Investors,

Remember in late 2022 when 100% of economists predicted that the U.S. would imminently fall into a recession, using this as a justification to sell stocks?

That didn’t age well.

Throughout 2023 and 2024, a massive bull market ensued amidst a backdrop of historically strong levels of employment, persistent disinflation, and robust levels of real GDP growth.

The consensus was wrong.

This serves as a stark reminder that the “masses” in the market are often wrong.

Fading consensus isn’t a new concept on Wall Street, with an entire investing style based on taking contrarian positions against the crowd.

While I certainly don’t view myself as a contrarian investor, I’ve had too much experience in the market to dismiss the fact that contrarian bets against extreme negativity are often lucrative.

This is where famous investing quotes, like the following, have come from:

“Buy when there’s blood in the streets.” - Baron Rothschild

“The time of maximum pessimism is the best time to buy.” - Sir John Templeton

“Be fearful when others are greedy and greedy when others are fearful.” - Warren Buffett

Given the fact that dollar-denominated assets tend to rise over the long-run, these have been effective strategies for long-term investors who are willing to stomach short-term downside & market volatility.

While these are cliché ideas & phrases, the likes of which most of you are already familiar with, the reason why I’m bringing them up is the following…

Consumer sentiment is now the worst that it’s been since mid/late-2022:

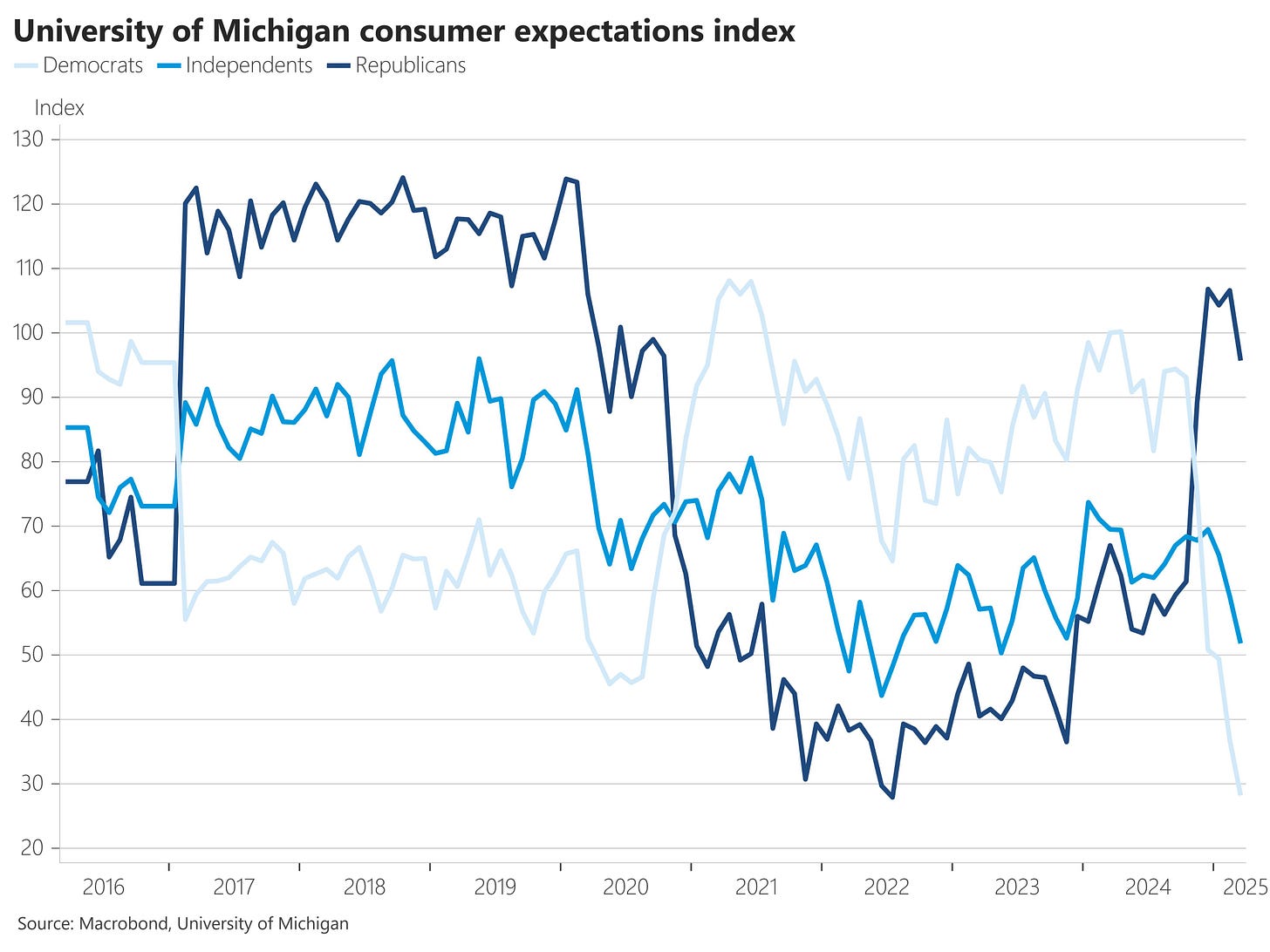

While this is largely a politically-driven sentiment test, the latest data from the University of Michigan Survey showed that all three political parties had a reduction in sentiment:

Democrats are feeling their least optimistic in years, even worse than during COVID!

Regarding expectations of future business conditions over the next year, the latest UMich Survey had its worst result in the history of the data series, going back to 1978:

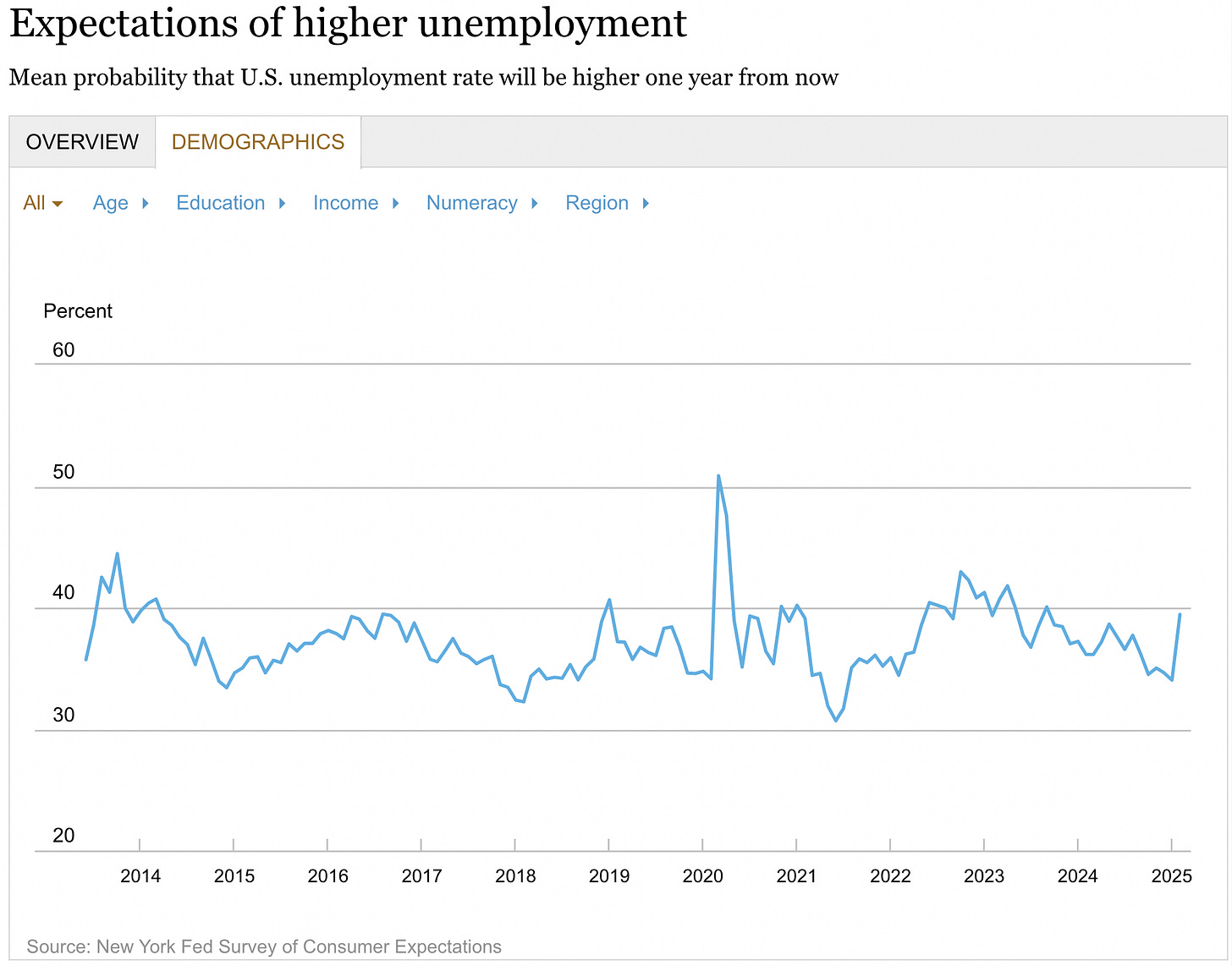

The New York Fed surveyed labor market participants, polling their expectations about future (un)employment, showing a massive acceleration in respondents who believe that there’s a risk of becoming unemployed:

This perceived risk of higher unemployment is being shared across geographic regions and across the full spectrum of education levels:

People with a bachelor’s degree or higher are now sensing the highest degree of unemployment risk since Q1 2020, in the depths of the COVID lockdowns.

Regarding household finances, more respondents are feeling more pessimistic about their future, with a notable increase in “somewhat worse off” and “much worse off”.

Going back to the University of Michigan Survey, the “Expected Change in Financial Situation” fell to its lowest levels in the history of the data series:

Previous readings below 100 occurred in 1979, 1980, 2008, and 2022, which I’ve highlighted in green on this chart of the S&P 500 in logarithmic scale:

Call me crazy, but those weren’t bad times to be steadily DCA’ing into the market.

The conclusion from this data is crystal clear: aside from our own personal and anecdotal evidence, United States households are historically pessimistic.

This pessimism is also being reflected into the market, which we can discern through actual sentiment and positioning data.

The Fear & Greed Index, which has plenty of flaws, is firmly in a state of extreme fear:

In fact, the Fear & Greed Index has been “Neutral” or worse since mid-December 2024:

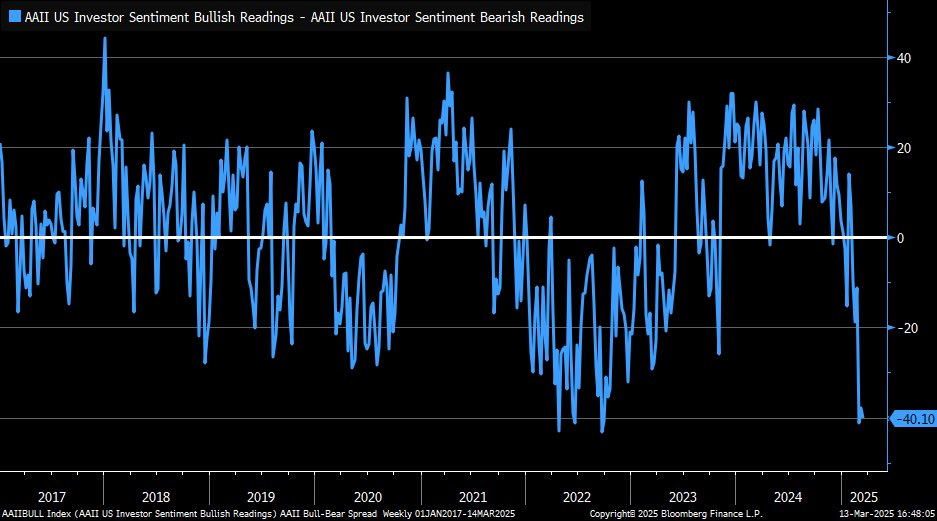

The AAII bull-bear spread has fallen to extreme bearish levels, falling to its lowest position since September 2022 (just a few weeks before the stock market bottomed):

Though the indicator isn’t a perfect contrarian signal, readings below -20 after being above 0 have provided great buying opportunities for long-term investors when looking at the S&P 500:

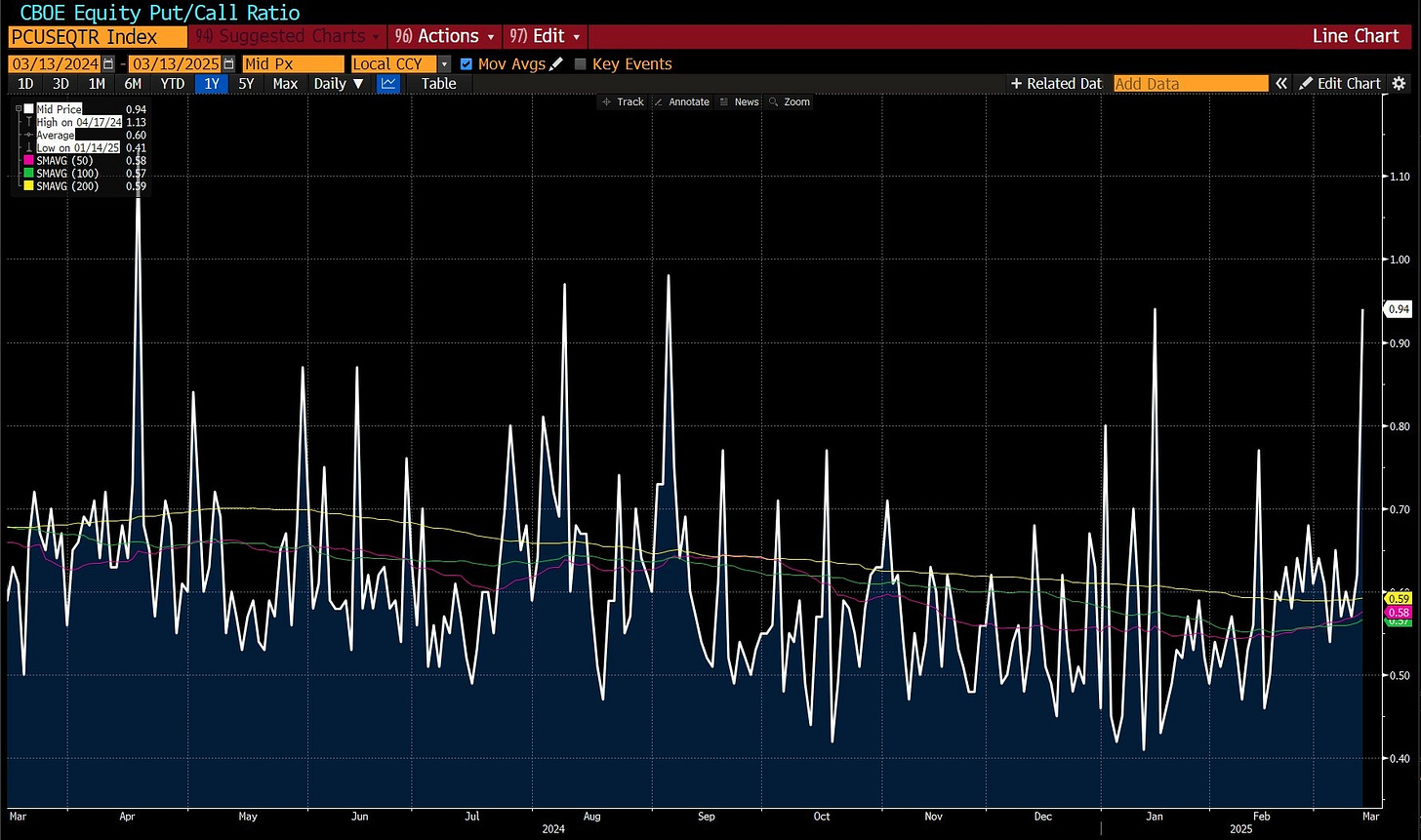

Positioning data for the stock market is also reflecting extreme negativity, shown via the CBOE equity put/call ratio:

But investors aren’t just making negative bets against U.S. stocks… they’re also speculating that high yield corporate bonds (often referred to as “junk bonds”) are also going to fall, shown via put volume on $HYG:

In other words, everyone is getting fully “bear’d up” AFTER the median stock in the S&P 500 has fallen more than -18%!

The list goes on and on…

There is plenty of blood in the streets.

There could be even more blood in the streets in the weeks/months ahead.

“Blood in the streets” does not mean “stocks aren’t going to fall even more”, but the data that I’ve reviewed in this report is a perfect reminder of the tried-and-true clichés that I quoted at the beginning of this report.

This is a time to zoom out, remind yourself of your long-term investment plans, and to avoid making emotional decisions based out of fear (the same way that I encouraged investors to avoid greed-based decisions throughout 2023 and 2024).

Planes have turbulence.

Comedy movies have sad parts.

Michael Jordan missed game-winners.

Bull markets have corrections & consolidations.

Best,

Caleb Franzen,

Founder of Cubic Analytics

This was a free edition of Cubic Analytics, a publication that I write independently and send out to 13,100+ investors every Saturday. Feel free to share this post!

To support my work as an independent analyst and access even more exclusive & in-depth research on the markets, consider upgrading to a premium membership with either a monthly or annual plan using the link below:

There are currently 1,030+ investors who are on a premium plan, accessing the exclusive alpha and benefits that I share with them regarding the stock market, Bitcoin, and my own personal portfolio.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.

I've been in the game long enough to know how to win; gather information from various sources over multiple days/weeks, then make my own decision based on my God-given intuition, which has served me very well. Earlier this week I basically went 100% MSTU at $4.52 per share 😉

Love the depth of your work. Always an interesting take within your posts.

While I generally agree with you, I think there is a tail risk unlike any we have ever experienced in our investment careers- even me being a lot older.

This administration seems to believe that complete reset of the US economy is warranted here. Goodbye to Bretton Woods- you could argue largely responsible the gift that we call American Exceptionalism. Hello Mar a Lago Accord, where we take that exceptionalism and throw it at the rest of the world in defiant anger.

What will the results of terming out to 100 years the holders of US treasuries in countries in exchange for protection? Aside from sounding like organized crime, what does that do to the perceived ‘risk-free’ asset, the Trust that has become such a large part of our country’s comparative advantage.

I use this as one example of many. There are massive structural changes being debated. This isn’t Volcker raising rates to crush inflation. If any or all of these policies are implemented, they will likely cause massive reallocations of global capital. First, our are financial markets structurally sound enough to withstand such paradigm shifts? And, second, wholesale changes to global capital structures will dramatically alter the winners and losers that we have become accustomed to in certain markets.

Just saying, we may need to use different lenses for analysis. It’s telling that the median stock is -18%. Reflexivity often kicks in after such losses. And if we cannot rely on the traditional tools for arresting a market decline, this time really could be different!