Investors,

In a world of high interest rates, stock market investors are tasked to find quality alternatives to Treasuries or money market funds if they want to achieve yield and investment income in equities. Utilities might be too boring (and carry capital depreciation risk), while Real Estate Investment Trusts might offer too much risk in a world where investors are concerned about commercial real estate.

That’s why I’m excited to introduce Austin Hankwitz from Rate of Return, a seasoned investor and friend of Cubic Analytics, who’s crafting a remarkable $2 million dividend growth portfolio from scratch!

Austin’s latest gem is $QQQI, the NEOS Nasdaq-100 High Income ETF.

With its covered call strategy on $QQQ, the NEOS team is reshaping how investors can generate income, while providing exposure to the Nasdaq-100 at the same time!

Check out Austin’s latest piece below for a full review on this game-changing ETF!

Austin’s newsletter, Rate of Return, is a must-read and I encourage everyone to check out his recent deep-dive on QQQI and sign up for his excellent research!

We had a jam-packed week of new macroeconomic data and important market dynamics, including a potential inflection point in the path of inflation, so let’s jump straight into this week’s edition of Cubic Analytics:

Macroeconomics:

For two straight months, we’ve seen notable misses with respect to CPI inflation where the year-over-year (YoY) results have come in higher than estimates.

While January 2024 data showed that YoY disinflation was still intact, the February data shows that one of two things are true:

YoY CPI inflation is stabilizing around current levels, above +3%.

YoY CPI inflation is reaccelerating, potentially ending the trend of disinflation.

Or perhaps this isn’t a binary outcome and both are valid & true.

When I analyzed the latest CPI data for February, which you can read here, it’s clear that there is an abundance of disinflation. On the other hand, some components are reaccelerating, while there’s another basket of components that are still experiencing outright deflation.

The February data was a mixed bag, making it difficult (if not impossible) to reach a decisive conclusion about how inflation dynamics are evolving and how they are likely to evolve going forward… nonetheless, I will try my best.

As always, the topic of disinflation is nuanced and therefore requires a nuanced analysis of the data in order to reach difficult conclusions.

These are the top charts from the CPI data that you need to see and know about:

1. Median CPI, trimmed-mean CPI and core CPI inflation all decelerated:

🟠 Median CPI inflation was +4.58% YoY, down from +4.85% in January.

🔵 Trimmed-mean CPI inflation was +3.51% YoY, down from +3.67% in January.

🟣 Core CPI inflation was +3.75% YoY, down from +3.86% in January.

In each of these cases, disinflation is intact and highlights how broad-based measures of inflation are continuing to show that YoY price increases are decelerating, despite the fact that headline CPI accelerated to +3.15% vs. prior results of +3.09%.

2. Energy inflation was the driver for the re-acceleration of inflation in February:

Given the fact that headline was the only major broad-based component to increase, the logical conclusion is that Energy was the predominant force behind the re-acceleration.

We can verify this in two ways: Headline CPI ex-Energy & Services CPI ex-Energy.

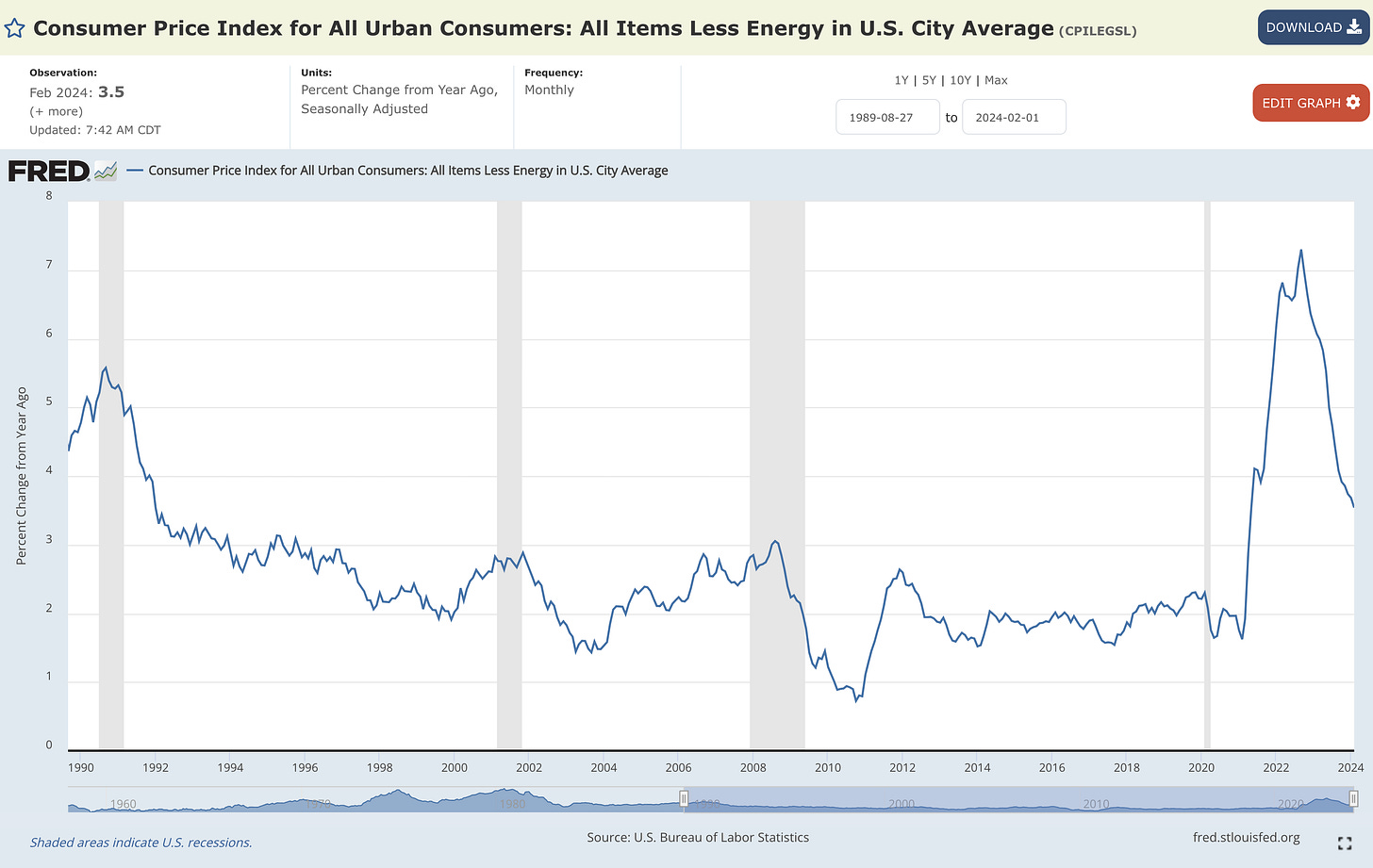

Headline CPI ex-Energy inflation was +3.5% YoY, down from +3.7% in January:

Services CPI ex-Energy inflation was +5.2% YoY, down from +5.4% in January:

Given the deceleration in these two important measurements, it becomes increasingly clear that non-energy consumer prices continue to experience disinflation.

I’m not saying that energy isn’t an important variable; however, energy is extremely volatile and uncertain. Consider the fact that crude oil has risen +19.5% since mid-December 2023 and that broad-based measures of commodity prices (like $GSG) have risen more than +12% over the same time period. These are drastic and fast increases, which are therefore having a direct impact on inflation dynamics, but are not guaranteed to remain on the recent trajectory.

This is the same message that I shared in Q3 2023 when crude oil gained +40% in three months, saying that energy prices would be volatile and weren’t guaranteed to keep rising. As we know, crude oil went on to fall -29% from September 2023 to December 2023, and the trend of disinflation resumed.

While the recent rise in energy prices is a concern (and certainly impacting headline CPI dynamics) I think it’s important to understand how non-energy components are evolving because the future trend of energy & commodity prices isn’t certain.

If non-energy components are still showing disinflation and then energy prices trend lower, then the disinflationary trend will continue to stay intact. If those energy prices increase in the months ahead, that could create a ripple effect & make inflation sticky.

I don’t have a crystal ball to know what crude oil will do next, so that’s why it’s important for me to understand how non-energy components are evolving on a YoY basis. As far as I’m concerned, these components are still showing disinflation and I think that’s good news.

3. Shelter, the largest & laggiest component of the CPI, continues to decelerate.

Shelter inflation was +5.75% YoY, down from +6.1% in January.

It’s still extremely elevated, but will continue to trend lower over the course of the next 6-12 months based on the proven lag effects of Owners’ Equivalent Rent vs. private market housing & rental data.

While the datapoints discussed above are encouraging & continue to indicate that disinflation is intact, there are two datapoints that I want to highlight which are posing a significant threat to the disinflationary trend:

1. Services ex-Shelter inflation is (and has been) reaccelerating substantially.

The latest result showed that Services ex-Shelter inflation was +3.9% YoY, up from +3.6% in January. After bottoming in September 2023 at a pace of +2.75% YoY, we’ve seen a notable & rapid re-acceleration in this particular datapoint. Given that the majority of the U.S. economy is service-based, this is not a good sign whatsoever.

2. Producer Price Index inflation is also re-accelerating, having implications for CPI:

🔵 PPI Final Demand YoY = +1.55% YoY (up from +0.95% in January)

🔴 Headline CPI YoY = 3.15% YoY (up from +3.09% in January)

Given the correlation between producer prices and consumer prices, in which producer prices (inputs) are a leading indicator for consumer prices (outputs). Given this sharp acceleration in PPI for final demand, this could create a ripple effect in the months ahead for CPI.

Both of these datapoints are giving me the greatest concern with respect to the disinflationary trend, potentially indicating that we’ve reached an inflection point in the current trend and that inflation could prove to be either stickier or higher than I had anticipated.

Remember, disinflation does not mean that prices are falling, but that prices are simply rising at a slower pace, closer to the Fed’s +2% YoY target.

I am “cheering” for disinflation in so far as my belief that it’s better than an alternative scenario where inflation rates continued to accelerate. In a world where the Federal Reserve is inherently aiming to have prices rise by +2% every year, I’ll choose the lesser of two evils where prices are rising at +3% instead of +6%. The Fed is not trying to bring prices back to their pre-COVID levels… they are trying to bring the rate of inflation down to +2% YoY; therefore, our framework for analyzing inflation dynamics must be viewed from this lens where disinflationary progress is the goal.

Stock Market:

There are two aspect that I want to focus on for stock market dynamics:

The first is that breadth showed some signs of deterioration this past week, but generally remains in “good standing”, as far as I’m concerned.

Specifically, I’m citing the chart below, which tracks the percentage of stocks within the S&P 500 that are trading above the following key moving averages:

Top = % of S&P 500 stocks trading above their 20-day moving average

Top middle = % of S&P 500 stocks trading above their 50-day moving average

Bottom middle = % of S&P 500 stocks trading above their 100-day moving average

Bottom = % of S&P 500 stocks trading above their 200-day moving average

All metrics are greater than 50%, indicating that more than half of the index is trading in a bullish formation with respect to their own price action, while 75% of stocks are trading above their 200-day moving average.

As the famous saying goes, “nothing good happens below the 200-day moving average”, therefore, we can invert this phrase and conclude that good things should happen above the 200-day moving average. With 3/4th’s of S&P 500 stocks trading above their 200-day SMA, I think that’s a good sign.

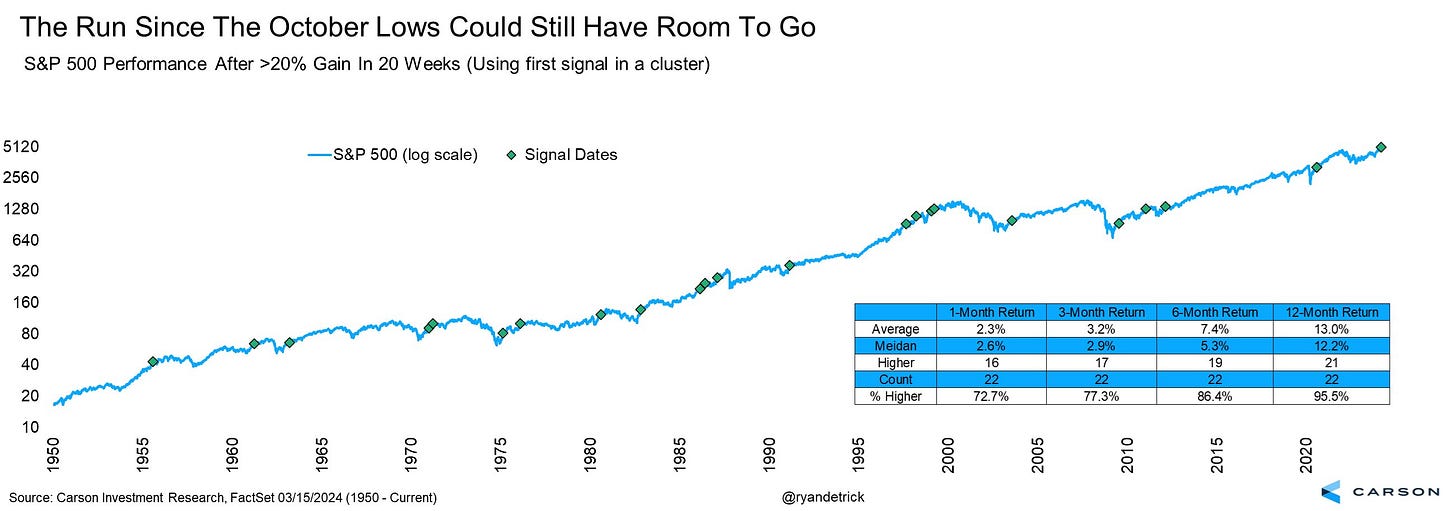

Ryan Detrick, the Chief Market Strategist from The Carson Group, recently published the following study to analyze the implications for the recent strength in the S&P 500:

While some market commentators are concerned that the S&P 500 has gained too much, too fast, data tells us that these types of bullish momentum thrusts are exactly that… bullish!

Generally speaking, these signals have occurred within bull markets and the data indicates that strong forward returns follow this signal. Specifically, the S&P 500 is higher one year later in 95.5% of all times that this signal has flashed since 1950, with an average 1-year return of +13%.

In fact, on a 1-month, 3-month, and 6-month basis, average forward returns are all positive and indicate that the momentum from the preceding 20 weeks helps to maintain the directional uptrend of the market.

Therefore, while the S&P 500 has gained +24% in the past 20 weeks, this is a justification to be bullish in the current environment, based on historical implications.

Bitcoin:

After briefly making new all-time highs this week above $73k, Bitcoin has consolidated since Thursday’s trading session… however, I think it’s vital to add some context to this recent decline.

First of all, BTC is still trading in a bullish formation with respect to its exponential moving averages and the three key ones that I pay attention to:

🔵 21-day EMA

🔴 55-day EMA

🟢 200-day EMA

I personally view all three of these dynamic moving averages as support, particularly because they have a positive slope and have a consistent track record of acting as support during bull market trends.

This latest consolidation has yet to even retest the 21-day EMA (blue), though that’s something I’m certainly prepared for.

If we switch to long-term candles, focusing on the weekly Heikin Ashi candles, we see that Bitcoin’s trend is continuing to be bullish (green candles):

In fact, BTC’s weekly Heikin Ashi candle is tracking for the highest weekly close of all-time and is about to produce the 7th consecutive green weekly candle.

Bitcoin is currently trading just shy of $68,000 per BTC, something that many of us wouldn’t have dared to entertain this time last year. I’m fully aware that a decline from $73k to $68k is uncomfortable and may force people to question their ability to handle volatility, but I think that investors should simply understand the asset that they are investing in and inherently recognize that BTC has always been a bumpy ride.

Get comfortable, or pick a different asset class.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Caleb - great insights - I appreciate your honest appraisal each time you provide your outlook.

I would love to see BTC drop back to the 50's. I was able to make some buys in January - however, would have liked to add more than I was able at the time.

Thanks again!,

Find comfort outside your comfort zone.