Is It Really Lagging?

Investors,

Bitcoin is lagging.

That’s what everyone, including myself, has been saying.

But I realized something this week, which challenges that narrative.

Yes, Bitcoin is lagging the S&P 500 and the Nasdaq-100.

But with both of these indices having such an overweight concentration to mega-cap tech and the Magnificent 7 (or the Elite 8, take your pick), it might be unfair to compare Bitcoin to the best companies in the history of capitalism.

In fact, I found a handful of U.S. stocks that are mirroring BTC’s price action…

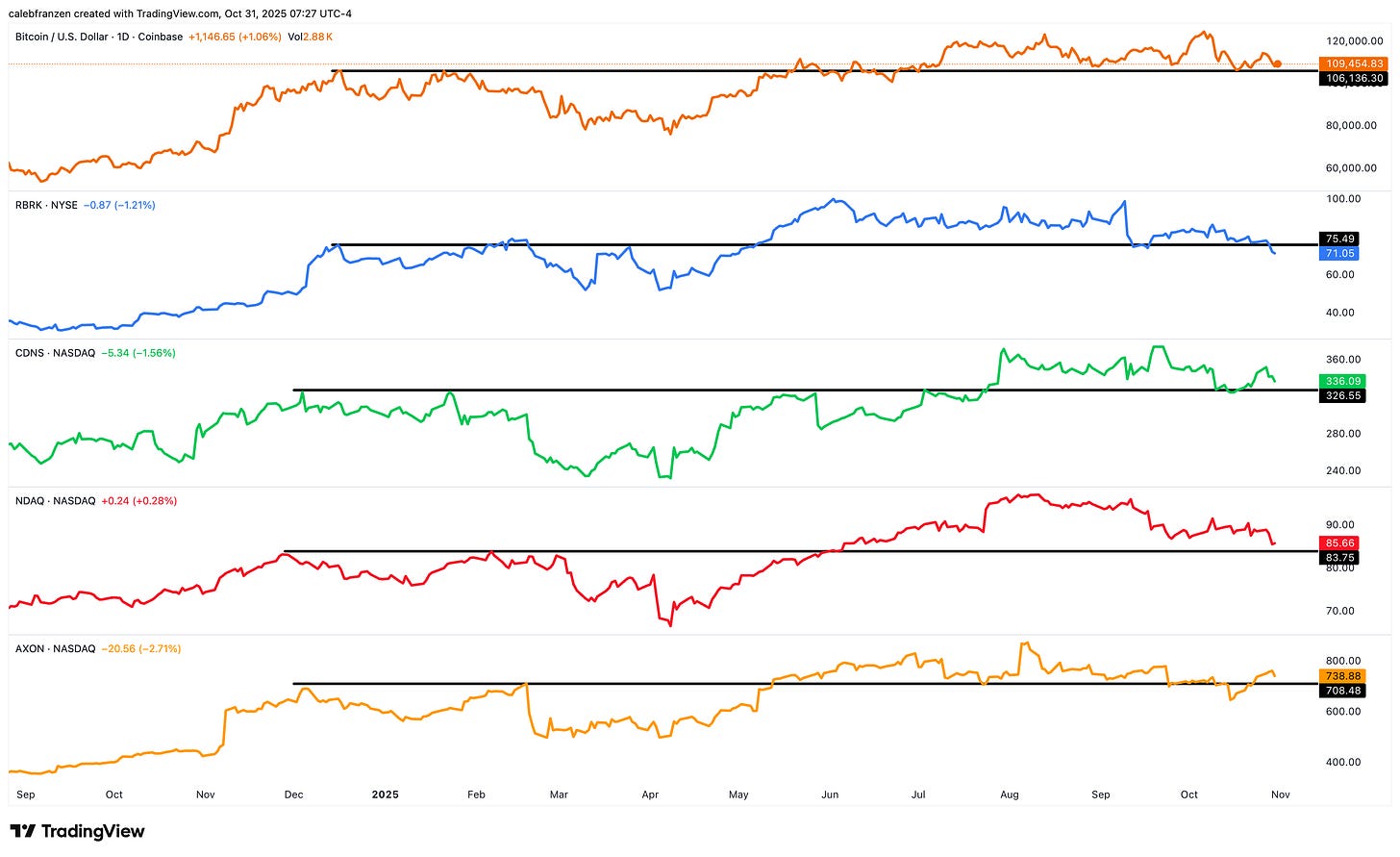

Take a look at this chart, showing (from top to bottom):

Bitcoin ($BTCUSD)

Rubrik Inc. ($RBRK) - a cloud security & data infrastructure company

Cadence Design Systems ($CDNS) - makes software tools for semiconductors

Nasdaq Inc. ($NDAQ) - the fintech company, which operates an exchange

Axon Enterprise ($AXON) - makes Tasers, bodycams & software for law enforcement

Given that all of these companies operate in completely different sectors, industries, and investment themes within the stock market, their tight correlation vs. Bitcoin made me wonder if Bitcoin is actually lagging the “stock market”…

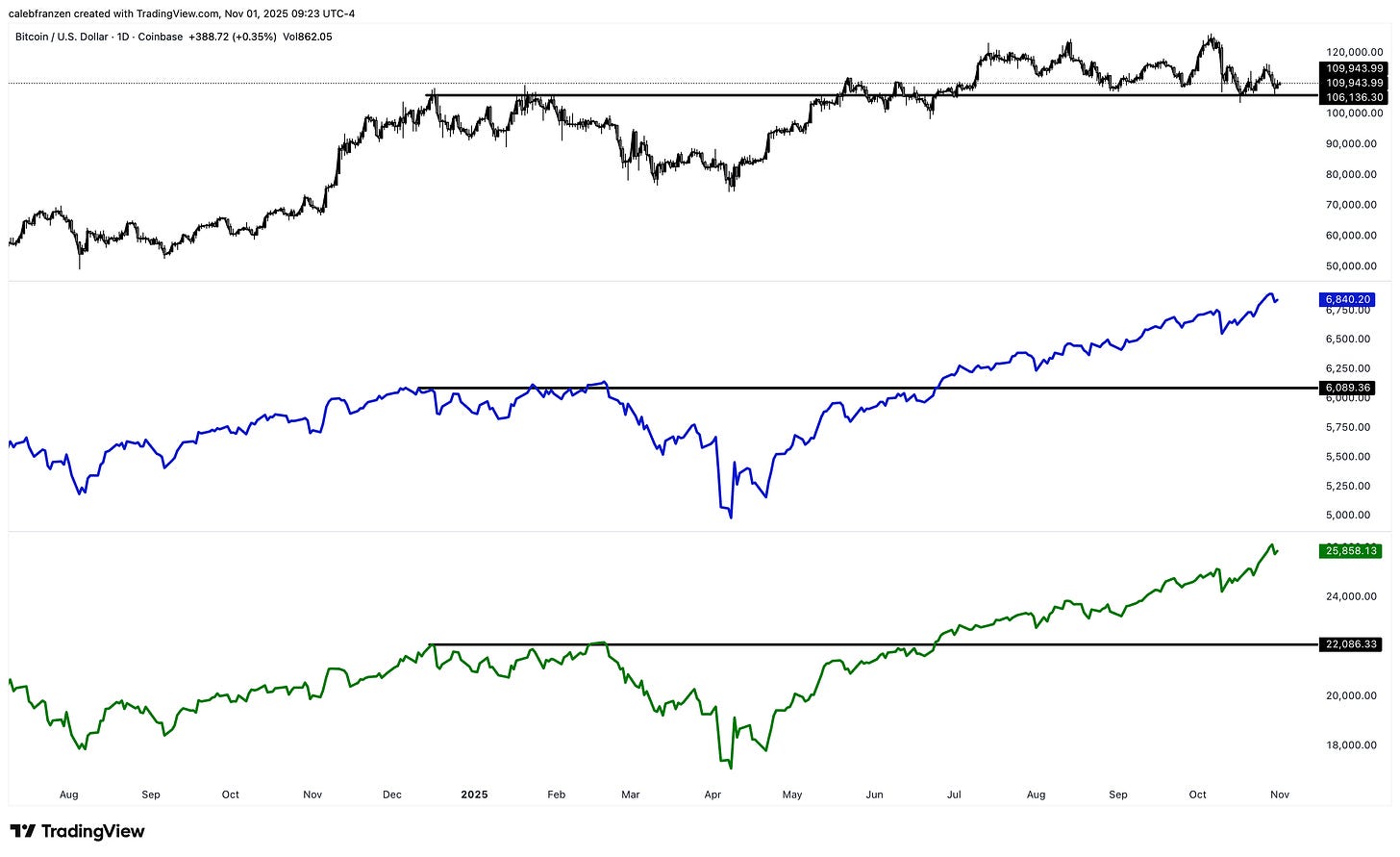

For context, this is Bitcoin vs. the S&P 500 vs. the Nasdaq-100:

Again, on this basis, it’s unequivocal that Bitcoin is lagging the “stock market”.

But because of the correlations that I found to a handful of random stocks (that took me only a few minutes to find), I decided to measure Bitcoin vs. the equal-weight version of the S&P 500. This would, in turn, reduce the impact of the strong performance of the Magnificent 7.

So here it is, Bitcoin vs. the equal-weight S&P 500 ($RSP):

Using equal-weight as the gauge for the “stock market”, we actually see that Bitcoin isn’t lagging at all… it’s completely matching the sideways performance of the average stock in the S&P 500.

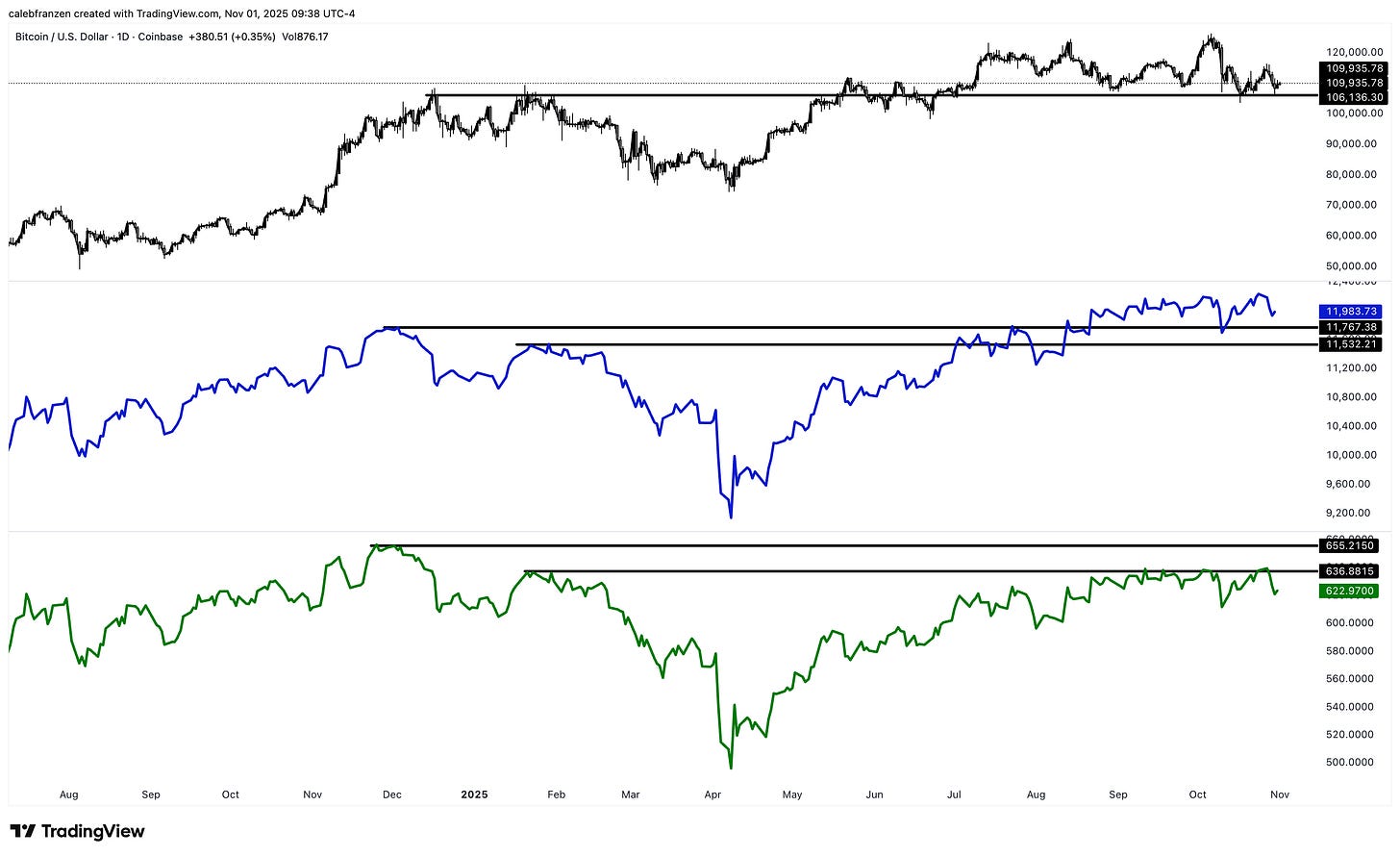

Or what if we compare Bitcoin to the Value Line Arithmetic and Geometric Index, both of which are designed to track the performance of the average stock listed in the United States, using an arithmetic mean and a geometric mean.

Bitcoin isn’t lagging.

It looks identical to VALUA, while it’s outperforming VALUG.

And listen…

I’m saying all of this despite the fact that I’ve contributed to the “Bitcoin is lagging” conversation; however, I’ve discovered these deeper insights and it challenges the narrative that I was previously sharing.

The reality is that this topic is nuanced, like most things.

Bitcoin is lagging vs. the S&P 500 and the Nasdaq-100, structurally.

But the reality is that most stocks are lagging vs. the S&P 500 and the Nasdaq-100!

Take a look at this chart, showing the relative performance of the equal-weight S&P 500 vs. the S&P 500 Top 50 ETF (RSP/XLG):

This chart implies that the S&P 493 are making new lows vs. the S&P 50.

But the top 50 holdings in the S&P 500 make up nearly 60% of the entire index!

This is why Bitcoin is “lagging”…

It’s lagging the MVPs of the stock market — the biggest & baddest companies on the planet, with the strongest fundamentals, the largest cash positions, and the most resilient growth metrics.

And the fact of the matter is that quite literally everything is lagging the MVPs.

This isn’t a Bitcoin-specific issue.

So I’m not going to make it one.

Best,

Caleb Franzen,

Founder of Cubic Analytics

This was a free edition of Cubic Analytics, a publication that I write independently and send out to 14,300+ investors every Saturday. Feel free to share this post!

To support my work as an independent analyst and access even more exclusive & in-depth research on the markets, consider upgrading to a premium membership with either a monthly or annual plan using the link below:

There are currently 1,140+ investors who are on a premium plan, accessing the exclusive alpha and benefits that I share with them regarding the stock market, Bitcoin, and my own personal portfolio.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.

Interesting insight, Caleb.

#TheRealAlpha