Investors,

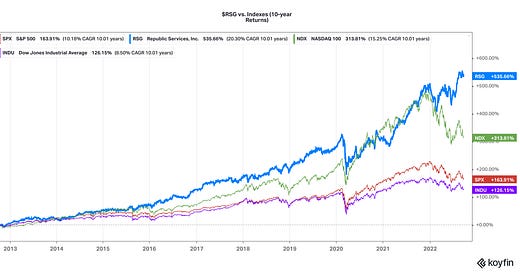

Welcome to the second edition of “Portfolio Strategy”, where I share and analyze the investment thesis behind each of the 15 stocks & ETF’s that I’ve been buying in portfolios that I manage! I’m extremely excited to share analysis on the two companies in today’s research report, as most readers have likely never heard of these businesses or ever considered investing in them. These are boring businesses that have outperformed the Dow Jones, S&P 500, and Nasdaq-100 over the past 5 and 10-year periods.

Considering that I’m trying to build exposure to long-term positions that have the potential to outperform the broader market, the fundamental tailwinds of these companies, the recession-proof nature of their businesses, and their track record of generating shareholder value make me confident that these two stocks belong in my long-term portfolio.

If you’re a new premium member and missed the first edition, I’d strongly encourage you to read it here:

These exclusive reports are distributed every other Wednesday, until each stock has been analyzed. The final edition will highlight the various other stocks that I love as long-term prospects, but didn’t make the cut in the primary list of 15 stocks & ETF’s. At the end of the day, we have limited capital with which to invest and limited portfolio slots to allocate into. It’s up to each individual investor to build the conviction necessary to hold an individual stock for the long-run.

If you aren’t already a premium member, but you’d like to read these exclusive research reports, please consider upgrading your subscription using the link above!

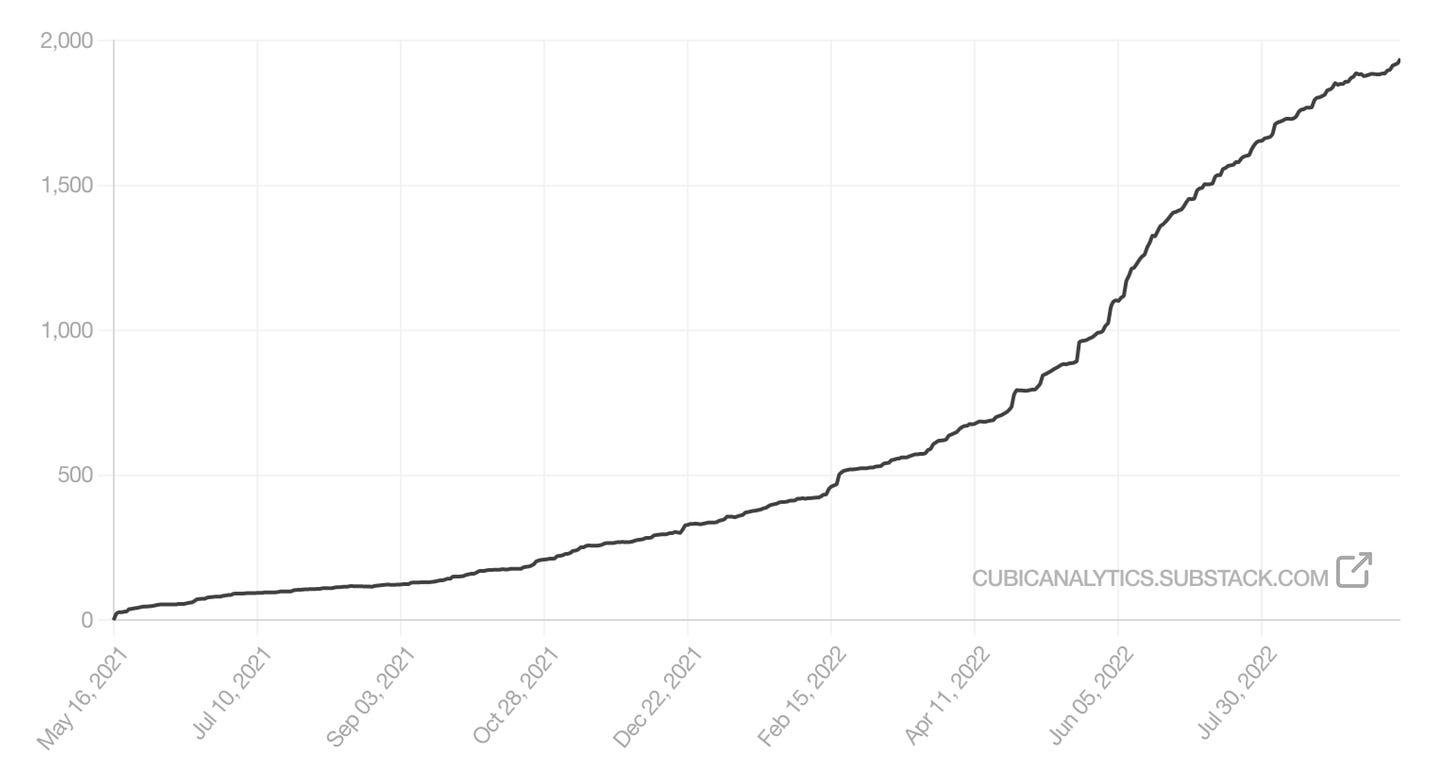

As a final item before diving into the analysis, today is the two-year anniversary of quitting my corporate banking position as a portfolio analyst and leaving San Francisco to launch Cubic Analytics. After launching the Cubic Analytics newsletter in May 2021, we’ve grown to a community of 1,950+ institutional and retail investors:

It’s been an absolute pleasure to share my market perspectives with each of you, and I’m honored at the rate of growth we’ve been able to achieve over the past 18 months. Your support, attention, and trust in me keeps me extremely motivated, and I can’t wait for the growth to continue!

With that out of the way, let’s jump straight into “Portfolio Strategy Pt. #2”: