Investors,

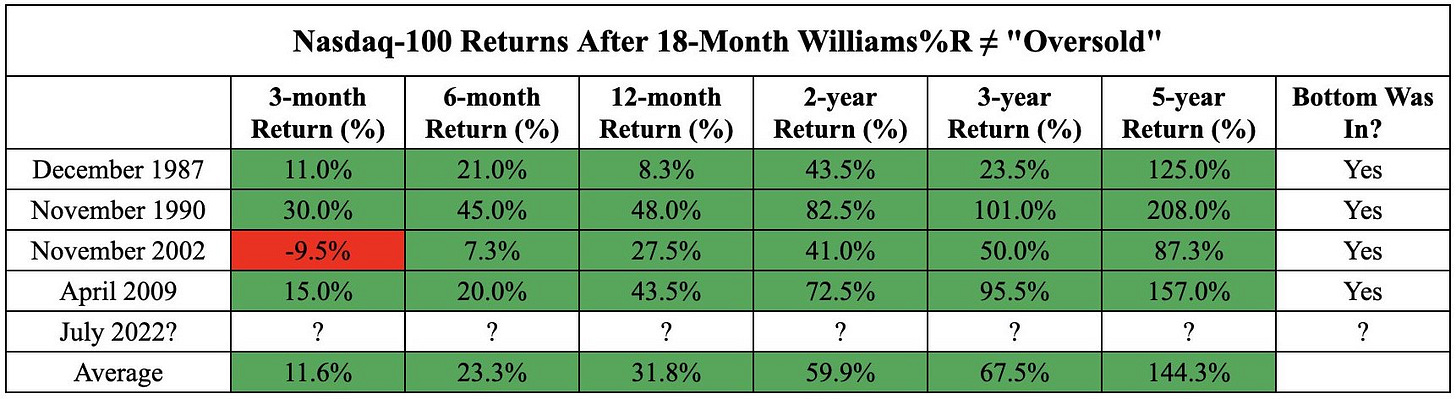

In July 2022, I shared a critical study about the Nasdaq-100 using the 18-month Williams%R Oscillator, which was about to flash a bullish signal for only the 6th time since the 1980’s. You can read the original post here, but I wanted to briefly recap the results of the study since the study flashed ~18 months months ago.

The signal itself is produced after the 18-month Williams%R Oscillator becomes oversold (identified by the oscillator crossing below the lower-bound) and then proceeds to leave the oversold level. One of the key aspects that stood out to me from this study (aside from its rarity) is that 1-year returns were 3x greater than the average 1-year return for the Nasdaq-100 . On top of that, the tech-focused index had never experienced a 6-month period of negative returns after the signal flashed!

So, how has the Nasdaq-100 performed this time around?

3-month return = -11.25% (the worst of any other period)

6-month return = -6.25% (the only signal with a negative 6M return)

12-month return = +22.0% (the 2nd lowest annual return from all signals)

Total return through February 23, 2024 = +38.5%

Unlike all prior signals, the Nasdaq-100 also made new bear market lows after the signal had flashed, falling a total of -18.9% from the July monthly close to the bear market lows in October 2022.

The takeaway: in almost every possible way, this time has been different.

Despite experiencing very strong 1-year returns, the Nasdaq-100 has underperformed its average by nearly 10 points!

Why am I highlighting how my own study & signal has underperformed? Two reasons:

I am always objective and willing to think critically about my research.

Many analysts (particularly the bearish analysts) continue to call this rally nonsensical and say that investors are acting irrational. They call this market exuberant and even accuse it of being in a bubble. However, the results of the current signal are dramatically underperforming historical results! Therefore, we know with certainty that the market has produced stronger returns after this signal flashed in the past. So is the market exuberant or is it actually lagging? To claim that it’s exuberant is subjective based on each person’s opinion, while the historical returns objectively imply that the market is lagging. As always, I’ll stick with the objective takeaways. The data suggests that the market is NOT exuberant and I plan on listening to the data, not the people who have been bearish for 18 months.

Technically, the indicator also flashed in November 2022 and January 2023, the only time where the signal occurred more than once in a short period of time. As I mentioned above, this adds further confirmation that this time is indeed different.

So perhaps the final signal from the cluster, in January 2023, is actually the true signal.

If so, the results of the study are as follows:

3-month return = +10%

6-month return = +30.3%

12-month return = +41.3%

Each of these are much more consistent with the historical returns from past signals, but focusing on the January signal is more akin to cherry-picking because it isn’t the first (or only) signal that flashed.

Either way, the results of the study and overall market dynamics since the signal flashed in July 2022 have been very positive and emblematic of a bull market, which was the entire purpose of sharing the study in the first place. Thankfully, the results continue to confirm that statistics provide meaningful alpha, even when market psychology and macro dynamics of the time seem insurmountable.

In the remainder of this report, which will be exclusive for premium members of Cubic Analytics, I’ll cover the following topics:

S&P 500 under-the-hood metrics & analysis of internal market data

Credit spreads & the implications for the stock market & crypto

S&P 500 earnings analysis & Warren Buffet discussion

Without further ado, this is the latest edition of Cubic Analytics:

S&P 500 Under-The-Hood Metrics:

As always, I like to get us kicked off with the market internals, because this is arguably some of the most important data that I track on a consistent basis and has been extremely vital for my bullish shift in April & May 2023.

I’ll warn you… this is arguably some of the most bullish data I’ve seen in awhile.