Investors,

This edition of Cubic Analytics will exclusively focus on the U.S. real estate market.

In this report, we’ll take an in-depth review to demystify how and why the housing market has been so strong, despite the fact that mortgage rates have stayed at their highest levels in 20+ years.

But first, I’d be remiss if I didn’t mention the following:

The Bitcoin Halving was a success.

You didn’t lose half your Bitcoin.

Bitcoin didn’t crash in value.

Satoshi’s face didn’t pop up onto our screens & laugh at us, as Jamie Dimon predicted.

Instead, Bitcoin is treading water around $64,000 amidst an array of concerns & market risks. Inflation is reaccelerating, geopolitical tensions are rising, the Fed is committed to “higher for longer”, stocks are coming under modest pressure, and earnings season is now upon us.

And yet Bitcoin has an exchange rate of $64,000.

Yes, this recent decline was unexpected from my vantage point and it certainly hasn’t been enjoyable, but context is key — BTC is “only” down -13.8% from the cycle highs.

Considering that those cycle highs occurred on March 14th, it’s taken 38 trading days to decline -13.8%, which results in a compounded daily loss of 0.34% each day.

This is not extreme. It’s not out of the ordinary. It’s actually extremely tame.

Then consider the fact that BTC is essentially just retesting the former ATH range:

I would’ve preferred a more decisive breakout & extension, similar to past cycle breakouts, but I think it’s appropriate to say that this “lack of conviction” here is neither supportive of bullish or bearish dynamics.

Bulls can look at it and say, “we’ve broken out and that’s been historically bullish.”

Bears say, “the lack of conviction and a potential failed breakout is bearish.”

If both sides can look at the same chart and come to the opposite conclusion, then there’s literally no value in the “signal” to begin with.

So from here, this is what both sides will want to see going forward:

Bulls need to see upside with conviction. The recent pullback since mid-March has seen repeated attempts for constructive behavior to turn into outright bullish behavior, but each time has resulted in mild deterioration. From a structural perspective, there needs to be a re-establishment of higher highs and higher lows.

Bears need to see further deterioration turn into outright weakness. While constructive behavior has repeatedly failed to produce sustained upside over the past month, we also haven’t seen deterioration turn into outright weakness. As such, bears require sustained selling pressure, lower lows, and a decisive breakdown below $60,000 for more than just a few minutes.

Who wins this battle?

I have my biases, even if I try to operate in an objective manner, and my perspective is that the bulls will win; however, I recognize that my bias & outlook could be proven wrong and so I remain open to a wide range of possibilities.

I also want to celebrate the Bitcoin halving by offering a 7-day free trial to my Patreon, where I’m sharing exclusive technical analysis on individual cryptocurrencies, stocks, and ETFs.

While I’m still posting frequently on Twitter/X, the decision to join Patreon in early March was to transfer the individual analysis & trade setups that I was sharing on X and to cultivate a group of advanced traders and curious learners on Patreon, which also helps to “clean up” my posts on X and really focus on big-picture dynamics.

I want to be clear, the analysis that I’m posting on Patreon is completely different than the long-form analysis that I’m sharing here on Substack and that there is zero overlap in the benefits associated with each subscription.

If you have any questions, don’t hesitate to reach out by simply responding to this email and I’ll do my best to respond ASAP. At the very least, this is a free trial with no commitment, so there’s no harm in joining the team and checking it out first-hand!

With that out of the way, let’s talk about real estate…

The U.S. Housing Market:

Many folks, including myself, have been impressed by the continued resilience of the housing market, despite the fact that mortgage rates have stayed at their highest levels since 1999-2001 and transaction activity is historically low.

Why is the market so resilient and what are the primary contributing factors?

That’s what I’m going to attempt to answer below…

According to Zillow’s recent report for March 2024, the median sales price was $327k.

The housing market has been incredibly resilient.

In fact, “resilient” might be an understatement given that Zillow Home Value Index for single family homes has been making new all-time highs every single month since August 2023 and are up +4.1% YoY in March 2024.

This is particularly interesting for two more reasons:

The median sales price is below the median listing price.

Less homes are being purchased above the listing price than below the listing price (25.8% above vs. 55.6% below).

Both of these dynamics indicate that buyers are in control of the market and having negotiating power… and yet existing owners (sellers) are seemingly benefiting the most with home prices at ATH’s!

Then consider the fact that rents are still contracting on a year-over-year (YoY) basis:

If real estate prices are, in part, a product of the future cash flows that can be generated by the property (aka rents), and rents are decreasing YoY, then it’s even more remarkable that home prices continue to make new all-time highs!

Sure, rents aren’t falling by a considerable amount (only contracting by -1% or less for the past ~12 months), but a decline is a decline nonetheless. It isn’t normal to see rents contracting at a pace of -0.8% YoY and have median home prices up +4.1% YoY.

So why have home prices been so immune to 7% mortgage rates and contracting rents?

These are the key reasons:

1. The United States has a high concentration of fixed rate mortgages, with 96.4% of all mortgages having long-term fixed interest rates (10+ years):

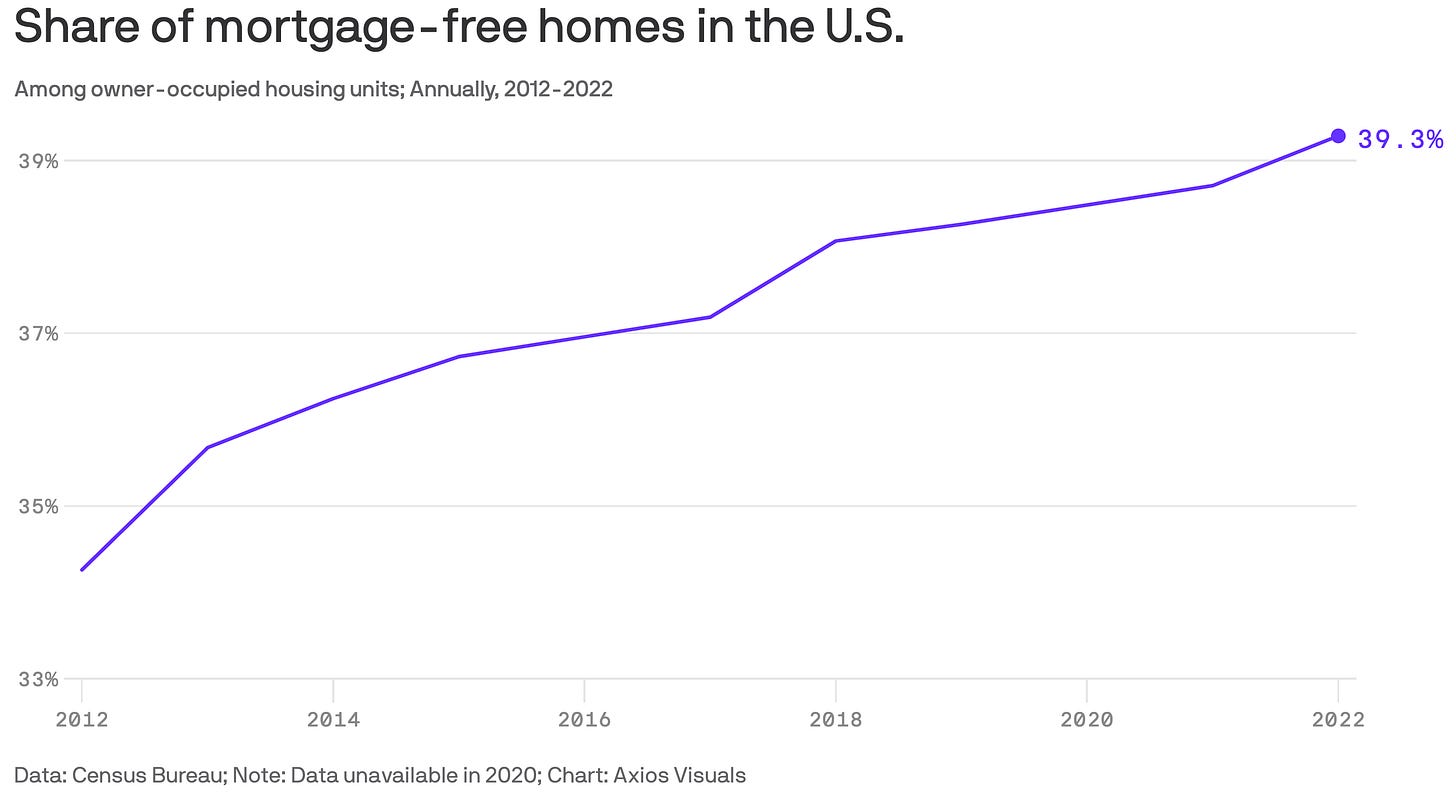

2. 40% of owner-occupied homes in the United States don’t have an outstanding mortgage, meaning that the home was purchased with cash or that the mortgage has been completely paid off!

If 40% of owner-occupied homes don’t have any debt and the remaining 60% have a debt composition that’s 96.4% locked into fixed rate mortgages, it’s clear why the housing market has been so immune to high interest rates from a price perspective!

But let’s take it a step further…

3. 61% of all outstanding mortgage contracts in 2023 had an interest rate below 4%, according to Apollo Asset Management:

So again, 40% of owner-occupied homes are paid off.

Then 96.4% of the remaining properties have fixed long-term financing.

Of those 96.4% of homes, 61% have locked in an interest rate below 4%!

4. Owner’s Equity in real estate (the cumulative value of all homes minus the cumulative value of outstanding mortgages) is nearly at all-time highs as of Q4’23.

Based on current real estate dynamics in 2024, it’s likely that this datapoint will reaccelerate in the Q1’24 data.

The chart below tracks the same datapoint going back to 1970, but using linear scale (top) and logarithmic scale (bottom) to better visualize the long-term trend of equity:

5. The homeownership rate in the United States is currently 65.7%, as of Q4 2023:

Essentially, this means that 66% of the U.S. population is unaffected by the current interest rate environment because they are locked into fixed interest rates or they are mortgage-free.

6. The remaining 34% of the population who are renters are benefitting from the income-effect dynamics from contracting/stable rental prices:

At the very least, rents aren’t going up since mid-2022 and I think that’s a win, particularly when nominal wage growth is substantially higher than the rate of CPI inflation. In fact, this recent reprieve and rising real wage growth are likely helping people absorb the higher cost of debt service on mortgages by either putting larger down payments or having larger pocketbooks to comfortably absorb the current high financing rates.

With all of these factors taking place, in addition to the resilient & dynamic nature of the labor market and persistent strength in the stock market, it’s clear why real estate itself has been so resilient and outright strong.

Based on these dynamics and the fact that the interest rate environment isn’t likely to change materially in 2024, the conclusion is that the real estate market will continue to be resilient so long as the labor market continues to be resilient. Whether median prices continue to make new all-time highs or simply tread water around the current levels, that’s a major win for existing homeowners and their equity value, which is the largest source of wealth for the average American.

Due to the wealth effect, this will in turn help to buoy economic activity, creating a recursive dynamic where resilient labor market dynamics will create resilient real estate dynamics, which will create resilient macroeconomic dynamics, which will create resilient labor market dynamics… and so on and so forth.

Based on my expectation that the labor market will continue to be resilient & dynamic, which has been my unwavering outlook for the past 2 years, I currently believe that there are minimal odds that the real estate market is going to collapse and drag the economy down with it. Perhaps conditions will change in the coming months or quarters, which is why I’m constantly reassessing the data and taking the weight of the evidence, but this is my stance right now.

If/when the data meaningfully changes or warrants a reassessment of my outlook, I’ll be sure to make it clear that my expectations have changed.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Insight into the percieved housing shortage:

https://spotifyanchor-web.app.link/e/YF26J3RhmJb

Do you have any concerns about office defaults sparking a bank crisis?