It's A Bull Market... For Now.

Investors,

On May 27th, I published a newsletter with the following introduction:

“These are the facts:

The Nasdaq-100 ($QQQ) hit new 52-week highs on Friday.

The Technology Select Sector ETF ($XLK) hit new 52-week highs on Friday.

The iShares Expanded Tech ETF ($IGV) hit new 52-week highs on Friday.

The VanEck Semiconductor ETF ($SMH) hit new 52-week highs on Friday.

The Vanguard Mega-Cap Growth ETF ($MGK) hit new 52-week highs on Friday.

The NYSE FANG+ Index $NYFANG hit new 52-week highs on Friday.”

The takeaway: new 52-week highs isn’t bearish and the outperformance of tech vs. small caps isn’t a reason to be bearish, in and of itself.

Today, we can add arguably the most important asset to this list — the S&P 500.

During Friday’s session, the S&P 500 hit new 52-week highs and has officially gained more than +20% from the October 2022 lows. While it briefly extended above the August 2022 highs, it didn’t close there. Either way, the behavior and pace of the 8-month uptrend is very reminiscent of the 10-month downtrend during 2022.

The market is steadily moving higher, producing higher highs and higher lows along the way. Mega-cap tech is still doing a great job of leading the market higher and the FANG+ stocks are still crushing it. I’m super excited to remind everyone about our sponsor, MicroSectors, who is responsible for several amazing funds and exchange traded products. I first discovered them when trying to gain exposure to the NYSE FANG+ Index, an equal-weight basket of 10 mega-cap tech stocks. Whether you’re interested in gaining long or short exposure to $NYFANG, MicroSectors has a handful of ETN’s that are worth your consideration:

If you think FANG+ is overextended, you might be interested in shorting them.

If you think FANG+ has momentum, you might be interested in longing them.

Either way, MicroSectors has a variety of different solutions. They also post insightful market data on Twitter, so I highly recommend that you follow them there!

Macroeconomics:

Initial unemployment claims have hit new highs, reaching 261k claims for the week ending June 3rd. This was a substantial jump vs. the prior weekly result of 233k.

While the level of initial claims (blue) has reached its highest level since October 2021, the 4-week moving average (red) didn’t hit new highs. Given that the nonfarm payroll data in May showed a substantive uptick in the unemployment rate to 3.7%, I think it’s clear that the resiliency of the labor market is being threatened.

However, I think it’s important to note that weakness in the labor market won’t immediately manifest into a recession. In fact, one important labor market indicator is still showing that the economy is strong. Below is the total number of employees in the construction industry, which hit new all-time highs in May at 7.928M.

Construction jobs stabilize and start trending lower before a recession. That simply isn’t the case today, though it could start to weaken soon. Monitoring this relationship going forward will be extremely important, particularly given the recent analysis that I shared about the YoY rate of change in the unemployment rate last week.

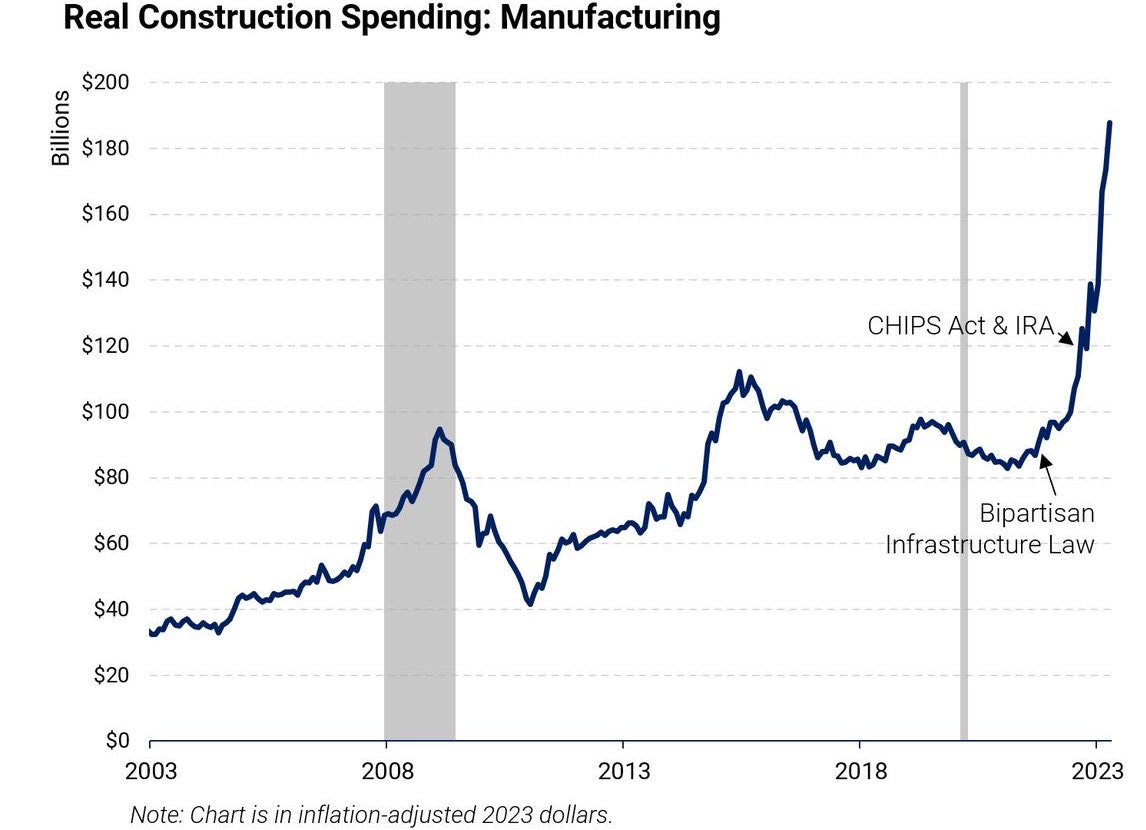

Continuing to focus on the construction industry, construction spending is booming:

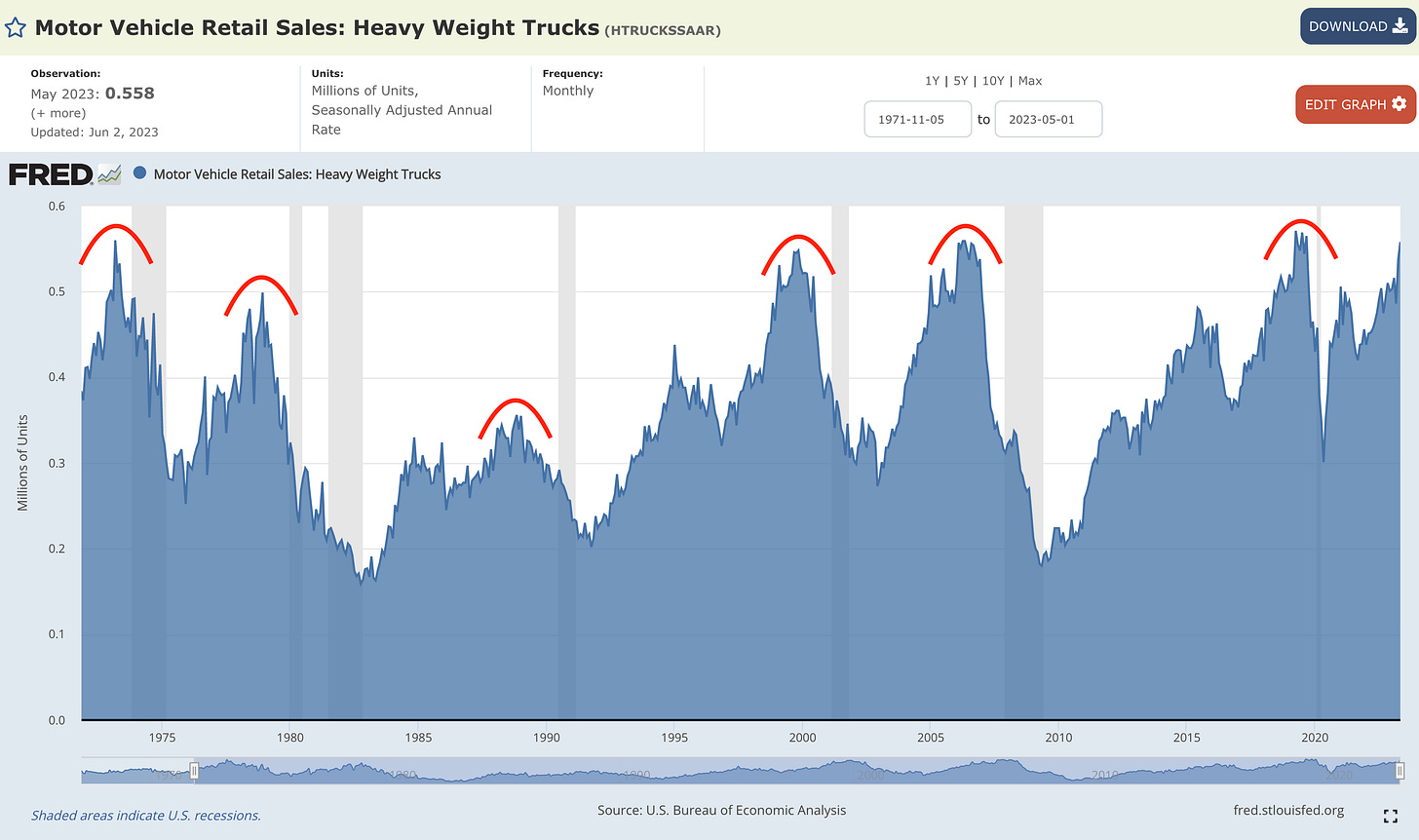

While it’s interesting to see that real construction spending in manufacturing was rising during the Great Recession, it’s hard for me to look at the current trend and say “we’re in a recession”. Additionally, heavy-weight truck sales, which have predicted every recession since 1973, aren’t slowing down either.

The current trajectory of this datapoint is starkly different than recessionary periods, in which heavy weight truck sales begin to decrease for months before entering a recession. Could this change soon? Yes. But we aren’t there yet.

Stock Market:

The market remained strong this past week, with each of the major indexes posting the following returns:

Dow Jones $DJX: +0.34%

S&P 500 $SPX: +0.4%

Nasdaq-100 $NDX: -0.12%

Russell 2000 $RUT: +1.9%

While the Nasdaq-100 was the only index with a negative weekly return, it’s worth noting that small caps and equal-weight versions of the indexes finally had strong upside. For example, note the different returns between the S&P 500 and the equal-weight version of the S&P 500 $RSP:

S&P 500 $SPX: +0.4%

Equal-weight S&P 500 $RSP: +1.0%

The same can be observed for technology stocks:

Nasdaq-100 $QQQ: -0.12%

Equal-weight Nasdaq-100 $QQQE: +0.28%

Focusing specifically on QQQE, it’s clear that equal-weight technology has been a strong performer in 2023. This ETF is now up +17% YTD! In other words, “mega-cap” tech isn’t the only thing working in the market — all of technology is working!

Similar to the analysis that I’ve shared for XLG and MGK, a breakdown below the August 2022 highs (grey) would make me more defensive in this market as a potential “risk off” signal. Until then, I think it’s totally permissible to have a bullish bias.

As the saying goes “when the music’s playing, you have to dance”.

Bears were screaming that the market needed broad-based participation. That’s exactly what we got this past week. So are the bears happy now? My guess is no.

In fact, they were actually complaining on Twitter Spaces throughout the week about non-profitable companies having monster days.

So let me get this straight… they were complaining when the best stocks in the world were going up and now they’re complaining when the rest of the market is going up? The hypocrisy and irony writes itself sometimes and all you can do is laugh. It’s vital to remember that permabears will always find something to complain about, the same way that permabulls will always find something to be optimistic about.

Staying objective, flexible, and self-critical is the only way to actually provide meaningful alpha, which is why I always try to observe the data & be willing to adapt.

The market appears to be fairly valued based on forward-looking earnings expectations, according to new data from Fact Set:

In terms of valuations, the price/earnings ratio for the index is trading between its 5Y and 10Y average, continuing to suggest that the market is not detached from reality.

Bitcoin:

I’ll be talking about Bitcoin & crypto in-depth in tomorrow’s premium report. There’s a lot to discuss, particularly with new liquidations that occurred late Friday night and early Saturday morning. I’m hard at work to look through the charts and try to discern what could be around the corner. I’ve posted some charts and early takeaways on Twitter, so I’d strongly recommend that you go through my feed and sign up for the premium newsletter that will be out tomorrow.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.