Prime Conditions Are Here

Investors,

The S&P 500 has made new all-time highs in 13 of the past 14 weeks.

In this environment, we’ve seen the Dow Jones Industrial Average, the Nasdaq-100, and even the Russell 2000 also make new all-time highs, illustrating the broad-based nature of this rally.

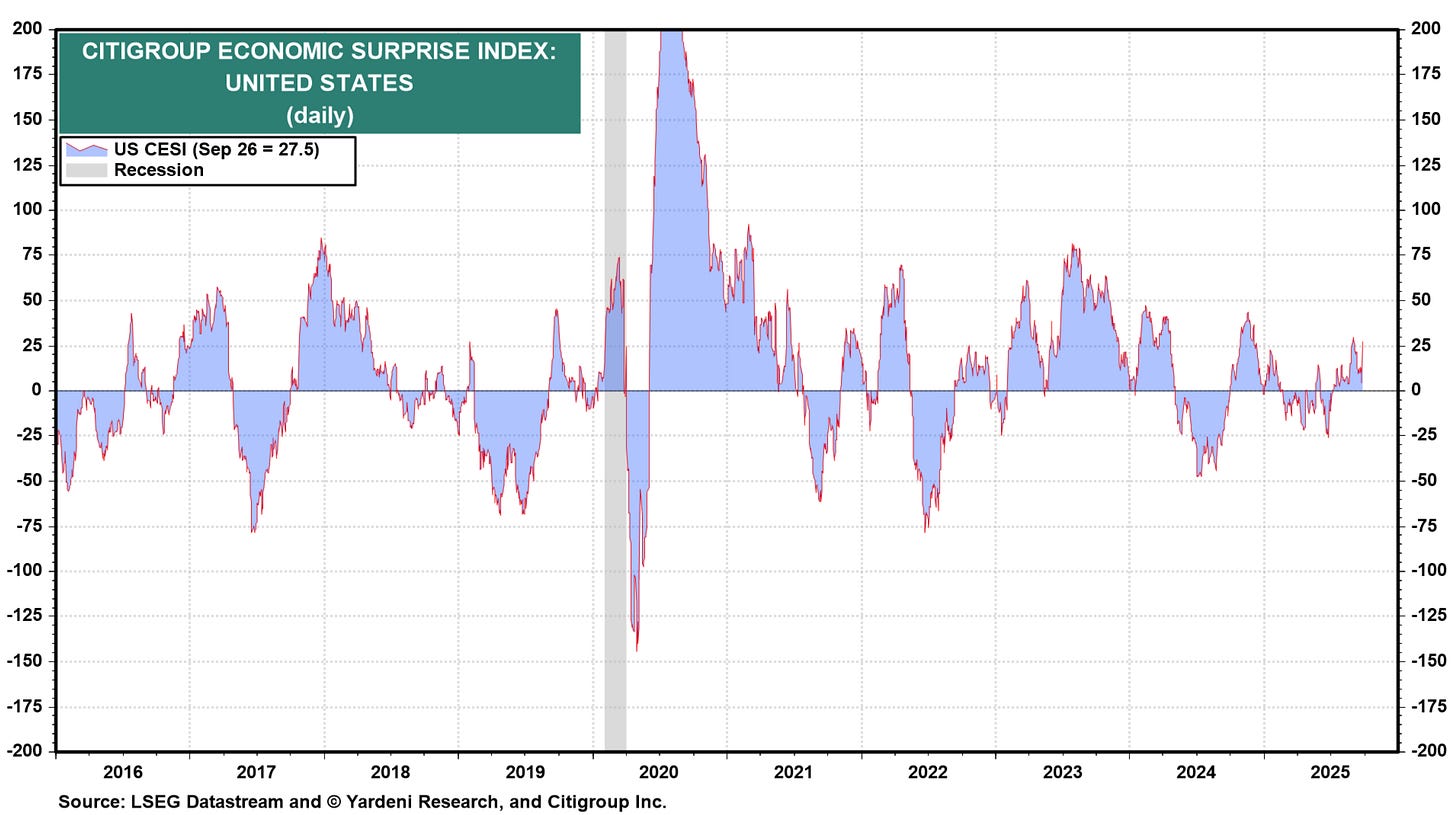

This is happening, in part, due to the fact that economic data continues to surprise to the upside, according to the Citigroup Economic Surprise Index:

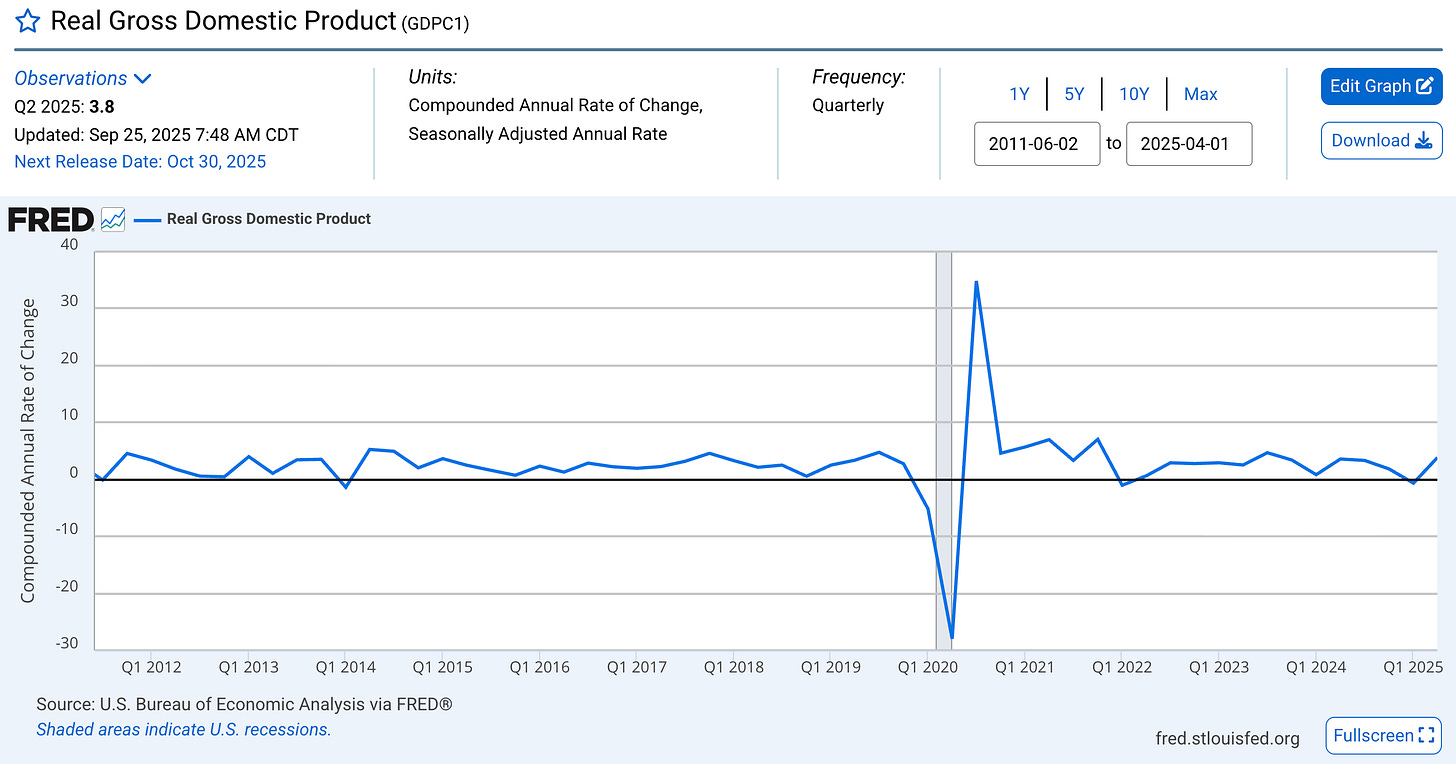

In recent weeks, we’ve received hotter than expected retail sales, lower than expected unemployment claims, stronger than expected industrial production, better than expected manufacturing activity from the Philadelphia Fed region, and Q2 2025 real GDP results that were revised up from +3.3% to +3.8% (annualized).

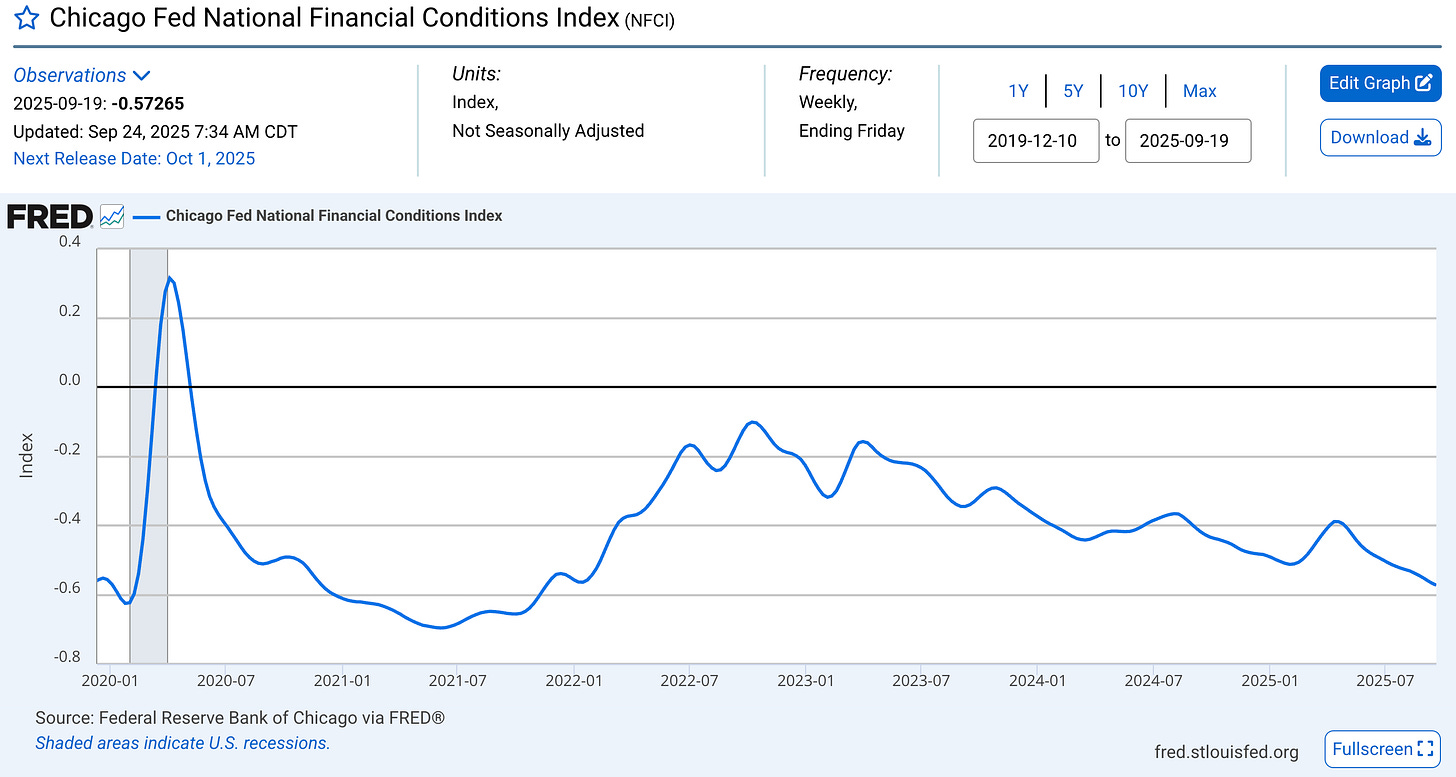

All of this in an environment where financial conditions are continuing to ease, at least according to the Chicago Fed’s National Financial Conditions Index (NFCI):

Why is this datapoint so important, particularly in the context of solid macro data?

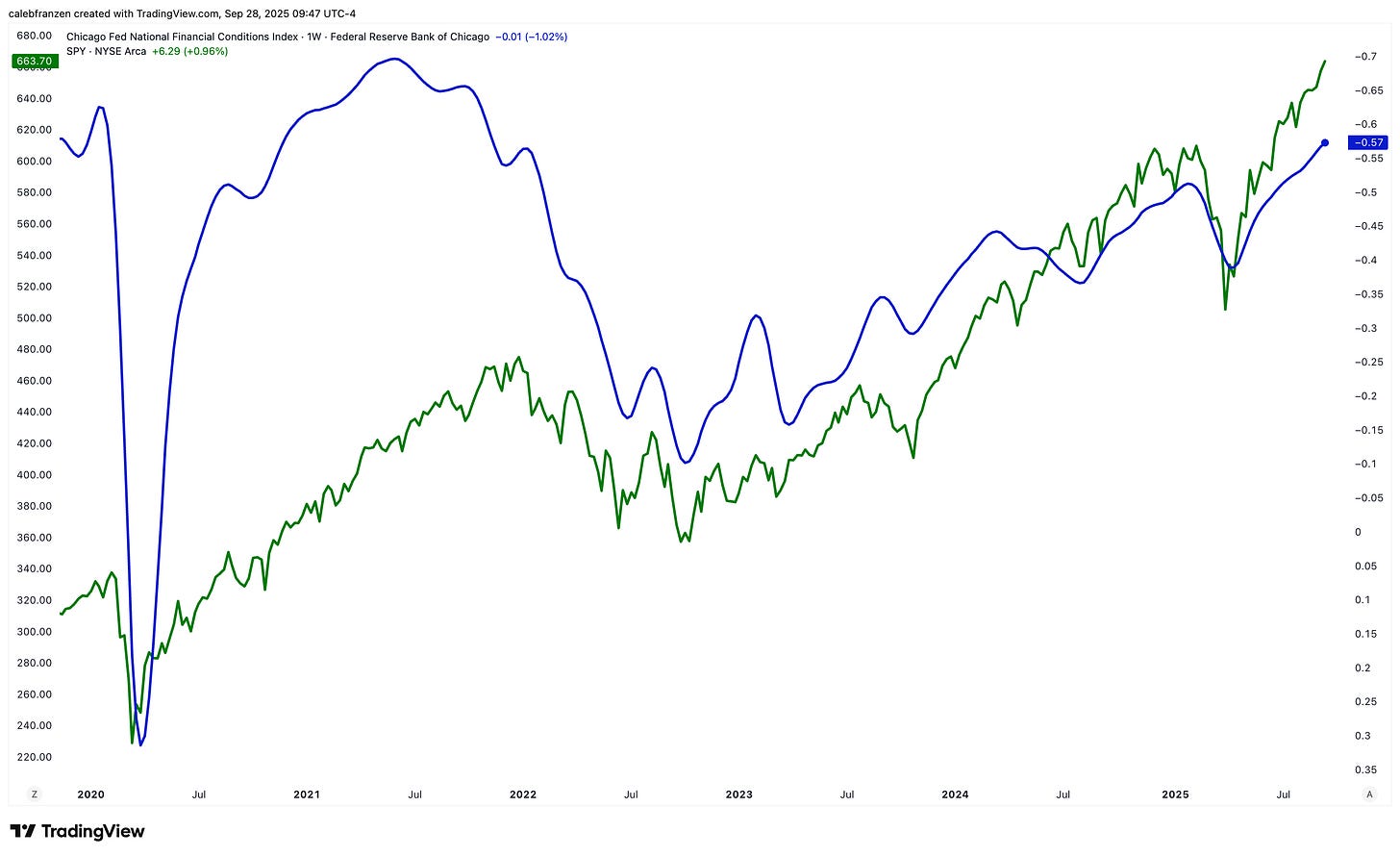

Because look at the inverted version of the NFCI alongside the S&P 500:

With the Fed cutting rates, macro datapoints showcasing their resilient & dynamic nature, and bank credit accelerating, we have prime conditions to allow for a further easing of financial conditions and an extension of the uptrend in equities.

We don’t need to make the game of investing more difficult than it needs to be.

But I continue to see constant pessimism, doubt, & people willing to fade the uptrend.

Instead of fading the uptrend, I’d rather recognize that the best path forward is to stay aligned with the uptrend, because it’s de facto the best possible way to ensure that my net worth is also in an uptrend.

Isn’t that the goal we have as investors?

Thankfully, that’s the purpose of these premium reports… to highlight the exact trends, relationships, strategies, and indicators that I’m using to achieve that goal.

In the remainder of this report, I’ll share 14 other charts related to Bitcoin, crypto, and the stock market that I’m closely monitoring as we head into the upcoming week.

Let’s begin…