Investors,

Everything is going up.

Value stocks, growth stocks, small cap stocks, mid cap stocks, large cap stocks, industrial stocks, technology stocks, real estate stocks, financial stocks, recent IPO stocks, semiconductor stocks, transportation stocks, crypto stocks…

Should I keep going or do you believe me now?

Trump this, Trump that…

Powell this, Powell that…

It doesn’t matter.

It’s just a bull market.

And bull markets tend to do even better when uncertainty fades away, which is exactly what we got this week with the swift & decisive election results in the United States and the Federal Reserve’s decision to cut interest rates by another 0.25%.

Regardless of the outcome, the market just needed an outcome in order to do well.

If you’re curious to know just how well the market is doing, look at this chart of the S&P 500 relative to M2 money supply, which is now trading at the highest levels since November 2000.

SPX/M2SL has gained more than +26% in roughly 11 months since the initial breakout to new multi-decade highs, highlighting how the S&P 500 is outperforming the debasement of the U.S. dollar. In other words, the rise in the nominal S&P 500 is being driven by debasement, rising corporate earnings, and multiple expansion.

Here’s what else mattered this week:

Macroeconomics:

There are two charts that I want to highlight here:

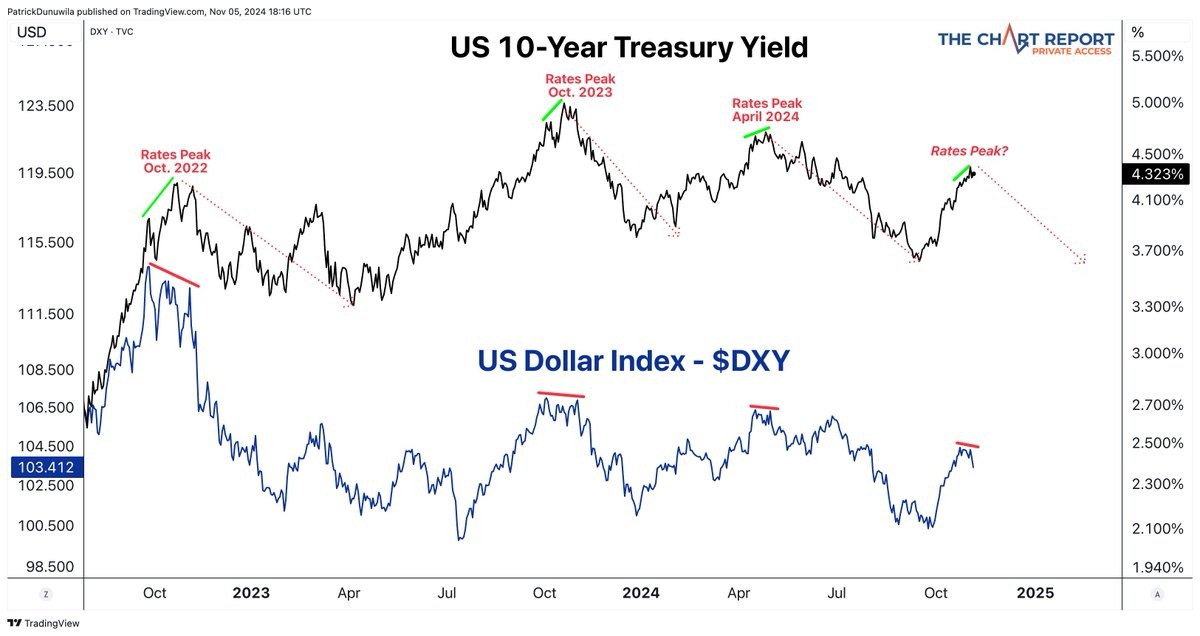

1. Yields vs. the U.S. Dollar: It’s no secret — the yields and the dollar are correlated… but this chart from Patrick Dunuwila indicates that the dollar might actually be a leading indicator for where yields are likely to head next. If the dollar is about to dip further, it might be signaling a short-term peak for yields, which could therefore create more tailwinds for the stock & crypto market (and even bonds).

2. October 2024 ISM Data: The ISM data is survey data, which is considered to be “soft data” and therefore inferior to “hard data” (like the unemployment rate or industrial production). Nonetheless, this chart from Liz Ann Sonders indicates three important developments:

The continued expansion & acceleration in the services component (above 50).

The continued expansion (but deceleration) in new orders.

The expansion & acceleration in employment.

My view is, simply, that none of these developments are recessionary or bearish.

Stock Market:

Like I said earlier, we’re in a bull market… regardless of Fed policy or who lives in the White House. I don’t mean to be dismissive of the significance of these latest political and monetary policy events; however, it’s important to understand that this market continues to be driven by fundamentals.

Yes, the naughty “F” word that technicians hate to talk or think about.

With earnings season now coming to a close, we have some key data about how companies are faring in the current macro climate. In short, they’re crushing it.

90% of S&P 500 companies have reported earnings so far, with 75% of them beating on EPS and 60% of them beating on revenue figures, generating blended earnings growth of +5.3% YoY. With Headline ex-Shelter CPI inflation at roughly +1.1% YoY, we can conclude that real corporate earnings growth is solid at more than +4%.

That sure doesn’t sound recessionary to me!

The fact of the matter is that the best companies in the entire world are components within the S&P 500, which is arguably the greatest investment vehicle in human history over a long-term timeframe.

If you don’t believe that these are the best companies in the world, or even in the United States, then how do you explain this chart, showing the percentage of U.S. corporate profits generated by the S&P 500:

Currently, S&P 500 companies are responsible for generating roughly half (yes, 50%) of total corporate earnings in the United States.

Again, these are the best companies in the world with an astounding ability to generate returns for their shareholders.

Bitcoin:

$77,000.

That’s it.

Enjoy the moment.

Best,

Caleb Franzen,

Founder of Cubic Analytics

This was a free edition of Cubic Analytics, a publication that I write independently and send out to 11,000+ investors every Saturday. Feel free to share this post!

To support my work as an independent analyst and access even more exclusive & in-depth research on the markets, consider upgrading to a premium membership with either a monthly or annual plan using the link below:

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.