Sharing A New Stock Market Signal

Investors,

I’m going to analyze a rare stock market signal in this report, but first…

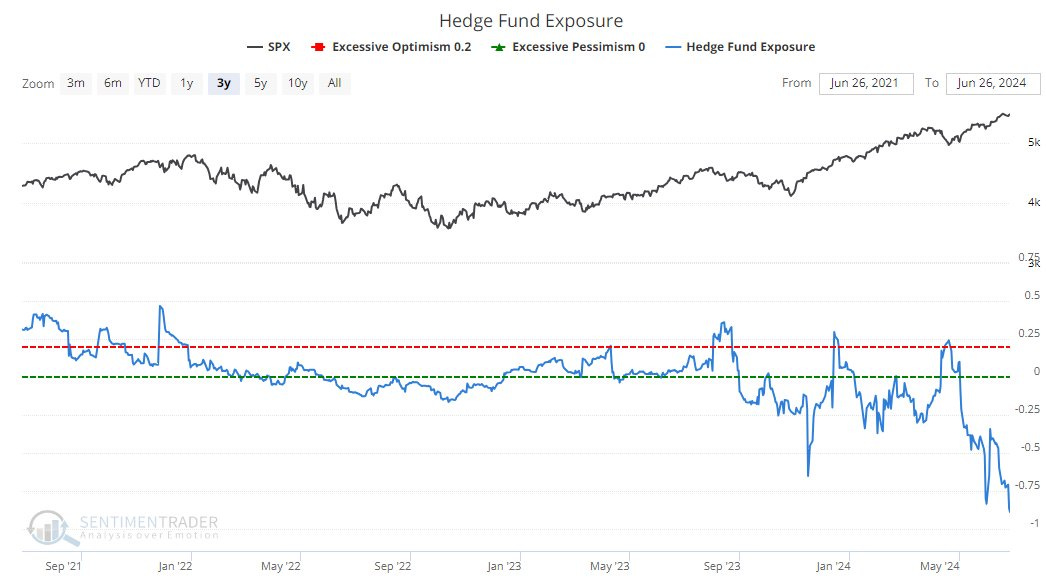

Hedge funds currently have their lowest exposure to the stock market in years.

Typically, pessimism is found during harsh market conditions, as we saw in 2022 and Q4 2023; however, the current degree of pessimism is more significant than those prior periods and also more severe.

Yet the S&P 500 just had its highest monthly and quarterly close of all-time.

The index, comprised of the best & largest companies in the entire world, is officially up +14.5% in the first half of 2024, with a total return (incl. dividends) of +15.29% YTD.

While some folks will retort that it’s only the Magnificent 7 who are moving higher, a quick glance at the data will easily debunk this myth, as the S&P 500 ex-Mag 7 return is +6.27% YTD. In other words, the S&P 493 is producing an annualized return of +12.93% so far in 2024, decisively outpacing the average calendar year return of the S&P 500 post-WW2 (roughly +9% per year).

So yes, the Magnificent 7 are outperforming the market (as they should), but that doesn’t mean that the “rest of the market” is weak. On the contrary, the rest of the market is outperforming the average calendar year return!

Personally, I think poor sentiment is reflective of the fact that breadth isn’t strong (though it has been improving), but I think it’s important to acknowledge that weak breadth is very different from a weak market, so long as the market continues to grind higher.

The fact of the matter is that the market does continue to grind higher.

My personal belief continues to be that mega-cap stocks and technology stocks will act as the primary source of alpha in the market, generating outperformance; however, I can’t help but wonder how the market will perform if/when sentiment improves and breadth materially strengthens.

Based on the current level of positioning, as cited in the chart from SentimenTrader above, hedge funds are currently underexposed to the market and would need to allocate substantially in order to realign with the market trend. Their reallocation, in and of itself, could help to catalyze a substantial move higher in U.S. equities.

Wouldn’t that be interesting…

In the remainder of this report, I’ll highlight even more important market dynamics that are currently unfolding, sharing the key information that I’m personally using to understand market trends and probabilistic outcomes.

In fact, I’ll be sharing a new & original study for the S&P 500 in this report, designed to understand how similar market environments in the past have performed going forward in order to forecast what could happen next for the current market.

I share these premium reports every Sunday, exclusive for monthly/annual members, who also receive a variety of other benefits. To unlock this report, past reports, and to access future premium reports, consider upgrading to a premium membership today.