Investors,

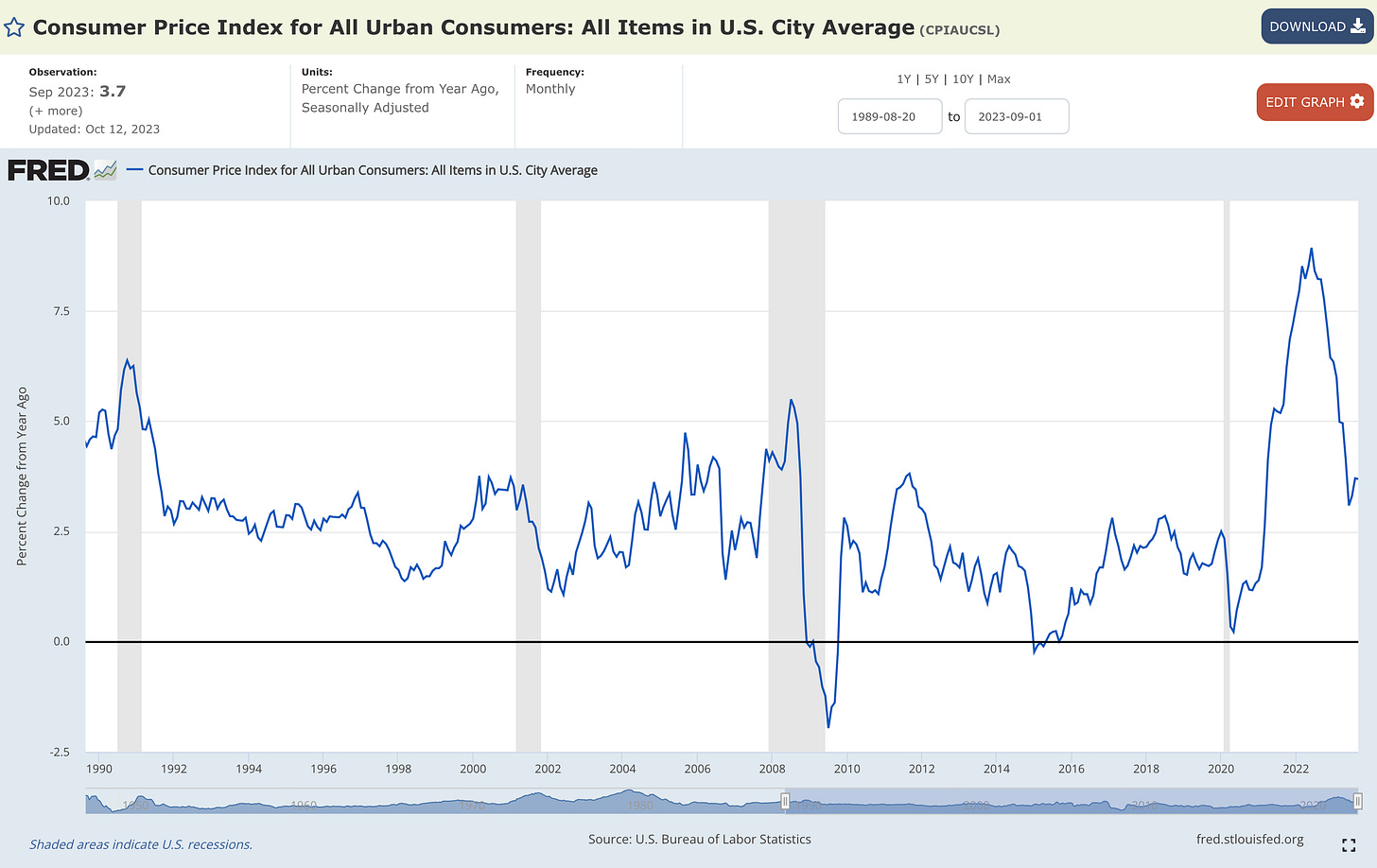

Disinflation is still intact, though prices continue to rise.

Excuse my harshness, but the latest round of CPI data has reignited the mistaken belief that inflation is speeding up, which is an incorrect and misleading assertion.

Prices are rising. The pace of inflation is not rising. It’s vital to understand this nuance because the increase of consumer prices does not equate to higher inflation.

Read that sentence again, if necessary.

Thus, we have disinflation — a period of economic activity characterized by a decelerating pace of inflation. If you’ve been following my research for some time, you know that I’ve been predicting disinflation since December 2022, upon the release of the November 2022 CPI data. The latest round of inflation data from September 2023 reaffirm two things:

My thesis is intact — we are in disinflation.

The U.S. economy will continue to experience disinflation.

Today’s report will focus exclusively on inflation dynamics, because nuance is a painful but necessary process. If you decide not to read further, just know this:

All of the inflation dynamics in September were driven by energy & nothing else.

How do I know this? Because the data proves it!

Here’s the Consumer Price Index All Items Less Energy YoY, which is exactly what it sounds like: a basket of all goods/services within the economy excluding energy.

The result in Sept.’23 was a YoY inflation rate of +4.1%, down from +4.4% in August.

By definition, aggregate non-energy prices are experiencing disinflation.

It’s that simple.

In the remainder of this report, we’ll dive into the nuance of the September data and also analyze the key factors that are driving inflation dynamics in order to diagnose how inflation is likely to evolve going forward. In plain English, I’ll analyze where we’ve been and where we’re going.

Where We’ve Been:

We’ll begin with a simple assessment of how CPI metrics evolved from August to September:

Headline CPI in August +3.70% YoY

Headline CPI in September +3.69% YoY

Core CPI in August +4.3% YoY

Core CPI in September +4.1% YoY

By definition, inflation did not accelerate. At worst, inflation stabilized; however, as we covered in the intro, all of this stabilization is due to energy dynamics. Hence why core CPI decelerated, once again.

On a month-over-month basis, we see the following:

Headline CPI in August +0.6% MoM

Headline CPI in September +0.4% MoM

By definition, inflation did not accelerate. Prices were still rising, as we should expect based on the Fed’s stated goal for +2% inflation, but the rate of inflation slowed down.

That’s disinflation folks.

It’s vital to remember that the Federal Reserve is not attempting to make prices fall.

I also want to be clear that these inflation rates are still too high, meaning that the Fed still has work to do in terms of remaining restrictive (not necessarily getting more restrictive) in order to get inflation to their 2% target. In a vacuum, there’s nothing to celebrate about +3.7% YoY inflation or +0.4% MoM inflation; however, we don’t live in a vacuum. Therefore, on a relative basis, the ongoing deceleration is a win.

As I alluded to in the introduction of this report, inflation is a nuanced topic and therefore requires a nuanced & detailed lens in order to analyze it. So let’s get our hands and knees dirty by diving into the nitty gritty.

We’re going to analyze a handful of these components, but at a high-level, we should recognize the following truths:

In fact, each and every single one of these components have decelerated (YoY) during the past three months of headline CPI “accelerating”, further highlighting that the uptick in headline CPI inflation is being caused by volatile & uncertain energy prices.

Core CPI decelerated on a YoY basis, from +4.3% in August to +4.1% in September:

Shelter, the largest individual component of the Consumer Price Index (33% of headline CPI and 41% of core CPI) decelerated on a YoY basis from +7.3% to +7.1%:

With respect to Shelter, it’s vital to recognize that the lagging nature of Owners’ Equivalent Rent used by the BLS is going to follow this trajectory of private-market housing/rental data:

Given that the largest CPI component is poised to decelerate substantially, what does that tell you about where CPI inflation is likely to go over the coming 12 months?

Food inflation decelerated, from +4.26% YoY in August to +3.7% in September:

This is the lowest level of food inflation since July 2021. It’s important to monitor this datapoint because food is 14% of the overall CPI weighting and has a significant influence on overall CPI dynamics. In fact, it’s the second largest component of the CPI after Shelter!

Medical Services inflation is experiencing outright deflation (prices are falling) and actually became even more contractionary in the latest data, falling from -2.1% YoY in August to -2.6% in September:

I think it’s important to track medical services, aside from obvious reasons, because it’s 7% of the total CPI weighting and one of the 5 largest components.

Energy inflation accelerated, but it’s still experiencing deflation on a YoY basis. Specifically, energy increased from -3.7% in August to -0.5% in September.

It’s a no-brainer that this is being influenced primarily by crude oil prices, so it’s interesting to see that this component, which is the 4th largest CPI component, is still negative on a YoY basis. I fully concede & recognize that this metric is accelerating and is likely to turn positive YoY in the coming months; however, we must also recognize that this is the most volatile component within the CPI.

Turning towards broad-based measures of inflation, rather than the individual components that we reviewed above, we can diagnose inflationary conditions through the following measures:

🟠 Median CPI (YoY) fell from +5.72% in August to +5.5% in September.

🔵 Trimmed-mean CPI (YoY) fell from +4.47% in August to +4.29% in September.

Both metrics are still too high, but they continue to decelerate on a YoY basis.

That’s disinflation.

Staying focused on these broad-based measures, used to analyze how most components of inflation are evolving, I also want to focus on these:

Services inflation decelerated on a YoY basis from +5.39% in August to +5.16% in September.

This datapoint actually includes energy-related services, so this is a major win to see an ongoing deceleration in this component. It’s still too high, largely driven by Shelter dynamics, but the normalization process is clearly underway. Therefore, it’s probably important to measure how services are evolving without the laggy Shelter component!

Services ex-Shelter decelerated on a YoY basis from +3.12% in August to +2.75% in September.

This datapoint is now back within the historically normal range, implying that Services inflation has been completely tamed when excluding the lag effects of Shelter.

This is so important to understand and cannot be understated enough!

On this point, it’s important to recognize that the inflation rate for All Items Less Shelter did accelerate for the third consecutive month; however, it’s right at +2% YoY and perfectly within the historic range of inflation.

In other words, we’ve returned back to a normal rate of inflation that the Fed would typically be happy with, congruent with their inflation target. Personally, I’m not concerned about the three straight YoY accelerations simply because of the context that we’ve reviewed thus far: Energy is the primary and sole driver of this acceleration.

Given the weight of Shelter, excluding it from the CPI inflation means that Energy will have an even more significant bias on the results. This is why we shouldn’t be surprised by an uptick in All Items Less Shelter, given that crude oil has risen by +41% over a three-month window, ending in September 2023. This is important… crude oil has gained +41% in a small period of time and yet the overall CPI inflation rate has increased from +3.1% to +3.7% over the same period of time.

In fact, the CPI basket has increased by +1.2% if we compound the three monthly inflation rates of +0.16686% in July +0.63119% in August and +0.39573% in September.

So when we actually compare apples to apples, crude oil has jumped +41% and yet overall inflation has risen +1.2%. This is what happens when literally every other component is experiencing disinflation.

When we look at a variety of individual components and alternative measures of broad-based inflation dynamics, the weight of the evidence firmly suggests that the U.S. economy is still experiencing disinflation. While prices remain high and continue to increase, the Fed’s goal of normalization towards +2% is still underway.

Given the fact that the estimate for real GDP growth in Q3 2023 (annualized) is currently +5.1% according to the Atlanta Federal Reserve’s model-based output, we continue to see evidence that the immaculate soft-landing is still intact.

As I alluded to in November 2022, soft-landing probabilities have been and continue to rise. So far, I haven’t had to eat these words...

Where We’re Going:

With respect to the factors that influence inflation dynamics, I really focus on four primary components:

Supply chains

Commodity prices

Wages

Credit creation

These factors have kept me on the right side of the inflationary uptrend in 2021 & 2022 and for the downtrend of 2023, so I continue to rely on them as an indicator of how inflation is likely to evolve going forward.

With respect to supply chains, the Global Supply Chain Pressures Index reflects the complete absence of any bottlenecks. In fact, the GSCPI is currently -0.69 standard deviations below the average conditions for supply chain dynamics:

With the GSCPI likely to remain in negative territory, implying loose supply chain conditions, it’s clear that bottlenecks are no longer influencing inflation in a negative way and are now creating an environment for more disinflation.

Turning towards commodity prices, it’s no secret that the massive increase in crude oil is fueling (pun intended) higher commodity prices. Referencing the Invesco DB Commodity Index $DBC, we are able to measure the evolution of broad-based commodity price dynamics:

I’ve shown two things in this chart:

The window of October 2022 (yellow) vs. October 2023 and estimated the average price from Oct.’22. We’re only halfway through the month, so things could change rapidly, but it’s likely going to be the case that the YoY rate of change will be flat, if not negative.

The linear regression from October 1, 2022 to the present (red). Given the fact that it’s downward sloping, my base-case is that commodity dynamics will be negative on a YoY basis for the month of October 2023.

While geopolitical risks in the Middle East could certainly alter commodity price trends, we could have said the same thing about the Russian invasion of Ukraine; however, the price of crude oil and commodities in general peaked just a few months after the invasion. We must recognize that prices are multivariate and uncertain, so relying exclusively on conflict to argue that commodity prices will rise is potentially accurate, but also not guaranteed.

With respect to wages, there continues to be an ongoing deceleration on a YoY basis.

The BLS’s nominal wage growth measurement decelerated in September, from +4.25% to +4.15%. This is a modest deceleration; however, we’ve seen CPI inflation decelerate substantially while wage growth has been stable.

Generally speaking, average hourly earnings has been growing at a pace of +4.3% YoY for the majority of the year. Meanwhile, YoY headline CPI has fallen from +6.35% to +3.7% during that same timeframe. In other words, disinflation has not necessarily required wage growth deceleration, which is a positive development for the consumer.

If we shift our focus away from BLS government data and analyze the Federal Reserve’s Wage Growth Tracker, we see a much clearer deceleration in wages:

This metric from the Atlanta Fed has a great correlation with YoY CPI inflation!

As wage growth decelerates, headline & core CPI tend to decelerate.

As wage growth accelerates, headline & core CPI tend to accelerate.

Simple!

Given the ongoing deceleration in wages and my broader outlook for labor market normalization, I suspect that wages will continue to decelerate and produce more disinflation for the CPI in the quarters ahead.

Finally turning to credit creation dynamics, my February 2022 prediction continues to come true as loans & leases in bank credit continue to decelerate. In fact, this deceleration has occurred much faster than I anticipated, according to the latest weekly data from U.S. commercial banks:

Data as of 10/4/23 shows that loans & leases have grown at a pace of +3.8% YoY, down considerably vs. readings earlier this year above +10%. Given that the ongoing rise in credit growth was part of my inflationary thesis during 2022, the deceleration has similarly been part of my disinflationary thesis in 2023! Considering that deposit growth and M2 money supply growth are both negative on a YoY basis, my assumption is that loans & leases will continue to decelerate and potentially contract. Therefore, I think that monetary dynamics from credit creation will produce more disinflation in the quarters ahead.

Speaking of monetary dynamics, we can’t forget the Federal Reserve’s direct influence on inflation! Personally, I suspect that the Federal Reserve is done hiking rates for the remainder of the year, as rising Treasury yields have likely provided the final strain that the Fed needs to defeat inflation. Therefore, a pause has been in place and is likely to remain in place, barring a significant change in commodity dynamics from uncontrollable risks overseas.

The effective federal funds rate is currently 5.33%. The headline inflation rate is 3.7%.

This means that the real federal funds rate is +1.63%.

Given that monetary policy operates with long and variable lags, which we can’t estimate for certain, most economists like to use a 12-month lag as a rule of thumb.

In September 2022, the EFFR was an average of 2.58% and the inflation rate was 8.2%.

This means that the real federal funds rate was -5.62%.

Just by measuring the 1-year spread between the nominal EFFR, we can recognize that roughly 2.75% of rate hikes haven’t had their full & material impact on the economy or the financial system yet. Therefore, we could argue that a significant amount of tightening is coming down the pipeline based on monetary policy decisions that influence economic dynamics with a lag of roughly 12 months as an estimate!

Financial conditions are tight enough and the Federal Reserve has been in a restrictive policy stance since December 2022. These factors have choked inflation and they will continue to choke inflation, even if the Federal Reserve pauses and keeps the EFFR at 5.33% (the highest since February 2007).

Therefore, my outlook can be summarized by the following:

Broad-based disinflation remains intact

Shelter is going to produce more disinflation based on lag effects

Supply chains are no longer an inflationary factor & point to disinflation

Commodity prices dynamics are a concern, but not substantial enough (yet)

Wage growth decelerations will produce disinflation

The deceleration of credit growth will produce disinflation

Monetary policy lag effects will choke inflation

We must also recognize that student loan payments just restarted in October and will cause consumers to reorient their spending towards principal & interest payments. This will create a negative income effect, pari-passu, that will cause the demand for all other goods & services to decline and help to produce more disinflation. While I recognize that energy & commodity price dynamics are a threat to my disinflationary thesis, I must rely on the weight of the evidence that clearly points to more disinflation in the months & quarters ahead.

While we’ve seen an uptick in headline CPI on a YoY basis, a nuanced approach is critical for evaluating how all other components (individually & collectively) are evolving. In taking this approach, I reiterate that disinflation is still intact & will likely remain intact, especially if the labor market shows more signs of softness.

The Federal Reserve is winning the fight against inflation, but is still searching for the knockout punch. Maybe the singular punch won’t come, but rather a series of jabs and faints that lead to a clear win via the judge’s scorecard. There’s still work to be done in order to get inflation back to the Federal Reserve’s formal target of 2%, likely requiring an extensive pause by the Federal Reserve (not a pivot/cut). Powell has countlessly said that the Fed will “keep at it”, invoking the words of Paul Volcker in the 1980’s, and I take him at his word. It’s vital to understand that a pause is congruent with “keeping at it”, given the lag effects of monetary policy that we reviewed above and the momentum of disinflation.

Prices are high.

Prices are still rising.

Prices aren't rising as fast as they were last year.

Prices will continue to rise, but likely at a slower pace.

Prices aren't going back to their pre-COVID levels.

Disinflation is intact and I reiterate my prediction of more disinflation.

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged & direct/inverse, to the NYSE FANG+ Index.

They have a suite of products ranging from big banks, to oil & gas, and even gold & gold miners.

I started a partnership with MicroSectors in 2023 because I’ve been using their products for over a year and it was an organic and seamless fit.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, & timeframes expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.