Investors,

The Ethereum ETFs have been approved by the SEC & Bitcoin is trading at $69,000.

We have bullish signals flashing for BTC, like the 30-day Williams%R Oscillator that I shared 10 days ago on X, amidst a broader uptrend that isn’t slowing down.

Meanwhile, the economy continues to be resilient & dynamic.

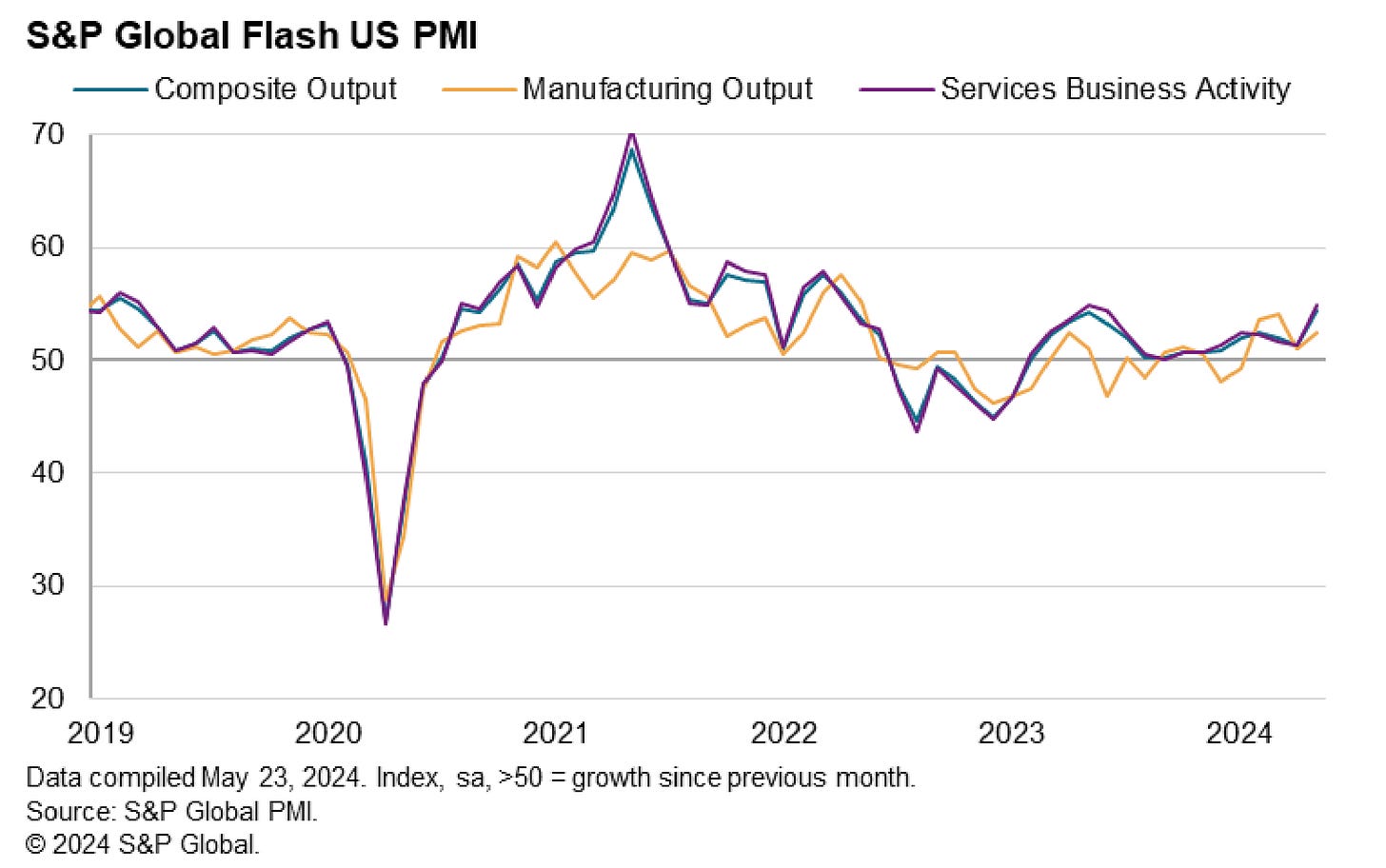

The Flash PMI data shows that U.S. output is growing at the fastest pace in 2+ years:

In fact, output has now risen for 16 consecutive months!

Expectations about the future are also rising, noted by the following from the report:

“Optimism about output in the year ahead lifted higher in both manufacturing and services in response to brighter business prospects, the latter in turn often linked to expansion plans, new products and increased marketing. Customers were also reported to have likewise become more optimistic.”

Maybe, just maybe, the economy is going to hell in a handbasket.

Maybe the Doomers were wrong yet again.

Maybe the future is worth investing in.

Here’s more data that you need to know:

Macroeconomics:

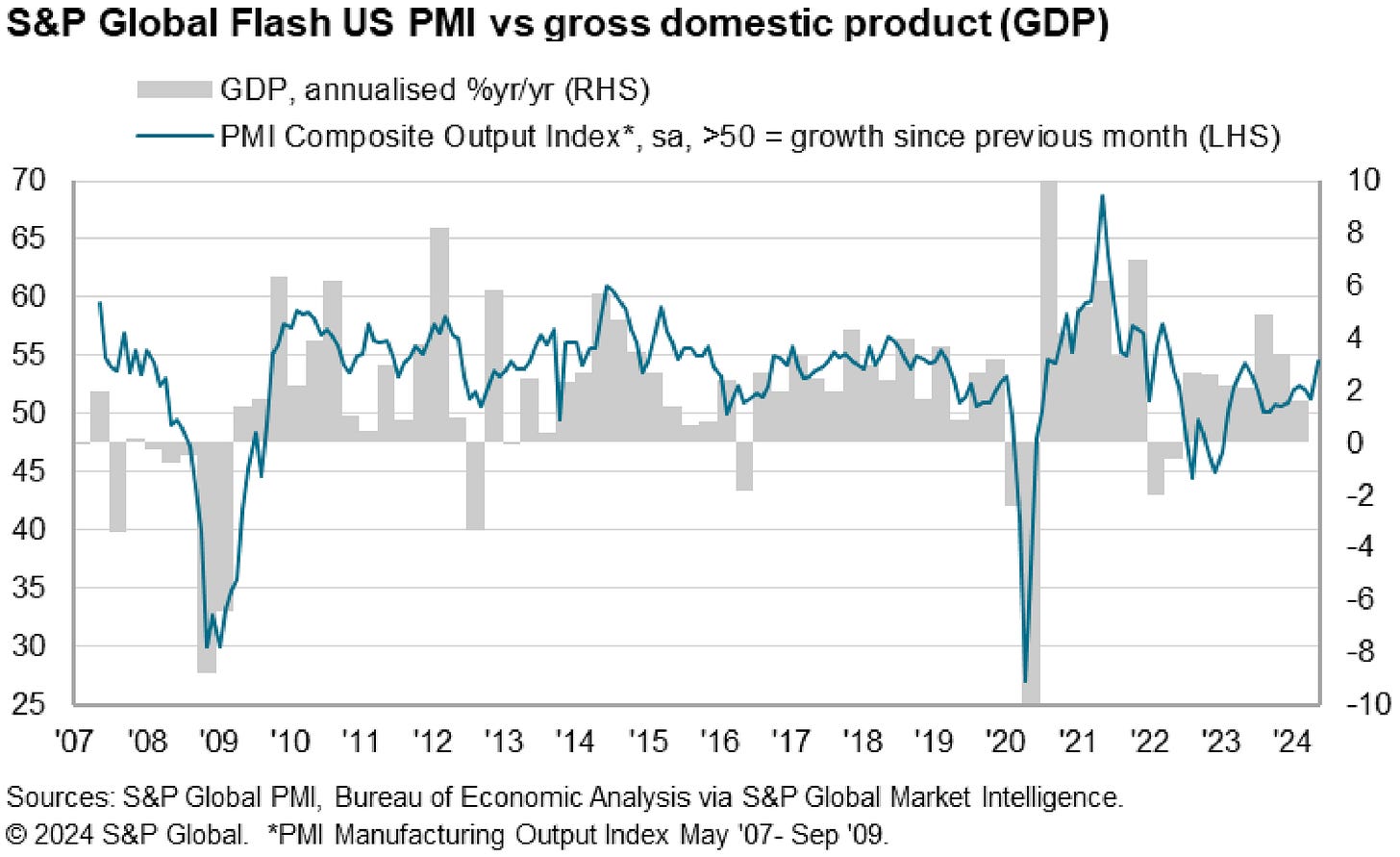

The Flash PMI data that I cited above also contained a fantastic chart showing the correlation between their Composite Output Index and Real GDP growth:

While it isn’t a perfect correlation, this is clearly a chart to pay attention to.

The economy is far from being bullet-proof, but this chart (amongst a variety of other charts & datapoints) indicates that we should continue to be optimistic about the economy.

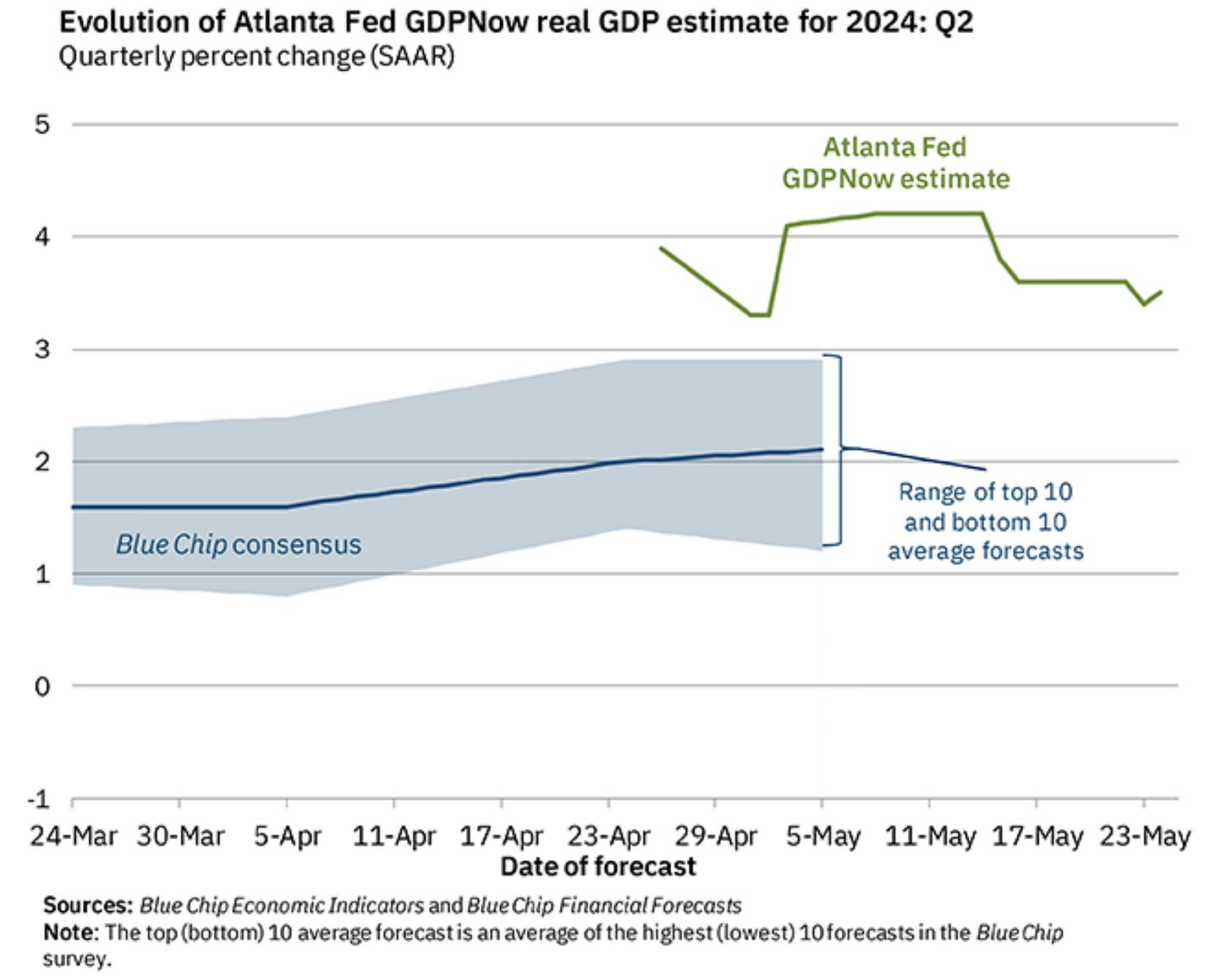

The Federal Reserve seems to agree, as the Atlanta Fed’s GDPNow estimate for Q2 2024 real GDP growth was just updated on Friday and is now calling for +3.6% growth.

This is the estimate for the annualized growth rate, which came in at +1.6% in Q1’24.

In other words, this would represent a significant re-acceleration vs. the Q1 data if the Atlanta Fed’s model is correct, or even if the results came in below the current forecast.

That doesn’t sound recessionary to me…

Take into consideration that weekly initial jobless claims remain steady at 215k:

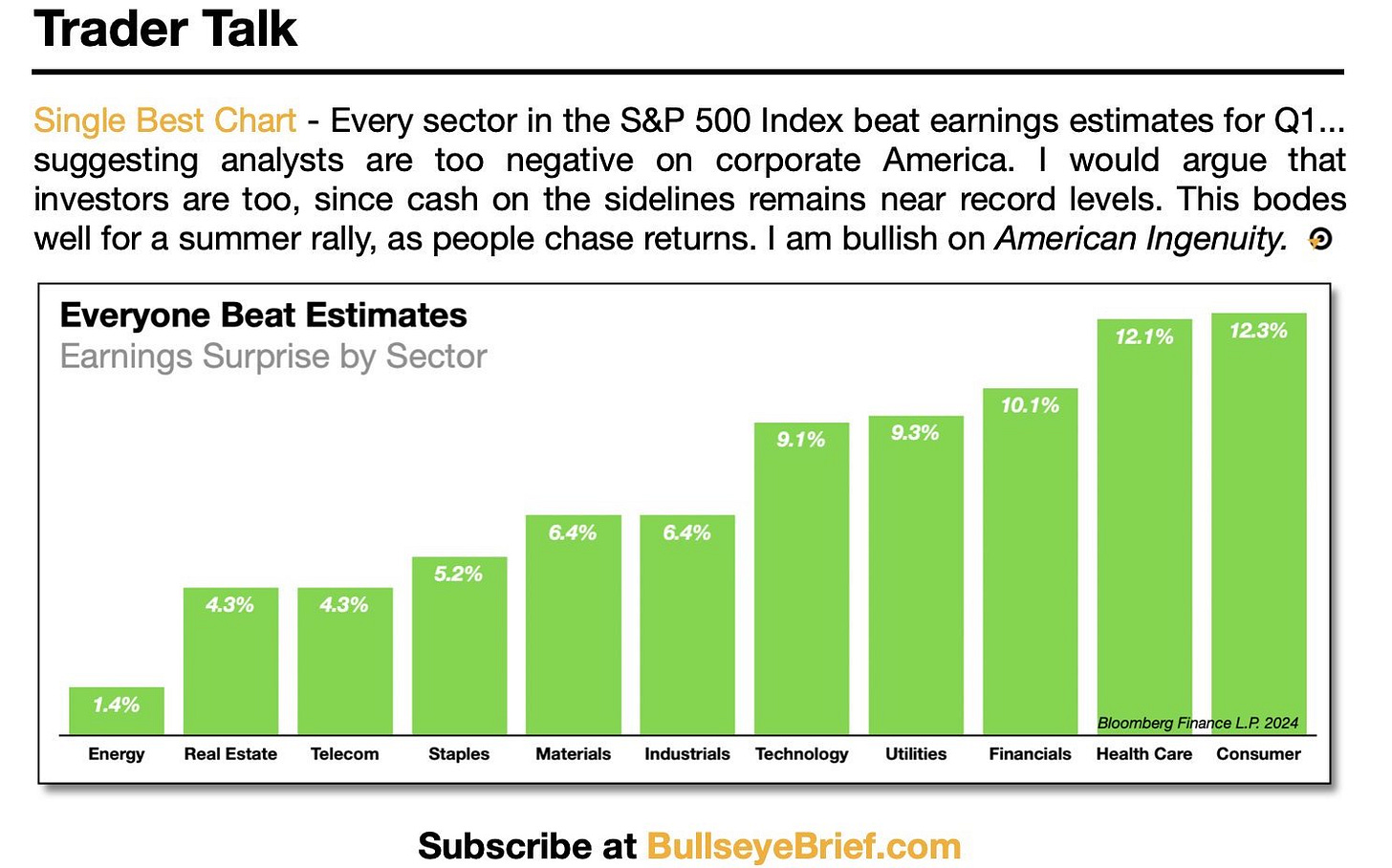

Then take into consideration that every single sector in the S&P 500 just beat their earnings estimates, according to this dataset & screenshot from Bullseye Brief:

This dynamic sheds light on one of two (or both) developments:

On the aggregate, investors have been too pessimistic.

On the aggregate, market fundamentals are more optimistic than expected.

Personally, I expect this trend to continue.

Stock Market:

The S&P 500 ($SPX) is up +28.8% year-over-year.

The equal-weight version of the S&P 500 ($RSP) is up +18.5% YoY:

Since the beginning of 2023, we’ve been told that “only 7 stocks are going up” or that “the market has weak breadth” and that “the S&P 493 are underperforming”.

Thankfully, readers of Cubic Analytics and followers on X have watched me carefully debunk and nullify these misguided remarks from the bears.

My argument was that these points were either blatantly false or not a proper justification to be bearish on the broader stock market. Specifically, I kept saying that the MVP’s of the market were acting exactly as they should — like MVP’s!

I shared this post on X almost exactly one year ago:

Over the past year, $MGK, the Vanguard Mega-Cap Growth ETF, is up +39.5%.

That’s not a typo… this basket of mega-cap growth is up nearly +40% YoY.

Despite all of the big tech layoffs. Despite all of the geopolitical risks. Despite all of the macro factors. Despite all of the Fed’s tightening. Despite all of the CRE risks.

Here’s the current chart of MGK relative to the S&P 500:

My view, for more than a year, has been that outperformance from mega-cap tech and/or growth is not bearish for the market and that mega-cap tech/growth will continue to be the source of alpha in the stock market.

Ironically enough, new followers of my work have started to call me a permabull.

As a friendly reminder, I was short-term bearish for the majority of 2022, predicting “below-average returns” as we entered 2022, and even predicted a recession as we entered 2023 (as did most macro folks).

I take an objective review of market data and use the weight of the evidence to shift and reorient my outlook on the market, as all proper analysts do.

In Q1 2023, I recognized the resilient nature of the economy despite all of the risks in the macro picture. I analyzed internal metrics for the S&P 500, noting that more stocks were making new highs than the amount of stocks making new lows on all major timeframes, and then observed how the Dow Jones and the S&P 500 had achieved structural & dynamic breakouts above key price levels and moving averages.

Objectively, this data forced me to become bullish in April 2023 and I’ve been on this train since then, based on the continued evidence of objectively bullish data.

If/when that data changes, so will my outlook & positioning.

Bitcoin:

I want to talk about Bitcoin by focusing on the Ethereum ETF approvals…

Yes, you read that correctly.

Personally, I’m seeing a lot of Bitcoiners and BTC maxis express a lot of cope and discontent over the SEC’s approval of the various spot Ethereum ETFs.

Hardcore Bitcoiners view Ethereum as a security, starkly different than the SEC’s previously determined view that Bitcoin is a commodity. I couldn’t care less what it is (or what it isn’t), as my view is that Ethereum is a technological platform while Bitcoin is the digital representation of scarcity — they’re two completely different things with two completely different investment theses.

ETH has an affiliated founder. Bitcoin’s founder was anonymous & disappeared.

ETH has a marketing team. Bitcoin doesn’t have a marketing team.

ETH has a variable monetary schedule. BTC has a pre-determined monetary schedule.

They are two different assets and I don’t view them as competitors.

Instead, my view is that a rising tide lifts all boats and that the Ethereum ETFs will spark an influx of new interest and demand, which in turn will produce more knowledgable investors.

As institutional investors become intrigued by the cryptocurrency industry and the ability to own exposure via ETFs, they will learn about the key differences between BTC and ETH. Their preconceived notions about them being competitors will evaporate and they will come to recognize that Bitcoin represents digital, immutable, and decentralized scarcity — something that Ethereum cannot lay claim to.

Ethereum is technology. Bitcoin is digital money.

Both have value.

Both will likely be more valuable in the future.

But they are not the same and new investors are going to learn the difference as they conduct their own due diligence. As such, an influx of new capital is going to be forced with an opportunity cost when deciding to invest in either BTC or ETH.

They’ll ask: “Do we buy BTC via ETF or do we buy ETH via ETF?”

They’ll learn about the fundamental differences and look at the ETHBTC chart.

Given the downtrend in ETHBTC during the uptrend in asset prices, they’ll be forced to try and understand why this divergence has occurred & why BTC is outperforming.

But Wall Street operates with recency bias, as we all know.

They’ll ask, “why has ETH lost -34% of its value relative to BTC over the past 3 years?”

In turn, this will prompt the following question “what will reverse this trend?”

Many of them will find an answer to justify why they should buy ETH instead of BTC.

Many of them won’t find an answer & they’ll decide to buy more BTC instead of ETH.

As such, my view is that these new onramps for institutional demand will result in better knowledge and understanding of these two assets, which will in turn help to create more demand for both assets.

The Ethereum ETFs are likely to be bullish for ETH.

The Ethereum ETFs are likely to be bullish for BTC.

There’s no need to overthink it.

Stay focused on what matters — institutional capital is coming.

Caleb Franzen,

Founder of Cubic Analytics

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Life After Stratton Oakmont - Still Making Money https://open.substack.com/pub/michael880/p/life-after-stratton-making-money?r=3b6pw1&utm_campaign=post&utm_medium=web