Investors,

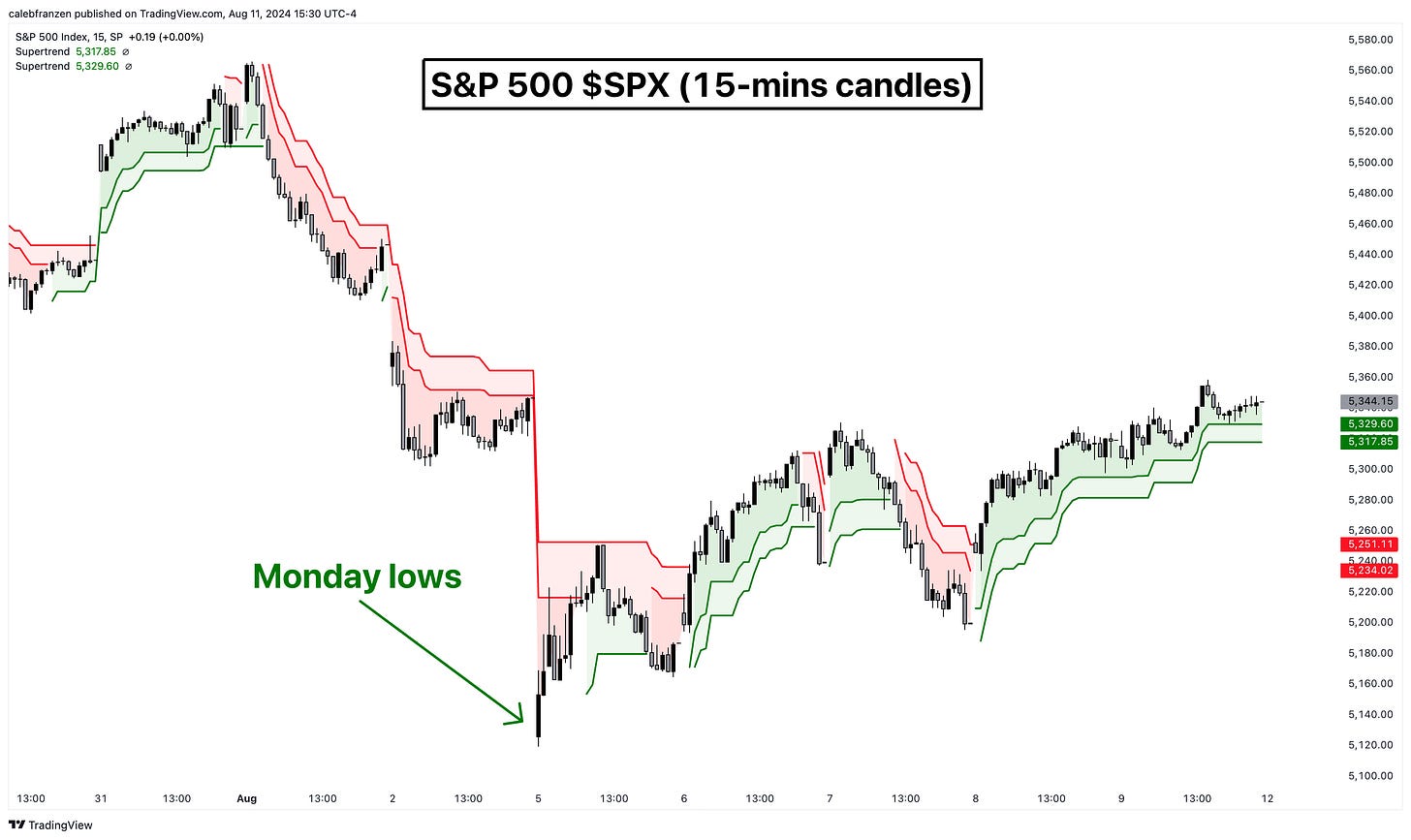

From the lows on Monday morning, asset prices have ripped to the upside & produced strong returns through the end of the trading week:

Dow Jones $DJX: +2.58%

S&P 500 $SPX: +4.39%

Equal-weight S&P 500 $RSP: +2.99%

Nasdaq-100 $NDX: +6.17%

Russell 2000 $RUT: +4.42%

NYSE FANG+ Index $NYFANG: +10.02%

Semiconductors $SMH: +12.12%

Software $SKYY: +9.98%

Broker/dealers $IAI: +5.66%

Aerospace & Defense $ITA: +5.77%

Industrials $XLI: 4.26%

Value $VTV: +2.46%

Growth $VUG: +7.41%

Bitcoin $BTC: +21.2%

Ethereum $ETH: +20.2%

Solana $SOL: +35.0%

Total crypto market cap ex-top 10 $OTHERS: +24.4%

Many, if not most, of these assets are now trading above their prices two Friday’s ago, erasing last weekend’s concerns about Warren Buffett’s cash position and the unwind of the Yen carry trade.

One of the more interesting characteristics about last week’s price action was the fact that riskier assets outperformed their less risky alternatives in a broad-based rally.

Just look at the discrepancy between value and growth, with growth stocks generating nearly 3x more returns on the week. On a relative basis, high beta stocks (SPHB) were up +6.68% vs. low volatility stocks (SPLV). This is representative of bull market behavior, as investors move out onto the risk curve and position themselves in the stocks with the most potential upside.

However, that higher potential upside is coupled with higher potential downside.

Hence why risk is typically congruent with reward!

So why would investors increase their risk by hunting for high upside stocks if they were so concerned about the future, an imminent economic collapse & geopolitical conflicts?

The short answer is, they wouldn’t.

So the natural conclusion is one of the following:

Investors are wrong

Headline risks are being overstated

As we think about these two options, which one has been more true over the past 18 months? By and large, investors who have increased their exposure to risk assets have continuously been proven right, even if they needed to sit through a bit of short-term volatility and downside.

I think that’s important, providing a “scoreboard” for who has been right.

Isn’t that the team we should be rooting for & the team that’s likely to keep winning?

For trend followers & objective investors/analysts, by definition, that’s exactly right.

In this report, I’m going to update my bull case and highlight some of the key components that will either strengthen or weaken that outlook, which will keep me flexible in the months/quarters ahead. Notably, I will interrelate this analysis to ongoing dynamics with the Bank of Japan and the “Yen Carry Trade”.

Let’s begin.