Investors,

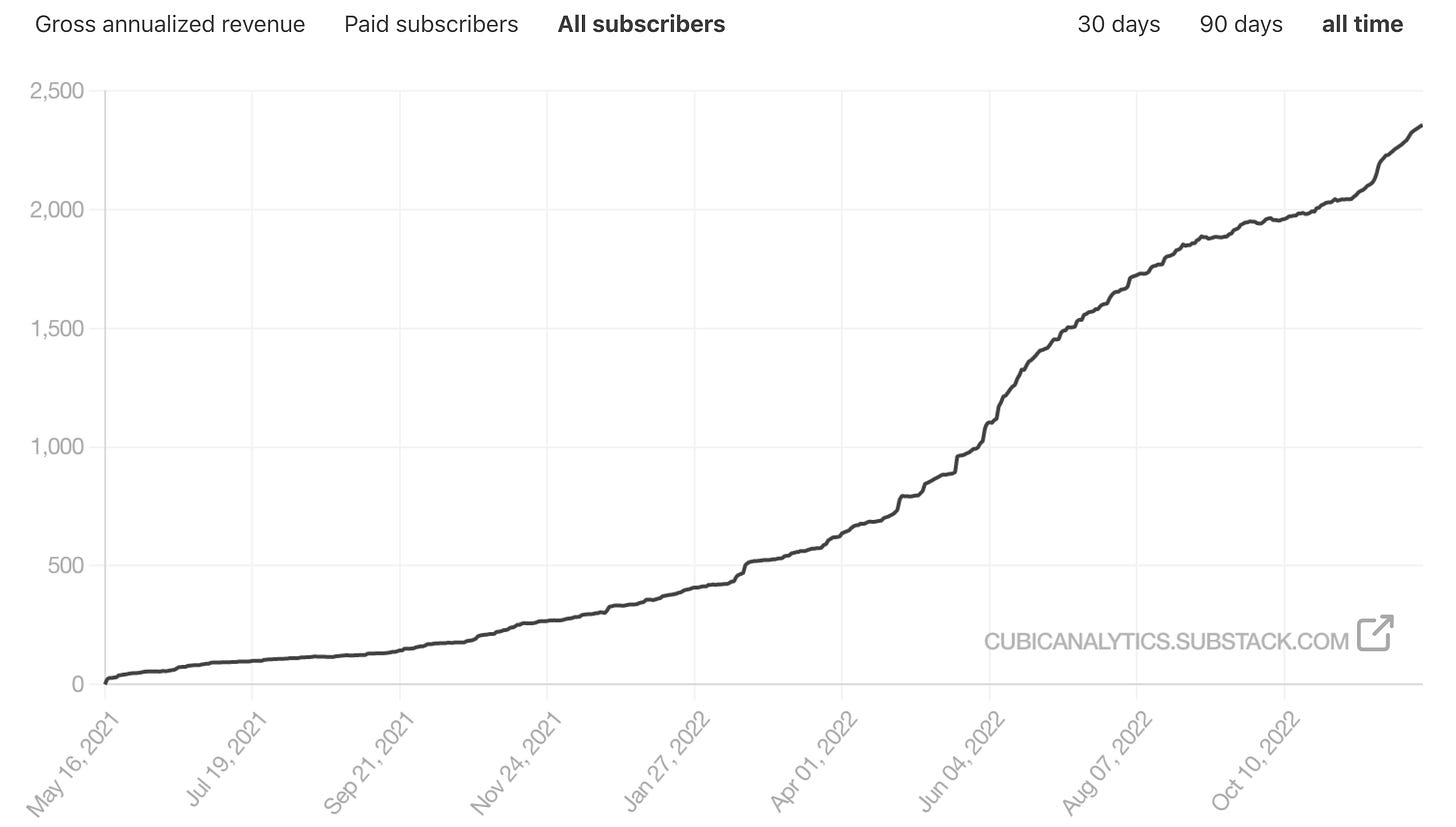

I’m extremely appreciative for the support that Cubic Analytics has been receiving lately, as we continue to onboard new members & subscribers to the publication! Thanks to your support, we’re rapidly approaching 2,500 total subscribers:

I have some big plans for 2023, so let’s continue to maintain the momentum into the new year! If you enjoy my free research and know other investors who would benefit from reading Cubic Analytics, please share it with them!

One of those plans is to keep building great relationships with other analysts who cover the financial market and macroeconomic topics, which is why I’m excited to introduce

, from Kuemmerle Research and The Commodity Report on Substack. I’d strongly recommend signing up for his newsletter, linked below:Considering that I rarely discuss commodities in my research, aside from occasional analysis of crude oil, I asked Lukas to share his insights on the broader commodity market and what investors should be focused on with respect to commodities. Here’s what he wants us to know:

Why you don't want to have much commodity exposure right now: The commodity super-cycle isn't over - but it's paused for now as the economic slowdown leads us into a recession. Demand destruction became visible over the last four months, leading to lower prices. Micro fundamentals remain very bullish, but macro fundamentals are more important in this environment. Therefore, you don't want significant commodity exposure in your portfolio right now.

Macro > Micro: Let me be clear, we still think the cyclical commodity bull market isn't over. Still, we must acknowledge that the current environment favors lower commodity prices and nothing else.

The inside story of most commodity sectors remains bullish. Single commodity market fundamentals show tight inventory levels, and the mismatch of production capacity, future CAPEX, and future demand will support commodity prices long-term.

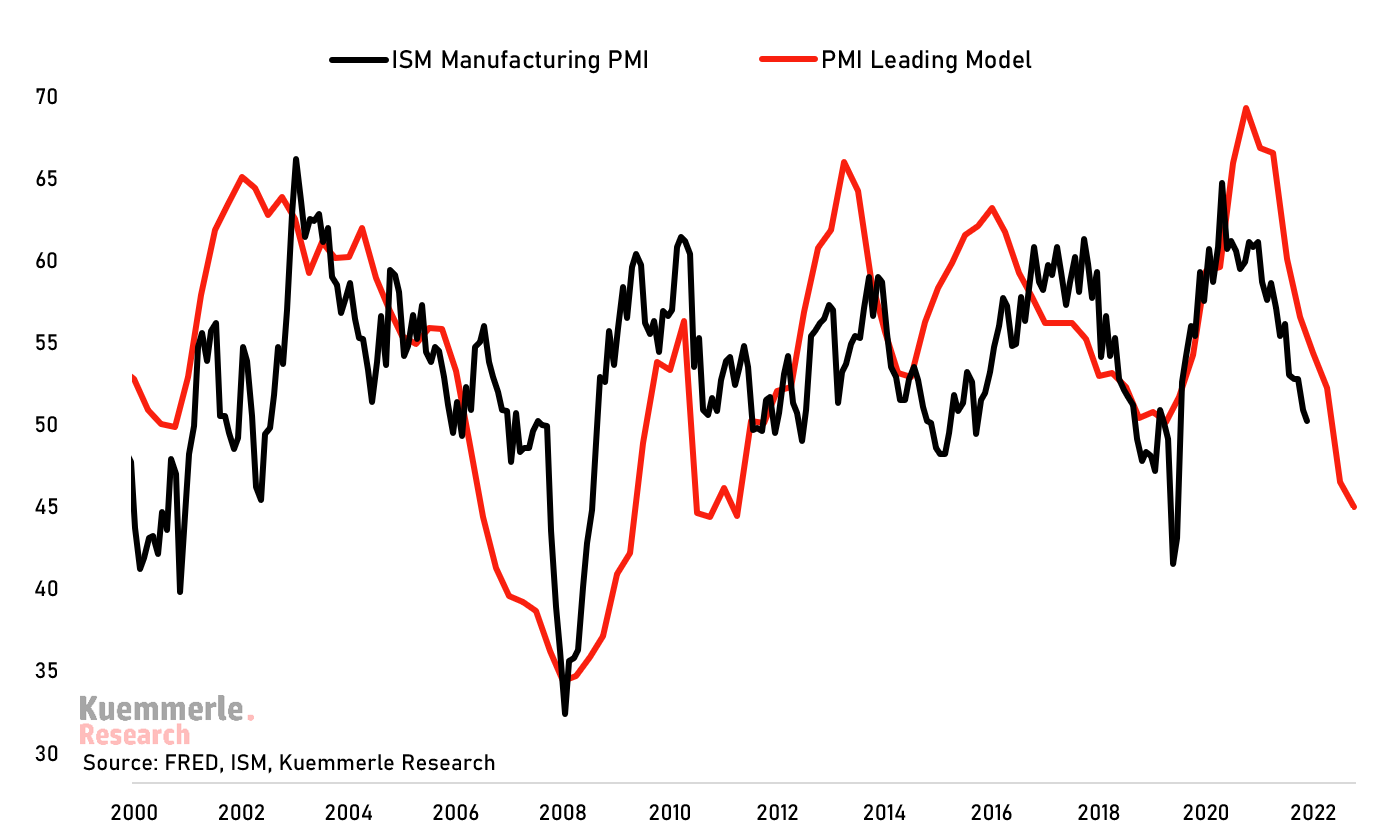

As bullish as the micro fundamentals of each market currently are, they are not the leading factors right now, as macro fundamentals dominate the price action. The most harmful fact for commodity prices remains to slow economic momentum and the high recession potential. In the US, we will most likely see a recession or perhaps are already in one. (see latest Conference Board Forecast)

PMIs will continue to decelerate. In this direction, pinpoint most of our growth models. A more bullish environment for commodities will be reinstated once economic momentum turns. In our opinion, this turning point will be reached towards Q2 of 2023 at a Manufacturing PMI level between 43 and 45.

Our latest positioning: As a result of this bearish environment, we are currently looking out primarily for selling opportunities in the market.

Over the last four months, we traded 90% on the short side, as we saw economic momentum fading. Currently, we're from a tactical perspective long the long end of the yield curve. Moreover, we're still short soybean oil, looking actively for opportunities to short orange juice as well as sugar.

I’d encourage everyone to subscribe to Lukas’s newsletter, The Commodity Report his research directly! This week’s version of Cubic Analytics will be entirely focused on economic dynamics that I’m currently focused on, specifically credit card debt and inflation expectations.

I’ll be publishing my latest analysis, insights, and research on the stock market & Bitcoin in tomorrow’s premium report, exclusive for monthly/annual members. To read it, please consider upgrading your subscription:

Macroeconomics:

There are two macro dynamics that should be on your radar:

Credit markets & default rates

Crude oil & inflation expectations

Credit Cards & Consumer Debt:

There’s been a significant amount of focus on credit card data lately, as doom & gloom analysts sound the alarm bells that a rise in credit spells misfortune for the U.S. consumer & economy. This is a fine perspective to have, but I’m hoping to share my perspectives on this dynamic and explain why I’m not worried (yet).

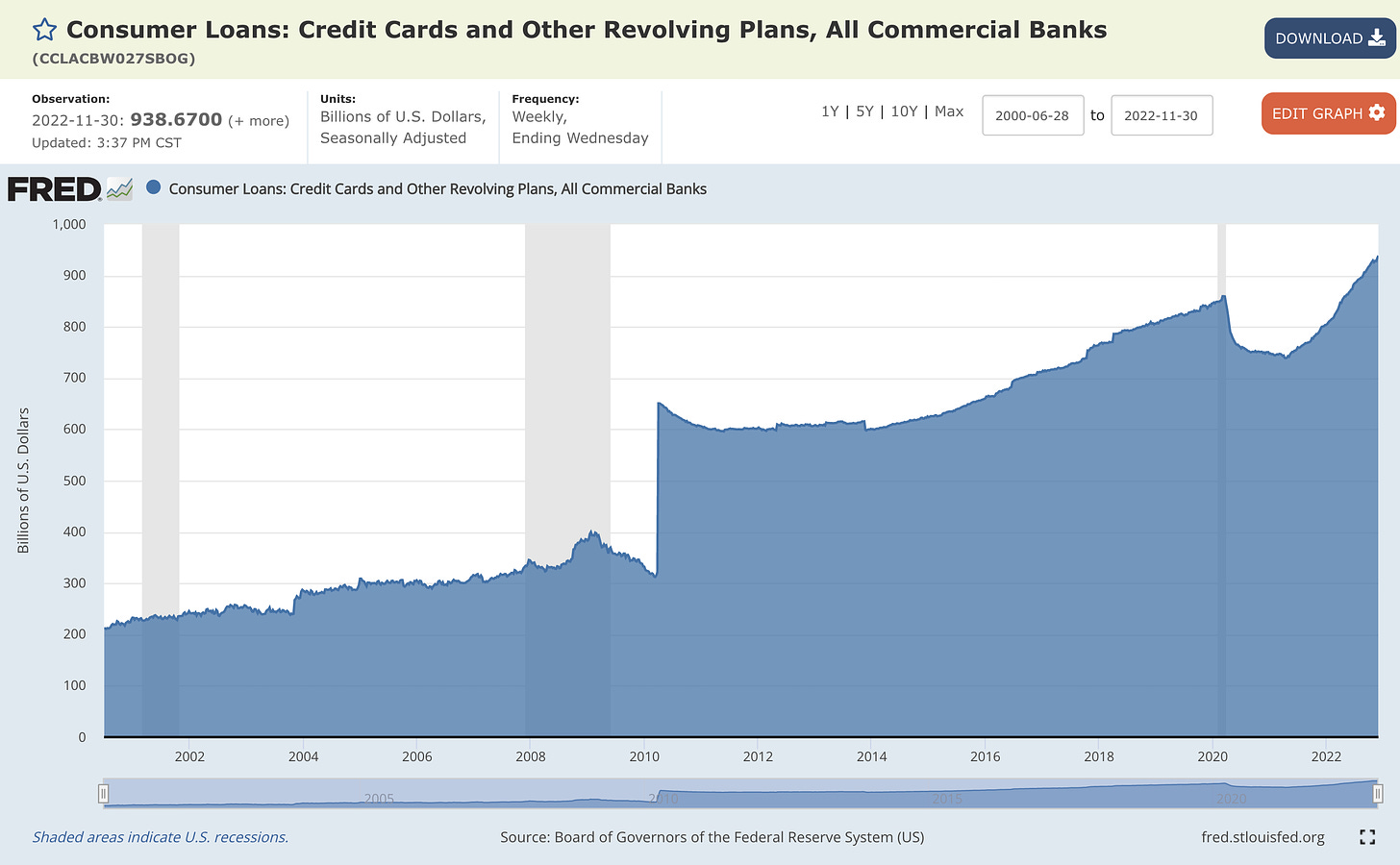

U.S. consumers are relying heavily on credit cards to fund consumption, particularly as the personal savings rate (2.3%) plummets to the lowest level since July 2005 (2.1%). The following chart has been spreading like wildfire, showing the total amount of credit card debt & revolving loans to U.S. consumers:

It’s easy to see why investors are concerned about the recent trend, with $939Bn of credit card debt & revolving loans outstanding. The implication is that households are living beyond their means and relying on credit to finance their spending. While this might benefit current consumption, it’s essentially stealing from future spending, as consumers will need to pay back principal and interest. Especially in a rising rate environment, the cost of borrowing can make it more difficult for households to pay off their debt. At the same time, low savings rates can make it difficult for households to cushion the impact of higher interest rates by drawing on their prior savings. This can leave households vulnerable to financial shocks and unable to weather unexpected expenses or income disruptions.

With a consensus expectation of a recession coming in 2023, investors & economists are fearful that consumers are backing themselves into a corner. However, we must contextualize this debt in order to get a firm grasp on the potential threats and the current condition of the U.S. consumer. Credit risk is a function of many things, but primarily:

Income.

Debt service costs, a function of principal & interest.

Credit risk is also a function of time, collateral, guarantors, etc., but let’s focus on the two above in order to explain why I’m not concerned about rising credit card balances:

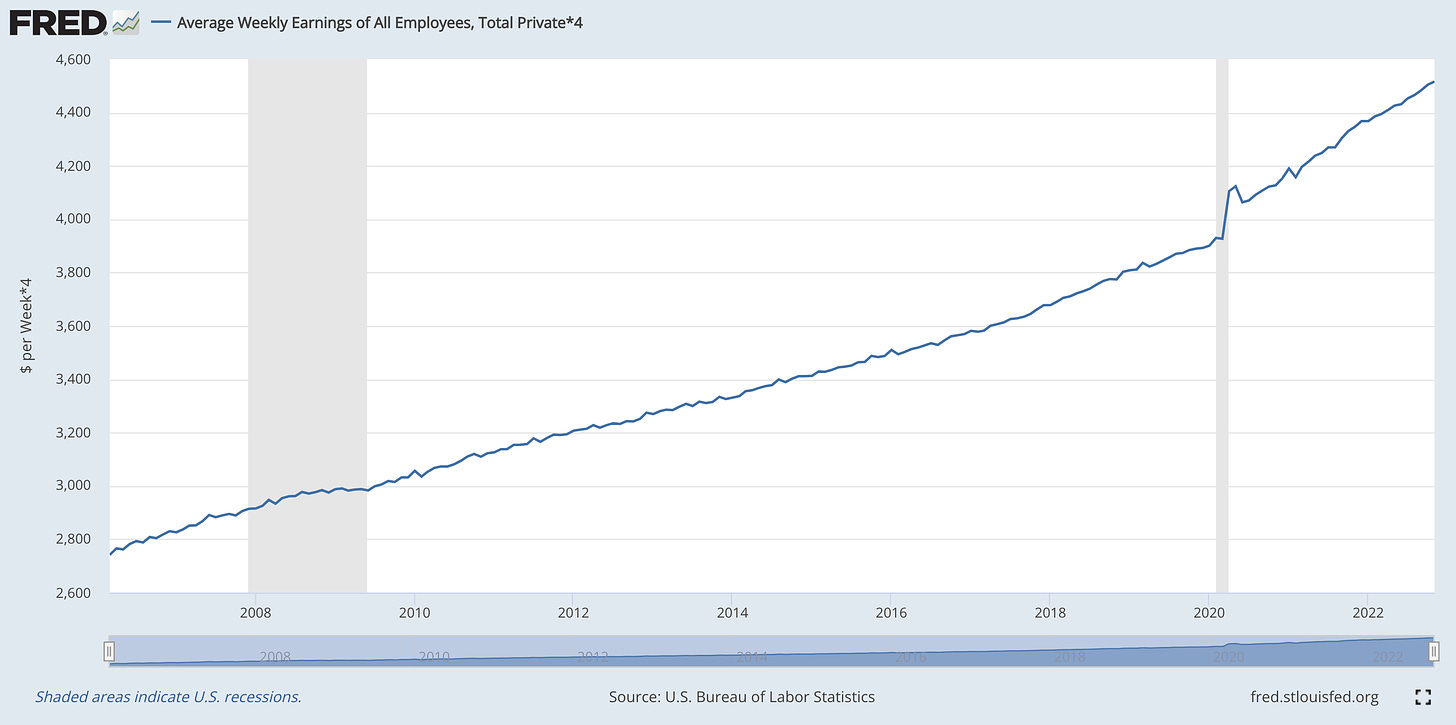

Incomes are rising! More specifically, the chart below tracks average monthly earnings by multiplying: 4x(avg. weekly earnings) = $4,516/month! On a YoY basis, monthly income has risen by +3.9% since November 2021. In fact, monthly income growth has consistently fluctuated between +4.2% and +5.5% from June 2021 through October 2022. These are historically elevated numbers, indicating that consumers have benefited from historically strong earnings growth post-Pandemic. With incomes rising so substantially, shouldn’t we expect to see consumers take advantage of credit card programs? The chart below highlights the steady rising trend of monthly earnings, currently at all-time highs:

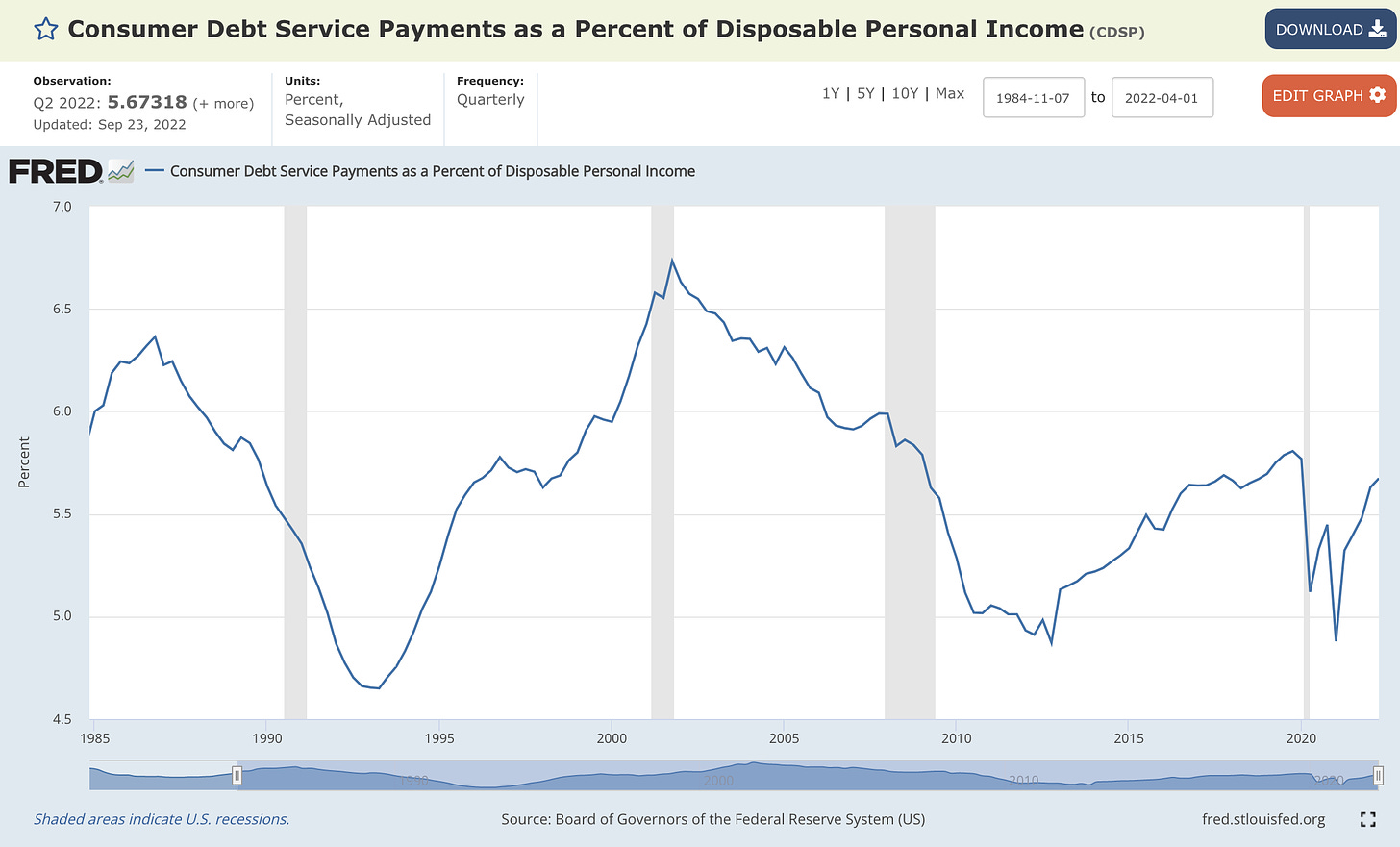

Debt payments relative to income are low, but rising. Thankfully, we have the ability to measure the stress of debt service payments relative to personal disposable income. This metric approached all-time lows in Q1 2021, but has been rising fairly quickly. Considering that debt levels continued to rise, and interest rates have soared in 2022, this isn’t much of a surprise. However, this measure is still below the pre-Pandemic level, indicating that debt payments are less today than they were in Q4 2019 relative to income.

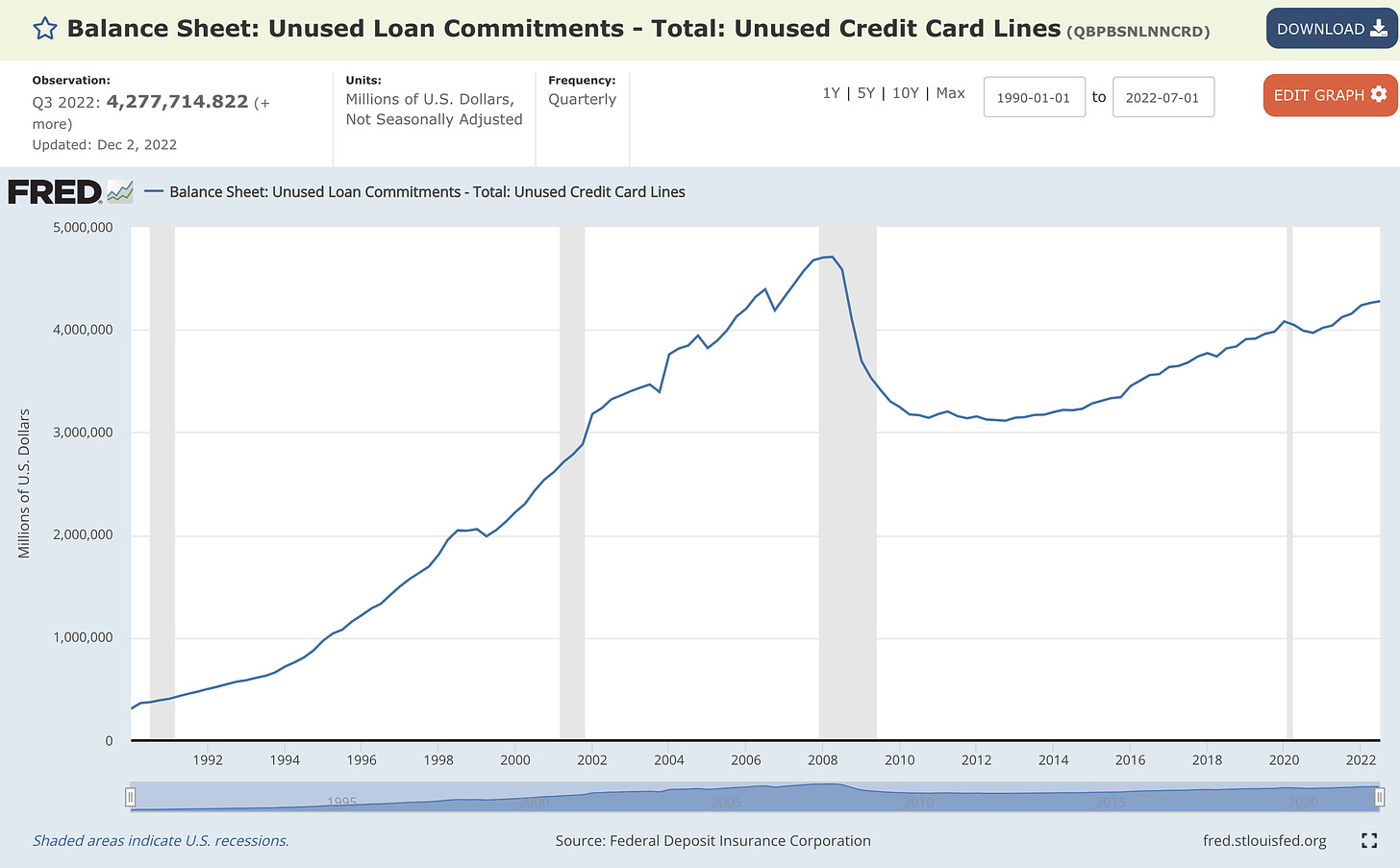

Utilization is extremely low! If a consumer has the ability to borrow $5,000 on their credit card, but they only use $1,000 of their limit, they have a utilization rate of 20%! This is important because we can contextualize the amount of total credit card debt by the amount with which consumers can actually borrow on their credit card. According to data from Q3 2022, there is a significant amount of unused credit card availability equivalent to $4.27Tn. With credit card debt standing at $939Bn and another $4.27Tn yet to be tapped into, the implied utilization rate is only 18%. Very simply, credit card borrowers aren’t maxing out their credit cards.

In summary:

Credit card balances are rising.

Consumer incomes are rising.

P&I payments relative to incomes are low, but rising.

Consumers aren’t maxing out their credit card availability and have the option to borrow even more, if they need/want to.

If incomes weren’t rising and utilization rates were extremely high, I’d be concerned; however, that simply isn’t the state of affairs as we look at the data today. It isn’t ideal to see credit cards balances rising, but it’s vital to look at the other side of the coin in order to evaluate the ability for borrowers to pay off their consumer loans. At the present moment, they don’t seem to have an issue.

Ironically enough, my own credit card just raised my borrowing limit earlier this week by roughly 50%, unrequested. I have every intention of maximizing as much usage as I can/need, earn points, & make full monthly payments. In reality, my spending isn’t likely to increase by a significant magnitude, but I plan to leverage the benefits of using a credit card to my advantage!

As a final thought on this, it’s super important to monitor delinquencies within the credit market in order to evaluate the health or potential deterioration of borrowers. Rising delinquencies can indicate an increase in credit risk, as more households may be struggling to make their debt payments on time. This can lead to higher default rates and losses for lenders, potentially undermining the stability of the financial system. In addition, high levels of delinquencies can also be a sign of economic distress, as households may be struggling to make ends meet due to economic downturns or other factors. This can be a leading indicator of a recession, as households may reduce their spending in response to financial difficulties, leading to a slowdown in economic activity.

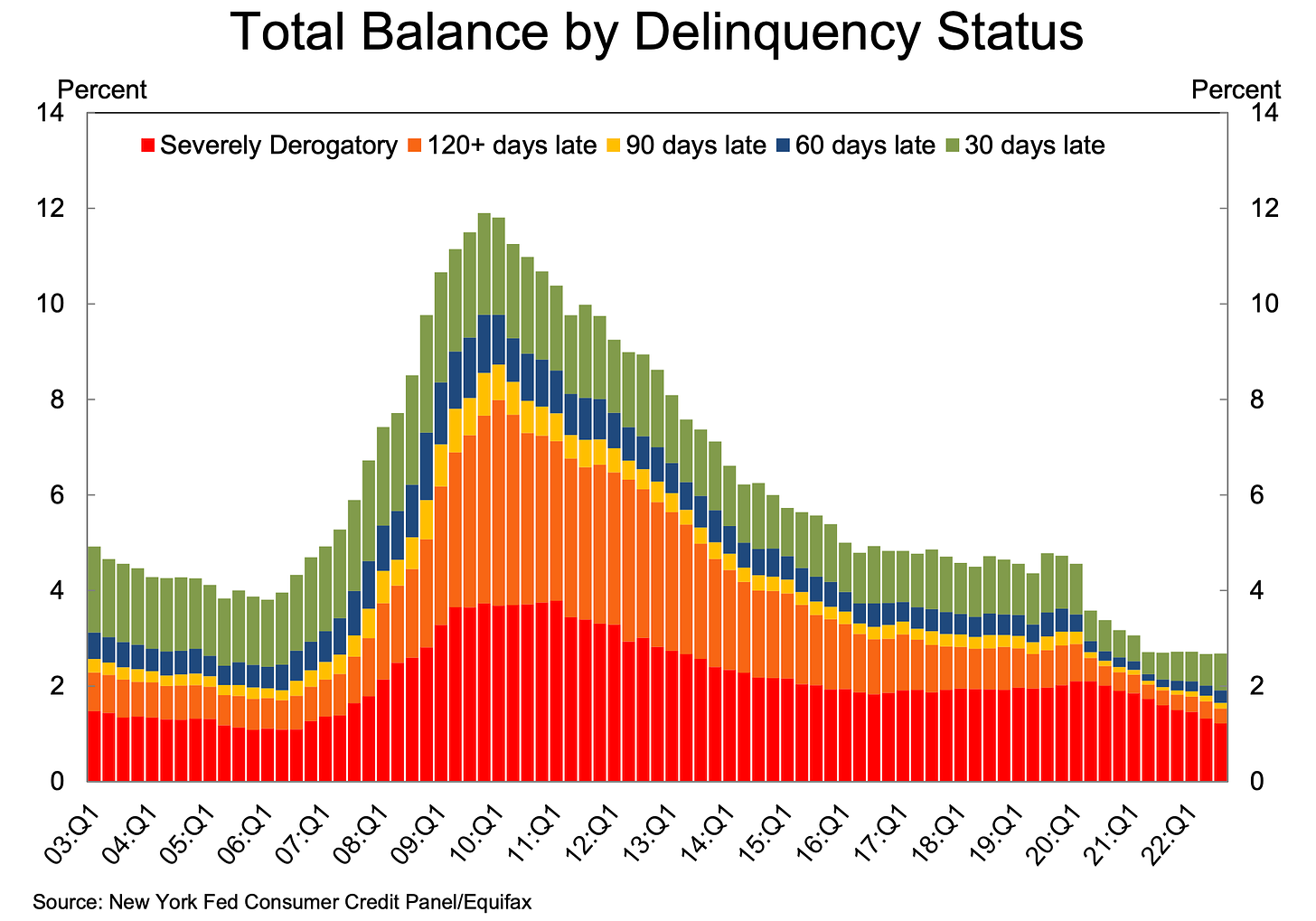

Somewhat unsurprisingly, delinquency rates are at/near all-time lows:

The current dynamic of delinquencies is completely different than the environment leading into the Financial Crisis of 2007/2008, in which delinquencies started rising very quickly. If/when we start to see a material increase in delinquencies, I’ll become cautious. With delinquency volume at historically low levels, we should be on alert for a sudden or material increase which could foreshadow financial instability & rising credit risks. Considering that we aren’t in that environment right now, I don’t see a reason to ring the alarm bells.

Crude Oil & Inflation Expectations:

Switching topics, I’m seeing critically important signals in the price of crude oil which has important implications for the Federal Reserve and their fight against inflation.

Crude oil futures traded at their lowest level of 2022, closing the week at $71.59/barrel. Since the peak in February, crude oil prices have fallen by -45%! From a technical analysis standpoint, the price of crude oil is breaking beneath critical support structure that has been effective for 20 months! This breakdown also appears to be a head & shoulders topping pattern, with crude oil falling below the long-term neckline:

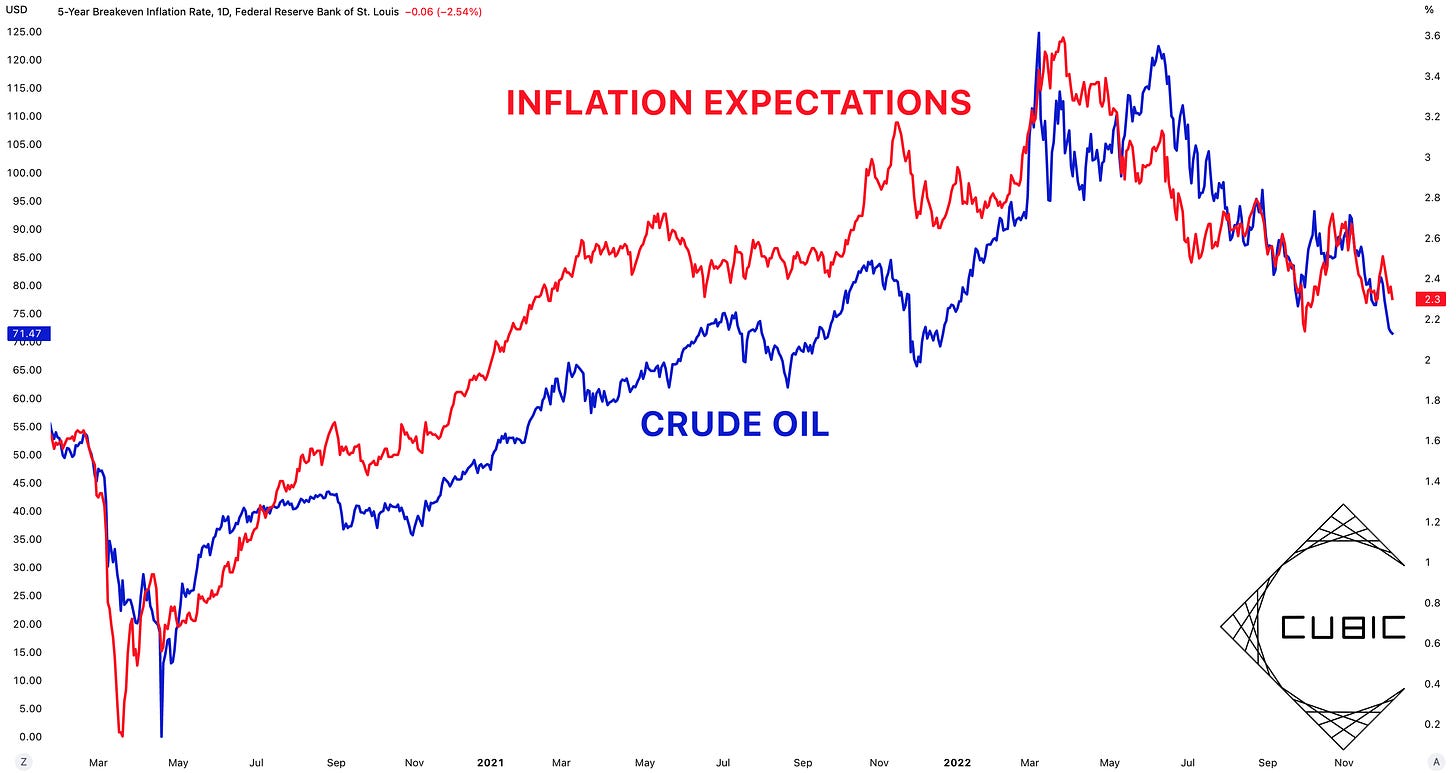

So long as crude oil trades below the teal trendline range, I expect to see more downside pressure for crude oil. This breakdown is an important indication that crude oil is potentially in the topping process and is about to fall even further. This signal has massive implications for the Federal Reserve’s mission to combat inflation, because of the historical correlation between the price of crude oil and inflation expectations. Consider the chart below, highlighting this relationship:

The Federal Reserve has done a spectacular job of keeping inflation expectations “anchored” in this market, despite multi-decade high levels of inflation. From the perspective of the Federal Reserve, it’s important to have well-anchored inflation expectations because this can help to keep actual inflation close to the central bank's target rate. When inflation expectations are well-anchored, households and businesses are more likely to base their decisions on the assumption that inflation will remain stable and close to the target rate. This can help to keep actual inflation stable, as households and businesses will be less likely to engage in behaviors that could drive up prices, such as hoarding goods or demanding higher wages in anticipation of higher inflation. Anchored inflation expectations can help the central bank to avoid using more aggressive monetary policy measures in order to keep inflation under control.

With crude oil breaking below key support structure and inflation expectations plummeting, I think that investors should expect to see both variables continue to decline further. This drastically increases the Federal Reserve’s likelihood of achieving their long-run target of 2% and could accelerate the process of disinflation. While I still believe that CPI inflation will be sticky, the data suggests that the Fed is on track to achieve their goals, even if it takes a bit longer than initially expected. The Fed is still far from achieving their goal of 2% inflation, but the market is eagerly awaiting further confirmation that YoY inflation is rolling lower. The upcoming CPI report on Tuesday, December 13th, will be extremely important for market direction in the coming weeks and likely set the tone for how we end 2022.

While we’ve seen YoY headline CPI decelerate in each month since June’s 9.1% inflation figure, month-over-month dynamics are still very inflationary. In fact, we continue to see MoM headline CPI increase or stabilize, despite the decrease in YoY figures. Consider the following MoM results for headline CPI:

July 2022: ±0.0%

August 2022: +0.1% MoM

September 2022: +0.4% MoM

October 2022: +0.4% MoM

Clearly, inflation is still accelerating on a sequential basis. This indicates that much of the deceleration of YoY headline CPI is largely due to base effects from 2021 inflation dynamics and the domestic reduction in energy prices. Ideally, I’d need to see two consecutive months of sequential deflation in order to confidently believe that inflationary pressures have subsided. Until then, there is a significant risk that inflation remains sticky & persistent.

Best,

Caleb Franzen

DISCLAIMER:

My investment thesis, risk appetite, and time frames are strictly my own and are significantly different than that of my readership. As such, the investments & stocks covered in this publication are not to be considered investment advice and should be regarded as information only. I encourage everyone to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that my investment approach is not necessarily suitable for your specific portfolio & investing needs. Please consult a registered & licensed financial advisor for any topics related to your portfolio, exercise strong risk controls, and understand that I have no responsibility for any gains or losses incurred in your portfolio.

Great take, a complementary note from my side 👇

https://twitter.com/Maverick_Equity/status/1602251620879941632

Thank you! Congrats for the 2,500 growth, keep it rocking!