Investors,

Last week’s edition was appropriately titled “Do You Feel Risky, Punk?” as a reference to Clint Eastwood’s famous line in the movie Dirty Harry. Amidst a fundamentally bearish monetary policy environment, the market was making significant bullish signals from a statistical perspective. After such a monumental rally to start the year, I believed that investors were taking on excessive risk if they continued to pile into the market. As it turns out, investors were confronted by these risks this past week.

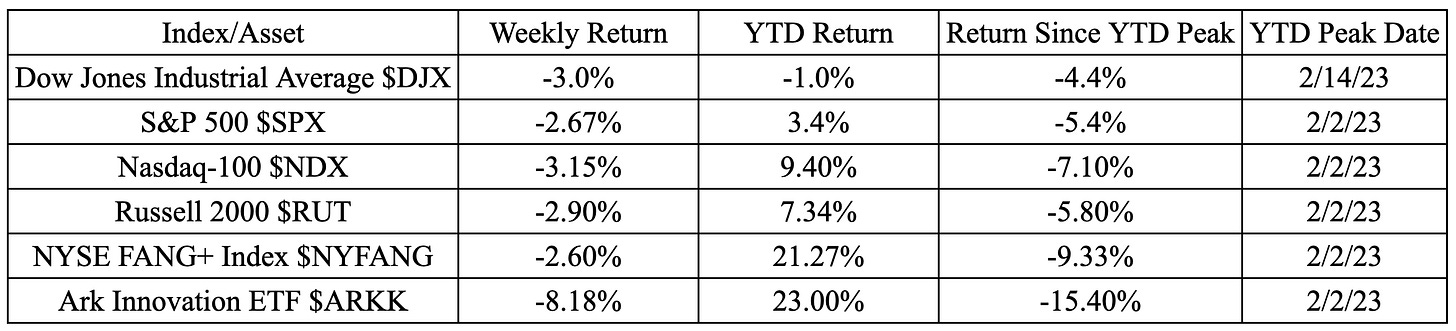

The riskier the asset, the more it’s fallen from the YTD peak.

At various stages of the year, investors were piling into stocks that had declared bankruptcy or were on the verge of bankruptcy, like Bed Bath & Beyond, Carvana, and Silvergate Capital. The darlings of 2020 that were punished in the post-vaccine era also saw significant spikes in their valuations, including Peloton, Redfin, Fastly, DraftKings, Roku, and Stitch Fix are all up at least +50% YTD (though they are down sharply from their peaks on ~2/2/23). At their recent YTD peaks, many cryptocurrency projects increased in value by factors of 2-4x, while total crypto market cap increased by +45%, or roughly $340Bn.

Meanwhile, defensive and boring stocks remained largely unchanged to start the year. Utilities, consumer staples, and healthcare sectors have been falling throughout 2023 and have a negative return so far YTD.

For right or for wrong, I’m highlighting this dynamic because it illustrates the dynamics of exuberance, greed, and speculation in the market. Investors haven’t been rewarded for prudence in 2023, they’ve been rewarded for excessive risk. The issue is, excessive risk hardly generates a congruent reward during a Fed tightening cycle. Since November 2021, when the Fed announced that they’d begin tapering their asset purchases, investors have been exclusively rewarded for extreme caution and simply leaving the market. By leaving their capital in dollars rather than financial assets (bonds, Treasuries, stocks, crypto, real estate, and precious metals), investors have dodged a bullet.

This report will focus specifically on S&P 500 dynamics as a way to gauge overall market direction and to analyze the perspectives of both bulls and bears. I’m not here to tell you what the market will do next, but what it could probabilistically do based on specific data, indicators, and price levels. By focusing specifically on the S&P 500, particularly at such an important juncture, we can generally gauge how every single other risk asset will perform. Whether we’re talking about Bitcoin and crypto, a specific technology stock, or even the Dow Jones, the S&P 500 can be reliably used as a way to understand overall market dynamics.

This report contains 7 charts and a variety of datapoints that will help us to better understand, navigate, and prepare for market action this upcoming week and into the future. Let’s jump right in…