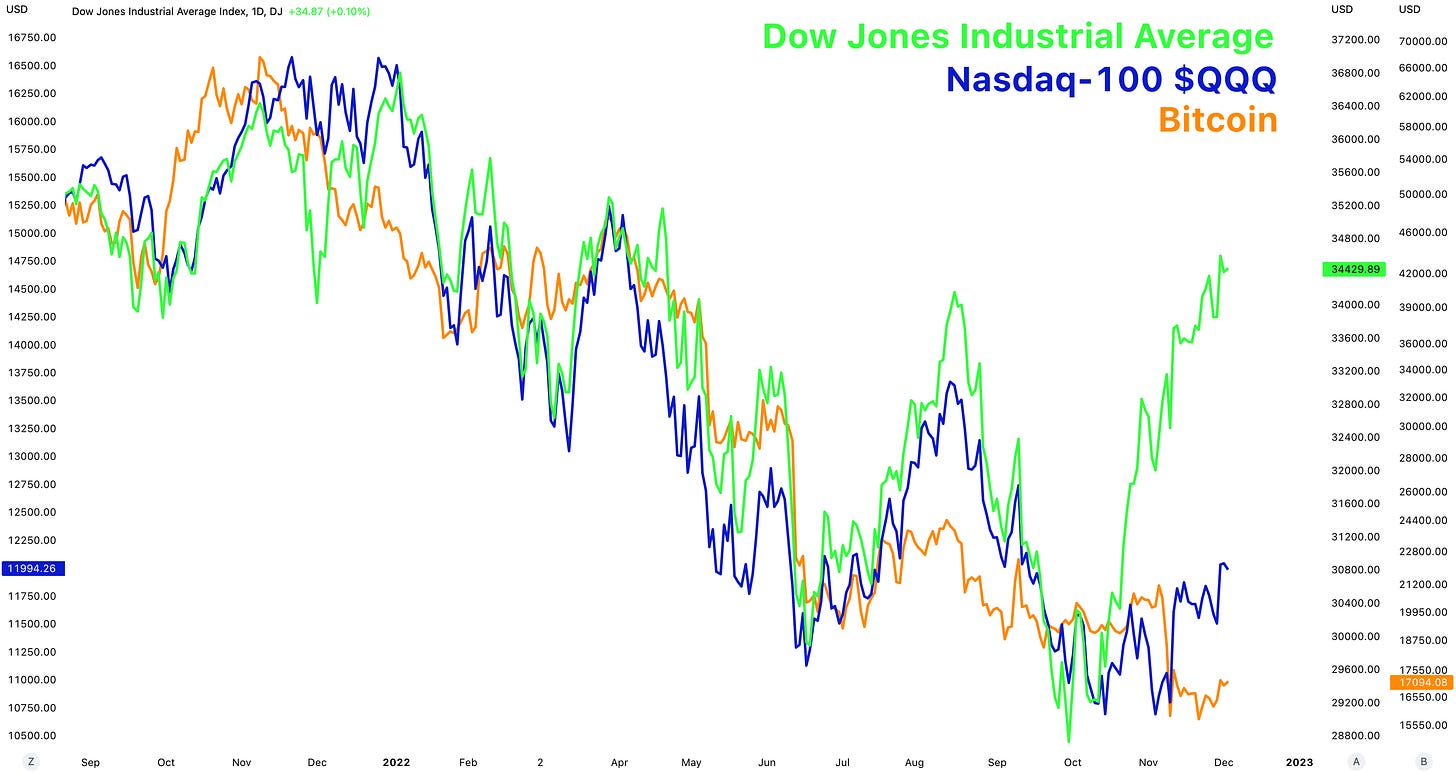

In fact, there is a massive deviation between the Dow Jones and the Nasdaq-100 at the present moment. Below is a chart comparing the two indexes from the same starting point in mid-June 2021:

There are two ways to interpret this chart, depending on what your personal bias is:

Bearish Interpretation: Leadership from defensive stocks & the lagging momentum for technology stocks isn’t a sign of optimism. While investors seemingly have demand for equities in general, they’ve poured their capital into defensive/value stocks in order to anchor their risk & generate dividend yield. Perhaps they’ve gotten too far ahead of themselves, doomed to trip over their own momentum. In this outlook, the Dow Jones and the Nasdaq would converge to the downside.

Bullish Interpretation: Investors have been patient to allocate to the riskiest segments of the market, illustrating a form of PTSD after a terrible year of asset returns. With the Dow Jones leading the market higher, it’s paving the way for riskier segments of the market to follow the path that it’s creating. In this outlook, the Nasdaq-100 is primed to accelerate higher and rejoin the Dow at these elevated levels. With the potential for strong upside momentum, assets could have further tailwinds to sustain a larger rally.

Personally, I lean towards the former. I generally don’t expect this divergence continue, meaning that one group of investors (value vs. growth) is wrong.

According to a fund managers survey at Bank of America, mutual fund managers are still extremely risk averse in the current environment. I don’t expect to see them wildly take on sustainably higher levels of risk while the Fed continues to tighten monetary policy, raise interest rates, and reduce the size of their balance sheet.

Bitcoin:

Building on the divergence between the Dow Jones and the Nasdaq-100, let’s also contextualize where Bitcoin stands relative to equities:

Bitcoin, considered to be far riskier than the Nasdaq-100, is substantially lagging behind both stock market indexes. I’m not surprised by this development, largely because crypto-specific risk events have weighed on investor appetite for the digital asset. If we reduce the noise by comparing BTC vs. NDX over the past several months, we can see how the latest divergence started at the beginning of November, when the FTX scandal first came to light:

Absent the FTX debacle, the current price of the Nasdaq-100 implies that BTC should be trading around $23k-$24k. Considering that BTC was trading at $21.1k pre-FTX, this isn’t an unreasonable expectation for “what could have been”. While these crypto-specific risks continue to anchor the performance of crypto relative to equities, the fundamental adoption of Bitcoin continues to grow.

At the end of December 2021, there were 812,788 addresses holding at least 1 BTC.

In June 2022, there were 849,255 addresses holding at least 1 BTC, up +4.5% in 6 months. Today, there are 958,006 such addresses, up +12.8% since June and up +17.9% since last December. In fact, it appears that the FTX-prompted decline has led to a new acceleration of investors stacking Bitcoin. Broadly speaking, this means that smaller existing holders of Bitcoin are increasing their long-term position in the asset.

Historically, we’ve seen this metric expand up and to the right over time, despite the similar exponential trend in Bitcoin’s price. This dynamic will likely act as rocket fuel for the next bull market, whenever it may come.

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.

It is interesting, of course, that fraudulent actions attract new investors :)