The Best Recession Ever

Investors,

We’ve been told for 18+ months that the economy is on the cusp of failure, doomed to experience sticky inflation, widespread unemployment, and a collapse in economic activity. And no, I’m not just referencing the sensationalism from Peter Schiff…

Doomers have pointed to a myriad of reasons why inflation will reaccelerate. It hasn’t.

They’ve pounded the table about why the labor market is poised to fail. It hasn’t.

They’ve proclaimed that the economy’s artificial growth will collapse. It hasn’t.

Their sensationalist rhetoric continues to be disproven by actual data, so they’re argument is now taking one or both of two forms:

The data is fake, misleading, or inaccurate: instead of acknowledging that their predictions were wrong, the point their fingers at the accuracy of the data and say that it’s not true. At no point do they suggest an alternative source that is more trustworthy. This form of cognitive dissonance is laughable, truly.

Moving the goal post: When growth was low, they said it was about to plummet. Instead, growth has been reaccelerating. Those same people are now saying that growth is peaking and is about to plummet. They were wrong. They’ve been wrong. They insist that they’ll be right this time. As the saying goes, even a broken clock is right twice a day.

This week, we received new macroeconomic data that addresses all three of the major components that I referenced above: inflation, the labor market, economic growth.

All of this data suggests that the macro bears & doomers are still wrong.

Let’s jump into the data & breakdown the key dynamics taking place in the economy, the stock market and Bitcoin:

Macroeconomics:

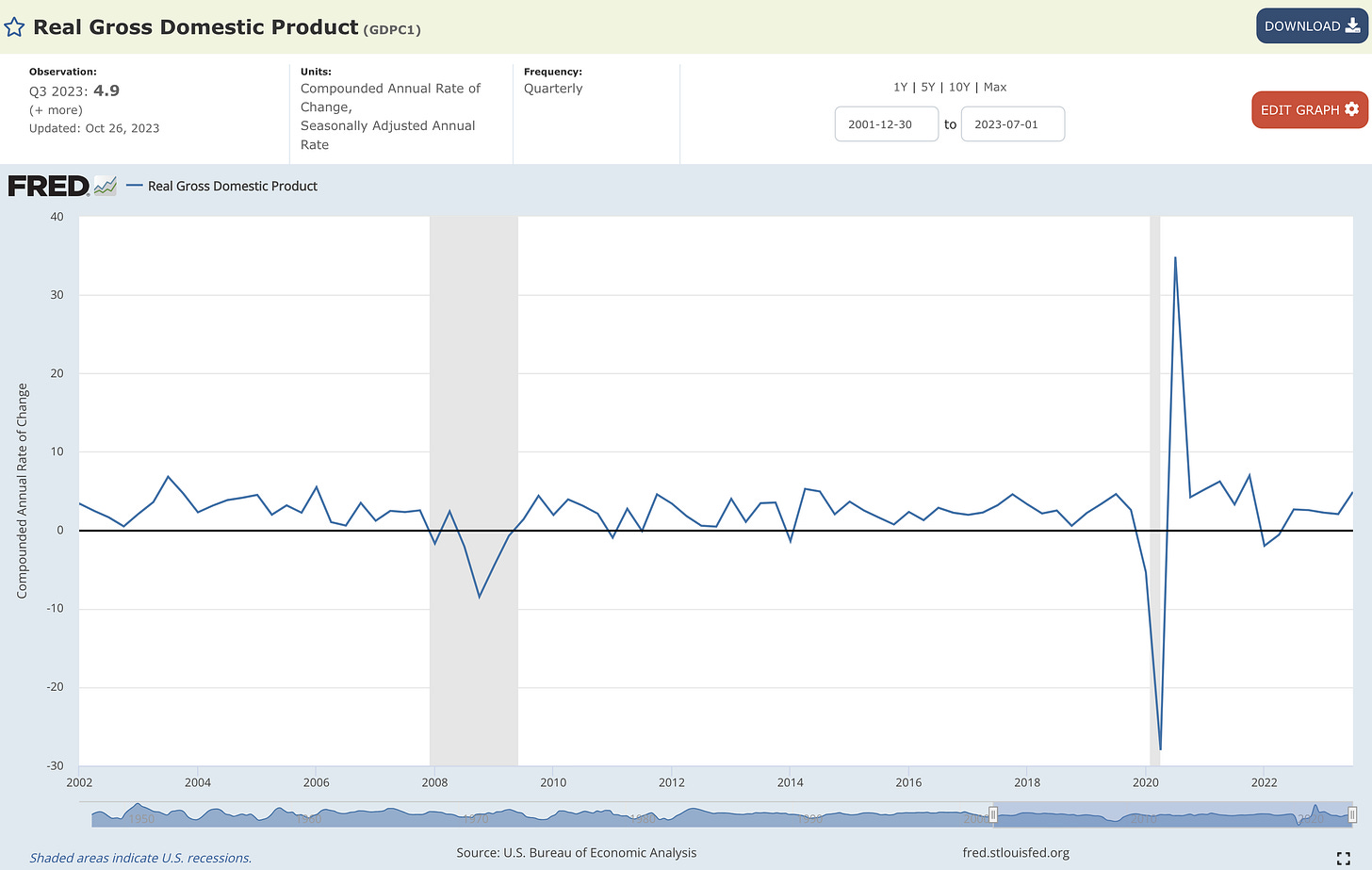

Regarding economic growth, the official results for Q3 2023 GDP were published on Thursday morning. While median estimates were expecting real GDP growth of +4.7%, the result came in even higher at +4.9%.

It’s important to remember two things with respect to this data:

This result is for real GDP growth, which is adjusted for inflation.

The +4.9% growth rate is an annualized result, calculating the quarter-over-quarter growth rate and then compounding it four times to reach +4.9%. In reality, the real economy grew at a pace of +1.2% in Q3 relative to the size of the real economy in Q2. Because growth isn’t linear & compounding is the 8th wonder of the world, I don’t like to annualize data very often. As such, I think it’s important to contextualize the +4.9% annualized real GDP growth with the YoY rate of change in the real economy, which was +2.93% YoY.

This result is, first of all, an improvement vs. the YoY result for Q2 2023 of +2.38% and it’s also matching the highest levels of growth that we’ve typically seen over the past 20 years. To contextualize this even further, an economy that grows at ~3% every year will double in size every 23.3 years! Not too shabby.

The quarter-over-quarter growth rate of +1.2% was a massive jump vs. the prior quarter results of +0.51%, so investors should objectively acknowledge the fact that the economy is resilient & has been much stronger than anticipated.

With that rosy picture out of the way, I do want to highlight how most (if not all) of the growth we experienced in the quarter is due to government spending. This is a fair criticism of the GDP results, highlighting how the private economy (real spending from businesses & individuals) isn’t as strong as the headline data wants us to believe.

Moving to the labor market, we had the typical weekly report of initial unemployment claims on Thursday morning, showing that 210,000 individuals filed for benefits in the past week.

The 4-week moving average stabilized right at 207.5k after coming in at 206.25k in the prior week. These are the lowest readings in the 4-week moving average since February 2023. Coupled with the fact that the layoffs rate from the nonfarm payrolls data is at/near record lows of 1.1%, it’s safe to say that labor turnover & firing activity is very muted.

Moving to the topic of inflation, the Federal Reserve’s preferred method of measuring consumer prices is the Personal Consumption Expenditures data, which was released on Friday morning. The result for PCE in September was stable at +3.4% YoY, consistent with the results from August. However, as we dive under the hood and focus on core PCE, which is what the Fed really cares about, we saw yet another deceleration on a YoY basis. Core PCE came in at +3.67% YoY, consistent with expectations and below prior month results of +3.84% YoY.

The rate of change is still too high, but it continues to unequivocally decelerate, which is the definition of disinflation. Reaffirming my conclusions from the CPI data we received a few weeks ago, the PCE data cements my belief in disinflation. The notorious “Fed whisperer”, Nick Timiraos, posted this phenomenal chart to highlight the gaps between shelter, core services ex-shelter, and core goods:

Yes, core goods are on the verge of experiencing outright deflation on a YoY basis. I’m primarily focused on the ongoing deceleration in core services ex-housing, which is an important variable that Jerome Powell has specifically cited.

All together, we’re seeing:

Resilient/strong GDP data

Dynamic/tight labor market data

Ongoing disinflation on a YoY basis

Sounds like the best recession ever to me.

Stock Market:

To their credit, the doomer argument has started to prove itself in the equity markets, where U.S. indexes continue to weaken since peaking in mid-July. Specifically, the Russell 2000 index closed at new 52-week lows, highlighting how a basket of small cap stocks are still in a bear market and are now falling below their 2022 lows!

The index is now down -7% YTD and has fallen -18.1% from the YTD highs in July.

Nonetheless, the S&P 500 is still up +7.25%, on track for an annualized calendar year return of +8.9% (not including dividends). So while the index has fallen -10% over the past three months, it’s important to contextualize that the index is still outperforming the average calendar year return since WW2. In other words… this is an average year in the U.S. stock market — neither extremely bullish or extremely bearish, but steadily growing in value.

Bringing out attention back to the Russell 2000, I want to highlight that the ongoing downtrend really shouldn’t be a surprise, particularly for those of you who read my research. After falling below the 200-day moving average cloud in mid-September, I posted the following analysis for the Russell 2k:

I told you we’d go lower. We’ve gone lower.

A few days before posting this analysis on Twitter, I dedicated an entire premium version of the newsletter to the bearish dynamics taking place in small caps, urging investors to literally “Avoid Small Caps”. You can read that report here:

Another reason why I am so uninterested in small cap stocks is because the Russell 2000 has the largest allocation to financial stocks & banks, which I have no intention of owning. One could even argue that the terrible performance of small cap stocks is being driven by the terrible performance of bank stocks & financials, shown by the correlation between $RUT & $XLF below:

Given that I have zero interest in owning bank stocks or financials, it’s very difficult for me to buy broad-based small cap indexes or ETF’s due to their allocation to financials.

On Thursday’s group call with premium subscribers (sign up below), I outlined downside targets for the Russell 2000 based on two important indicators.

Let’s just say I think the index has a bit more room to fall… quite a bit more room.

Bitcoin:

I don’t have much to say about Bitcoin at this point. I continue to remain tactically & fundamentally bullish on the apex digital asset. From a tactical perspective, I’ve been outlining the bullish developments consistently on Twitter:

Bitcoin is officially up +106% YTD, achieving the highest daily close of the year for three consecutive days this past week. That’s not bearish.

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged & direct/inverse, to the NYSE FANG+ Index.

They recently released four new individual stock ETF’s for Tesla and Nvidia, using 2x leverage in each direction:

I started a partnership with MicroSectors in 2023 because I’ve been using their products for over a year and it was an organic and seamless fit.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, & timeframes expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.