Investors,

There are just 3 full trading weeks left in 2024.

After being big-picture bullish all year on equities and Bitcoin, I’m hopeful that my research has kept you on the right side of this market and that you’ve generated significant returns.

The S&P 500 is up +29.1% YTD (including dividends) and Bitcoin is up +136.5%.

My two biggest themes in the equity market have been mega-cap growth & software, which have also generated significant returns:

Vanguard Mega-cap Growth ETF ($MGK) +36.4% YTD

iShares Expanded Tech & Software ETF ($IGV) +35.7% YTD

The fact of the matter is that investors haven’t needed to do fancy backflips in order to generate substantial returns — they’ve just needed to have a bullish outlook on the market as a whole and position themselves in proper bull market themes.

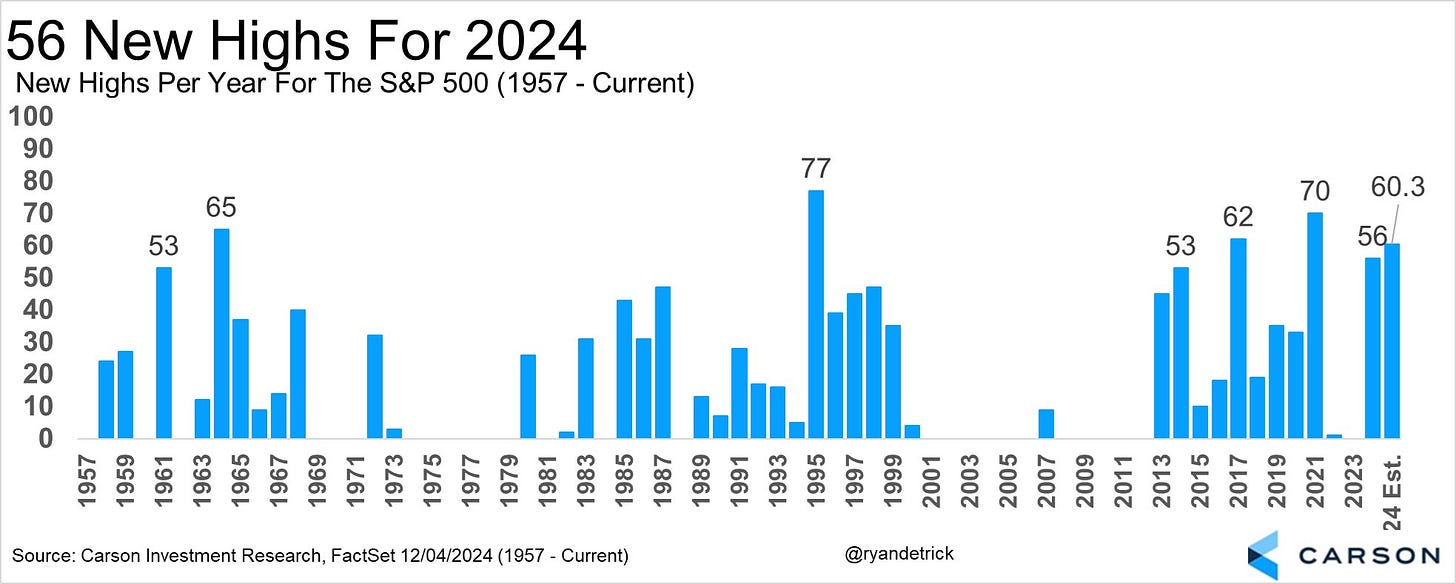

One of the key phrases that I’ve been sharing for 20+ months is that “new highs aren’t bearish”, which is one of the reasons why I track new highs on a 20-day, 50-day, and 52-week basis every single week in the internal S&P 500 data.

Why has this been such an important phrase?

Because trends are real, relative strength is real, and we often see clear evidence that strength begets more strength.

Said differently, new highs often beget more new highs.

Here’s proof: As of December 4th, the S&P 500 had achieved 56 all-time high daily closes (which has since grown to 57 as of Friday’s close).

If the year ended today, this would be the 5th best year for S&P 500 new highs going back to 1957!

One thing that I noticed about this chart and its data is the following: