It's Imploding

A Deep-Dive On Software Stocks

Investors,

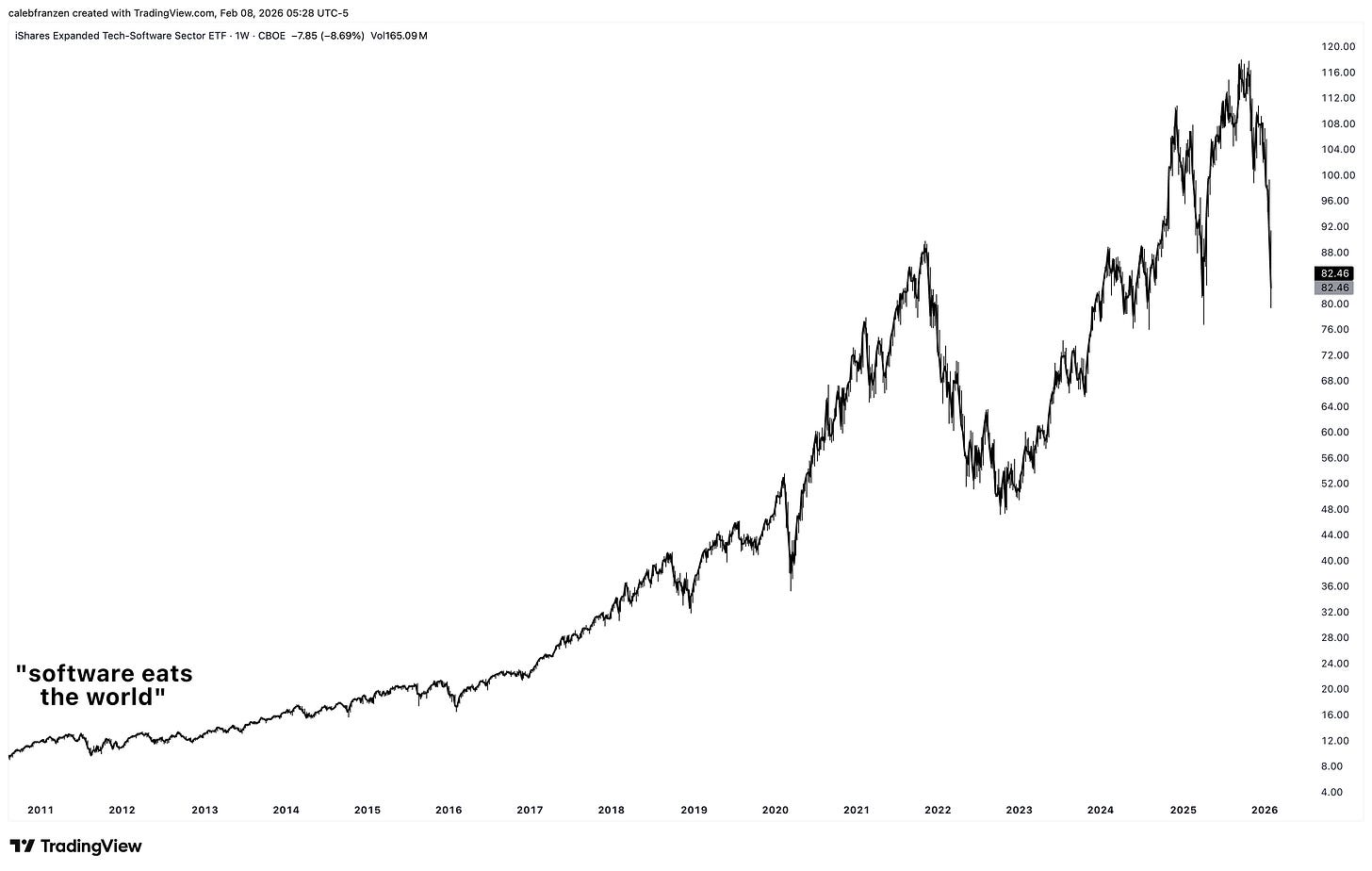

“Software eats the world” is what Marc Andreessen told us in 2011.

Today, just 15 years later, software is getting eaten by… itself.

I’m not a technologist or some philosophizer of change, but I just look at charts.

And right now, the charts tell us that software is unequivocally imploding.

This is the iShares Expanded Tech & Software ETF, $IGV:

The ETF has fallen -32.8% from the all-time high in September 2025, the largest drawdown since the bull market began in Q4 2022.

But here’s where it gets even crazier…

While the software ETF is still up +75% from the bear market lows in 2022, the fund is making new lows relative to the S&P 500, shown by this chart of IGV/SPY:

Now trading at its lowest levels since January 2018 on a relative basis, the implosion of software is undeniable… instead, the debate is centered around the question “what can we do about this?”

If we hold software, is this where we panic, capture our gains and/or cut our losses?

Regardless of if we hold software stocks or not, is this where we step in and buy?

Which individual stocks look like the best opportunities right now?

What does this mean for the broader market and for Bitcoin?

These are the questions that I’m going to explore in this edition of Cubic Analytics.