Investors,

The Federal Reserve is going to cut rates.

Their latest policy decision on Wednesday reflects a new inflection point in their current policy stance, where they will be reducing the cap on their balance sheet runoff. In plain English, the Fed’s balance sheet will decline at a slower pace and therefore reduce the amount of monetary tightening on the market/economy.

On net, the slower pace of balance sheet runoff will help to improve liquidity conditions and even has the potential to boost asset prices (all else being equal).

The Fed’s balance sheet has shrunk by 21.8% since the peak in April 2022, which is the largest contraction of their balance sheet in the history of the FRED dataset.

Given that the Federal Reserve has been in a pause regime since their final rate hike in July 2023, the first major inflection point in monetary policy, I believe that their latest decision this past week marks another turning point that brings us one step closer to eventual rate cuts.

So the natural question is, “when will those rate cuts come?”, to which I would reply:

Just watch the 6M Treasury yield.

According to this relationship, the bond market continues to tell us that rate cuts aren’t coming for at least 6 months. If the bond market was expecting rate cuts within the next 6 months, the 6M Treasury yield would be at least 0.25% below the effective federal funds rate (EFFR).

But it’s not…

So cuts aren’t coming for at least 6 months, which means that the November 7-8th FOMC meeting is the earliest meeting where cuts might happen… However, if the 6M Treasury yield is still trading around the current levels for the next few days, then the November FOMC meeting is out of the picture too!

I’m currently expecting only one 0.25% rate cut in 2024, coming in December.

Without further delay, this is the latest edition of Cubic Analytics!

Macroeconomics:

In his press conference following the FOMC policy decision, Jerome Powell made two extremely important points:

Verbatim, Powell said that “It’s unlikely that the next policy rate move will be a hike.” With the recent acceleration of inflation after 16+ months of disinflation, investors started to get concerned that the Fed’s next rate move could actually be a hike instead of a cut. In part, I think this is one of the reasons why asset prices have come under pressure since late-March 2024. With Powell’s remark during the press conference, it reassured investors that the Fed will not be hiking rates again, based on their current expectations & forecasts about the future.

When asked about the path forward to receive rate cuts, Powell highlighted their desire to see more progress on inflation moving sustainably down to their 2% target, but he also said that “an unexpected weakening in the labor market [could necessitate a rate cut].” This was one of the first times where Powell has bifurcated between progress on inflation and labor market conditions, where the Fed could be comfortable to cut rates even if inflation stayed at/around current levels but the labor market came under significant pressure. This is important because it’s signaling that the Fed is becoming increasingly more focused on both aspects of their dual mandate (price stability and maximum employment), rather than their laser focused efforts to bring inflation down.

Combining these two points, Powell sent a clear message that cuts are more likely than hikes and that their dual-mandate is coming into better balance.

With the labor market becoming increasingly important to the Fed’s reaction function, let’s evaluate how recent labor market data is behaving!

Firstly, the JOLTS data provided us with two important conclusions about disinflation:

1. The quits rate fell from 2.2% to 2.1%.

Given the historical correlation between the quits rate and headline CPI inflation on a YoY basis, inflation should continue to decelerate in the months ahead!

2. Job openings declined to their lowest levels since February 2021, reaching 8.488M.

The ongoing decline in nonfarm job openings also has a clear correlation with inflation dynamics, this time focusing on the relationship with the Federal Reserve’s preferred inflation metric — Core PCE inflation YoY:

Both of these metrics imply that:

The labor market is softening.

Aggregate income growth is expected to slow down.

Inflationary pressures should continue to abate in the months ahead.

Of course, these two datapoints from the JOLTS data aren’t exclusively sufficient to make these determinations, but they help us to find the weight of the evidence.

Thankfully, we also received additional labor market data this week with the NFP.

Estimates expected for:

Monthly payrolls to increase by +240,000 (less than the prior month’s +303,000)

Unemployment rate to stay unchanged at 3.8%

Wage growth to decelerate to +4.0% YoY (down from +4.1% in the prior month)

Instead, the results came in much softer than expected…

Payrolls increased by +175k and prior month results were revised up to +315k

The unemployment rate increased to 3.9%

Wage growth decelerated to +3.9% YoY

To be clear, while this data was certainly softer than expected, it is NOT weak or bad.

By all accounts, this still looks like a rock-solid report that continues to indicate that the labor market is resilient & dynamic.

Additionally, it moves us one step closer to rate cuts, as softer labor market data implies that economic growth and inflation should both normalize further.

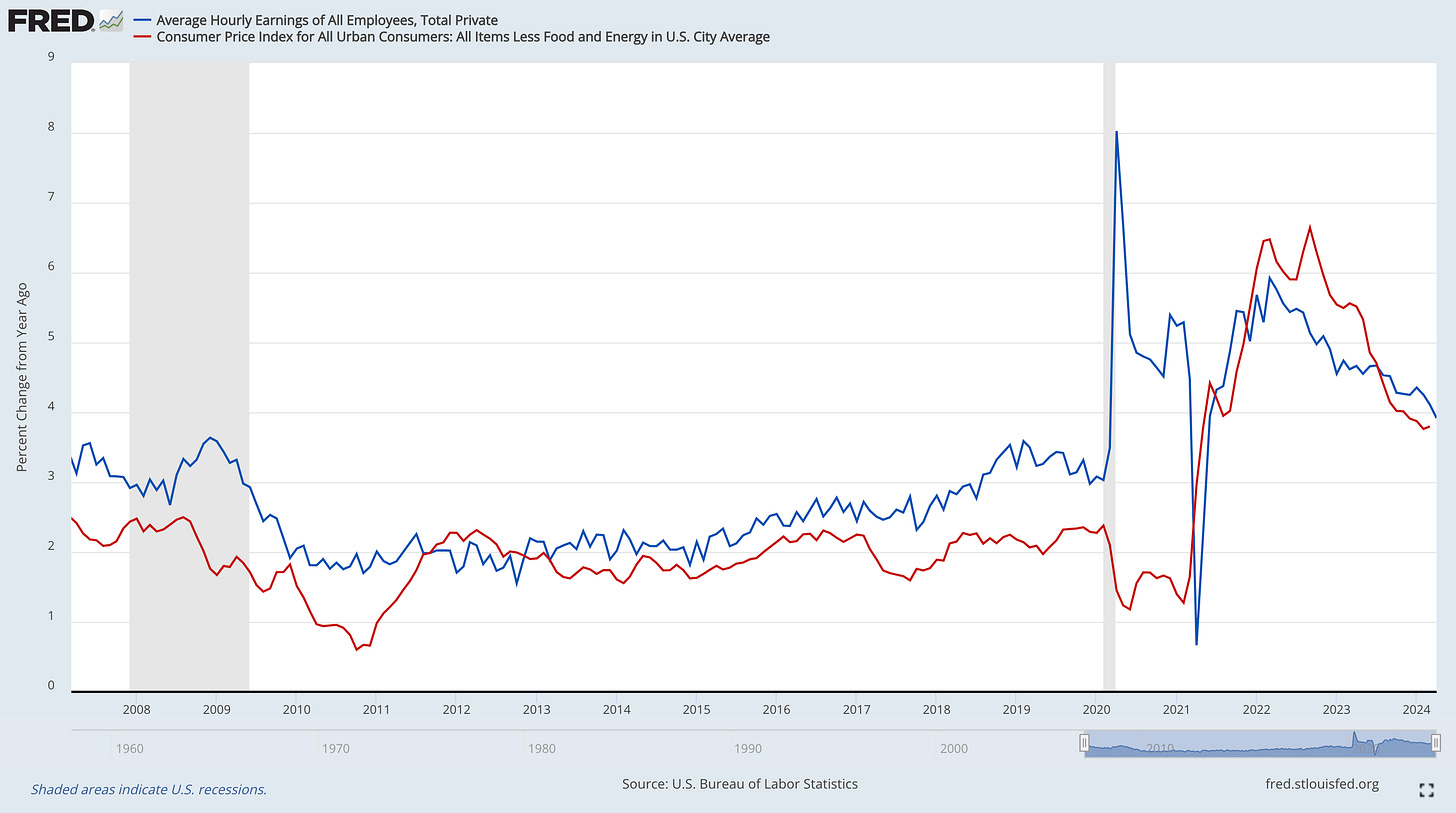

Notably, wage growth dynamics clearly point to more disinflation:

With wage growth expected to decelerate further, based on my own personal outlook, this should help to reduce inflationary pressures even more and facilitate even more disinflation going forward.

On net, the latest round of labor market data fits within the Fed’s desired path and move the economy one step closer to the Fed’s 2% inflation target and rate cuts.

Stock Market:

On the back of softening labor market conditions, stocks rallied.

Specifically, the S&P 500 gained +1.26% on Friday after the release of the nonfarm payroll data and secured a weekly gain of +0.53%.

The S&P 500 continues to string together a series of higher highs & higher lows on a short-term basis, indicating that constructive improvements are taking place.

Keep in mind, the S&P 500 is only +2.7% away from making new all-time highs!

While this market correction (max drawdown of -5.9% on an intraday basis) has been unpleasant, it’s not out of the ordinary or something that gives me “pause” about the health or the validity of the current bull market.

Amidst a Q1’24 earnings season that appears to be quite strong, the resiliency of demand during this correction has been very impressive, though it’s important to note that we aren’t “out of the woods”, so to speak.

Aside from the market structure that I highlighted above, I wanted to make one important point about mega-cap technology stocks based on their earnings data…

Per their latest earnings reports, these companies have the following amounts of short-term cash & equivalents (marketable securities) on hand:

Apple AAPL 0.00%↑: $67Bn

Microsoft MSFT 0.00%↑: 80Bn

Amazon AMZN 0.00%↑: $86Bn

Alphabet GOOGL 0.00%↑: $111Bn

Combined, these four companies have $344Bn in cash on their balance sheets, which doesn’t include long-term marketable securities (Treasuries) or financed capital in revolving lines of credit.

This is an astounding amount of capital.

For context, it’s roughly the same size as Ethereum’s market cap (currently $374Bn).

It’s larger than the market cap of Costco (currently valued at $330Bn).

It’s larger than the market cap of Walt Disney (currently valued at $208Bn)

It’s larger than the combined market caps of Lockheed Martin, AirBnb, and Citigroup.

In fact, the combined cash position of these four stocks is larger than the individual market cap of 482 stocks within the S&P 500. The only stocks that have a larger market cap than the cash position of these four stocks are:

Microsoft

Apple

Nvidia

Alphabet

Amazon

Meta

Berkshire Hathaway

Eli Lilly

Broadcom

Tesla

JPMorgan Chase

Visa

Walmart

Exxon Mobile

United Health

Mastercard

Procter & Gamble

Johnson & Johnson

Home Depot

That’s it.

That’s the list.

Those are the only stocks in the index that have a market cap larger than $344Bn, the combined short-term cash position of AAPL, MSFT, AMZN, and GOOGL alone.

The fact of the matter remains: mega-cap tech represents the MVP’s of the market, firmly holding the title of the best group of stocks from a fundamental basis and market return basis.

While the S&P 500 is up +7.5% YTD, the NYSE FANG+ Index is up +15.1% and is only inches away from making a new all-time high.

You can complain that the MVP’s of the market are acting like MVP’s (outperforming everything else, on the aggregate), or you can own the MVP’s of the market.

I choose the latter.

Bitcoin:

After intense selling pressure and structural breakdowns on Tuesday and Wednesday, I had posted vehemently on Twitter/X that BTC would need to reclaim above $61,000 in order for me to have confidence in short-term crypto market dynamics.

The drawdown on Wednesday pushed the price of Bitcoin to $56.5k, the lowest trading price since February 27, 2024, representing a peak to trough decline of -23.4%.

Seasoned Bitcoin investors know that a -24% decline is normal, but I understand why so many investors had become afraid about the current state of affairs in the market, particularly when many, if not most, altcoins had fallen between -40% and -60% from their respective highs.

On the back of Friday’s NFP data and the strong move in equities, Bitcoin was able to thrust back above $61,000 and was able to secure a daily close at $62,913.

At the time of writing, BTC is currently trading at $63,709 after reaching highs of $64,540 on Saturday morning around 7am ET.

BTC is now trading above:

The short-term holder realized price, trading around $59.8k.

The AVWAP from the ETF approval highs, trading at $60.7k.

The AVWAP from the ETF approval lows, trading at $58.98k.

The former support range between $59.5k and $60.8k.

I believe that this momentum thrust represents a new round of constructive behavior, which therefore represents a short-term risk-on signal; however, a breakdown below $59.5k would shift the market back into a risk-off environment.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.