Investors,

Last weekend’s news about the “not-to-be-mentioned” AI catalyst caused the markets to gap lower at the open on Monday, which I immediately called out as a questionable reason to sell equities. In fact, I even said it was worse than the Japanese Yen carry trade fiasco from August 5th 2024, which I also questioned in real-time back then.

Stocks have ripped back to the upside since Monday’s opening gap, with the S&P 500 gaining +1.18% from the open on Monday through the close on Friday.

The Nasdaq-100 was up +2.19% over the same time.

Despite the efforts to rally during the week, neither the S&P 500 nor the Nasdaq-100 were able to fully recover from their gap and both finished with negative returns on a week-over-week basis.

But hey, the market is doing just fine.

The S&P 500 gained +2.7% during January 2025, off to a strong start for the new year.

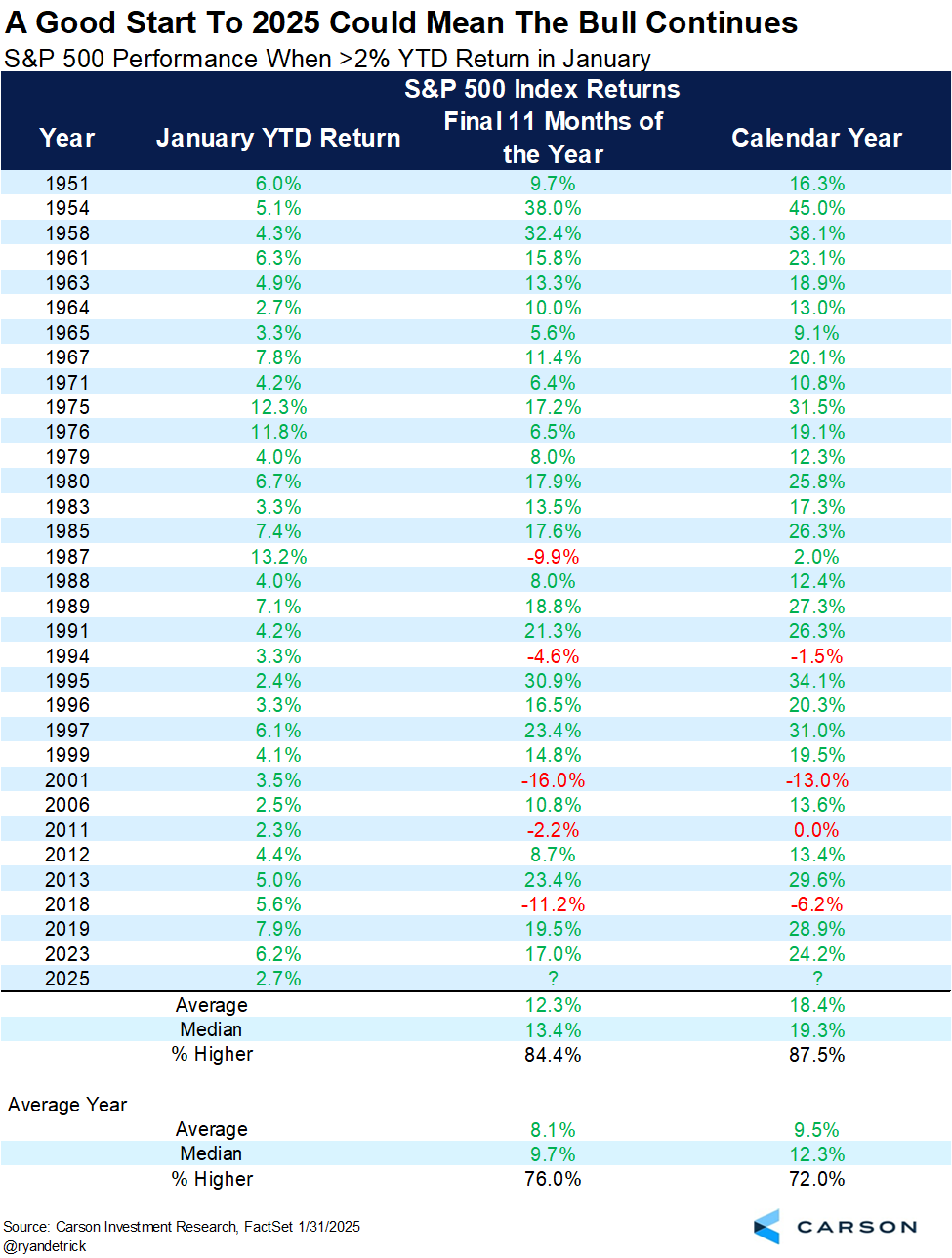

Historically, strong performance in January has bullish implications for the remainder of the year, as shown by the fantastic data provided below from Ryan Detrick:

The fact of the matter is, when the S&P 500 gains at least +2% in January, the index generates a median return of +13.4% in the final 11 months of the year for a net calendar year return of +19.3% with an 88% success rate!

Strength begets more strength.

So as we think about selloffs or “weakness” in this market, the data continues to suggest that being a buyer during periods of fear will have rewarding results.

As I continue to spread the message of “less is more”, investors should embrace volatility and focus on big-picture market dynamics, rather than obsessing over intraday moves, headlines, and substantial swings in sentiment.

This is a bull market.

We’ve been in one for more than 2 years.

Historically, betting on the end of a bull market isn’t practical or profitable, because we know for a fact that asset prices trend and that markets historically grind higher by climbing a wall of worry.

Of course, that doesn’t mean that we should be dismissive of short-term headwinds or material changes in the market’s risk appetite; however, it’s vital to focus on the weight of the evidence.

And the weight of the evidence proves, undeniably, that we’re in a bull market.

Before we dive into this premium report, I also want to remind you that I shared new video analysis with premium members on Friday morning, which you can watch here.

Let’s begin…