Just Admit It

Investors,

You weren’t bullish enough. Admit it.

Even if you were bullish, you still weren’t bullish enough.

Here, I’ll start: even I wasn’t bullish enough.

That’s right — I’ve been the guy talking about disinflation, resilient macro, and the persistent uptrend in asset prices, and even I haven’t been bullish enough.

I’ve mocked bears, debunked their narratives, and provided fact-based evidence to support my bullish outlook on macro, the stock market, and Bitcoin for 18+ months…

And even I haven’t been bullish enough.

If I can say it, so can you. I promise, you’ll feel a lot better after you say it.

On the back of sufficiently strong labor market data, which continues to be resilient & dynamic, the U.S. stock market was able to grind higher. In fact, for the 3rd straight week, the S&P 500 achieved its highest weekly close of all-time!

While the same conspiracies are being thrown around about new labor market data, the market (which inherently contains the aggregate opinions, views, and beliefs of all global participants) is telling us what’s important.

The market is being driven higher by fundamentals, not some manic or crazed sense of euphoria detached from reality, which is consistent with the exact point that I’ve been making for 18+ months.

In this report, I want to debunk the bearish myths about the labor market to make sure that you know exactly what’s going on and so that you don’t fall victim to misleading headlines.

But first…

I want to give a special shoutout to the team at REX Shares and congratulate them on the success of their recent ETFs, the 2x bull/bear MicroStrategy ETFs!

For the aggressive investors/traders who fit the risk appetite of these funds, REX Shares has an exclusive offering that exceeds the 1.75x leverage from their competitor.

Quite literally, there’s nothing else like this on the market.

To learn more, click on the link above, this one, or the banner.

Macroeconomics:

There are several popular myths about the labor market, many of which I’ve debunked already… but I figured that the new round of data gives us another fresh opportunity to debunk them once again.

Specifically, these are the top myths that come to mind:

Job growth is coming from part-time jobs only.

The data is being manipulated and will be revised lower.

Job growth is coming from the public sector, not private enterprise.

Part-Time Jobs Myth:

Yes, part-time jobs are growing… but you know what else is growing: total jobs.

In other words, as the pie gets larger, so do the individual slices.

Per the latest employment report from the Bureau of Labor Statistics (BLS), a grand total of 254,000 jobs were created in the month of September 2024. This was a significant beat vs. the estimate of 140k and the prior month result of 142k.

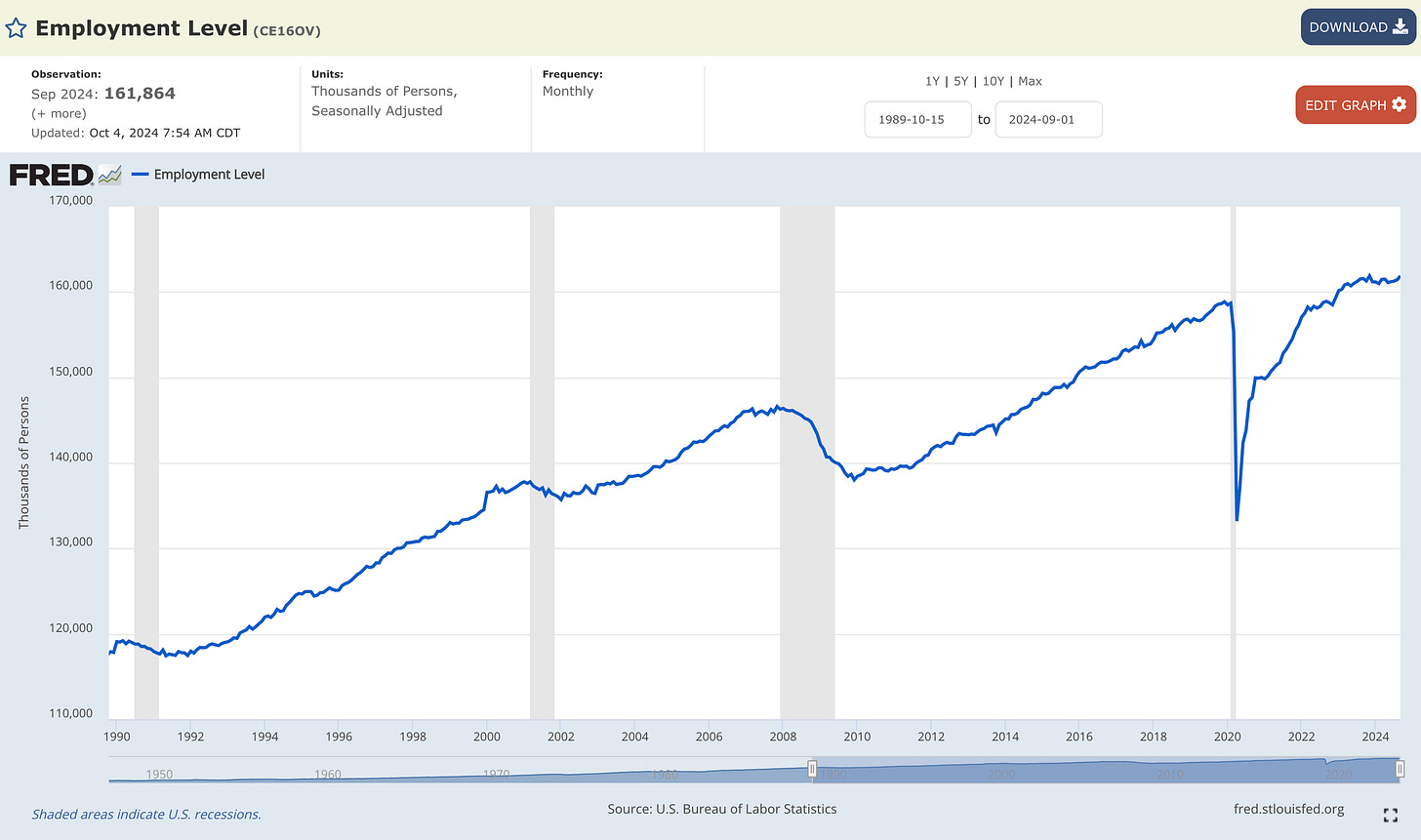

With 254k jobs created, the current employment level is now 161.864M (a record high).

Now of the 161.864M people who are working in the United States, how many of them are working at least one part-time job?

27.19M people, which is roughly 16.8% of the total employment level.

However, and this is key, there are two types of classifications for part-time work:

Part-time for economic reasons: people who work part-time because they cannot find full-time employment or because of unfavorable business conditions.

Part-time for noneconomic reasons: people who work part-time because they have life commitments (like taking care of their parents or children or because they are also enrolled in school).

Therefore, if we’re trying to gauge the health of the labor market and the structural dynamics that are leading to an increase in part-time workers, wouldn’t it be important to focus solely on the “part-time for economic reasons” because this is the cohort that is actually working part-time due to financial & economic stress?

The answer is “yes, absolutely”.

But let’s take a quick look at these two cohorts in order to understand their composition of the 27.19M people who are working at least one part-time job:

Part-time for economic reasons: 4.624M (which is 2.85% of total employment)

Part-time for noneconomic reasons: 22.566M (13.94% of total employment)

So let me get this straight…

Less than 3% of total employment is working part-time jobs due to economic factors?

Yeah, respectfully, I’m not going to fret over that number.

And neither should you.

Of course, as a human, my heart goes out to those individuals who are unable to find full-time employment or having to work several part-time jobs to replicate the income of a single full-time job, but the economist in me cannot be worried about the 3% of the employment level.

But hey, let’s take it a step further and focus on the individuals who are working multiple part-time jobs, as this is an important cohort to focus on if we’re trying to evaluate the economic stress within the labor market.

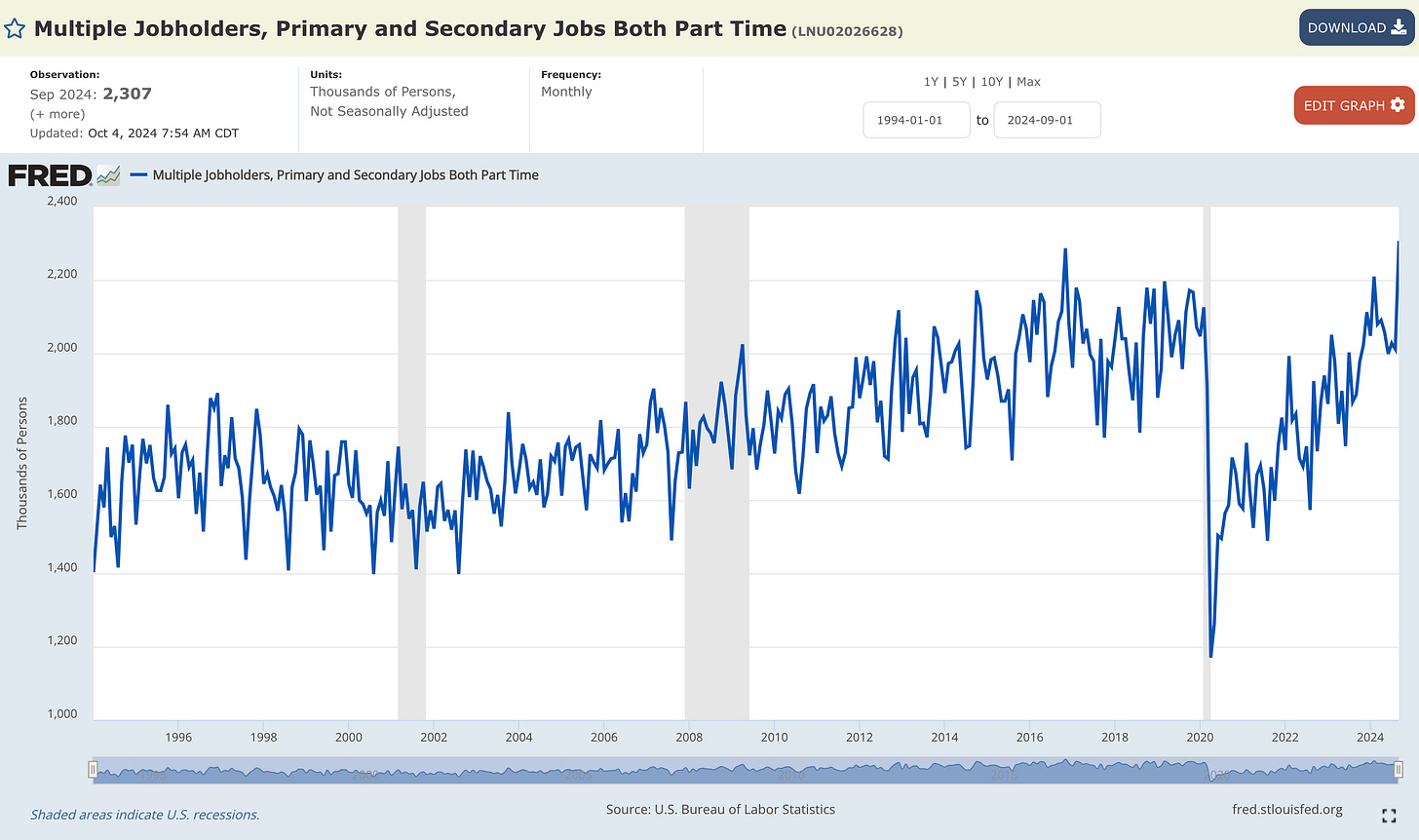

The most recent data shows that there’s a 2.3M people who are working two part-time jobs, which is a new all-time high:

However, as I said earlier, “as the pie gets larger, so do the individual slices”.

So it’s important (if not vital) to evaluate this figure on a relative basis!

The chart below shows multiple jobholders relative to the total employment level:

At 1.425% of total employment, it’s clear that multiple jobholders with two part-time jobs is simply following the historical trend that’s been in place since the year 2000!

So is there anything to be fundamentally worried about regarding the current labor force if we’re simply following the trend of the past ~25 years and only 1.4% of the working labor force is being focused on?

No, there isn’t anything to worry about.

Data Manipulation + Revisions Myth:

One of the bears’ favorite narratives is that the data is being faked & manipulated in order to cover up the weakness of the U.S. economy. As part of this manipulation, which intentionally overstates the amount of job growth, government officials revise the data lower in the future when no one cares and they try to sweep it under the rug.

Ironically enough, whenever the data comes out “bad” or weaker than expected, these same bears & Doomers say “see, I told you the labor market was weak!”

In other words, they agree with the data when the data is weak, but claim that it’s manipulated when the data is strong.

So which one is it?

But hey, aside from the intellectual dishonesty, let’s talk about the actual numbers.

Again, nonfarm payrolls increased by 254k jobs in September 2024.

The BLS also published revisions for the July & August 2024 data too, showing:

July 2024 job growth was revised higher by 55k, from +89k to +144k.

August 2024 job growth was revised higher by 17k, from +142k to +159k.

In other words, over the past 3 months, average monthly job growth is +185.67k.

Read that again.

Of course, the narrative that I was seeing throughout Friday was “just wait until next month when they revise this number lower!”

First of all, that isn’t promised. As we just saw, July & August were both revised higher substantially.

But, for the sake of discussion, let’s assume that next month does get revised lower.

In fact, let’s assume that it gets revised much lower, with a -100k adjustment.

If that scenario happens, then job growth in September will be roughly +150k jobs.

Does that sound like a recession to you?

Does that sound like a weak labor market to you?

It sure doesn’t to me.

It’s like a month and a half ago when everyone was panicking about the 12-month revision of -800,000 jobs, which was the largest downward revision since 2009.

I felt like I was the only person to see the reality of the situation, which I outlined in the post below:

Again, context is key.

Revisions are going to happen.

It’s anyone’s guess if the numbers get revised higher or lower.

If the data gets revised lower, then there’s a 99% chance that it still shows job growth.

That’s what’s important.

Government Jobs Myth:

Let’s assume that the bears/Doomers are right and that the BLS data is manipulated for the sake of the government trying to pull the wool over our eyes.

But what about data from private institutions, like the world’s largest payroll company Automatic Data Processing Inc. (ADP), which is a $116Bn publicly traded human resource software stock.

Surely, they aren’t in on the fugazi.

Why is this important?

Because they also publish monthly data about how many new payrolls were added, specifically for the private sector (aka non-government or public sector jobs).

So what are they saying about the U.S. labor market?

According to ADP, a record 132.589M jobs existing during September 2024, a monthly increase of +143,000 jobs vs. August 2024.

This is a new all-time high in private employment.

Boom, end of story.

In conclusion, context is key.

A certain cohort of investors/analysts have been citing cracks in the labor market for 18-24 months (and some have been saying this for years), yet those “cracks” are overly exaggerated and haven’t actually produced any material fissures in the labor market.

While some of their concerns are true, they lack context and intellectual honesty; however, most investors are too naive to know any different and take these warnings at face value without digging deeper.

Thankfully, I have an obsession with details.

I’m willing to spend hours diving into the data, analyzing individual slices and aggregate components on a relative basis in order to determine, with some degree of confidence, truth.

That’s what I’ve been doing and that’s what I’ll continue to do, showing you exactly what I’m seeing and why I think it’s important so that you can stay ahead of market trends.

If you enjoy this type of analysis, but want to see more market-related implications and investing analysis, I encourage you to upgrade to a premium membership of Cubic Analytics. In doing so, you’ll unlock a variety of benefits and join a team of 720+ investors who are part of the premium team.

In fact, since you made it all the way to the end of this report, I want to offer you a special discount to join the team. You’ll receive tomorrow’s weekly premium edition of Cubic Analytics, where I’ll be sharing key market insights with you.

Don’t hesitate to reach out if you have any questions.

Best,

Caleb Franzen,

Founder of Cubic Analytics

This was a free edition of Cubic Analytics, a publication that I write independently and send out to 11,000 investors every Saturday. Feel free to share this post!

To support my work as an independent analyst and access even more exclusive & in-depth research on the markets, consider upgrading to a premium membership with either a monthly or annual plan using the link below:

SPONSOR:

This edition was made possible by the support of REX Shares, a financial services and investment company that creates an array of unique investment products and ETNs.

I first collaborated with the REX Shares team in 2023 because I’ve been using their products as trading vehicles since 2022 and it was an organic & seamless fit. They have a unique product-suite, ranging from leveraged products, to inverse products, and income-generating products.

They recently listed their brand new and unique funds, providing directional leveraged exposure to Microstrategy. Whether you’re a bull or a bear on BTC or MSTR, these funds could provide significant opportunities, especially because there’s nothing like it in the rest of the market.

Please follow their X/Twitter and check out their website to learn more about their services and the different products that they offer. The REX Shares team did not have any say about the specific language, analysis, or commentary contained in this report

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.

Lights-out analysis 💥

Hi Caleb! I recently joined your premium membership. I wanted to ask you, where did you get the number of part-time for economic reason employees? Where I can see the evolution of that number? Thank you, very good analysis.