Investors,

After publishing yesterday’s edition, where I highlighted

’s analysis of the ISM Services Prices Paid vs. CPI inflation, I decided to go even deeper into this relationship. The goal: what is the real economy, particularly the services economy, telling us about where inflation is likely to go.The answer: more disinflation.

No, I don’t mean deflation (where prices fall).

I mean disinflation (where prices rise at a slower pace than before).

The various components of this chart indicate that CPI inflation is going to decelerate further, implying that more disinflation is around the corner. Thankfully, there’s substantive history & evidence to strengthen this outlook, purely based on the data.

With June’s CPI and PPI data set to be released this upcoming week, this report will serve as a full preview of CPI data and my exact expectations, based purely on economic data. I will also dive into key internal data for the S&P 500 and highlight the key price structure that I’m watching this week as key risk-on & risk-off signals.

CPI Deep-Dive:

There have been four primary components for my analysis of inflation dynamics:

Commodities

Supply Chains

Credit creation

Wages

Let’s discuss each of these components and highlight the different dynamics that I’m seeing.

1A. Commodities - Average monthly price of crude oil:

In June 2023, the average monthly price of crude oil was $70.25 vs. $71.58 in May 2023. That represents a month-over-month (MoM) decrease of -1.9%, which is deflationary MoM. On a year-over-year (YoY) basis, the average monthly price of crude oil fell -38.8%, which is also deflationary on a YoY basis. This YoY figure (chart below) represents a new cycle low, a steeper contraction from May 2023’s -34.7% decline.

In fact, the average monthly price of crude oil has been contracting on a YoY basis since January 2023, helping to fuel consistent disinflationary data all year.

1B. Commodities - The S&P Goldman Sachs Commodity Index $GSG:

There are certainly more commodities than only crude oil, so it’s vital to keep a pulse on how the broader basket of commodities is performing. Unfortunately, I’m not able to calculate the precise YoY change in the monthly average; however, I can try to get some meaningful data using common sense. In the chart below, I’m highlighting the windows of June 2022 vs. June 2023:

Commodities, on the aggregate, are clearly lower this June relative to last June. You’ll even notice that the absolute peak of commodities occurred last June! Therefore, I certainly expect YoY declines in commodities to be at their largest in the June CPI print, helping to produce broader disinflation amongst the entire basket of consumer goods & services.

If I just estimate the mid-point of each of these ranges and compare YoY, my best guess is that commodities fell roughly -21% YoY.

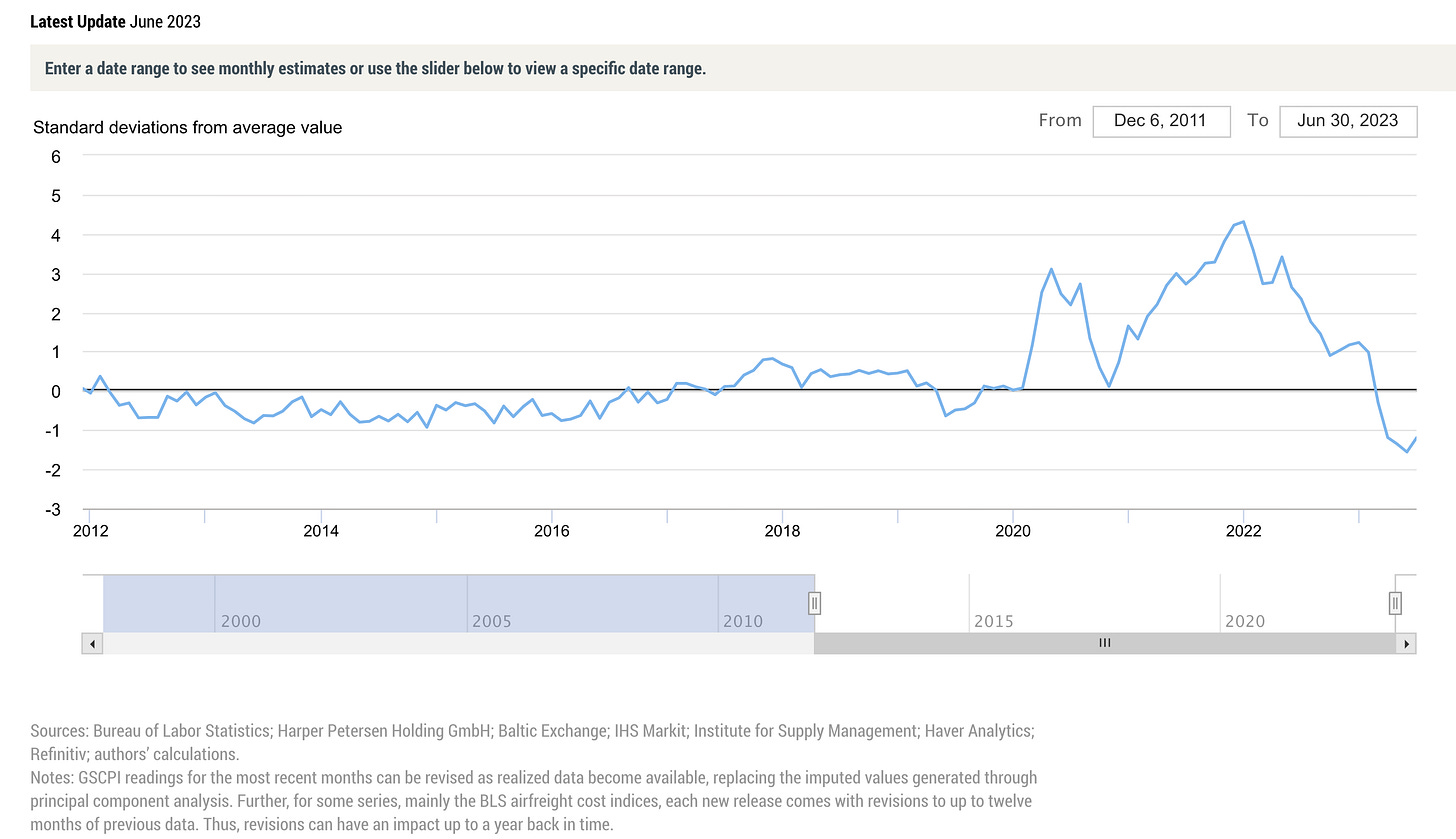

2A. Supply Chains - Global Supply Chain Pressure Index (GSCPI)

Thankfully, the New York Federal Reserve publishes monthly data on supply chain bottlenecks (or the lack thereof) via the GSCPI. It’s an interesting measurement, calculating where current supply chain bottlenecks are relative to their average, reported as a standard deviation. A positive/high number means that supply chains are more constrained than their historical context. A negative/low number means that supply chains are “easy” and unconstrained relative to their historical context.

So what’s the GSCPI telling us? Supply chains are historically loose.

The latest monthly data for June ticked up vs. May’s near-record low, but the result was -1.2 standard deviations. This is still an extraordinary result, certain to produce strong YoY disinflation.

2B. Supply Chains - Drewry World Container Index:

Supply chain bottlenecks are one thing, shipping prices themselves are another. The Drewry World Container Index helps to track this data, measuring the price to ship a container from a variety of ports to a variety of destinations, on the aggregate. It continues to plummet and was hitting new 1-year lows throughout the month of June.

Some U.S.-related ports in particular are down substantially YoY:

Shanghai → Los Angeles: -78% YoY

Los Angeles → Shanghai: -32% YoY

Shanghai → New York: -75% YoY

New York → Rotterdam: -41% YoY

Rotterdam → New York: -71% YoY

Looks like deflation to me; however, I want to be clear that I merely expect this to produce strong disinflation for the broader CPI basket.

3. Credit Creation - Loans & Leases from U.S. commercial banks:

It’s only when banks lend money that the Fed’s stimulus enters the real economy; otherwise it just remains trapped within the financial/banking system. Measuring the rate of credit creation (loan growth) is a vital tool to be able to monitor how much money is entering the economy, particularly on a relative basis.

That’s why I track YoY loans & leases in bank credit.

Thankfully, I predicted this deceleration in February and we continue to see evidence that credit creation is decelerating on a YoY basis (the same way that CPI inflation is decelerating on a YoY basis).

When measuring the average monthly amount of loans & leases, June showed an increase of +6.5% YoY vs. May 2023’s result of +8.1%. That’s a massive deceleration!

As credit creation decelerates (which it is), my view is that inflation is likely to decelerate (aka disinflation).

4. Wages - Average hourly earnings all employees:

On a YoY basis, average hourly earnings have stabilized right around +4.4% for the past several months and remains historically elevated.

However, I’m not concerned about this stabilization. Why?

The result for the YoY percent change in average hourly earnings was +4.4% in January 2023, when YoY CPI inflation was +6.35%.

In May 2023, the YoY percent change in average hourly earnings was +4.4% and the YoY CPI inflation was +4.0%.

In other words, we’ve seen clear evidence of disinflation despite a stabilization in nominal wage growth. It’s that simple.

Tying it all together:

Now that we’ve analyzed each of the four components that are fundamentally impacting inflation from a pure economic perspective, I think it’s 100% clear that we’re going to witness a massive deceleration in YoY CPI inflation from +4.0% in May 2023 to perhaps +3.0%.

Median estimates are currently projecting for a YoY headline CPI of +3.1%.

I think we come in lower than that.

Structurally, there are an abundance of aspects certain to produce disinflation in the months ahead, including:

Credit creation is rapidly decelerating

M2, reserves, and deposits are all contracting

Supply chain bottlenecks have evaporated in 2023

~350bps of hikes haven't impacted the economy yet

Wage growth has been normalizing

The quits rate has been normalizing

Commodities will be down YoY, likely through Q3'23

Rents/Home prices are decelerating/declining YoY

Student loan payments will reorient consumption

Even if this month comes in higher than expectations (extremely unlikely), my view is that we are still in a disinflationary trend and that we will be approaching 2% quickly.

S&P 500 Under-The-Hood Metrics:

296 stocks in the index have a positive YTD return vs. 300 last week.

S&P 500 YTD return = +14.58%

250 stocks in the index had a negative weekly return vs. 52 last week.

S&P 500 weekly return = -1.14%

314 stocks are trading above their 200-day moving average vs. 263 last week.

Is the S&P 500 > 200 SMA? Yes.

130 stocks are down at least -20% from their 52-week highs vs. 128 last week.

54 stocks are down at least -30% from their 52-week highs vs. 56 last week.

66 stocks are making new 20-day highs vs. 193 last week.

21 stocks are making new 20-day lows vs. 2 last week.

Net new 20-day highs - new lows = 45 vs. 191 last week.

48 stocks are making new 50-day highs vs. 148 last week.

12 stocks are making new 50-day lows vs. 0 last week.

Net new 50-day highs - new lows = 36 vs. 148 last week.

11 stocks are making new 52-week highs vs. 76 last week.

5 stocks are making new 52-week lows vs. 0 last week.

Net new 52-week highs - new lows = 6 vs. 76 last week.

All in all, I think it was still a good week despite the index’s -1.14% decline.

Despite the index-level decline, exactly half of the index had a positive weekly return. There was a strong improvement in the number of stocks trading above their 200-day moving average. With respect to the number of stocks down at least -20% or -30% from their 52-week highs, these numbers were basically flat week-over-week, highlighting how we didn’t see a significant deterioration in performance.

Then to top it all off, we still had net new highs (new highs - new lows) on each of the short, medium, and long-term timeframes! Net new highs decelerated vs. the prior week’s phenomenal results, but this was likely to happen anyways after last week’s insane results.

Truly, I think this still reflects bullish behavior in the market internals for the S&P 500.

We had a pretty mixed bag in terms of sector relative performance:

However, I think it’s noteworthy that cyclicals were at the top of the space. Utilities (a defensive sector) performed very well, while healthcare and consumer defensive (also defensive sectors) performed terribly. Therefore, I don’t think this divergence is as simply as “defensive” vs. “offensive” sectors of the market and there are perhaps unique weaknesses occurring in healthcare (or perhaps strength occurring in utilities?)

In terms of market cap performance, it’s interesting to see nano caps perform the best:

A nano cap is classified as a stock with a market cap less than $50M, so I literally couldn’t even name one of these companies. This whole graph is a mixed bag, so I don’t want to try and pull a rabbit out of a hat to figure out what the hell took place.

Important Levels to Watch:

My baseline expectation for this week: low volatility in the first half, high volatility in the second half. Expect to see low volume in the beginning of the trading week, as investors don’t want to front-run the CPI & PPI reading. Once these events are over with, particularly the CPI on Wednesday morning, markets will have an ability to move forward.

These are the specific levels, on an index level, that I’m going to be focused on:

1. The S&P 500 and the August 2022 highs: I’ve been pounding the table on this since mid-June and I will continue to do so, so long as it remains relevant.

As of Friday’s close, the S&P 500 would need to fall -2.2% in order to fall below the green zone (peak wick & daily close from mid-August 2022). I’ve also included the 200-day moving average cloud as a way to visualize where the index is trading relative to the past ~9 months. Notice how the EMA (teal) and SMA (yellow) are rising? That’s a great sign.

2. The Dow Jones and the rising support trendline: Structurally, the Dow looks great.

It’s had a choppy year, but the index is up +1.9% YTD and has been trading above the 200-day moving average for the large majority of the year.

Since breaking out of the descending channel last year (which I outlined in real-time), and flipping the 200-day moving average cloud into support (which I also outlined), we’ve seen clear signs that the index is producing higher lows (rising green support trendline). However, we haven’t made higher highs.

I think that could come soon, but there are some key areas to defend:

Price needs to rebound on the green support zone, otherwise;

Price needs to rebound on the 200-day moving average cloud.

These retests could happen this week, but it’s unlikely to see such a significant downward decline to fall below the 200-day MA cloud this week. A breakdown below the green support trendline could foreshadow further weakness; however, it’s valid as support until proven otherwise. “Risky” traders might take an entry on the Dow if/when it retests the green range, with the preconceived plan to sell the position if/when it falls below the trendline.

Conversely, I also want to focus on the grey range. While the S&P 500 and the Nasdaq-100 have both hit new 52-week highs this year, the Dow Jones hasn’t. Breaking above this grey zone would accomplish said feat, which would add further ammo to the bullish case for the market.

Either direction this wedge goes, it looks like we could be in for a massive swing in either direction and we should be prepared as such.

3. Russell 2000 vs. the 200-day moving average cloud: The Russell 2k continues to look like the weakest link from a price structure perspective, though the index has gained +5.8% YTD. Due to a resurgence in financials & bank stocks over the past two months, the small cap index is up +10% from the YTD lows.

Last Thursday, the Russell retested the 200-day moving average cloud as potential support once again, then jumped higher on Friday by gaining +1.22%.

In other words, the 200-day MA cloud continue to work as dynamic support (and resistance) for the Russell 2000:

In fact, I’d suggest that the R2k has the most consistent response-rate to the 200-day moving average cloud of all the indexes: perfect support in 2021, rejection at the start of 2022 and resistance throughout the bear market, now flipping into support (2x) for the first time since Q3’21.

So long as the Russell stays above this zone, I think small caps could perform well.

If/when the Russell falls below this zone, I think small caps perform poorly.

It’s that simple.

Conclusion:

The reason why I’m highlighting each of these three charts is two fold:

They are all trading right on/near critical levels & lines in the sand.

Since they are indexes, they can be extrapolated into broad-market analysis.

Oh the Russell breaks below the 200-day moving average cloud? That’s bad for small caps. Oh the Dow Jones breaks above the grey zone? That’s good for value stocks. Oh, the S&P 500 stays above the August 2022 highs? That’s good for the market & tech.

The inverse of each of these cases is also true, so I’m hoping that these three charts equip you with the tools to diagnose market trends & unfolding dynamics this next week. Regardless of how the data comes out, it will be reflected in the price of assets.

Therefore, studying price (which is simply an equilibrium of supply and demand) will help us to identify key areas where investors (buyers & sellers) have behaved in a unique fashion in the past, in order to extrapolate how they might behave in the future. These are the exact levels I’ll be paying attention to, regardless of the specific CPI & PPI results.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.