Greed Fades To Fear

Investors,

Economic data has been so good that investors have, once again, been pricing in a “higher for longer” interest rate environment. The central bank symposium at Jackson Hole was a dark cloud hanging over the market, with investors still dealing with PTSD from Powell’s stoic remarks last year. In combination with resilient economic data, rising interest rates, and increasing uncertainty around Powell’s speech on Friday investor sentiment has shifted away from greed towards fear.

While economic data hasn’t been perfect, the Atlanta Federal Reserve’s forecast for real GDP growth in Q3 2023 was revised higher (once again) to +5.9%.

This simply doesn’t happen in an economic environment characterized by weak data.

On net, stronger economic data gives the Fed more slack to tighten monetary policy, or at the very least, to keep the high interest rate regime in place for longer. Equities aren’t happy about that, but they aren’t distraught either. We need to put this market pullback into context! Since their YTD highs in mid-July, the indexes have fallen:

Dow Jones $DJX: -3.7%

S&P 500 $SPX: -4.3%

Nasdaq-100 $NDX: -6.2%

Russell 2000 $RUT: -7.5%

Nonetheless, all have positive and/or strong YTD returns:

Dow Jones $DJX: +3.6%

S&P 500 $SPX: +14.75%

Nasdaq-100 $NDX: +36.6%

Russell 2000 $RUT: +5.25%

Investor enthusiasm has hit the reset button, creating a sentiment capitulation. According to the Fear & Greed Index, the market has returned to a state of neutrality after 3+ months of “greed” or “extreme greed” readings.

This is healthy. Very healthy, in fact.

While I have concerns that asset prices will face short-term pressure and have been in a defensive position for the past few weeks, outlined in real-time, I think these headwinds will produce opportunities. In fact, while my short-term trades were stopped out 2-3 weeks ago, I’ve been using these headwinds to increase my allocation in long-term portfolios. If you want to know exactly what I’ve been buying, refer to the premium post I shared last weekend, which provided an in-depth breakdown of my portfolio construction & long-term holdings:

I’d like to thank the team at MicroSectors for their continued support of Cubic Analytics, and I’d encourage all of you to research their product list and follow them on Twitter.

Macroeconomics:

Macro data was relatively bland this week, but the big event took place on Friday with Powell’s speech at the Jackson Hole Economic Symposium. Still suffering from PTSD with last year’s event, investors were completely preoccupied by comments from various Fed officials and Powell’s speech in particular.

Many feared that Powell would retain his stoic yet aggressive tone from last year. Others speculated that he would abandon and raise the 2% inflation target in order to ease their mission. In the end, neither were correct.

Powell came out and walked the line perfectly. Powell acknowledged the disinflationary progress that has occurred so far, while recognizing that some aspects of inflation have been stickier than others and that more work must be done. His comments maximized optionality in upcoming meetings, reassuring that policy decisions will be data-dependent. In a rare admission, Powell truly acknowledged the challenges & uncertainty of monetary policy when he said that “we are navigating by the stars, under cloudy skies.”

The Federal Reserve receives a tremendous amount of criticism, often deserved but sometimes unwarranted, and these types of comments are a healthy reminder that they are doing the best they can with the tools they have. They know that their tools are not perfect, but they are sufficient with enough time.

At the end of the day, Powell reiterated the comments we’ve grown accustomed to:

The inflation rate is too high

The inflation rate is falling

The inflation rate needs to fall more

Monetary policy will remain restrictive to ensure continued progress

The Federal Reserve is committed to their target of 2% inflation

He ended his remarks, once again, by referencing the famous words from Paul Volcker, saying “we will keep at it until the job is done.”

I don’t think we could’ve asked for a better and more succinct speech.

With yields continuing to respond to fundamental macro data & Federal Reserve rhetoric, we’ve seen a strong breakout in the U.S. Dollar Index $DXY above its 200-day moving average cloud, which objectively means that the dollar is likely set to strengthen vs. global currencies.

This is a logical reaction to a disinflationary environment where the Federal Reserve is committed to maintaining high interest rates, when the rest of the world is still dealing with significant inflationary problems & having to play “catch-up” to the Fed.

Stock Market:

As I alluded to in the intro, the market’s ongoing enthusiasm capitulation has been a healthy & necessary development. While it could certainly persist in the days/weeks ahead, I don’t see any deterioration in the fundamental macro data responsible for this selloff. In other words, I truly believe that this selloff is a function of:

Stronger-than-expected economic data

Investor psychology & the unwinding of extreme bullish positioning

The only argument with real merit regarding “bad” fundamental data is that a significant amount of companies (notably tech companies) lowered their forward guidance, despite strong beat-rates for revenue and earnings in Q2 2023. Because markets are forward-looking pricing mechanisms, stock prices have been able to adjust immediately in response to the potential for worse-than-expected future results.

Stocks are now priced for these expected results, which therefore proves that investors are not detached from reality and that we aren’t in some speculative mania.

Investors are being prudent, on the aggregate, and responding to fundamental data.

That’s exactly what we want.

Nonetheless, the consolidation that we’ve been witnessing for the past four weeks has been mild at most. It certainly has felt good, and some pockets of the market have felt terrible, but the market as a whole is doing quite alright. In a year where bears have been whining about valuations throughout the uptrend, you’d think that they’d be saying something along the lines of: “Hey, some stocks are finally looking cheaper and more attractive to start buying!”

Instead, they’re doubling down on the valuation contraction and I’m seeing renewed confidence that the best of 2023’s returns are behind us. In fact, I ran a poll with the intent of gauging investor sentiment on August 19th:

40% of 873 respondents believe that the S&P 500 is going to make new bear market lows and fall below October’s low mark of 3,491.58 within the next 12 months! As of Friday’s market close, the S&P 500 would need to fall -20.8% for these bears to be vindicated. I won’t pretend that a decline of this magnitude is impossible, however, I think the current pullback has placed a tremendous amount of fear in market participants, incongruent with the magnitude of the pullback.

If I had asked this question one month ago, I fathom that less than 20% of respondents would have voted this way.

There’s nothing like price to change sentiment.

Bitcoin:

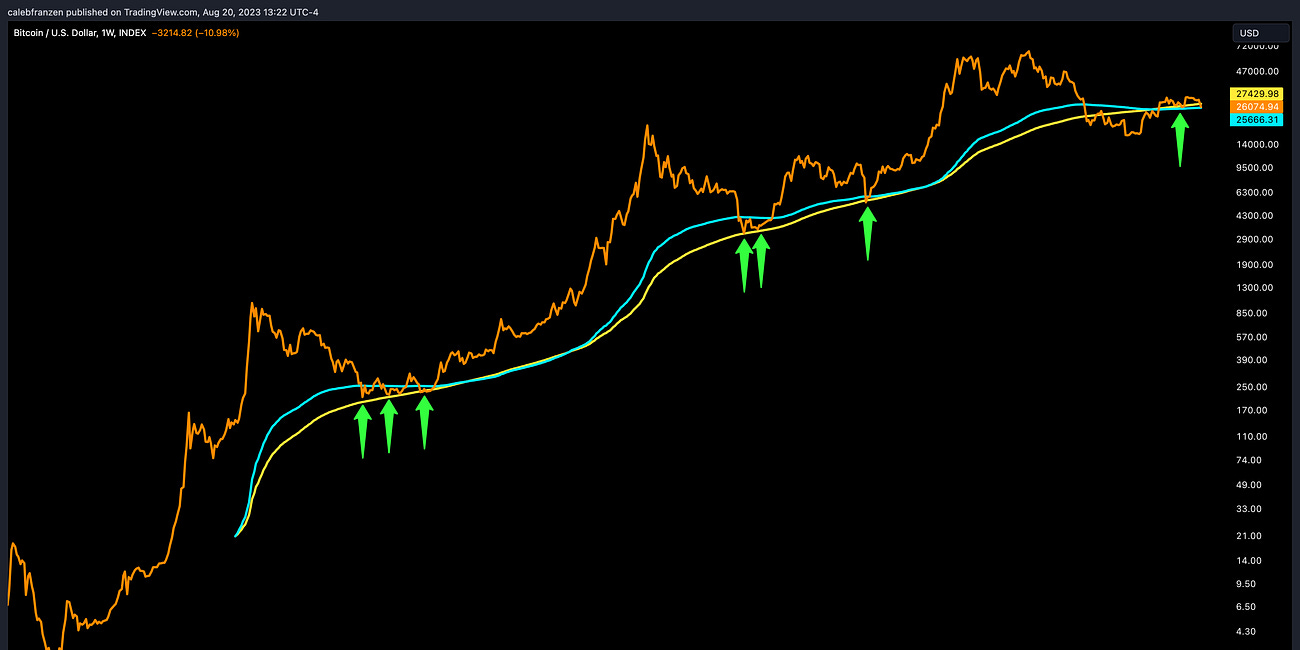

With respect to the cryptocurrency market & Bitcoin in particular, the market continues to digest the sharp selloff from a week and a half ago. Bitcoin’s exchange rate has fluctuated around $26,000 for ten consecutive days, illustrating the tug of war between bulls & bears and the lack of decisiveness from both sides.

The market is simply digesting this new price and the selling pressure that surfaced two Thursday’s ago; however, the price of Bitcoin has increased by +58% YTD. It’s significantly outpaced traditional equities, on the aggregate, and significantly outperformed Treasuries in a macroeconomic environment still plagued by uncertainty. In fact, Bitcoin relative to U.S. Treasuries (BTC/TLT) has gained a whopping +65% YTD.

Bitcoin has behaved exactly how investors have come to expect: it’s a volatile asset with an upward trajectory.

Many might argue that Bitcoin has experienced limited volatility throughout 2023, to which they’d be correct when comparing to Bitcoin’s own history. However, it’s still clearly volatile vs. traditional markets in 2023.

For context, Bitcoin’s largest peak to trough drawdown of 2023 has been -22.5% in Q1.

The S&P 500’s largest drawdown was -9.2%, which occurred at the same time.

Said differently, while Bitcoin has experienced 2.45x the downside as the S&P 500 (22.5/9.2), it’s produced 3.93x the upside so far this year (58/14.75).

You can’t argue with that.

Best,

Caleb Franzen

SPONSOR:

This edition was made possible by the support of MicroSectors, a financial services and investment company that creates an array of unique investment products and ETN’s. Their NYSE FANG+ products are the only one of their kind, allowing investors to gain exposure, leveraged/un-leveraged and direct/inverse, to the NYSE FANG+ Index. They have a suite of products ranging from big banks, to oil and gas, and even gold/gold miners.

I started a partnership with MicroSectors in 2023 because I’ve been using their products for over a year and it was an organic and seamless fit.

Please follow their Twitter and check out their website to learn more about their services and the different products that they offer.

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

@caleb Franzen: are there any projections of the impact from changes to the level of savings on disposable income and how it’s impact, if any, would affect corporate sales revenues in various sectors in the forward quarters?