Investors,

For years, we’ve heard about “cracks in the labor market”.

This theme became increasingly popular in the 2nd half of last year, particularly once the Federal Reserve started to cut interest rates in September. Pundits began to shout that these apparent cracks would create massive fissures across the economic system.

But where are those fissures?

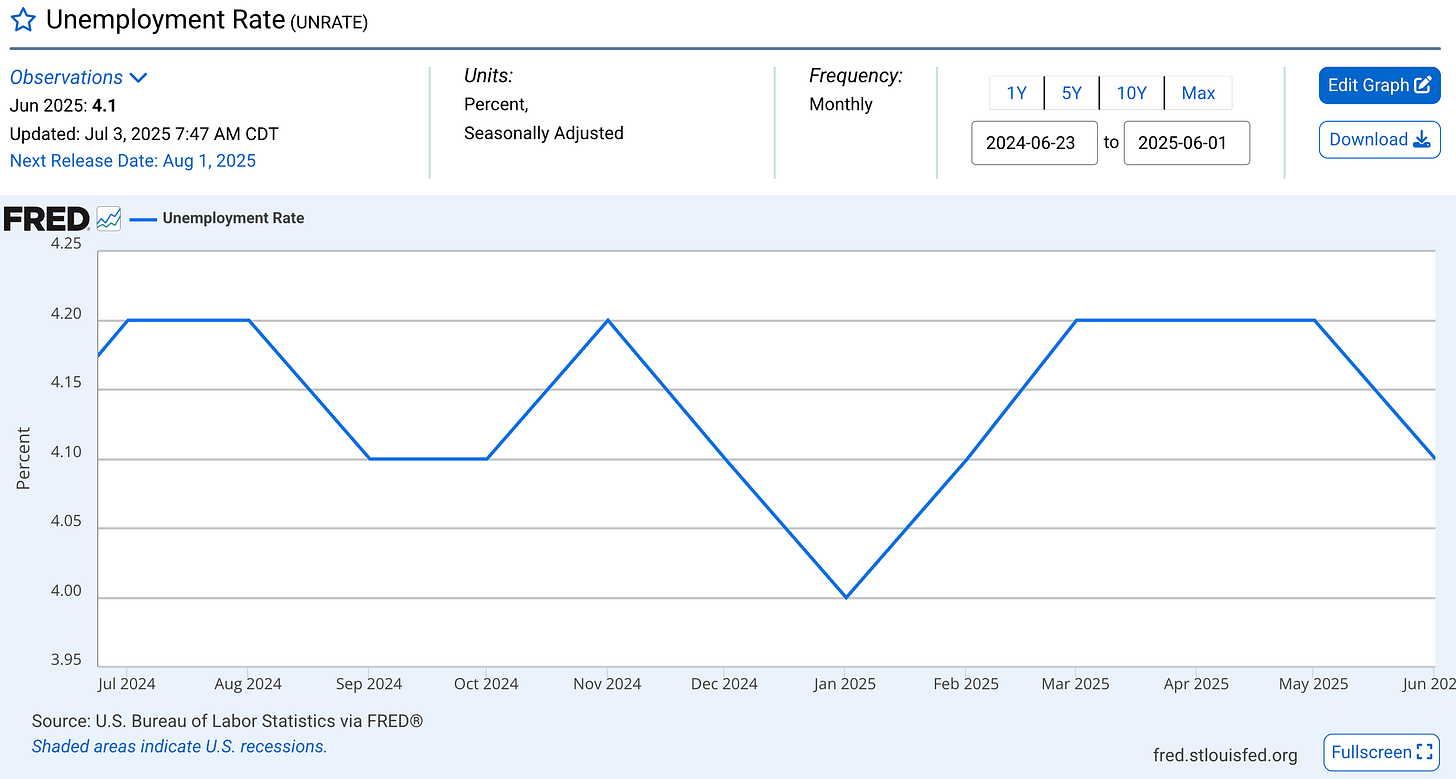

The unemployment rate over the past 12 months has averaged 4.14%.

The min/max range of the unemployment rate is [4.0%, 4.2%], highlighting the stability of the labor market over the past 12 months (and even longer than that).

The nonfarm payrolls data, even after revisions, continues to produce solid results:

Latest NFP job figures = +147,000 in June 2025

3-month average job creation = +149.67k jobs/month

6-month average job creation = +130.3k jobs/month

12-month average job creation = +234k jobs/month

Sure, multiple jobholders who are working two part-time jobs is on the rise since COVID, but it’s merely back on track with the trend that began in the year 2000!

But we must consider the fact that, while the number of people working multiple jobs has increased, the size of the labor market itself has also increased! Therefore, it’s appropriate to consider that multiple jobholders as a percent of the employed is 5.4%.

The employment level for part-time work due to economic reasons remains low, highlighting limited stress in the economic system that would otherwise force people to work several part-time jobs because of a lack of opportunity or weak income.

Wages continue to produce solid growth, on both a nominal and real basis.

This is average hourly earnings ($) divided by the Consumer Price Index:

Nominally, wages are growing at +3.7% YoY according to this datapoint.

Meanwhile, the Atlanta Fed’s Wage Growth Tracker is showing nominal wage growth of +4.3%. While this figure has certainly decelerated from its post-COVID peak, it’s higher than any result in the 2010-2020 period.

So where’s the stress? Where are the cracks? When will the fissures appear?

My bet over the past several years has been simple: the labor market (and the broader economy) will continue to be resilient & dynamic, despite some pockets of weakness.

The fact of the matter is that every single macroeconomic environment ever has been imperfect, with identifiable characteristics that were soft (and/or softening) or even outright weak. Focusing on individual data to make economic conclusions is a foolish way to pursue economic analysis. Instead, we must take a “weight of the evidence” approach, unveiling consistency across multiple datapoints.

Because, even in a resilient & dynamic economic environment, weak points do exist!

But should we focus on the outliers of weakness, or the consistent factors which generally show that the labor market is both robust and solid?

Only one of these options has worked.

As many of you know, I’m an economist because of my academic background.

But my primary goal as an investor is to make money in the market, which means that I’ve had to re-learn how to apply economic analysis to become a better investor.

In reality, most investors would be better off if they didn’t focus on macro at all.

Thankfully, the macro analysis that I’ve implemented over the past few years has only kept us in the market to enjoy the fruits of our labor in terms of the technical analysis that we use to make actual investment decisions.

Macro conditions don’t need to be perfect in order to make money in a bull market.

So let’s keep making money, by focusing on TA and risk management.