Investors,

The Nasdaq-100 is trading at all-time highs relative to the Russell 2000:

In other words, 100 technology stocks have been outperforming 2,000 small cap stocks. However, this outperformance isn’t a new phenomenon. It hasn’t occurred over the course of days, weeks, or even months, but rather years & years of steady appreciation. The logical reaction to this chart is recognizing that NDX/RUT is now trading above the peak from the Dot Com Bubble, and many investors have responded by insinuating that the market is in a bubble.

However, there is one major difference:

The outperformance of tech in the late-90’s occurred at a much faster pace than today!

More specifically, the final run-up in tech during the Dot Com Bubble took ~1,250 days to make the exponential rise into the peak. Starting from the same level, it’s taken technology stocks ~7,750 days to achieve the same degree of outperformance.

That’s more than 6x longer to achieve the same magnitude of outperformance, therefore, the characterization or investor sentiment is unquestionably different today than it was in the late-90’s.

So why is this important?

It tells us that the market, on the aggregate, is not experiencing irrational exuberance like it did during the Dot Com Bubble. While the size of the current “bubble” (if we can even call it that) is now congruent with the peak in Q1 2000, the pace of the trajectory is completely different. According to The Balance, an asset bubble is a period in which assets “dramatically rise in price over a short period, not caused by the value of the [asset].” In other words, it’s the formation of a massive divergence between price and value over a quick period of time.

Quite simply, the pace of the Nasdaq’s outperformance vs. the Russell is not characteristic of a bubble. Second of all, I’d argue that technology stocks in the present era are more valuable, profitable, efficient, and resilient than ever before. The best and arguably most important companies in the world are technology companies!

As I’ve said time and time again, Apple, Microsoft, Alphabet, Amazon, Netflix, Meta, Tesla, and Nvidia are the MVP’s of the market — the most innovative & results-oriented companies in the world. Due to their consistency & operational prowess, investors are willing to pay top dollar to buy shares in these companies because current investors are hard-pressed to sell.

Their valuations aren’t necessarily detached because they continue to innovate & deliver year after year. For example, after each of their last two earnings reports, Nvidia’s stock has actually been cheaper on a forward P/E basis despite the massive increases in the stock price as a direct result of their earnings.

Is the valuation high? Yes. Is the valuation detached? I’m not so sure.

When we analyze the market, on the aggregate, it’s quite clear that valuations are high but they still aren’t even half as high as they were in 1999/2000 when using the 10Y Cyclically Adjusted Price/Earnings (CAPE) Ratio:

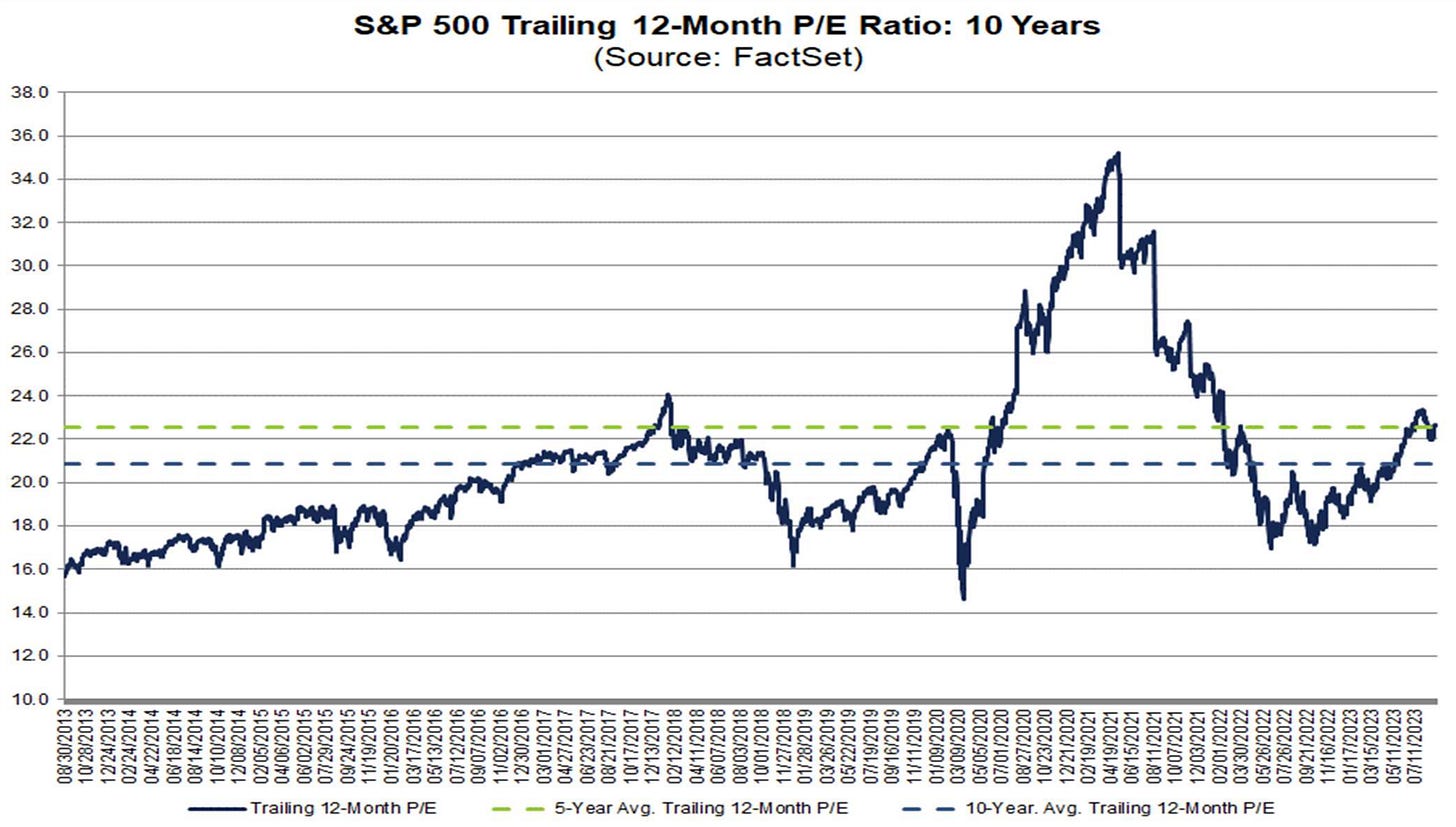

Even using a more real-time measurement of P/E (trailing 12-month instead of 10Y), courtesy of FactSet, we can see that current S&P 500 valuations are in-line or slightly above average with respect to their 5Y and 10Y figures:

This tells me that investors aren’t not being irrational or exuberant, on the aggregate, unless you believe that they’ve been both irrational and exuberant for the past decade.

Even if we look at the S&P 500’s forward P/E ratio, we can see that investors are priced to perfection based on their expectations of future corporate earnings. Maybe those expectations won’t come to fruition, but the market is a forward-looking pricing mechanism and it’s priced today based on current expectations of future results.

Behavior looks completely normal, even though valuations have been rising. However, rising valuation are also completely normal! Why? Because companies deserve higher valuations when margins are expanding and corporate profits rise (aka they’re more efficient at producing a profit from each dollar of revenue). Valuations have also been rising because falling interest rates allow for valuations to expand, simply because of the present value formula.

While we can debate whether or not the market deserves this valuation in the current interest rate environment, which is a fair argument to have, interest rates likely won’t be this high for much longer. The Federal Reserve will default back towards providing an “easy money” environment if/when one of two things happen:

There’s a financial crisis or recession that warrants a return to QE.

The Fed wins their fight against inflation while maintaining full/maximum employment, and can therefore lower rates to a more neutral (rather than restrictive) level.

Part of my long-term thesis is that global central banks, of which the Fed is the leader, have trapped the global economy to depend on a low interest rate environment. The world simply cannot handle the magnitude of debt today at these interest rates for long. Maybe for a year. Maybe for two. Maybe even for three. But not for 5-10.

Even with the massive increase in rates over the past 18 months, most borrowers & economic participants are paying interest at much lower rates because they locked in fixed-rate financing. Take the mortgage market for example, where the 30Y mortgage rate is the highest in 20+ years. While the average quote for a 30Y loan is above 7.2%, the effective interest rate on all mortgage debt that exists in the U.S. economy is 3.6%!

The housing market has come to a halt because people don’t want to participate in such a high interest rate environment, which means that significantly higher interest rates are clogging up activity but not resulting in significantly higher debt servicing costs, on the aggregate. At the end of the day, not many people are choosing to buy a house in this environment when affordability is at its lowest level ever, especially when it’s easier to justify renting:

There is a wall of corporate & government debt set to mature over the coming years, which will struggle to be re-serviced in a higher rate environment.

Regarding corporate debt, here’s great data showing the maturity profile of different loan segments in the coming years:

Regarding government debt, data shows that 31% of federal debt will be maturing within the next year!

With at least $3.4Tn in corporate debt set to mature over the next three calendar years and $7.6Tn in government debt over the next 12 months (!!!), an eventual return to lower interest rates is all but certain, simply by necessity.

This isn’t sustainable. The Federal Reserve knows that it isn’t sustainable. That’s why they’ve gone so far so fast, in order to combat inflation as quickly as possible. I think their policy decisions have had their intended effect, yet the economy will feel the ripple effects of rate hikes + tightening in the months and quarters ahead, which is one of the reasons why I think inflation will continue to decelerate going forward.

This brings us full circle to my point, which is that high rates are here, but they won’t be permanent. An eventual return towards QE will prime financial markets and asset prices for another sustained bull market; however, the catalyst for QE/lower interest rates is certainly up for debate. I don’t know what that catalyst will be or when it will occur, but I fully believe that the days of easy money will return again and therefore facilitate higher asset prices over time, even if the catalyst causes asset prices to fall initially.

Many folks are calling this market a bubble, accusing investors of being irrational. I’m here to say the opposite… investors aren’t perfectly rational, but they’re rational enough, on the aggregate. Prices are high, but they aren’t detached. If anything, it’s clear that the typical trend is for valuations to rise steadily over time, due to a low interest rate environment and improved operating performance for corporations.

Sensationalist analysts who call this market a bubble are likely frustrated with their underweight exposure or underperformance YTD, therefore resorting to assign blame via irrational exuberance. It’s likely a form of cognitive dissonance, designed to protect their ego from confronting why they’ve missed such a substantial move in equities. If these analysts are rational (which they likely are), then the only way to justify their lack of participation is simply to say that the market is irrational! It’s a great way of saying that they were wrong without accountability.

I’ll be the first to admit, my stock portfolio has certainly underperformed the S&P 500 this year due to the amount of cash I had on the sidelines at the start of the year and the lack of tech/FANG+ exposure. Thankfully, due to short-term trading activities and Bitcoin-related exposure, I’ve been able to produce a strong return on invested capital, but I’ve also held a significant cash position throughout the year. Even today, the sum of cash in long-term accounts plus money market fund exposure plus short-term Treasuries is approximately 40% of my portfolio (down from nearly 70% at the start of the year). Therefore, on net, I’ve underperformed. Which is completely expected given that 40% of my assets are generating a 5% annualized return while the S&P 500 has gained +16.1% YTD. Given how I’m en route to building a long-term portfolio, I’m comfortable with underperformance over small periods of time, particularly as I continue to allocate capital in such a way that’s aligned with my goals.

The difference between me and the bubble boys is that I provide reasonable solutions…

Do you think that inflation will re-accelerate? Buy energy stocks.

Do you think that the Fed will break something? Buy 6M & 1Y Treasuries.

Do you think that we’ll have a soft landing? DCA into core holdings.

Do you think that we’ll have a “no landing”? DCA into core holdings.

Do you think that the Fed will cut rates without a recession? DCA.

None of my solutions are going to be “sell everything”, because selling everything therefore requires a second critical step: buying things back. What if you have to buy stocks back at significantly higher prices? What if the crash comes, but it happens three years down the road and the market crash is still higher than prices today? What if the market crashes, but you think it’s going to keep crashing and you never allocate back in? If it does crash, what are your rules for engagement?

All of these various problems arise, when in reality, the market has historically been able to surmount a wide range of risks and appreciate over time:

Those with enough patience have been able to overcome the most difficult market environments. Those who continued to buy assets during times of pain (and the good times) have done an excellent job of compounding their capital steadily over time in order to growth their wealth. I don’t know what you’re trying to do, but that sounds pretty good to me. Given that I’m still in roughly 40% cash & equivalents, intending to buy more equities steadily (as I have all year), I’m comfortable with whatever the market does over the next 12 months. I’ll be a buyer, regardless of what the S&P 500 is trading at. My future self hopes that I get a chance to buy lower. My current self doesn’t have a crystal ball to know if I’ll have that opportunity. My solution is to simply just keep buying, especially because the stock market isn’t in a bubble.

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged and direct/inverse, to the NYSE FANG+ Index. They have a suite of products ranging from big banks, to oil and gas, and even gold/gold miners.

I started a partnership with MicroSectors in 2023 because I’ve been using their products for over a year and it was an organic and seamless fit.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

Nice writeup and analysis...along with an interesting take.

Need to be aware of valuation bubbles. But over time, you want a market cap weighted index of companies on the cutting edge of technology to outperform the average small-cap stock.

Demonstrates progress in the economy (and probably society?).