Investors,

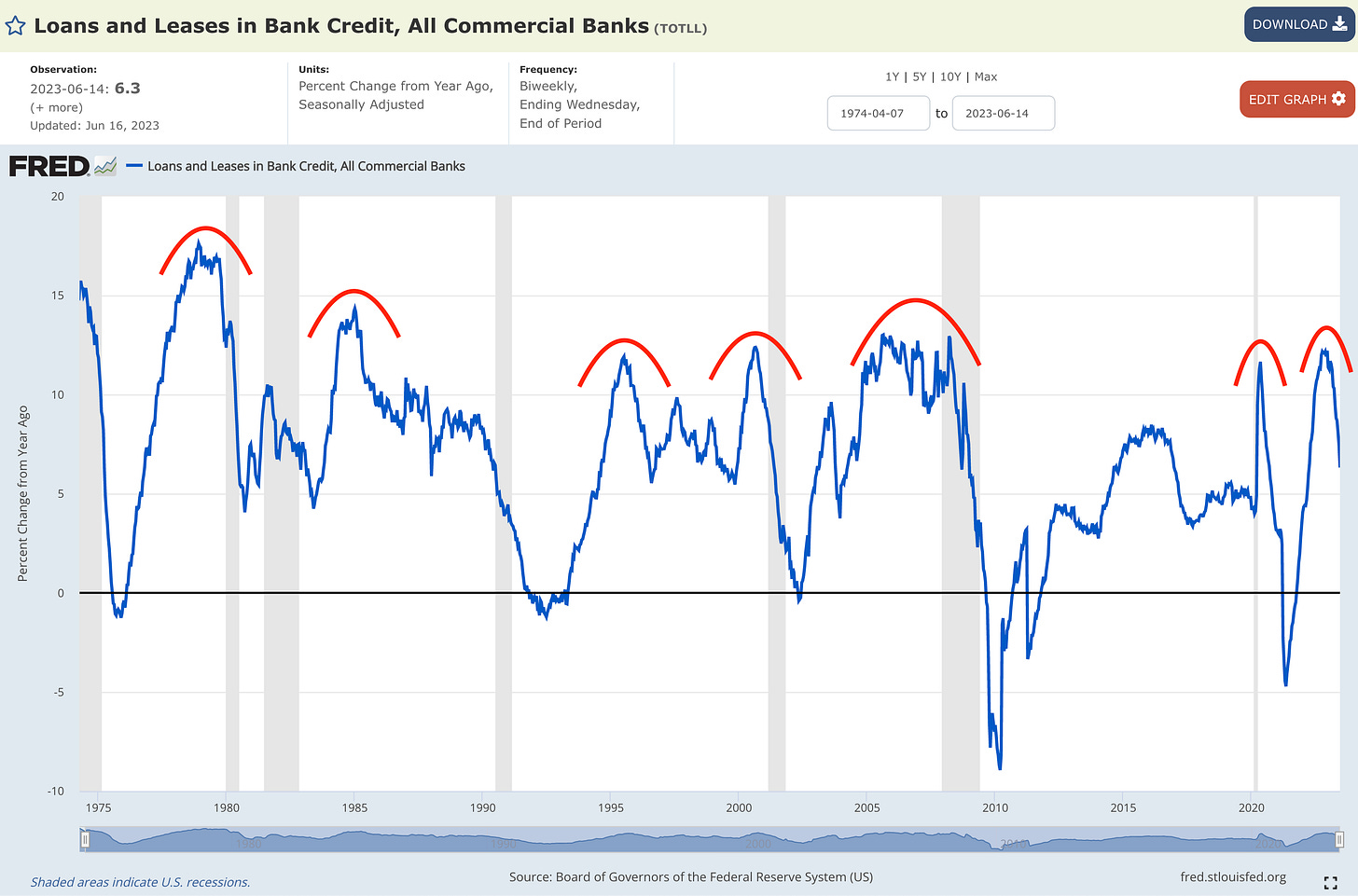

The growth rate of credit creation is plummeting, measured by the YoY rate of change in loans & leases from commercial banks in the United States. Per the latest data as of June 14th, total credit has grown by +6.3% relative to one year ago.

While the 6.3% growth rate itself isn’t anything notable, the ongoing & persistent deceleration is. The current growth rate is a steep deceleration vs. the growth rate of +11.2% in late-February (pre-SVB failure) and the +12.2% growth rate in mid-December 2022.

While this deceleration is occurring faster than I initially predicted before the banking crisis, I was alerting about the normalization and peak in credit creation back in February.

In the wake of bank failures/shutdowns, I quickly became more forthright in my prediction of an outright slowdown and said “I expect this to keep trending lower”.

The latest data confirms that and I continue to reiterate my expectation that the YoY growth rate in loans & leases will trend towards 0.0% and possibly even go negative.

While everyone else is focused on “credit conditions”, the “tightening of lending standards” and survey data, I’m focused on what banks are actually doing with their own balance sheet and how they are extending their customers’ capital to borrowers.

As they saying goes “don’t listen to what people say, watch what they do”.

While Janet Yellen, Federal Reserve officials, and bank CEO’s have reassured the market that the banking system is fine (it might be), banks aren’t behaving as if everything is fine. They are licking their wounds, regrouping, and being cautious.

On the aggregate, one of three things is taking place right now in the credit market:

Banks are slowing down their lending activity

Businesses have less demand for new loans

Some combination of both factors

Why is this important and why have I been maniacally focused on credit creation?

All else being equal, lower credit growth = less economic growth = more disinflation.

In 2022, the growth in credit fueled my inflationary outlook. In 2023, the deceleration in credit creation has fueled my disinflationary outlook.

The latest CPI and PPI data reaffirmed this relationship, aided by a variety of other disinflationary factors currently present in the U.S. economy. Amidst this backdrop of persistent disinflation, stronger than expected corporate earnings, and a renewed enthusiasm in investor psychology, the stock market is grinding higher and reaching new YTD and 52-week highs across the board.

Is economic data great? Nope. However, economic data doesn’t need to be great in order for equities to be resilient and grind higher. As I mentioned last July, “the market doesn’t bottom on good news, it bottoms on ‘less worse’ news”. Things are certainly less worse than they were 6-12 months ago.

In turn, stock prices are higher than they were 6-12 months ago.

This report will cover:

Disinflation and the key takeaway from recent CPI & PPI data.

The Federal Reserve’s first official pause and what it means for future policy.

Data & facts to prove that it “isn’t just 7 stocks that are going up”.

Bitcoin price structure analysis.

Macroeconomics:

First, it’s important to add more context to the ongoing credit crunch and the YoY data that I shared above. Quite simply, more time sensitive data shows that the dollar amount of loans and leases declined by -$49Bn on a trailing-two week basis for the period ending 6/14/23.

This is the 2nd steepest contraction over the past two years, which is important given that the trend can be described as a “rolling over” and curving decline since the strong & consistent credit growth in 2022. It’s clear that the general uptrend from mid-2021 through December 2022 has shifted into a downtrend, which I expect to persist.

In turn, this will further dampen the YoY rate of change in loans and leases that we reviewed at the beginning of this report, which is likely to reduce economic growth and inflationary pressures, all else being equal.

Regarding disinflation, which is merely a deceleration in the rate of inflation, the latest CPI data once again reaffirms that prices aren’t going up as fast. The headline CPI fell from +4.9% YoY in April 2023 to +4.0% in May 2023, slightly lower than estimates which projected for a growth rate of +4.1%. In other words, inflation slowed down faster than the market anticipated!

Each of the four broad-based measures decelerated relative to their YoY readings in April, which indicates that there is consistent disinflation across the various components within the consumer price index.

Specifically, here are the slowdowns that occurred for each variable in the chart above:

Headline CPI (April YoY → May YoY): +4.9% → +4.0%

Core CPI (April YoY → May YoY): +5.52% → +5.33%

Trimmed-Mean CPI (April YoY → May YoY): +6.07% → +5.54%

Median CPI (April YoY → May YoY): +6.98% → +6.74%

While Median CPI has lagged the three other measures of CPI inflation, I fully expect to see this metric decelerate very quickly going forward.

Why do I have such a strong outlook for disinflation? These bullet points will explain:

Wage growth is normalizing & decelerating.

The quits rate will keep declining, leading to even slower wage growth.

Supply chains are completely absent of bottlenecks.

Energy & commodity prices are in a firm downtrend and will likely get weaker.

Credit creation is decelerating quickly YoY and contracting in real-time metrics.

Student loan repayment will force consumers to reduce spending on consumption.

The unemployment rate is likely to rise, meaning less aggregate income to spend.

Home prices peaked in June’22 & the Shelter component of CPI is finally falling.

My view is that Shelter will decelerate sharply given rent/housing decelerations.

M2 is contracting on a YoY basis.

Deposits are contracting on a YoY basis.

Reserves are contracting on a YoY basis.

Fed policy only became “restrictive” in 2023 (EFFR > 2Y & EFFR > YoY CPI), which will put more stress on the economy and break the back of inflation.

The U.S. economy & financial system still needs to reckon with rate hikes from mid-2022 & 2023, considering that monetary policy operates with a lag effect.

ISM Services Prices Paid continue to plummet, which has a 6-month lead on CPI.

Producer prices are plummeting, which impacts and leads consumer prices.

Speaking of producer prices, the PPI for May 2023 was released on Wednesday and continues to decelerate at a rapid pace on a YoY basis and outright contracted on a MoM basis! Once again, this is a strong indication that the CPI basket will face further disinflation going forward.

More specifically, the YoY rate of change decelerated from +2.3% in April 2023 to just +1.2% in May 2023.

Considering that the YoY PPI peaked in March 2022, we can assume a 3-month lead time in the PPI relative to the CPI. That isn’t to say that the CPI will be around +1.2% in the next three months, but I am more focused on the general “shape” of the YoY rate of change and the general trend of persistent disinflation.

At this point in the disinflationary cycle, it’s quite apparent that Shelter (the largest component of CPI at roughly a 33% overall weighting) is the primary factor keeping the CPI elevated relative to the Fed’s 2% target. How can we know this? Thankfully, the team at WisdomTree has provided thorough updates on this influence of lagging Shelter data on the CPI, swapping the BLS’s data for private market data using the Zillow Home Value Index and the S&P Case-Shiller National Home Price Index. In doing so, they leave every other component of the CPI untouched and only swap the Shelter data for Zillow’s data.

Using this data, WisdomTree’s team points out that the actual inflation rate in May 2023 is already below the Fed’s 2% target!

My belief is that this alternative data, which relies on actual private market data, is telling us where the BLS’s measurement of CPI inflation will be within the next 6 months. Yes — I think there’s a real probability that headline CPI is below 2% by the end of 2023.

As a final thought on macroeconomic dynamics, I’d be remiss if I didn’t provide commentary on the Federal Reserve’s decision to leave the federal funds rate unchanged in their FOMC policy meeting this week.

I believe that the Federal Reserve is done raising rates for the remainder of 2023.

Why?

First of all, my opinion is that the inflationary cycle is dead. The Fed is aware of this, but they don’t want to jump the gun given the persistence of Core CPI and PCE measures. This is a policy mistake in my opinion, but this pause is the first admission of this policy mistake. The Fed is aware of Shelter’s lag effects and the lag effects of their prior rate hikes, which still haven’t had their full impact on inflation. I believe that they know inflation is dead, but they cannot openly admit so and back themselves into a corner of admitting that they are late to the party.

Second of all, I predicted that the Federal Reserve would raise rates by an aggregate amount of +0.5% to +1.25% in 2023, which I published in my 2023 outlook. As of right now, they have raised rates by an aggregate amount of +0.75%. Given that we’re within my target and that the Fed has achieved a positive real federal funds rate (FFR > YoY CPI), I think they are done.

Finally, I hate to toot my own horn, but I know how the Federal Reserve operates. They’ve been the focus of my macroeconomic obsession for the past 10 years and I’ve done everything in my ability to fully understand how they operate and why.

While the Fed grants themselves the ability to pivot their monetary policy stance by claiming to be “data-dependent”, they don’t like to flip-flop on monetary policy. Once they make a decision about the direction of monetary policy and reach an inflection point, they continue in the direction of that inflection point.

Think back to November 2021…

The Fed had been forecasting for months that they were getting ready to transition away from monetary stimulus and begin tapering their asset purchases. The announcement to taper officially occurred in November and the withdrawal of stimulus began. Shortly thereafter, in March 2022, the Fed made their first decision to outright tighten monetary policy by raising rates by +0.25%. In the next meeting, they raised by a larger magnitude of +0.5%. Then they started to reduce the size of their balance sheet by conducting balance sheet runoff. Then they raised by an even larger magnitude of +0.75%.

In plain english, their policy followed the trajectory of:

Warn of transition

Start the transition by reducing the rate of stimulus

Elevate the transition by raising rates a little bit

Elevate the transition by raising rates by a larger amount

Expand tightening by conducting balance sheet runoff

Elevate the transition by raising rates by an even larger amount

Each step within the tightening process was more aggressive than the last. I fully expect that their transitioning towards “less monetary tightening” will be the same consistent, stair-step process.

In fact, we’ve already seen evidence of that! Since their final +0.75% rate hike in November 2022, we’ve seem them conduct the following rate hikes:

December 2022: +0.5%

February 2023: +0.25%

March 2023: +0.25%

May 2023: +0.25%

June 2023: +0.0% (pause)

Let me be very clear: Barring an economic calamity or financial crisis, the Federal Reserve does not make sudden and quick changes to their monetary policy trajectory.

That isn’t to say that they don’t have inflection points in their policy! It simply means prefer to make inflections very slowly, if/when they have the ability to do so.

Immediately following the Fed’s pause on Wednesday afternoon and watching the entire press conference from Jerome Powell, I wrote the following on Twitter:

“The Federal Reserve doesn’t flip-flop.

This pause marks an almost certain inflection point in monetary policy, wherein an extended pause is the most likely case scenario going forward.

Remember how Fed officials have invoked the mistakes of Arthur Burns [in the 1970’s]? They won’t make [those] mistakes again, so this pause should reflect their confidence that disinflation is firm and that we’ll be at their 2% target soon enough.

My prediction is before the end of the year.

Regarding a cut, I don’t foresee it this year, based on the signals that I’m seeing in the bond market [right now]. The signal from the 3M and 6M Treasury yield is dynamic, so perhaps the cut becomes probable in the coming weeks/months/quarter. I don’t know. I will continue to post updates and adapt my views based on this dynamic signal.

A pause at 5.08% effective federal funds rate is still sufficiently restrictive to combat inflation, but the Federal Reserve is late to the disinflationary party.

We are in disinflation.

We have been in disinflation.

Disinflation will get stronger in the coming 3-6 months.

The Fed seems to finally recognize this, officially, with their policy decision at today’s FOMC.”

While Powell suggested that the July FOMC meeting will be a “live meeting” and that more rate hikes could be warranted, I think it’s important to remember that his rhetoric and forward guidance is a policy tool! If he tells the market today that they aren’t going to raise rates again this year, he removes the Fed’s ability & desire to stair-step monetary policy. By suggesting that there’s potentially more rate hikes, depending on future data, Powell allows the market to smooth out the adjustment from the tightening cycle to the pausing cycle.

Given that we’ll have the June CPI data in mid-July before the next FOMC meeting, in addition to new labor market data that is likely to soften, I fully expect to see the Fed pause again in their next meeting.

Stock Market:

The bearish argument that “only 7 stocks are going up” is dead. First of all, it was a terrible argument in the first place. Second of all, it’s wasn’t ever really true. Thirdly, it’s certainly not true today.

The S&P 500 gained +2.57% this week and now has a YTD return of +14.9%, which doesn’t include dividends. The index hit new YTD highs during each trading session this week, generating the highest daily close of the year in 4 of 5 sessions. The index itself is now firmly above the August 2022 highs, which we reviewed in last week’s premium edition of Cubic Analytics.

I’ve also added the 20-day (yellow), 50-day (blue), and 200-day (red) exponential moving averages on the chart to illustrate the behavior of short, medium and long-term momentum. Regarding these indicators, there are two things I want to point out.

Price > 20 EMA > 50 EMA > 200 EMA since early April 2023. This is a bullish dynamic, very different than the behavior that we witnessed in 2022.

Each of the three major moving averages have a positive & rising slope, illustrating that short, medium, and long-term averages are becoming more indicative of an uptrend.

Under the hood, internal metrics for the S&P 500 reflect strong participation across a variety of market capitalization sizes and sectors, with upside momentum on short, medium, and long-term timeframes.

What do I mean? The following data tracks S&P 500 stocks, as of Friday, June 16th:

223 out of 500 stocks in the index hit new 20-day highs, roughly 45% of the index.

Industrials = 52 stocks

Technology = 41 stocks

Healthcare = 31 stocks

Financials = 23 stocks

Consumer Discretionary (cyclicals) = 22 stocks

Utilities = 19 stocks

Real Estate = 15 stocks

Consumer Staples (defensives) = 7 stocks

Communications = 6 stocks

Basic Materials = 5 stocks

Energy = 2 stocks

126 out of 500 stocks in the index hit new 50-day highs, roughly 25% of the index.

Industrials = 39 stocks

Technology = 33 stocks

Consumer Discretionary (cyclicals) = 15 stocks

Healthcare = 13 stocks

Financials = 10 stocks

Real Estate = 8 stocks

Communications = 3 stocks

Basic Materials = 2 stocks

Consumer Staples (defensives) = 2 stocks

Utilities = 1 stock

56 out of 500 stocks in the index hit new 52-week highs, roughly 11% of the index.

Industrials = 17 stocks

Technology = 15 stocks

Consumer Discretionary (cyclicals) = 7 stocks

Healthcare = 7 stocks

Financials = 3 stocks

Real Estate = 2 stocks

Basic Materials = 2 stocks

Communications = 1 stock

Consumer Staples (defensives) = 1 stock

Utilities = 1 stock

What about new lows on Friday for each of these timeframes?

New 20-day lows = 1 stock

New 50-day lows = 0 stocks

New 52-week lows = 0 stocks

This was the theme during each and every single trading session this past week — a massive amount of new highs across a wide range of sectors participating, with an absence of stocks making new lows.

We also saw similar data for the Nasdaq-100, which is predominantly comprised of technology stocks, and even the Dow Jones!

The data above is emblematic of a clear uptrend with broad-based participation. Stocks are catching bids, and it isn’t just tech stocks, or 7 tech stocks in particular.

Tech is winning the most, but we’re seeing evidence that industrials are also leading the way higher, in addition to consumer cyclicals. Heck, even financials were in the top 5 for each category! In other words, the economically sensitive sectors of the market on on fire, indicating that investors are not concerned about a recession in the immediate future. If they were concerned, these stocks wouldn’t be performing well.

Apple, Microsoft, and Nvidia each hit new all-time highs this week. While Nvidia is certainly expensive on a traditional valuation perspective, both Apple and Microsoft are much more in touch with reality. They are arguably the greatest companies of all time and are both the largest stocks in the entire world. What’s bearish about them hitting new all-time highs? Nothing. Nothing at all.

You can either accept this data as true, which it is, and therefore extrapolate bullish conclusions, or you can be a bear with cognitive dissonance. While tomorrow is not guaranteed, I will reiterate that I will remain bullish on the market so long as the index remains above the August 2022 highs. If/when the S&P 500 falls below those August 2022 highs, I will likely shift into a more defensive position and respect what the price action is telling me. As of Friday’s close, the index would need to fall -2.5% in order to achieve this defensive signal, which I think is an attractive level of risk.

Bitcoin:

BlackRock, the largest financial services & investment firm in the entire world, has officially filed for a spot-Bitcoin ETF and submitted their application to the SEC. Bitcoin immediately started bidding on the news, based on the assumption that, if approved, BlackRock would be competing for the most scarce asset in the world.

As you might guess, price rebounded based on this news. Once again, the fundamentals act as a catalyst to reaffirm price structure. As I’ve been sharing on Twitter and Substack for weeks and months, Bitcoin had the opportunity to rebound within a proven support zone:

There are three components to this analysis:

Horizontal support/resistance structure in green.

Descending wedge in red.

The 200-day moving average cloud (EMA in teal & SMA in yellow).

All three of these components would be valid support on their own, but the confluence of all three has given me confidence that price will hold this level as support, in addition to the fact that the 200-week moving average cloud is also aligned within this zone!

While there’s still a chance for price to move lower within the entire support zone, I reiterate my confidence that price will use this range as support. To be fully transparent, as always, I did buy more Bitcoin and Ethereum on Friday evening.

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged and direct/inverse, to the NYSE FANG+ Index. They have a suite of products ranging from big banks, to oil and gas, and even gold/gold miners. I’m currently using two of their products, GDXD 0.00%↑ and OILD 0.00%↑ as short-term trades to bet against gold miners and energy stocks!

I started a partnership with MicroSectors because I’ve been using their products for over a year and this was an organic and seamless fit with my views.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

"Energy & commodity prices are in a firm downtrend and will likely get weaker."

I agree with the disinflation thesis and all the points except part of this one. 👆Look at DBA, it's rallying back toward 52 week highs. Not sure what comes of it but I think we're about to see commodity prices give the bulls a nice counter trend rally to keep the inflation narrative from dying a peaceful death.

Nice analysis!

Credit contraction following the bank crisis is totally back of mind w/ markets rallying. Nice update on what's happening there.