Investors,

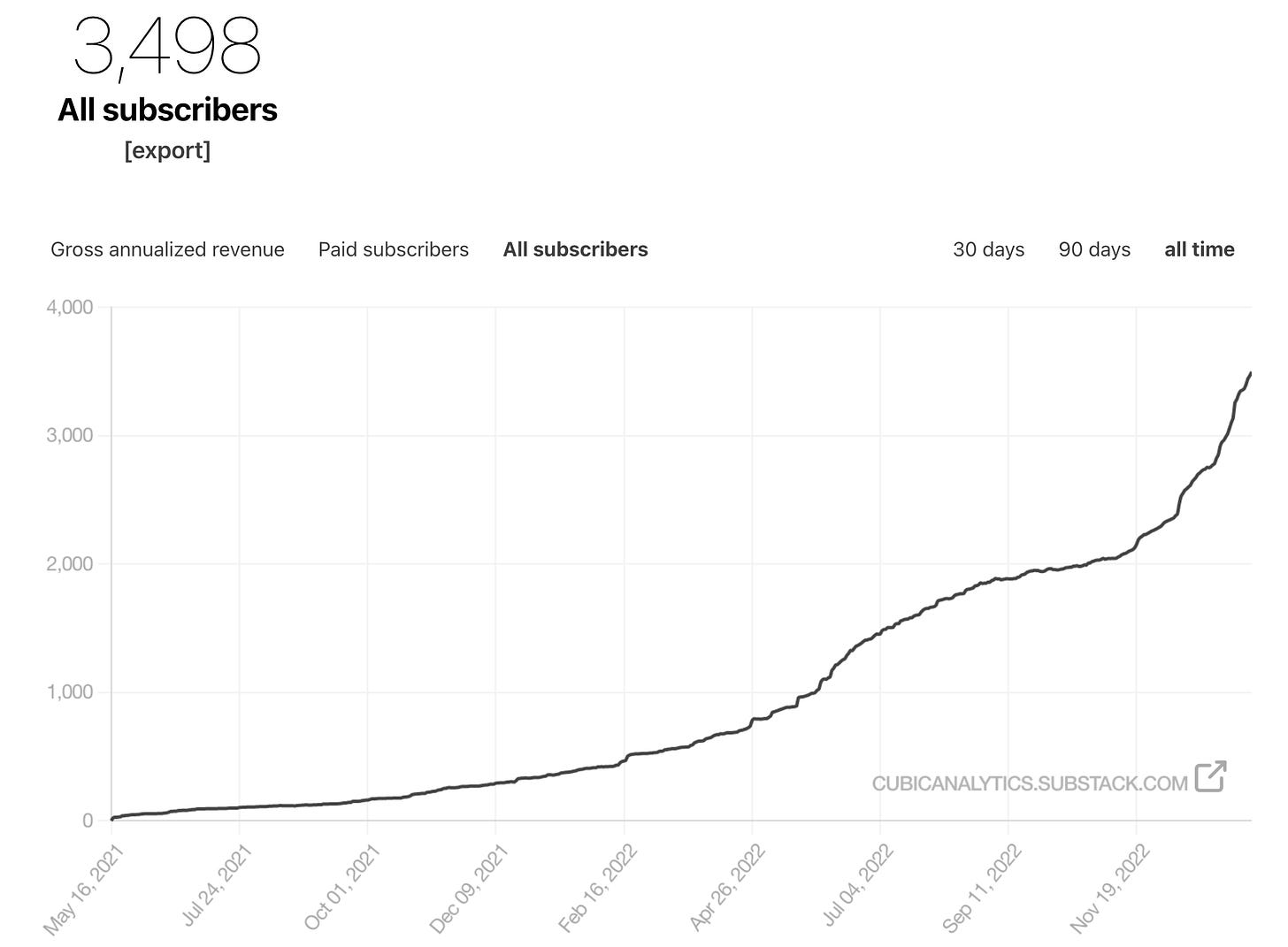

The Cubic Analytics team has grown by +75% in the past 90 days, roughly reaching 3,500 total subscribers! I’m grateful for your continued support, but I have huge aspirations for this newsletter in 2023. By simply liking this post or sharing it with a colleague or a friend, you’re contributing to the success of Cubic Analytics!

As a way to welcome all of the new subscribers and to celebrate the success of market returns so far in 2023, I’m happily offering a free 7 day trial for premium research by Cubic Analytics. If you’ve been on the fence about upgrading your subscription, this offer will give you a taste of what to expect from my premium research! Come join the fun and activate the trial to read tomorrow’s premium report:

Macroeconomics:

This was a quiet week in terms of fundamental economic data, though the Producer Price Index for December 2022 was certainly the most meaningful. At the end of the day, it didn’t tell us much that the Consumer Price Index didn’t already tell us on January 12th. Importantly, the PPI data helped to confirm the deceleration in the CPI.

Median estimates were projecting for the December PPI to fall by -0.1% month-over-month (MoM), but the result was even more deflationary at -0.5% MoM. This brings the YoY rate of change to +6.2%, down from +7.3% in November 2022. We’re seeing disinflationary dynamics on a YoY basis and deflation on a MoM basis, exactly how the CPI data is evolving as well. Immediately following the release of the data, I shared the following perspectives on Twitter:

I continued with the following:

“Regarding CPI inflation, I’m finally seeing a stabilization and deceleration in the alternative measures of inflation:

Core

Median

Trimmed-mean

These are now evident in the December data for the first time. 3-month annualized services ex-Shelter has plummeted:

Going forward, it’s evident that inflation concerns will move further behind us in the rearview mirror, while labor market dynamics and overtightening concerns become more important. For now, those concerns haven’t materialized, allowing markets to celebrate peak inflation.”

While the Federal Reserve and various officials continue to talk a big game about “higher for longer”, markets are dismissive of inflation and are focusing on data that suggests inflation will continue moderating at a steady pace. While I personally feel that the market is getting ahead of itself with respect to the pivot narrative, I can’t argue with the sentiment regarding the direction of inflation.

As we look at PPI data from a historic perspective, we’re still experiencing elevated levels of producer price inflation. However, the markets appear solely focused on the direction of the slope at this point. If we focus specifically on the YoY rate of change in PPI for Final Demand Services, we see the following:

Currently measured at +5.0% YoY, I fully expect to see this decline steadily towards the historic norm, likely below +2.0% by the end of 2023. As I grow increasingly confident that inflation will trend lower, I’m growing increasingly fearful that the Fed is going to overtighten with respect to monetary policy. This week, Patrick Harker of the Philadelphia Fed reiterated that he favors raising rates slightly above 5.0%. Meanwhile, Vice Chair Lael Brainard echoed that “policy will need to be sufficiently restrictive for some time”. Cleveland Fed President Loretta Mester indicated that “further rate hikes are still needed” and that the policy rate should rise a “little bit” above the range of 5.0%-5.25% rate that’s currently projected for 2023. Christopher Waller, on the Board of Governors, said that the Fed will need to keep rates high and not cut by year-end. All of these comments were made this past week.

Unequivocally, this is language & rhetoric which reaffirms higher for longer. With inflation dynamics decelerating even faster in recent months, the stage is set for a policy mistake.

Stock Market:

After a monumental 2 weeks to start the year, the market sold off during the first three days of the holiday-shortened trading week. However, stocks ripped back on Friday & made a substantial thrust higher to end the week. On net, here’s how the indexes performed relative to the prior Friday’s close:

Dow Jones $DJX: -2.7%

S&P 500 $SPX: -0.67%

Nasdaq-100 $NDX: +0.67%

Russell 2000 $RUT: -1.05%

As I’ve been highlighting for the past few weeks, we’re officially seeing tech regain leadership within the market, as evidenced by the significant outperformance by the Nasdaq-100. The +2.7% weekly gain for the NYSE FANG+ Index confirms that mega-cap tech stocks are driving the market higher, which is exactly what we want to see during a potential bull market formation.

While I have sincere doubts about the sustainability of the rally and the idea that we’re forming a new bull market, we can’t ignore the fact that momentum has been strong. Extremely strong, in fact.

Per data from Grant Hawkridge on Twitter, there are positive implications for the rest of the year when the Nasdaq-100 starts this hot:

This data goes back to 1999, but helps to highlight how recent years have performed once the Nasdaq produces three-straight weeks of gains to start a calendar year. While these numbers certainly paint an optimistic picture, based on the average gains, I can’t help but to be reminded of market dynamics that occurred in 2018…

Markets were a bit euphoric in 2017, wherein the Nasdaq-100 produced an annual return of +31.6%, even while the Federal Reserve was steadily raising interest rates by +0.25% every other meeting. Markets were able to overcome the drag of higher interest rates & less liquidity simply because the economy was strong and corporate profits were booming under the Trump administration’s tax cuts & deregulation.

The Nasdaq gained +81% from the lows in Q1 2016 to the peak in January 2018; however, fears surrounding the China and 2+ years of monetary tightening started to make the market quiver.

Circled in the grey oval, the market started to experience a yield tantrum and experienced two double-digit percent drawdowns very rapidly. The first drawdown lasted for 11 trading days, during which time the Nasdaq declined by -12.2%. The second drawdown, which started less than two months after the first, saw the market fall by -12% in 14 trading days. Miraculously, the market seemed to shrug off these concerns in the middle of the year, but then became concerned once again about Fed policy. The combination of steady rate hikes & quantitative tightening shook the market. From October 1 through December 24, 2018, the Nasdaq-100 fell -23.4%.

So, while the calendar year return was -0.9% in 2018, investors had to survive a tumultuous environment that contained three separate double-digit percent declines. As we look back in hindsight, those bumpy dynamics appear to be a mere blip on our screens; however, the market was full of panic and fear at the time. Ironically enough, the current market environment has many of the same characteristics:

The Fed is still raising interest rates, after 10 months of rate hikes.

The Fed is reducing the size of their balance sheet by conducting QT.

Fiscal stimulus is waning in a post-COVID environment.

Geopolitical risks are still significant.

Call me crazy, but these dynamics seem to rhyme with what was taking place in 2018. Fundamentally, it’s logical to identify 2018 as the most similar of all the cases outlined in Grant’s data above. This means a few things:

The market environment in 2023 is likely to be very choppy. Remember, 2018 had three separate double-digit percent drawdowns!

If the bear market & downtrend resumes, the market will also have violent rallies. From 4/2/18 to 10/2/18, the Nasdaq-100 gained +21.75%!

The heavy burden of monetary tightening will continue to impact markets, even if tightening decelerates. As I outlined in my 2023 market outlook, I truly believe that balance sheet dynamics will impact market returns this year.

Money will be made to the upside and to the downside. Investors/traders who are able to actively analyze the tape will have an abundance of opportunities to make bullish/bearish trades based on market direction.

Bitcoin:

BTC is booming — plain and simple.

Last week, I highlighted how upside momentum was improving given that price had broken above the STH realized price. On Monday, Bitcoin officially closed above the 200 day moving average cloud, a critical win for the bullish case. As I shared in last week’s edition of Cubic Analytics, “while this range is currently threatening as resistance, it could become support if we break above it.”

Sure enough, we’ve flipped it into support!

Outlining this breakout in real-time on Twitter, I’ve continued to monitor a variety of market conditions that are setting up positively for Bitcoin. First of all, this retest & rebound is a clear bullish signal; however, we must get comfortable with the idea of possibly retesting it again. By no means does this price action indicate that it’s “up only from here”.

While analyzing Bitcoin’s raw price action is important, I’m getting a tremendous amount of value by comparing Bitcoin’s price action relative to the stock market:

1. Bitcoin vs. S&P 500 (BTC/SPX), daily candles:

This relationship echoes the same sentiment as the BTCUSD chart, showing how BTC/SPX continued to get rejected by the 200 day moving average cloud during the downtrend (3x rejected). This latest breakout, retest, & rebound is a clear shift from the behavior that we’ve seen for the past 12 months!

2. Bitcoin vs. the Nasdaq-100 (BTC/NDX), weekly candles:

I continue to use the 200 MA cloud in this chart, this time providing an insight for the 4-year average price of BTC relative to the Nasdaq. BTC/NDX has historically rebounded on this dynamic range during prior bear markets (2018 & 2020), but it failed to act as support in 2022. In fact, we actually flipped it into resistance twice! However, these rejections on the 200-week moving average cloud were also aligned with a key horizontal range highlighted in red. We can see clear behavior around this range, acting as resistance in 2019, a breakout launchpad in 2020, a support range in 2021, and resistance in 2022. Where are we right now? Perfectly retesting the confluence of the 200-week MA cloud and the red range. This is BEAUTIFUL price structure, which all investors should have on their radar.

If we can break above this range (yet to be seen), we have the potential to use it as a launchpad (see 2020/2021 breakout) and as support (see mid-2021 rebound). At the present moment, this range is threatening to act as resistance and we should all be paying attention to how BTC/NDX reacts to this critical retest in the weeks ahead:

Breakout = bullish

Rejection = bearish

This will have major implications..

On the aggregate, I’m seeing positive developments across the board. BTC is trading above the STH realized price & the 200 day moving average cloud. BTC/SPX is trading above the 200 day moving average cloud. BTC/NDX is retesting a key level, which could illustrate even more bullish behavior if (big “if”) we can secure a breakout.

These are key lines in the sand that allow me to be bullish right now. If we reverse beneath them, I’ll shift my stance towards the downside. But for now, there’s reason to be bullish.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subjected to change without notice. The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. Everyone is responsible to conduct their own due diligence, understand the risks associated with any information that is reviewed, and to recognize that the information contained herein does not constitute and should be construed as a solicitation of advisory services. Cubic Analytics believes that the information & sources from which information is being taken are accurate, but cannot guarantee the accuracy of such information.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation & reference.

As always, consult a registered financial advisor and/or certified financial planner before making any investment decisions.

I really appreciate your hard work. This is very helpful and informative. I am unsure if i am already subscribed to the premium research - how can i confirm this?