The Tipping Point

Investors,

Precious metals are the talk of the town these days.

As a former gold bug who moved to greener pastures in 2019, I feel qualified enough to talk about the recent price action in gold & silver with a degree of objectivity.

Though I previously doubted gold’s ability to sustain this rally, particularly in 2023 and 2024 when I saw significantly more upside in mega-cap technology stocks and Bitcoin, I’ve been forced to acknowledge the strength of the trend in 2025.

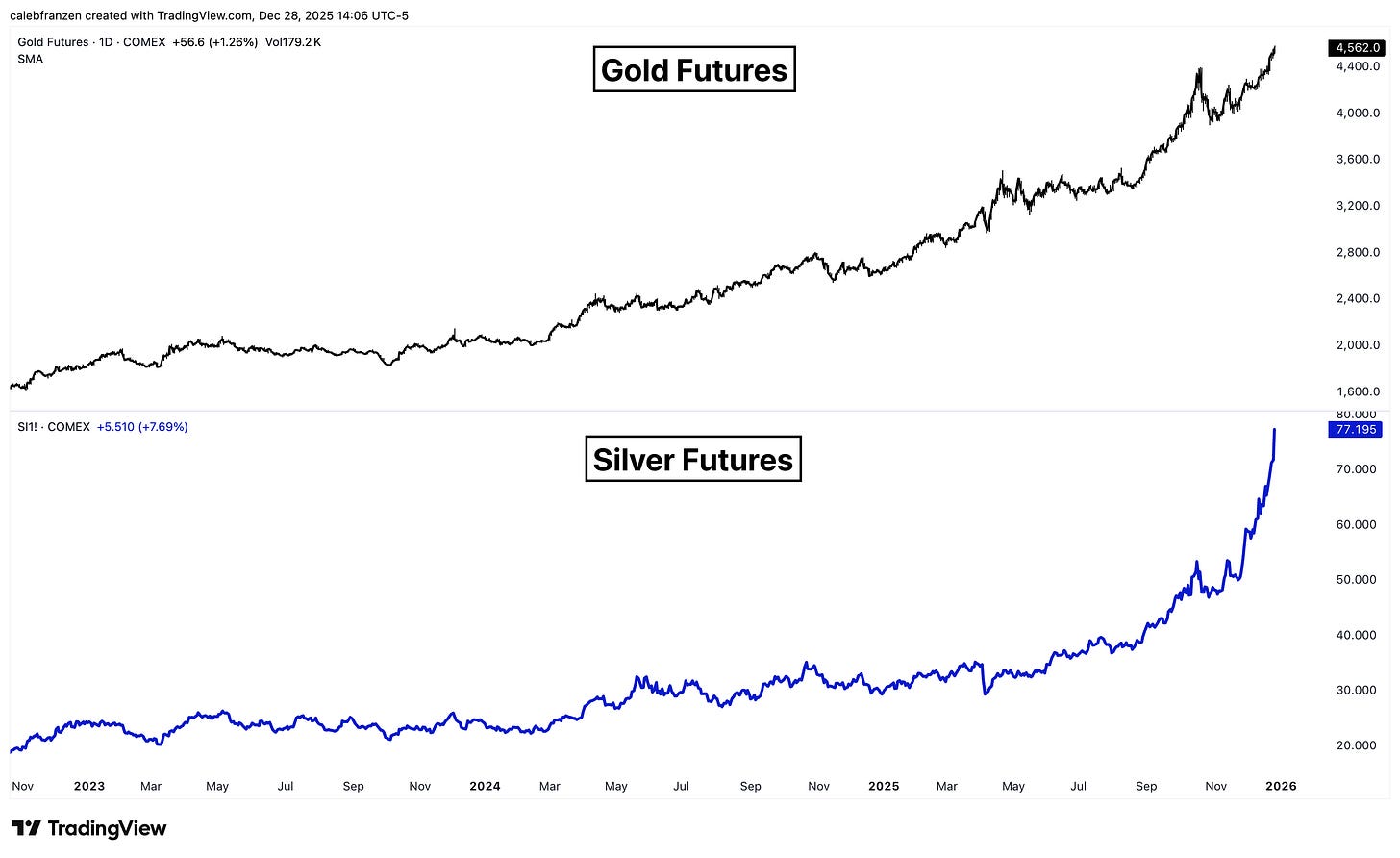

In fact, the uptrend in 2023/24 has only gotten stronger this year, reaching such a strong exponential phase that the ascent in those prior years is nearly unobservable.

The recent vertical price action, particularly for silver, has produced an influx of questions, asking me what I think about the precious metals market.

It’s important to acknowledge that I’m not the best person to ask about this, since I didn’t foresee this price action to begin with. When I’ve shared my analysis on gold & silver in the past, I’ve shared various price targets where I think investors should capitalize on their gains.

All of those targets have been hit, by the very nature of their strong uptrends.

But investors who secured profits at those levels — while prudent — would have experienced significantly larger gains had they just continued to tighten their grip.

So that’s been my flaw regarding gold & silver.

I’ll own that as a precursor to what I’m about to say next…

Which is that I think the precious metals trade is hitting a tipping point.

Here’s why: