The Good, The Bad, The Ugly

Investors,

According to the latest round of the Purchasing Managers’ Index (PMI), the U.S. economy continues to expand and the pace of the expansion is even accelerating:

The Composite PMI came in higher than prior results & estimates at 54.6.

The Services PMI came in higher than prior results & estimates at 55.1.

The Manufacturing PMI came in higher than prior results and estimates at 51.7.

All three readings are above 50, which indicates that they are expanding (while readings below 50 indicate a contraction); however, they are also accelerating!

This is on the back of the Atlanta Fed’s latest estimate for Q2 2024 real GDP growth, coming in at +3.0% (annualized), which would represent a notable acceleration vs. the Q1’24 result of +1.3%.

Then take into consideration that the industrial production increased in May 2024, reaching its highest levels since September 2023 and rising at a pace of +0.4%:

While this is certainly an underwhelming growth rate on an annual basis, it’s a sign that things aren’t collapsing or imminently in danger.

Then recognize that construction spending in manufacturing continues to make new all-time highs, with the most recent data from April 2024:

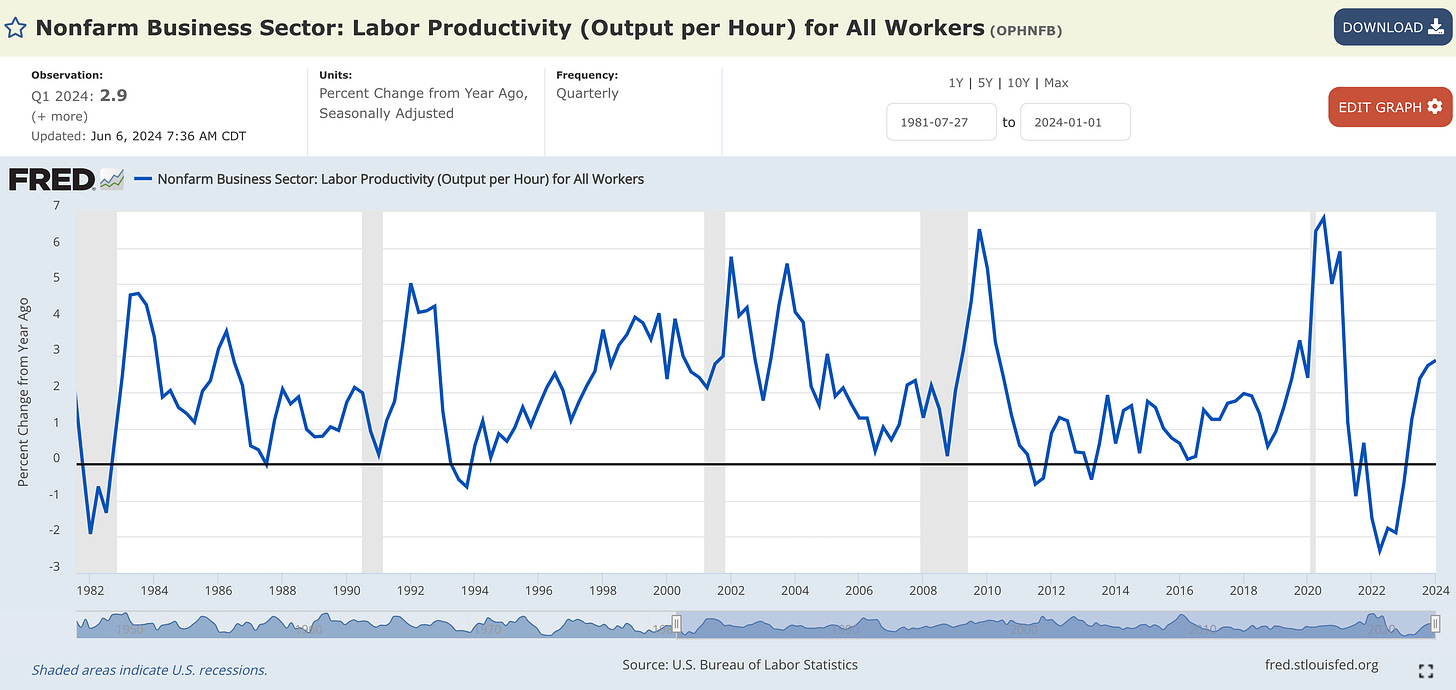

Then look at labor productivity, which continues to exhibit non-recessionary trends, growing at +2.9% YoY in Q1’24 and accelerating for 5 consecutive quarters:

Then look at capacity utilization, which “measures the percentage of an economy’s potential output that is actually being realized” (Investopedia), trying to find a footing and reaching the highest levels since November 2023:

The latest result was 78.7%, higher than the prior result of 78.4% & estimates of 78.6%.

These are just some of the latest reports & datapoints to be published about the U.S. economy, all of which are highlighting the resilient & dynamic nature of the economic environment that continues to exceed expectations.

Does this mean that all of the data is rosy and perfect?

Nope. Far from it, in fact.

But as an investor who is trying to use economic data (amongst other things) to maximize returns in the stock market, I understand that economic conditions don’t need to be perfect in order to generate a persistent uptrend in asset prices.

The fact of the matter is that risks are always present in the market & in the economy.

If there weren’t risks, there wouldn’t be the potential for returns!

My optimistic outlook over the past 15 months has often been spun by critics to insinuate that I’m ignoring warning signs or bad datapoints that are weakening.

I assure you, I’m not ignoring them. I just simply take the weight of the evidence of the good, the bad, and the ugly and then make a determination about what’s important vs. what’s not as important and then take the weight of the evidence.

So let’s talk about some of the concerning datapoints:

Right off the bat, delinquencies on consumer loans in the U.S. are rising.

I have three retorts for this:

1. Delinquencies can rise without triggering a recession (mid-1990’s, mid-2010’s).

2. With a current delinquency rate of 2.68%, this means that roughly 5 in every 200 consumer loans are at least 30 days late on their payment. This is less than the lowest delinquency rate between 1987-2012, indicating that the current delinquency rate is still very low relative to history.

3. Stocks can perform well during periods where delinquencies are rising. For example, delinquencies started to rise at the end of Q3 2015 before the COVID pandemic and the ensuing recession. How did the S&P 500 perform during that period, during which time delinquencies continued to rise? It gained +76% in less than 5 years.

Another point that negative-centric economists like to reference is bankruptcies.

According to data from the American Bankruptcy Institute (ABI), bankruptcies are rising at a rapid pace on a YoY basis:

This data indicates that bankruptcies are accelerating across all segments, ranging from small businesses to individuals, to commercial filings.

Fundamentally, this is a concern. Clearly, it’s not indicative of strong or overwhelmingly healthy macro dynamics… which is why I don’t ever describe the economy as being “strong”, but rather “resilient & dynamic”.

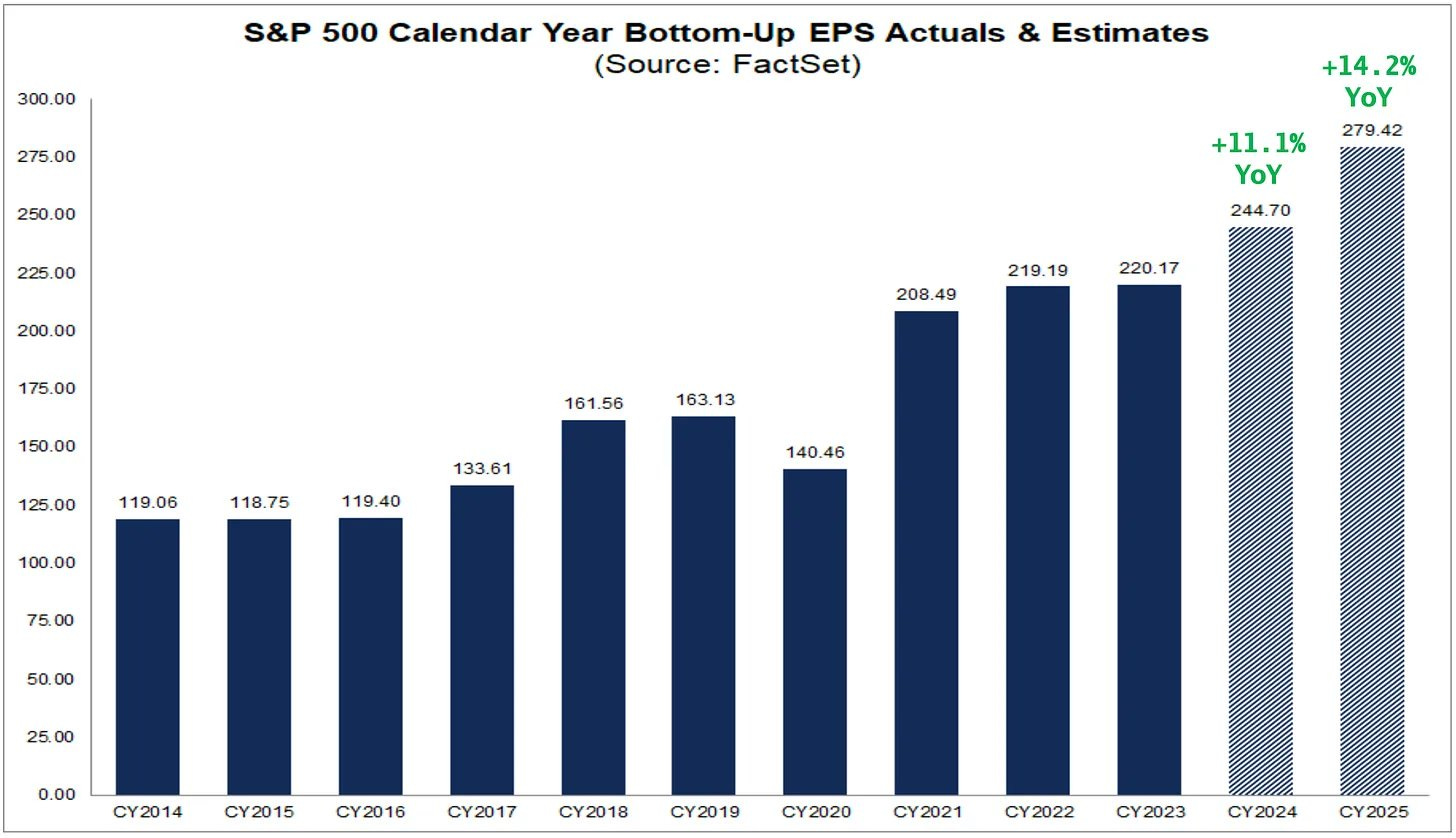

In other words, despite the pressures from rising delinquencies & bankruptcies, the economy is still growing at an annual pace of +2.9% YoY with an unemployment rate of 4.0%, average hourly earnings growth of +4.1% YoY, expansionary PMI’s, stocks at all-time highs, credit spreads at multi-decade lows, decelerating inflation, real income growth, rising corporate profits & margins, and increasing earnings per share estimates (based on guidance provided by S&P 500 companies):

Plainly, EPS estimates don’t trend higher during periods of poor economic conditions!

Some folks will retort, “but roughly 40% of companies in the Russell 2000 are unprofitable and have negative earnings!” (chart below), to which I would respond “then don’t own the Russell 2000 and just buy the best & largest companies in the United States, aka the S&P 500”.

The Russell 2000 is the U.S. small-cap index, intentionally designed NOT to hold the best and the largest companies in the stock market… so why would I use those companies as a measuring stick for economic performance to decide whether or not to invest? Their lack of fundamentals, on the aggregate, simply suggests that I shouldn’t own them and should focus on buying companies with stronger fundamentals. If the goal of studying macro conditions is to decide whether or not to invest and what to invest in, I’d rather focus on the top-tier and the upper-echelon of corporations to determine how the investable universe is performing.

The fact of the matter is that the S&P 500, comprised of the MVP’s of the market, has consistently outperformed the Russell 2000 since the Great Recession and the dawn of the Quantitative Easing era:

Moving on, another concern is the contraction in leading economic indicators (LEI).

Per the latest update from The Conference Board, the LEI has now contracted in 26 of the past 27 months on a MoM rate of change basis, with the latest data reflecting a decline of -0.5% MoM.

On a YoY basis, the LEI continues to contract, but it’s important to note that the rate of contraction is declining. In other words, it appears that the worst is behind us.

The same is true on a 6-month annualized basis, coming in at -4.04% vs. the prior 6-month period’s contraction of -6.9%.

Since 2000, the recession signal threshold has been triggered by a decrease below -5%; however, we’ve managed to avoid that (so far) and resurfaced back above the threshold.

The last three times this recovery above -5% occurred, strong market returns ensued:

In late-2001, there was still a bit more downside in the market in the aftermath of the Dotcom bubble, but this provided long-term investors with a great buying opportunity.

In mid-2009, the recovery in the 6M annualized LEI back above -5% occurred after the market lows during the Great Recession, also providing long-term investors with an excellent buying opportunity.

In mid-2020, the re-acceleration in the LEI provided an “all-clear” to investors.

So now that the 6M annualized LEI is back above -5% for only the 4th time in the past 20+ years, isn’t the implication that long-term investors are currently being presented with attractive long-term buying opportunities?

In a vacuum, yes, that is the implication.

But no sound investor ever uses one datapoint, study, or indicator to make investment decisions, which is why we evaluate the entire set of important data and take the weight of the evidence!

Another datapoint cited by macro Doomers and stock market bears is the substantial increase in consumer credit, implying that the U.S. consumer has tapped out their savings and are forced to rely on credit to maintain their spending.

It’s true, credit is rising!

Total consumer credit, which includes all revolving and unrevolving loans by U.S. households is currently $5.05Tn, growing at a pace of +1.9% YoY:

However, total household income is also rising!

Specifically, we can look at the following datapoint for real personal income excluding transfer receipts, which measures the inflation-adjusted income of U.S. households, excluding government programs like social security and unemployment benefits.

This measure of aggregate income is currently $15.86Tn, more than 3x larger than the total amount of consumer credit, and growing at a pace of +1.7% YoY (slightly below, but generally in-line with, the +1.9% growth rate of consumer credit).

Notice anything about these two charts? They both trend higher over time.

But this is also comparing income to debt, without taking into consideration household net worth (which can often be used as collateral on loans in order to qualify for better financing opportunities) or even the amount of debt-service payments (monthly P&I).

While Doomers & bears like to focus on half of the picture, I look at both sides, then look at the good vs. the bad on a relative basis!

As such, household debt service payments relative to disposable income provides a unique view into the ability of U.S. households to maintain their existing debt payments:

Most recently measured at 9.79% as of Q4 2023, current household debt service payments relative to income have been at their lowest levels in the history of the dataset (going back to Q1 1980). It’s certainly been rising since 2021, but it’s largely been trending sideways for the past two years!

Based on an objective and full-picture review of the data, it doesn’t appear that U.S. households, on the aggregate, are strapped with debt. The fact is:

Debt is high and rising.

Income is high and rising.

In combination, there isn’t a glaring issue on a relative basis, particularly when household net worth (assets minus liabilities) is at an all-time high.

People make the same mistake when talking about the rise in part-time jobs and government jobs, only focusing on the sub-par datapoint instead of evaluating the entire state of affairs.

I can disprove the concerns around these two datapoints with two charts:

1. Multiple jobholders as a percent of the employed = 5.2%:

2. Government employees relative to total nonfarm employees = 14.7%:

So what are the conclusions from all of this?

An abundance of economic datapoints are both expanding & accelerating.

Other economic datapoints are reflecting a contraction and signs of concern.

On the aggregate, it’s difficult to say that the economy is strong, but it’s irresponsible to ignore the fact that economic conditions are resilient & dynamic, which have been sufficient to sustain the ongoing uptrend in asset prices.

The current “resilient & dynamic” nature of the U.S. economy isn’t guaranteed to stay intact, though I expect it to, which is why it’s vital to continuously review incoming data through an objective lens and take the weight of the evidence.

Finally, it’s necessary to view economic datapoints on a holistic basis, rather than only focusing on half of the picture. Doomer headlines, by their very nature, are designed to catch your attention and maximize the click-through-rate of the article in order to maximize ad revenue. On the contrary, a headline of “Everything Will Be Okay” tells investors everything they need to know without even having to click on the article. Therefore, traditional media and social media inherently incentivize negativity by cultivating a sense of urgency and panic amongst their readers in order to maximize ad revenue and sell the solution via a subscription.

While I tend to highlight the positive dynamics taking place, I’m willing to confront the worrisome datapoints and provide my reasoning to explain why resilient & dynamic conditions are sufficient to sustain the ongoing bull market in asset prices.

Given that the S&P 500 is up +14.6% YTD, +25.1% YoY, and just secured the 3rd consecutive weekly close at all-time highs (and 5 of the past 6 weeks), I’m glad to say that I’ve been on the right side of this market since I became bullish in April 2023.

I don’t shy away from bad data or exclusively operate with a bullish outlook, as long-time followers will recall my outright short-term bearishness throughout 2022.

I simply recognize that there is a time to be bullish and a time to be bearish.

I also use economic data as one tool within a broader toolkit of analysis in order to understand (or estimate) how market dynamics will unfold.

I certainly don’t have all the answers, but I’m doing my best to make sense of an uncertain world, in which uncertainty is inescapable.

Best,

Caleb Franzen,

Founder of Cubic Analytics

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Some great retorting my friend.

I always love reading these newsletters and this one got lost in my inbox but I just got to it! Amazing work per usual. Your analysis is always objective, and the facts are that it's hard to be a permabear right now and for the last 18 months.