Investors,

Bitcoin is currently back above $64k, surging higher during Friday’s trading session as a result of Jerome Powell’s speech at the Jackson Hole symposium, in which he said that “the time has come for policy to adjust”.

I’ll talk about Powell’s speech (which I’m referring to as “The Pre-Pivot”) in the macro section of this report, but I want to start by acknowledging the ongoing consolidation in the crypto market since the highs on March 14, 2024…

Those highs were 163 days ago, which has felt like a grueling length of time for those of us who have continued to remain optimistic on Bitcoin; however, we must recognize that consolidations aren’t necessarily bearish. In fact, we experienced a similar sideways range for 194 days last year, between April & October!

Once prices were able to achieve the breakout in late October 2023, the train left the station and total crypto market cap excluding stables increased by +121% in 140 days.

So what happens if we can achieve the same breakout in the coming weeks/months?

In an environment with continued disinflation, upcoming rate cuts (yes, plural), improving fundamentals in the stock market, a resilient macroeconomic environment, and bullish seasonality in an election year, I think that a potential extension to new highs could catalyze even more upside momentum.

As a reminder before we jump into this free edition of Cubic Analytics, I published a comprehensive update of my long-term equity portfolio last weekend. In the report, I shared all of my long-term holdings, their allocations, and how I’m planning to make changes to my portfolio for the remainder of the year.

If that sounds valuable to you, I’d encourage you to upgrade your membership and access the full report here:

Without further ado, this is the latest edition of Cubic Analytics:

Macroeconomics:

The only thing worth talking about regarding macro is the imminent shift in monetary policy and the fact that Jerome Powell essentially just gave us a “Pre-Pivot”.

While Powell didn’t explicitly say that the FOMC will cut interest rates in September, we got as much confirmation as we could possibly have expected during his 8-minute speech. For the past 6-12 months (and potentially even longer), Powell has specifically said something along the lines of “we need to gain greater confidence that inflation is moving sustainably towards 2% in order to cut rates”.

In his speech on Friday morning, Powell said the following:

“My confidence has grown that inflation is on a sustainable path back to 2 percent.”

There it is folks.

Like I said, it won’t get much clearer than that, especially when coupled with the following statements:

“The upside risks to inflation have diminished. The downside risks to employment have increased.”

“The time has come for policy to adjust. The direction of travel is clear.”

“With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market.”

Then take into consideration the market reaction to this “Pre-Pivot”…

The U.S. Dollar Index $DXY tanked on the news, falling -0.83% on Friday. On a closing price basis, the dollar had its lowest daily close since July 19, 2023!

Why is this happening and why is it significant?

Because the market is actively pricing in lower yields and it’s subsequently causing the dollar to get repriced lower.

Conversely, risk assets soared on the news, with the S&P 500 gaining +1.06% on Friday and the Nasdaq-100 gaining +1.18%. Moving further out onto the risk curve, the long-duration and high growth segments of the market jumped even more on Friday:

VanEck Semiconductors ETF ($SMH) +2.46%

Ark Next Generation Internet ETF ($ARKW) +3.89%

Renaissance IPO ETF ($IPO) +3.62%

All of this is happening because the market is actively pricing in imminent rate cuts.

I expect to see the Fed cut by 0.25% in September, followed (most likely) by cuts in both the November & December meeting, of which one of those final two meetings will most likely be a 0.5% rate cut.

My disinflationary rate cut thesis that I’ve been sharing for the past year is upon us.

Stock Market:

Regarding equities, it’s necessary to know that the equal-weight version of the S&P just achieved the highest daily and weekly closes of all-time on Friday.

By definition, this can only happen during a bull market and/or an uptrend.

Isn’t the entire point of being an investor to own assets during bull markets?

That’s what I learned 10+ years ago when I started learning about investing seriously.

The equal-weight S&P 500 is now up +10.47% YTD, +18.84% on a trailing 1-year basis, and a whopping +30.7% since the October 2023 lows less than 10 months ago.

While sidelined bears are still crying that the market is being irrational and that it’s detached from fundamentals, the reality of the situation is the exact opposite…

In fact, fundamentals are better today than at any other point in history, if we use 12-month forward earnings per share expectations as a gauge for fundamentals.

If asset prices are a function of future cash flows and interest rates (which is true), then both variables of the net present value formula are contributing to the rise in asset prices.

It’s just a basic fact of math that asset prices will rise, all else being equal, when:

Interest rates fall

Future cash flows rise

The market is benefitting from both variables in the current environment and will continue to experience upside tailwinds if these conditions remain intact.

Bitcoin:

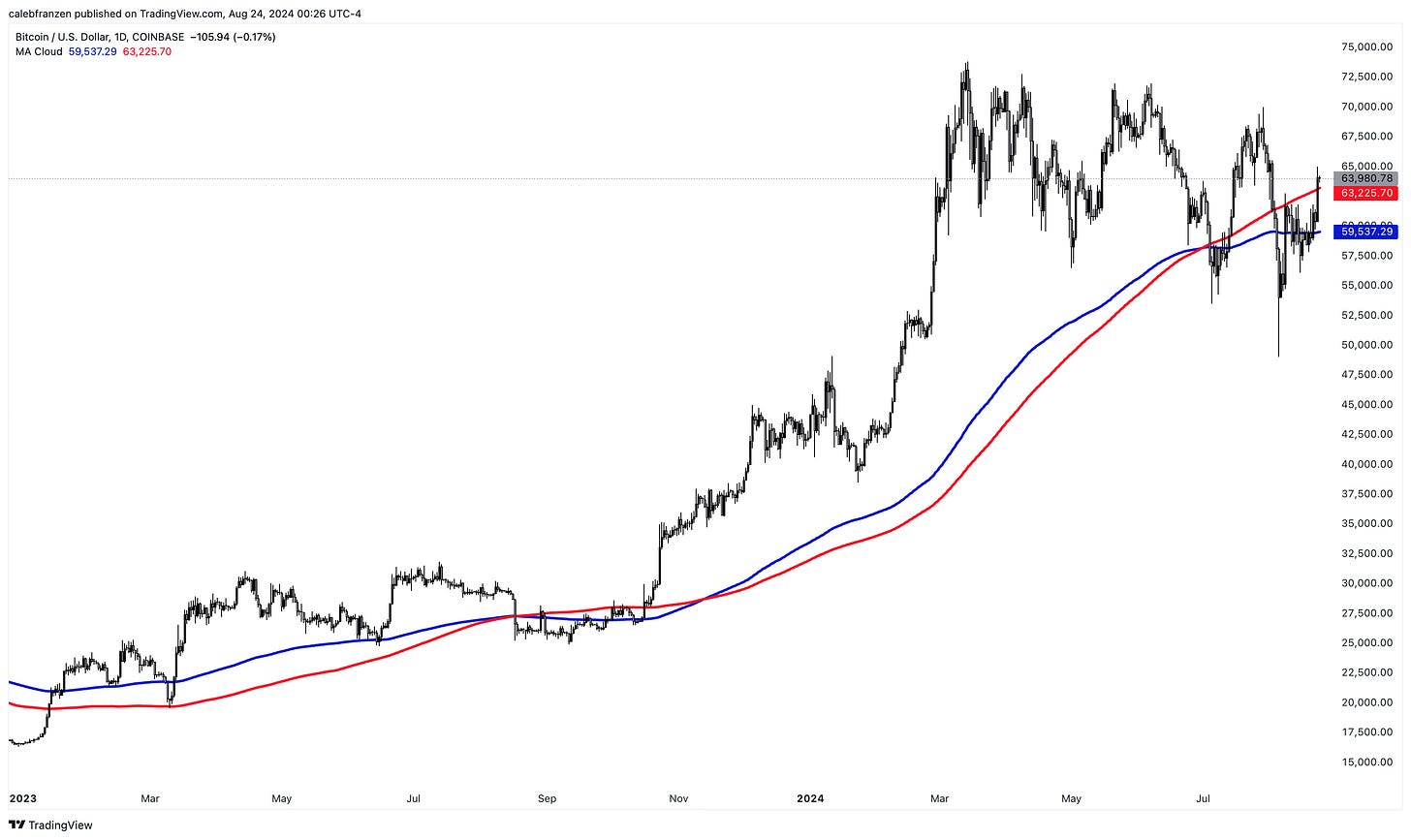

My favorite indicator for Bitcoin is the 200-day moving average cloud, but the fact of the matter is that I apply this indicator, which I created, to almost every asset that I analyze. Recently, I’ve been raising caution and encouraging patience because Bitcoin had fallen below its 200-day moving average cloud.

However, I’ve repeatedly said that the 200-day MA cloud could act as a launch pad if BTC is able to recover back above the dynamic range, which is something that I had highlighted just a few weeks ago on the Thinking Crypto podcast.

As of Friday, August 23rd, Bitcoin has now managed to break & close above the cloud!

So long as Bitcoin stays trading above the 200-day MA cloud, I think investors can be wildly bullish and expect to see BTC make new ATH’s.

But hey, maybe I’m wrong…

The beautiful thing about the 200-day MA cloud is that it allows us to manage risk, especially in a responsible way when we’re so close to the cloud today.

In other words, if BTC falls back below the cloud with a breakdown below $59.5k, then investors can reduce their expectations, get defensive again, and possibly even reduce risk by taking some chips off the table. That would “only” require a -7% decline at the current price, but with the possibility to gain at least +15.5% to make new ATH’s.

If we zoom in and look at Bitcoin’s price action with 1hr candles, I’m focused on the following structure, particularly the support/resistance range between $61,450-$62,850:

If we retest that green zone, my expectation is that price will rebound there, setting up for a beautiful “breakout, retest, rebound” setup.

Given the fact that spot Bitcoin ETF’s generated $504M in weekly net inflows, in a bullish market environment for stocks and resilient macro data with disinflationary rate cuts around the corner, I think it’s irresponsible to be bearish here.

But that’s just me.

Best,

Caleb Franzen,

Founder of Cubic Analytics

This was a free edition of Cubic Analytics, a publication that I write independently and send out to 10,000+ investors every Saturday. Feel free to share this post!

To support my work as an independent analyst and access even more exclusive & in-depth research on the markets, consider upgrading to a premium membership with either a monthly or annual plan using the link below:

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.

Great thoughts as always. It really is amazing to hear so many people continue to bang their hands on the table about how we are in a recession and/or bear market when the data couldn't be more opposite to that.

Does anyone have a list of some favorite Crypto relate equities (spot etfs, related to crypto, etc) with liquid options markets? Thank you.